The Indexing of the Alt Assets Universe

Category defining companies in the alternative assets space

A few weeks ago, Elad Gil wrote a great blog post about Index Companies. He talks about Index Companies being platforms that are both synonymous with their underlying market and serve as a proxy for value creation in those markets.

Index Companies are critical to the growth of their markets because they are an essential component of market infrastructure.

Users need them to transact and Markets need them to establish a valuation reference.

For many categories of alternative assets, the market structure is sufficiently nascent where the companies that are building the platforms for their market have the potential to also develop into that market’s Index Company. And they also have the potential to create investable products for investors who want exposure to that market via indexes they can create with the data that they have.

Index Companies aggregate both data and participants. These features are essential to establishing active user engagement with their platform and the markets they reflect.

As I mentioned in last week’s post, Alt Goes Mainstream, we are at the dawn of an exciting time in the alternative asset space.

There will be companies that come to define this space and help usher alternative assets into the mainstream investing world.

This post will map out the alt assets space as we know it today. It will define what makes the potential Index Companies different and valuable. It will take a look at who can be the potential Index Companies in this nascent space. And finally, it will discuss what it could take to create a successful index or suite of investable products for areas of the alt asset space.

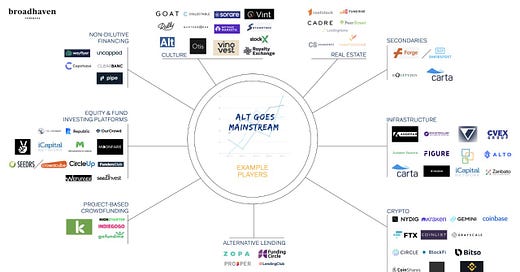

Today’s universe of Alt Assets (may not be tomorrow’s)

The universe of new alt assets may be in its early days of development, but there are a number of companies that are building exciting businesses to serve this space.

We are seeing an explosion of companies across all areas of alternative assets - thanks to the financialization of everything.

Winners in this space will have a defining set of features that both (1) make them valuable companies and (2) help grow the space by virtue of the fact that users need to engage with them to be active participants in the market.

One thing to note on the market map: there are a few companies, like Coinbase, Carta, iCapital, and Republic (amongst a few others) that are both distribution or capital raising platforms and infrastructure businesses.

It’s highly likely that businesses that own both infrastructure and distribution will be defining companies in the alt investment space.

They will own their customers and grow their own AUM through product distribution and own the toll-taking infrastructure / rails that enable institutional investors and wealth managers to provide their own customers with access to alt assets.

What makes Index Companies different and valuable?

Index Companies have a number of features that make them different and incredibly valuable due to the fact that they are critical to their market structure.

They benefit from the growth in their space. As their markets grow in size and scale, so too do these Index Companies. They benefit from helping to enable growth in their space as they enjoy some benefit from increasing transactions.

They are a critical piece of market infrastructure. An Index Company can provide the necessary infrastructure to the space that everyone has to use in order to participate in that market. For example, if retail investors or their wealth managers want to access private equity funds at low minimums, they most likely need to use iCapital’s pipes to access these funds. If a non-accredited investor wants to access a startup at a $20 investment minimum, they will likely have to turn to Republic. If an investor wants to manage and store their cards, they will likely have to use Alt.

They become the personification or identifier of the space. Much like Google, Uber, and Venmo have made their way into mainstream conversations as synonymous with their categories, the Index Companies in the alternative assets space will become the personification of their space. When people ask, “do you invest in xyz asset? And how do you do it?” these companies become the de facto response.

They aggregate liquidity. Many of the Index Companies enable users to exchange value. That is not a surprise, given that they create the venue for the exchange of value. Marketplaces and exchanges tend to be incredibly valuable companies because they aggregate liquidity, provide the platform for discovery, create the trusted venue for exchange, and in doing so, become the place where people transact.

They have data as a feature, which becomes the moat of defensibility. Companies that own the data can own the space. Data creates both trust and a platform for discovery for users, leading them to want to use the platform for other things. Data is also the enabler for both liquidity and institutionalization of a financial asset. Some of the most successful FinTech companies of all time, Bloomberg, MSCI, and IHS Markit / S&P owe much of their respective success to their data aggregation capabilities. And these companies make markets go. They enable investors to execute trades, make investment decisions, and understand risk and asset allocation exposures based on their data platforms across asset classes.

They create community. Index Companies in the alts space will leverage community to their advantage to create a movement. Millennials and Gen Z’s want to be part of movements. And movements are created by community. Companies that are intensely focused on engaging their userbase and creating community will win. And it will be very hard for incumbent marketplaces to compete with community.

Who could be the Possible Index Companies for Alternative Assets?

In more developed areas like crypto and alternative investment funds, we have more clearly defined winners who are synonymous with their respective space.

In crypto, the Possible Index Company is Coinbase. Coinbase is very much the bellwether for cryptoassets. Coinbase has become the trusted onramp for many mainstream investors to buy and sell cryptoassets. They are a proxy for crypto as they have actively engaged the retail investor community with over 35 million customers. Coinbase has also built out an institutional business line, including a custody business, that enables institutional investors to invest in crypto without holding the cryptoassets themselves. There’s also a possibility that Index Companies will also develop by region. Bitso, a crypto exchange in LatAm, for example, just raised $62 million from Kaszek and QED. They may end up becoming the Index Company in this space in LatAm.

In private equity and alternative investment funds, the Possible Index Company is iCapital. iCapital provides the critical infrastructure to enable the retail high-net-worth investor community to access top-tier alternative investment funds at lower minimums. iCapital has grown its platform to over $65 billion in assets and acquired its main competitor, Artivest, as they continue to serve both funds and the HNW community. As iCapital facilitates the flow of more dollars into alternative investment funds and partner with many of the largest banks and wealth management platforms, they become a bellwether for retail demand in the alternative investment fund space.

As other areas of the alternative asset space emerge, it will be fascinating to watch who becomes the Index Companies in equity and real estate crowdfunding, trading cards, art, shoes, collectibles, wine, esports, and other areas of alt alt assets.

The financialization of everything = the index-ification of everything?

While it’s not a defining feature for every Index Company, companies that have the ability to create indexes in their market have the potential to become incredibly valuable.

If we believe that the financialization of everything will occur, then we will see a new wave of Index Companies create indexes based on their market position and data advantage.

What does this look like? There will be a number of indexes in alternative assets that will be created which will enable the assets on their platform to become financialized and investable - and enable institutional capital to come into the space.

Companies here have the potential to either create the index in their alt asset class or create index-linked investable products based on an index in their space.

What will it take to create a successful index or suite of index products for an alt asset space?

First, some background on the evolution of indexes and index products in more mature financial markets.

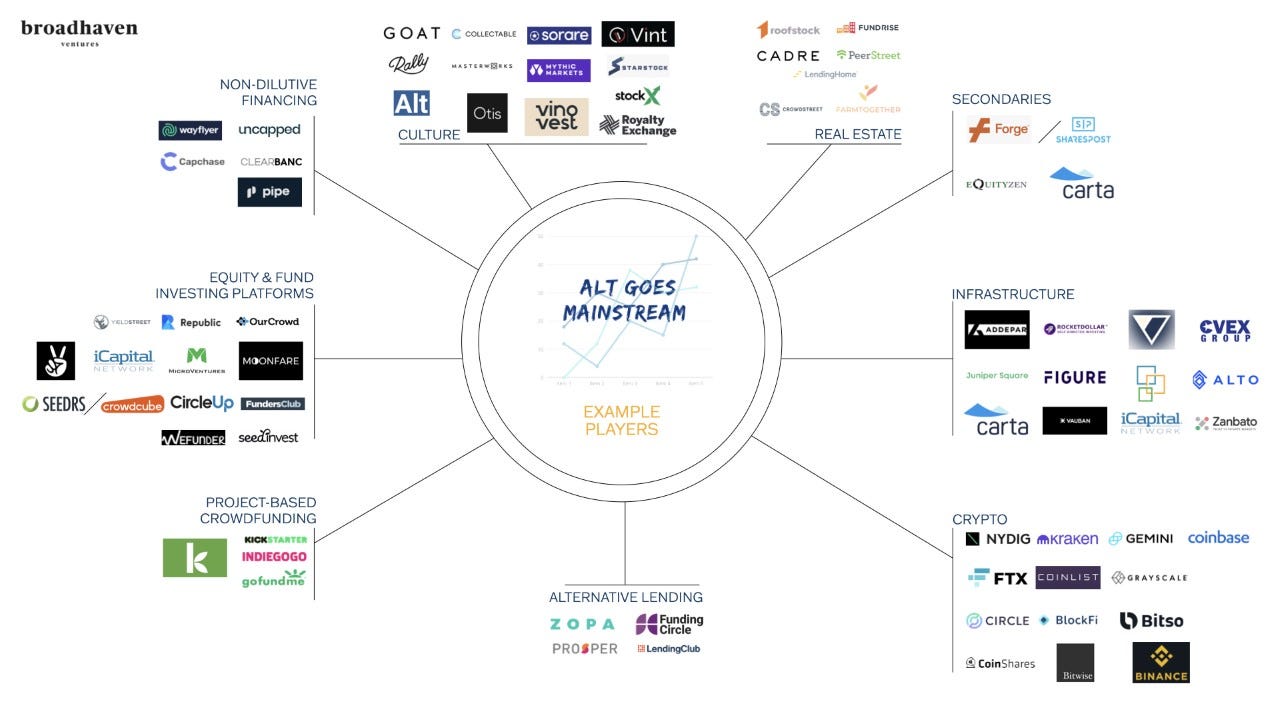

We’ve seen a rise in traditional financial index providers like MSCI and S&P thanks to the growth of passive investing. Equities markets in particular have experienced a massive increase in passive investment product as a percentage of overall dollars invested in the equities markets.

Passive mutual funds and ETFs, investment products that track an index rather than seek to beat the market, are the new kings of Wall Street, growing market share in US equities markets from under 25% in 2010 to over 45% in 2019.

Alts have historically been the domain of active investing for a number of reasons. Generally, passive investing trends upward in more mature markets that can sustain broadly distributed, incremental capital flows. These markets enjoy established indexes to measure performance and have substantial demand for allocation to the asset class as a whole.

But in spaces that are nascent in their development, investing in a diversified way can still generate meaningful returns.

Take crypto for example. If you invested in the Bitwise 10 Crypto Index Fund when they launched in November 2017, you would have returned 231% since inception (crypto has a bit of volatility, so don’t quote me on this return by the hour!). That’s a 2.3x return in 3 years, which is better than many private and public investments over that time frame and significantly more than an index fund in traditional equity markets (even if it may not be better than investing directly in Bitcoin, but that’s sometimes the price to pay for diversification). That’s in large part because crypto is still growing its AUM and institutionalizing.

What is required to build an index?

(1) A lot of data. Companies like Carta have a significant amount of data about their respective markets. Carta has data on a large - and growing - number of private tech companies. So unsurprisingly, they already publish the Carta 100 Index.

(2) Institutional sponsorship and investors who are willing to create and sponsor an index-linked ETF. Eventually, markets mature to the point where institutional investors want to access a market. Often, investors will want diversification - and index funds are a good way to provide diversification and low-cost exposure to a market.

Once there’s index-ification of an asset class, then we can see a path to institutionalization, which will include institutional investor inflow and the creation of more sophisticated financial products, like derivatives, as we’ve seen in other asset classes.

What’s next? Where could we go from here?

Eventually, we could see investment managers like Fidelity, BlackRock, and Invesco team up with these platforms to create ETFs. One way we’ll know that alt goes mainstream is when there is a Fidelity StockX ETF or an Invesco Alt ETF.

Index Companies will be some of the most exciting developments in the alternative investments landscape. They will shape the new market structure for how people will invest into these assets. And they will define the future of alt assets.

And they will be a big part of what makes Alt Go Mainstream.

What other Index Companies for the alt space am I missing? Would love to hear your comments / questions below or on Twitter at @michaelsidgmore and @GoesAlt.

You can subscribe below to get access to more written and audio content from Alt Goes Mainstream.

Very compelling read and it (alongside ‘Put Your Money Where the Movement Is’) led me to think about how impact investing fits into the alt space. Even though impact investing startups continue to invest in traditional stocks, I feel that the driver behind these investments is very much an alternate desire that isn’t very well served in the current markets. For example, OpenInvest offers individuals a platform to ‘invest their values’ and I believe that anyone who invests with them cares little about the underlying asset and is largely driven by their values. So, could investing in 'values' in itself be called an alt space? There can also be an intersection between impact investing and the possibility of investing with/in an influencer which you talk about. For example, someone focused on managing climate change could chose to invest with/in Leonardo DiCaprio! Would love to hear your thoughts on this as well.