AGM Alts Weekly | 12.8.24: There were clues

AGM Alts Weekly #81: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good morning from DC, where I’ve returned from a busy week of meetings in NYC.

BlackRock has shaken up public and private markets again in 2024.

Not once (GIP), not twice (Preqin), but a third time. And this time, BlackRock has added vast private credit capabilities to its growing private markets platform. Reinforcements came this week in the form of HPS, a $148B AUM credit manager that BlackRock acquired for over $12B.

In the 6.18.23 AGM Alts Weekly, I wrote about BlackRock’s potential to become an “index company” for public markets. In their 2023 Investor Day, BlackRock highlighted three core pillars of their business — (1) ETFs, (2) Aladdin, and (3) Private Markets — that have driven the firm to over $11.5T in AUM.

From the 6.18.23 AGM Alts Weekly: To some extent, BlackRock has been an index company for public markets. The growth of BlackRock’s AUM and product suite in liquid markets has enabled more people to invest into public markets. Now, they appear poised to run a similar playbook in private markets.

At the time, they still needed to build out certain aspects of their business in private markets to supplement the organic businesses they had built in both asset management and software / data.

With this week’s acquisition of HPS, BlackRock is going for blackjack. They have since filled out their platform with significant capabilities in both data (Preqin) and credit (HPS).

“Fees rule everything around me” (a Glenn Schorr quote)

BlackRock’s Q3 2024 Earnings Statement paints some of the picture as to why BlackRock might want to add a major private credit franchise to the fold.

Alternatives represent 3% of BlackRock’s $11.5T AUM but 11% of the firm’s base fees. Public equity and fixed income are heading in the opposite direction. Equity represents 55% of BlackRock’s AUM but 51% of their base fees. Fixed income represents 26% of BlackRock’s AUM but 23% of their base fees.

Adding HPS to the mix should offer a quicker path for BlackRock to grow its private markets management fees in a meaningful way.

HPS’s $107B of fee-paying AUM is expected to add ~$850M of 2025E base fees and $360M of post-tax 2025E FRE. All of this will come at nearly 50% margins, representing ~90% of distributable earnings.

HPS’s fees will supplement BlackRock’s revenues in private markets from management fees. Adding GIP’s management fees to the newly-acquired HPS’s management fees, pro-forma private markets management fees are expected to increase by ~35% to over $2.5B.

Not to mention, BlackRock is adding a business in a growing industry. A chart from BlackRock’s HPS presentation illustrates that “traditional” private credit AUM is expected to more than double in the next 5 years to over $4.5T AUM.

That figure doesn’t even include the much larger $35T TAM in private credit that consists of a broader array of assets that could be financed outside of the banking system as the continued convergence of public and private take hold.

Distribution deluge

The other interesting aspect of BlackRock’s acquisition is that they add a highly capable and proven distribution business in HPS to their already proven distribution engine and expansive network.

HPS is a top five firm by private credit AUM and a top two-ranked firm by private credit fundraising over the past five years, according to private markets data provider Preqin (which, as we know, has also been acquired by BlackRock). This ranking is surely punctuated by the eye-popping $21B Specialty Direct Lending VI that HPS closed on earlier this year.

While HPS has been a stellar fundraising machine, the majority of its capital has come from institutional channels. 68% of HPS’s $148B AUM has originated from insurance companies and pensions.

They’ve also managed to do a fantastic job of cross-selling their platform amongst their LP base, with 78% of their AUM emanating from multi-product relationships.

HPS has managed to grow to meaningful size and scale with a rather institutional capital base. And that should continue, particularly given some of the data points from the BLK / HPS presentation, such as the fact that “institutions are underallocated to private debt targets by ~200 bps (5.7% vs. target 7.8%)” and the fact that “80% of insurers expect to increase or maintain private debt allocations in next 24 months.”

But there’s also a massive opportunity for HPS (and now BlackRock) to meet the growing demand for private debt within the wealth channel.

BlackRock’s presentation states that “retail private debt industry AUM of $116B has grown by more than 30% since 2022.”

That figure will surely continue to grow as the wealth channel grows its allocation to private markets.

These data points illustrate that there is clearly potential for HPS to further tap into the wealth channel — and the insurance channel — for distribution. And BlackRock might be the right firm to help them do that, particularly since there’s only 6% overlap in their respective LP bases.

BlackRock’s insurance clients, which represent over $700B AUM, are exhibiting increasing demand for investment-grade private debt. HPS can help provide solutions.

BlackRock’s wealth channel clients are structurally underallocated to private markets.

And the wealth management industry appears to want whole portfolio solutions.

There were clues

BlackRock’s 2023 Investor Day presentation provided some clues.

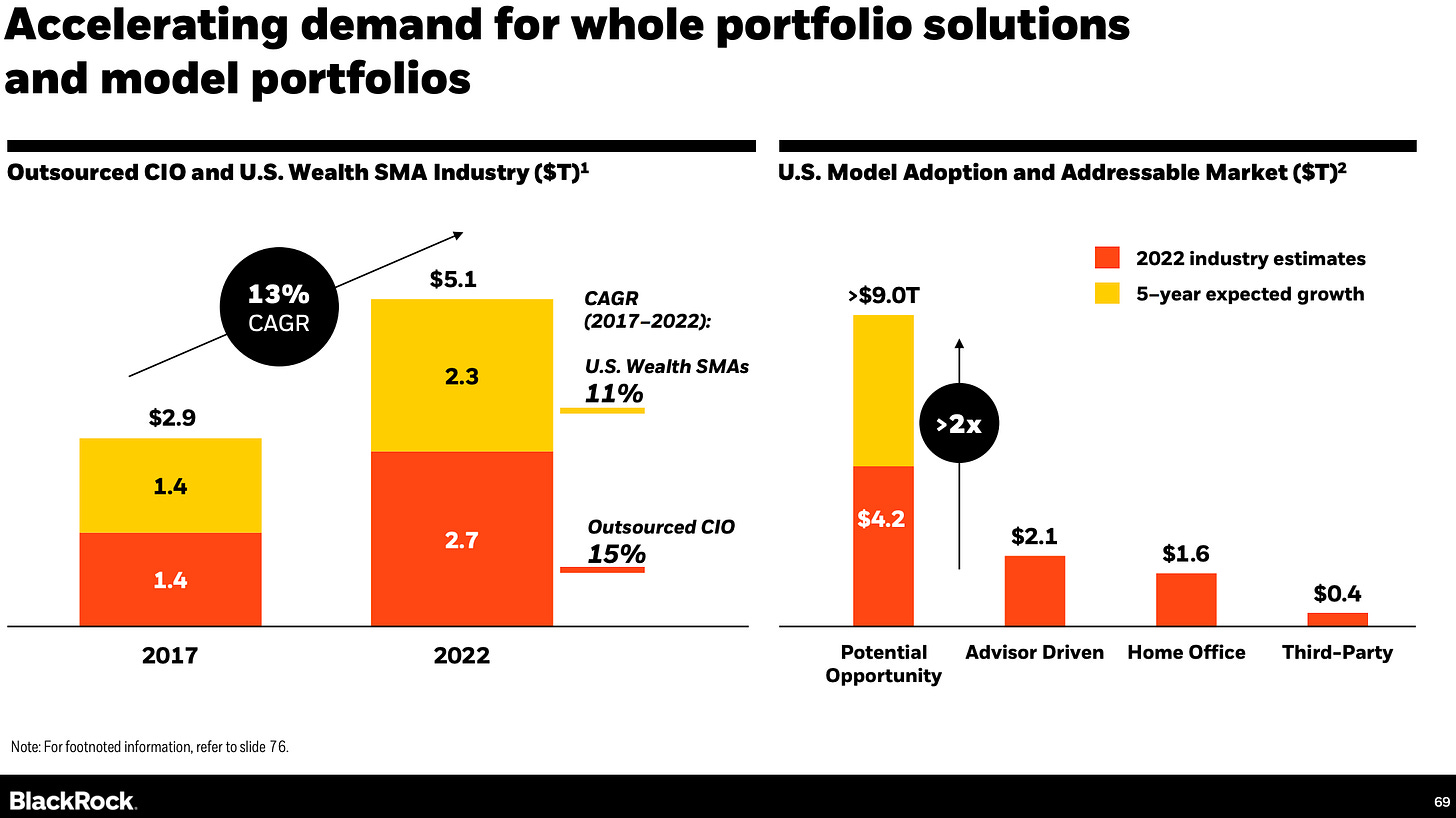

Whole portfolio outsourcing growth was outpacing the industry from 2017 to 2022. The global whole portfolio solutions market exhibited 16% CAGR, growing from $2.9T in 2017 to $5.3T in 2022.

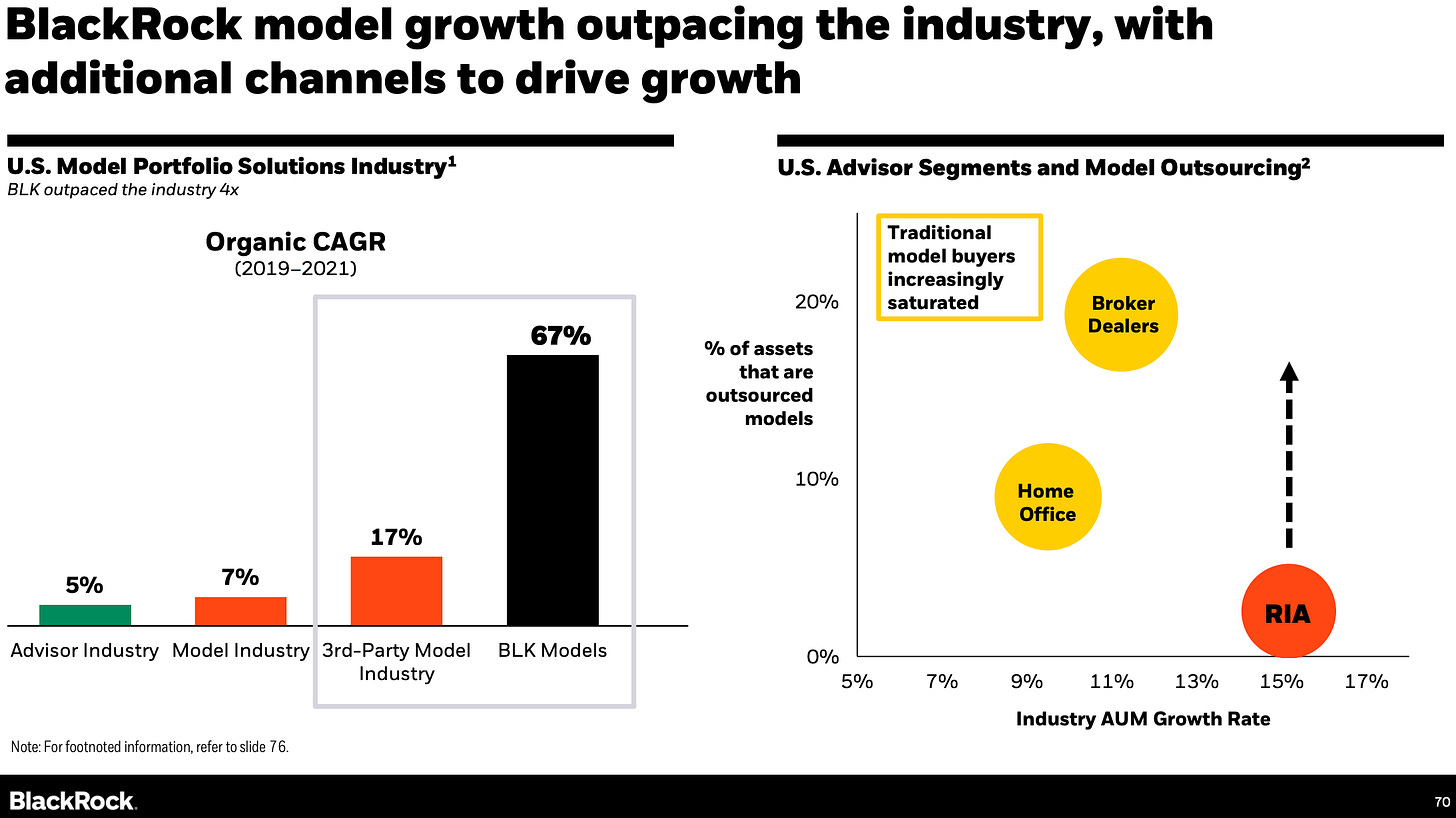

Advisors have been adopting model portfolios and whole portfolio solutions over recent years.

And yet, despite growing faster than other segments of the US Advisor market, much of the RIA channel has yet to move its assets into outsourced models

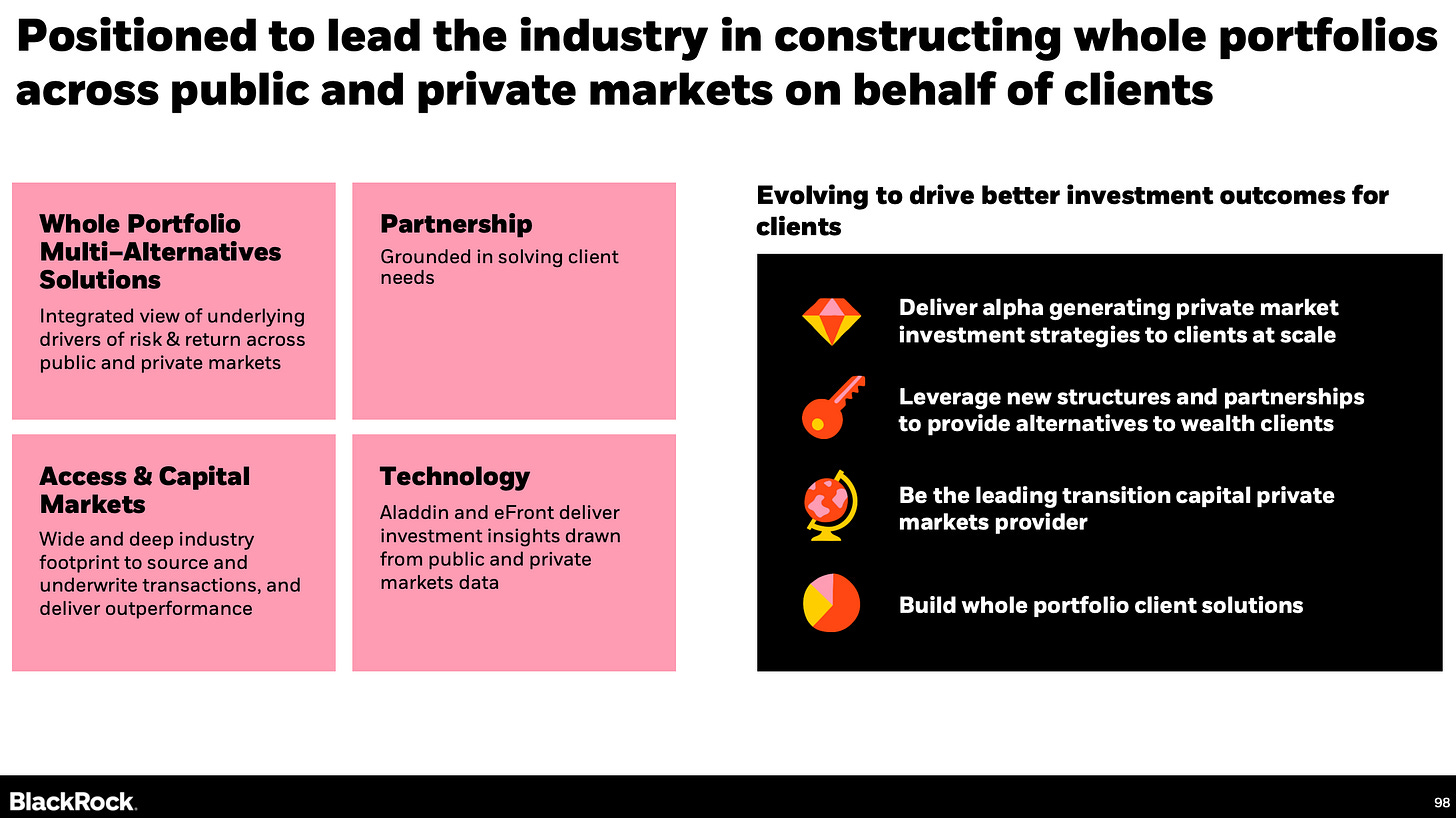

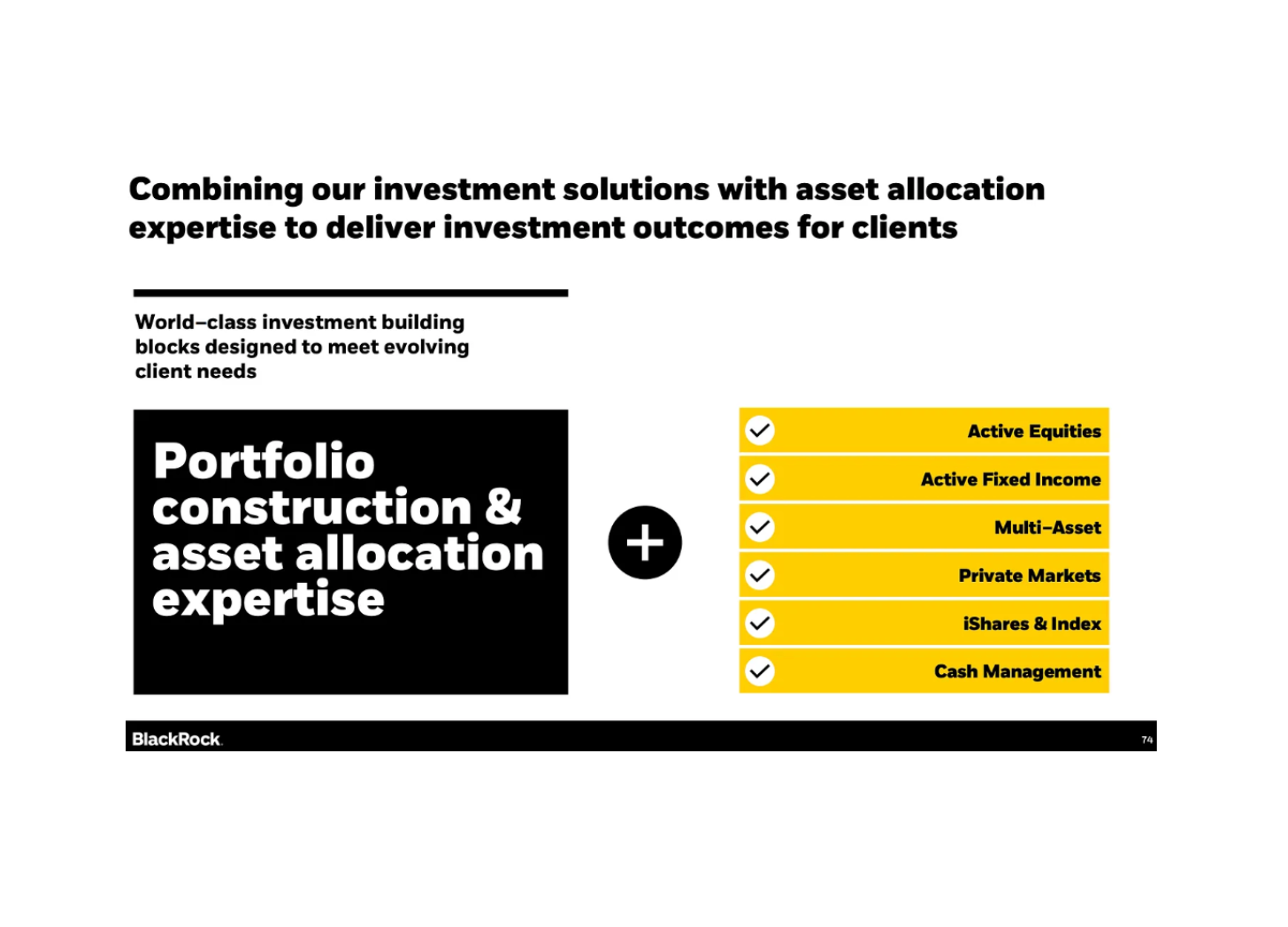

BlackRock, whose growth of model portfolio solutions has far outpaced its competitors in recent years, is now positioned to build whole portfolio multi-alternatives solutions, as they say in the slide below.

The pieces of the puzzle have come together. BlackRock has built a platform across asset management and technology — underpinned by Aladdin, an operating system for investors to manage portfolios and risk — that enables them to capture the re-architecting of portfolios. The industry has moved from pieces of a pie to buckets and spectrums. And as the world of asset allocation begins to think of credit and equity along the spectrum of liquid to illiquid, who better to serve them than BlackRock?

The technology componentry that BlackRock has built or acquired, particularly in private markets, like eFront and Preqin, complement Aladdin. The product suite across public and private markets now includes deep capabilities in private credit (HPS) and infrastructure (GIP).

Not to mention, the HPS acquisition elevates BlackRock into a top-five private credit manager.

BlackRock is now part way through its transformation into a private markets juggernaut.

What’s next for them to build or acquire?

The remaining pieces of the private markets puzzle

Late last year, BlackRock was reportedly looking to partner with Warburg Pincus to develop joint products. This apparently came after BlackRock wanted to buy a majority stake in independently owned Warburg Pincus.

That clearly would have been a transformative deal for BlackRock (and Warburg Pincus) if it had happened.

It didn’t take long for BlackRock to execute on a transformative deal for their private markets ambitions, buying $100B AUM GIP for $12.5B.

A few months ago, BlackRock announced a partnership with $147B AUM Partners Group to build out a “first-of-its-kind model portfolio solution streamlining retail wealth access to private equity, private credit, and real assets.”

Could this partnership be a foreshadowing of BlackRock making an even bigger move in private equity than a partnership, just as they’ve done in private credit and infrastructure by buying HPS and GIP, respectively?

It would seemingly make sense for BlackRock to round out their private markets capabilities on the investment product side by fortifying other investment strategies, such as private equity, secondaries, venture, and possibly even a category like GP stakes or sports. There’s also reason to believe that they could continue to acquire their way into valuable software solutions that further the buildout of the Aladdin, eFront, and Preqin technology suites with either pre-investment workflows, distribution tools, or post-investment data and analytics that would add important features to the Aladdin toolkit.

What chess moves are left on the board?

With BlackRock’s major move for HPS, what chess moves remain on the board for their traditional asset manager competitors, banks that have (or would like to have) private markets franchises, and alternative asset managers that want to continue to grow?

For traditional asset managers and banks, one path would be to acquire their way into owning a scaled specialist, like Vista or Stonepeak, or a multi-strategy platform like Sixth Street.

Some firms, such as CVC, chose to go public themselves. Perhaps a larger asset manager would still want to buy a firm with the expansive capabilities of CVC, but less likely now that they are public.

And the question becomes, how many firms are left to be acquired?

Perhaps one place to look, as I wrote in the 9.8.24 AGM Alts Weekly, would be to look at the Blue Owl GP Strategic Capital portfolio.

An interesting thought exercise of the firms that could be next in line for acquisition or going public prompted me to create what I call “AGM’s Next Wave” (a non-exhaustive list of firms that could be in line to go public or be acquired).

Continued consolidation is coming in private markets — and the number of firms that are in a position to be acquired or go public seems to certainly be coming into focus.

There are a cohort of firms that have built strong brands as either multi-strategy platforms or vertically specific scaled specialists that could be in the crosshairs for acquisition by a bigger firm looking to add to its platform or build private markets capabilities. Some of those firms are below in an illustration of AGM’s Next Wave, a set of alternative asset managers that could either be acquired or go public.

The next wave of private markets will feature consolidation and the buildout of platforms — both by traditional and alternative asset managers. BlackRock has made their moves, with potentially more to come. Who will be next to make their moves and catch the next wave in private markets?

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the week

Blackstone President & COO Jon Gray shares his outlook for 2025 (in an office and in a suit! For anyone who sees his running videos on LinkedIn, they will know what this means).

Gray says that it’s a “pretty good outlook for asset values … [should be] a better year for IPOs … and transaction activity.”

He goes on to say that “the sharp reduction in cost of capital and a still pretty resilient economy … is a powerful combination.”

AGM News of the Week

Articles we are reading

📝 Public pension plans and [sovereign] wealth funds to invest more in private markets | Mary McDougall and Sun Yu, Financial Times

💡Financial Times’ Mary McDougall and Sun Yu report that a survey from the Official Monetary and Financial Institutions Forum (OMFIF), a UK think-tank, could indicate that institutional allocators plan to invest more money into private markets in the coming year.

Half of the public pension schemes and sovereign wealth funds expect to increase exposure to private credit, and 40% expect to up their allocation to private equity. Infrastructure appears to be in demand, with 60% of those surveyed planning to increase their allocation to the asset class. OMFIF surveyed 28 pension and sovereign wealth funds globally that collectively manage $6.5T of assets.

Some of the industry’s largest pension plans have turned to private markets in search of returns. CalPERS adjusted its strategic asset allocation by increasing its target private equity exposure from 13% to 17% and increased its private debt allocation from 5% to 8%. AustralianSuper’s annual report supported a similar sentiment, saying, “unlisted assets are expected to outperform listed equivalents over the medium to long term.”

OMFIF Managing Direct Nikhil Sanghani said that the survey highlights institutional allocators’ focus on long-term returns: “They’re going back to being long-term investors and seeing opportunities over the long term in private markets and being less worried about liquidity and are willing to take on more risk.”

Some central banks and regulators have expressed concerns about the rapid growth of public markets, particularly in private credit. The IMF said that large financial institutions could face potential contagion risks from exposure to private credit. The Bank of England has warned about the widespread use of leverage within private equity firms and their portfolio companies, making them “particularly exposed” to tighter financial conditions. JPMorgan CEO Jamie Dimon also shared a similar sentiment, calling out the lack of transparency and liquidity in private markets, as did UBS CEO Colm Kelleher.

💸 AGM’s 2/20: The survey and quotes from this FT article bring up a number of notable trends in private markets.

We’ve spent a lot of time talking about how the wealth channel is structurally underallocated to private markets and how an increase in wealth channel allocations to private markets would move the dial on overall private markets AUM. Part of the focus on the wealth channel by alternative asset managers has emanated from the view that institutional allocators would not represent as much of a net new growth area as individual investors in private markets allocations on a go-forward basis. This, in part, has been due to some of the structural challenges that the industry has faced over the past few years. Many institutional allocators were already exposed to private markets and, with declining distributions, couldn’t recycle that capital into private markets in the same size and scale that they had done so in the past. The denominator effect left them upside down on their allocations. Perhaps this survey is foreshadowing that institutional investors expect to receive distributions in 2025 and allocate to private markets in a big way.

The interest in infrastructure and private credit by institutional allocators also signals that the alternative asset managers with size and scale will be winners in the fundraising game. Scale matters in certain areas of private markets more than others — and infrastructure and private credit represent categories that benefit from scale. Larger funds will win the larger deals, which require both meaningful capital and certainty of funding, benefitting the largest scaled platforms. This perhaps can help make sense of why BlackRock acquired $100B AUM GIP and $148B AUM HPS.

Data from Blue Owl illustrates that the largest funds have raised the lion’s share of the capital, particularly in infrastructure and private credit, which aligns with the trend of institutional allocators looking to deploy capital into these categories.

📝 EQT fires up energy transition strategy as LPs bet on green infrastructure | Jessica Hamlin, PitchBook

💡PitchBook’s Jessica Hamlin dives into EQT’s latest infrastructure bet, where the $142B AUM alternative asset manager just launched a new energy transition infrastructure strategy by purchasing German battery storage company ju:niz Energy. EQT’s new strategy will invest into categories such as electrification, recycling, battery storage, electric vehicle charging, and electric heat pumps. Interestingly, the strategy will initially be backed with capital from EQT’s balance sheet — and ju:niz Energy will be the first deal out of this new strategy.

Zooming out, energy transition is a major theme for infrastructure funds. As the world looks to shift its energy production from fossil fuels to low- and no-carbon-emitting alternatives, infrastructure funds focused on energy transition investments have attracted the bulk of the capital. A PitchBook analyst report notes that private infrastructure vehicles with at least some energy transition allocation attracted $892B in commitments, which was roughly 80% of the total capital raised by all infrastructure funds from 2014 to 2024.

PitchBook senior funds strategies and sustainable investing analyst Anikka Villegas notes that EQT’s strategy is focused on a segment of the energy transition infrastructure market that has historically attracted less capital. The majority of investments in infrastructure have been concentrated in renewable energy generation, with less capital being directed into battery storage, electric vehicle charging infrastructure, and other supportive technologies. But EQT’s new strategy could help make it easier to transition to clean energy by supporting other areas of the energy transition. EQT’s strategy helps to address the issue of intermittency when renewable energy sources like wind and solar power are unable to produce consistent energy. Villegas said, “Better, cheaper, more available energy storage is a big part of the solution. EQT’s new strategy zeroes in on energy storage and distributed energy themes, both of which help address the intermittency problem and thus enable a smoother transition.”

This new strategy by EQT adds to the $76.1B AUM infrastructure business, which includes a $30B infrastructure fund that the firm closed in 2023.

💸 AGM’s 2/20: Infrastructure and transition investing require significant amounts of capital. EQT’s new strategy is an interesting way to build out a new strategy. By investing balance sheet capital to acquire a business in ju:niz Energy that will likely serve as a core part of their investment strategy as they look to build and invest in other solutions that will enable the transition to a low-carbon economy. It looks like EQT’s scaled platform and reach in infrastructure will enable them to add on other businesses to ju:niz Energy’s platform and compliment EQT’s $72B AUM infrastructure investment business. This move by EQT is notable because it highlights the trend of owning something rather than just investing in it. Now, private markets firms have the size and scale to own and build businesses within their larger platforms — and infrastructure investing is no exception. Owning rather than just investing in a business provides the alternative asset manager with more flexibility to grow the business — and possibly even means they can leverage other areas of their broader investment platform across real estate, private credit, and private equity to finance the continued growth of a strategy like their Transition Infrastructure Strategy. EQT isn’t the only alternative asset manager looking to build rather than buy. General Catalyst has done something similar, incubating a company that aims to buy a hospital system. With ownership being critical in both venture and private equity — and particularly in capital intense categories of private markets like infrastructure investing — I’d expect more firms to look to incubate or build in order to have more ownership early.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Product Marketing, VP, EMEA. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Vanguard (Asset manager) - Venture Investing - Senior Associate. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 BMO (Asset manager) - VP, GAM Alternative Investments, Investor Relations. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Sagard (Alternative asset manager) - Head of National Accounts, Private Wealth Solutions. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.