AGM Alts Weekly | 2.9.25: "I don't know"

AGM Alts Weekly #89: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

LemonEdge is a leading fund, partnership, and portfolio accounting solution for private markets investment firms with backing from Blackstone Innovations Investments, amongst others. LemonEdge helps GPs, VCs, Family Offices and Fund Administrators transform their back-office operations, through making the complex, simple.

LemonEdge helps firms manage equity, real estate and infrastructure across closed-ended, open-ended and hybrid structures of any variety, with all management fee, waterfalls or other typical Excel based calculations all embedded in LemonEdge. Scale your operations with high efficiency and deliver exceptional LP / GP service.

Good morning from Washington, DC, where I’m back after a week of meetings in New York City.

This past week, HEC released the results of its HEC Dow Jones Large Buyout Performance rankings. This report shows the top 20 PE firms based on all buyout funds raised between 2011 and 2020.

How many firms on this list would most people recognize?

Probably not many.

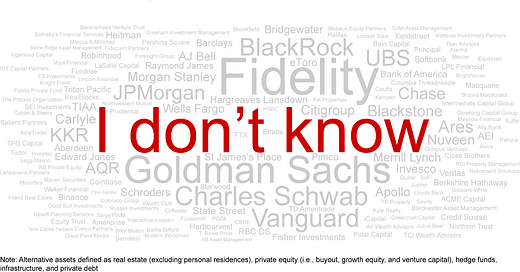

A December 2022 Bain & Company HNWI survey asked the question:

“Please list up to three firms you are familiar with that provide investments into alternative assets.”

The most common answer?

“I don’t know.”

Bain’s survey revealed a number of interesting insights into the mind of a wealth channel investor.

“I don’t know”

“I don’t know” was the top answer amongst 418 HNWI investors surveyed when asked to list up to three firms they were familiar with that provide investments in private markets.

If there’s a picture that’s worth a thousand words about just how early the wealth channel is in its adoption of private markets, this one is it. The opportunity to create a brand — or enhance an established brand, particularly for traditional asset managers — is there for the taking.

Another notable feature of the survey results is that many wealthy investors automatically associated a large brand in financial services with their provision of private markets products. Certainly, BlackRock and Goldman Sachs have large private markets businesses that have amassed over $400B and $500B AUM, respectively (I have talked about BlackRock going for blackjack in private markets with their acquisitions of GIP, Preqin, and HPS on Alt Goes Mainstream and Goldman’s sleeping giant alternatives business here).

While I have no doubt that large and recognizable financial services brands like Fidelity, Schwab, and Vanguard will expand well beyond the private markets capabilities that they already have, their private markets footprints are a fraction of the size and scale enjoyed by established alternative asset managers Blackstone, KKR, Ares, Apollo, Carlyle, each of which garnered smaller word bubbles in the above chart.

Now, let’s reveal the firms on the Top 20 HEC Dow Jones Performance Rankings.

For those entrenched in private equity, the firms listed above represent some of the who’s who of the industry. Certainly, the appearance of many of these firms on the list shouldn’t come as a surprise based on these firms’ respective performances from 2011-2020, the period that the rankings cover.

Rank and file it away

There are a few interesting takeaways from the results of the rankings:

Not (yet?) everything to everyone

Yes, some of the firms on the list have added other strategies, like credit, as part of their investment platforms. But they are not true multi-strategy platforms that offer virtually every strategy within private markets as part of their platform. Francisco Partners has a $3B AUM credit business, but that business compliments their core business of $45B AUM, which has a heritage of investing in technology companies as a private equity and growth investor. While a $45B AUM platform is no small feat by any means, FP has not expanded their platform to include infrastructure, real estate, venture capital, or secondaries strategies.

Expansion, but not at the expense of private equity fund performance

Some firms, like Clearlake, have expanded their credit business, but not at the expense of strong performance in their core private equity business from 2011-2020. Clearlake, which has taken in GP stake investment from Blue Owl’s GP Strategic Capital platform, Goldman Sachs’ Petershill Partners, and Landmark Partners (now part of Ares), grew its credit franchise both organically and inorganically through acquisition to over $57B AUM. That figure represents over 60% of the firm’s $90B AUM.

Permira, similarly, has grown its direct lending credit strategy to over €16B AUM and its CLO management business to over €4B AUM as its platform has increased to over €80B AUM.

Credit can certainly be complement a private equity strategy. A track record and scaled platform within private equity has likely created a brand for these firms within the private equity world that lends itself well to these firms building a credit business that can also serve existing portfolio companies or companies of a similar profile and can create synergies across their business units.

We’ve talked a lot about alternative asset managers being one-stop-shops for LPs, particularly in the wealth channel, but the same can also apply to firms serving companies. A credit business and a private equity business can be a solutions provider to private companies across their equity and credit needs.

While this strategic imperative certainly makes sense for firms building out their platforms and continuing their growth trajectory, LPs are likely wary of their exposure to a specific sector or industry. If an LP allocates to a firm’s private equity strategy focused on technology companies and then also invests in their direct lending strategy that has exposure to technology companies, though the risk profile, volatility, and return streams differ, the LP is exposed to the same sector or company profile.

It will be interesting to see how firms navigate the evolution of their platforms to meet the needs of LPs, particularly in the wealth channel, where LPs want less, not more, GP relationships.

Could the next Blue Owl, which has grown from $0B to $250B in AUM in the past nine years, be created from scratch in today’s private markets ecosystem?

I think it would be hard.

But could we see two firms with completely different areas of focus — say, infrastructure and technology equity and credit investing — come together to leverage synergies in distribution and grow their platform into a combined $100B-200B AUM business across strategies?

I think we could.

I think firms could look to partner to create the next private markets behemoth that could argue that it possesses “best-of-breed” investment competency and track record across specific strategies.

A tech focus

Many of the private equity funds that topped the rankings are tech-focused firms. Perhaps this shouldn’t come as a surprise given that arguably every company is a tech company in today’s world, or at the very least, touches technology and is a tech-enabled services company.

2011-2020 represented tremendous growth in technology innovation and increased digitalization, so it makes sense that firms like Francisco Partners, TA Associates, Thoma Bravo, Accel-KKR, Veritas Capital, Hg, Permira, and others on the list performed exceptionally well during the period.

I’d expect the coming years to represent an opportunity for private equity investors to leverage GenAI and the rise of AI agents to drive business efficiency in services and tech-enabled services businesses that they invest in. So, while the next ten years might see new firms appear on these rankings, firms that have deeply entrenched brands in private equity and technology should continue to have persistence in performance.

A dedicated focus on the wealth channel

A number of the firms in the rankings, such as Hg and Permira to name a few, have built out dedicated business units focused on private wealth.

Hg built a team in 2022 dedicated to serving the needs of the private wealth channel, and in 2023, launched its first open-ended fund, Fusion, to provide investment opportunities exclusively to private banks, family offices, and individuals.

As the firms in these rankings continue to build their firms and grow AUM, I anticipate we’ll see them build out dedicated wealth businesses to serve the specific needs and product manufacturing requirements of the private wealth channel, just as Hg and Permira have done.

Scale didn’t hinder returns

Scale didn’t hinder returns. HEC Professor Olivier Gottschalg noted that the average scale (i.e. quantum of capital raised over the relevant “vintage decade”) for the top 10 performers was higher than that of firms ranked 11-20. Seven of the top 10 firms listed raised more than $10B during that period, highlighting that top firms performed well even as they grew in fund size.

I’ll share again the chart from Blue Owl’s 2024 GP Strategic Capital Outlook, which has become an oft-used illustration to highlight the trend of the larger firms raising meaningful portions of capital relative to other firms with the same strategy.

The big are getting bigger. But, in certain instances, that doesn’t seem to be a hindrance to performance for some of the top-ranked funds in the HEC Dow Jones rankings. Veritas Capital is one case in point: their 2017 vintage Fund VI was bigger than prior funds yet performed even better than prior, smaller funds (and prior fund performance was quite good, to boot).

Really big or really unique

But does performance eat brand’s lunch when it comes to capital raising, particularly in the wealth channel?

Not necessarily. Brand, reach, product manufacturing and construction all matter with wealth.

Fights for inclusion on wirehouse menus will largely be duked out between the largest funds which have the brands that resonate, and distribution teams that can cover advisors nationally and globally.

Large wealth platforms, particularly the independent wealth platforms that are massive in size and scale, have to balance customization with scalability, so they will often need to work with funds that can handle a $200M allocation, not a $20M allocation.

Model portfolios offer another avenue for funds that are looking to work with the wealth channel. The largest alternative asset managers will likely be able to create their own models that comprise of strategies across their entire platform. These firms possess the size and scale, breadth and depth to create a “firm” model portfolio. Brand matters, and so too will the ability for a firm to offer a single multi-strategy solution to the wealth channel.

So what can firms that lack the necessary size, scale, and distribution teams do to combat the challenges of having a less well-known brand within the wealth channel?

An opportunity for partnership

Partner.

Recently, I alluded to ways in which scaled specialists and firms that have unique areas of expertise and track records can navigate the wealth channel.

But scaled specialists — like Stonepeak in infrastructure, which has over $72B AUM, or Vista, with over $100B AUM, Hg Capital, with over $75B AUM, and Permira, with €80B AUM, in software and growth — have the ability to carve out a niche in marketing and branding that should enable them to win in the wealth channel (note: Stonepeak and Vista have taken GP stakes from Blue Owl’s GP Strategic Capital and Permira from Petershill, while Hg has not).

These firms can create unique product structures, either by how they structure evergreen funds or how they seed these funds with a specific LP base, that can enable them to achieve success in capital raising.

I’d also expect these types of firms to figure out how to partner with other firms that have no competitive overlap to create “best-of-breed” model portfolios.

Getting in the models will be critical to success in winning the wealth channel, so if firms can establish alliances to build a bespoke model portfolio in private markets for the wealth channel, then they could fit the pieces of the puzzle together to become a relative winner in a complex and fragmented wealth market.

The strategic imperative?

One of the possible strategic imperatives? Devise unique and differentiated model portfolios.

A sentence tucked away in a white paper from Broadridge about the rise of model portfolios within public markets provides insight to private markets wealth solutions teams: “Finally, asset managers view model portfolios as a new distribution channel of sorts. They provide an avenue for inserting active funds into portfolios to compete against passive funds.”

But for firms that are not as big, being unique can be their strength.

Being in the models provides turnkey distribution for an alternative asset manager.

Why not partner to create best-of-breed models across strategies and asset classes?

iCapital has created two model portfolios, each comprised of a hand-picked set of managers across private equity, private credit, and real estate.

Ease of use matters — and models can help achieve the ability for advisors to allocate to private markets in a turnkey fashion.

iCapital is not the only firm creating model portfolios that include multiple managers. BlackRock and Partners Group’s groundbreaking partnership with their multi-private markets portfolio should serve to enhance advisors’ practice management and their ability to seamlessly allocate to private markets.

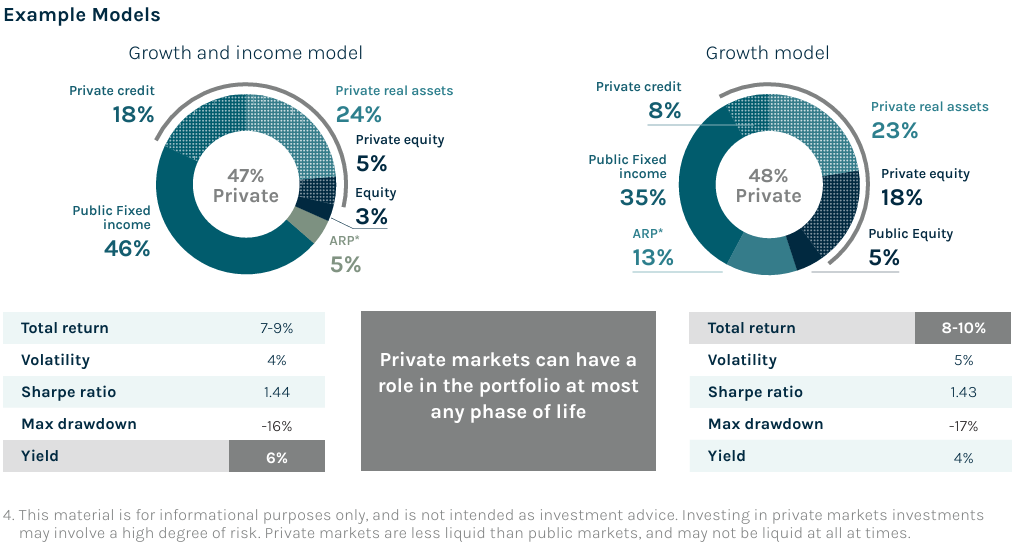

Models — and the addition of private markets exposure to portfolios — can help reduce volatility in a portfolio while increasing the frontier of returns, as the below chart from BlackRock and Partners Group illustrates.

Models offer an opportunity for investors to complement a more traditional 60/40 portfolio, particularly in a time when public market returns are expected to be lower in a more uncertain investing world.

BlackRock’s Q4 2024 Student of Private Markets white paper illustrates what could lie ahead for allocators. Looking ahead, their capital market assumptions peg private markets across credit, infrastructure equity, and buyout as potentially higher returning options to public market alternatives.

A new set of solutions?

What are the solutions in a new world order of investing?

Apollo’s Partner and Chief Client and Product Development Officer Stephanie Drescher highlighted a possible framework to approach investing in a recent Bloomberg TV interview.

She noted that “both public and private can be safe and risky, depending on the manager.”

This view was also covered in an interesting 2024 white paper by Ares, where Brendan McCurdy dove into the why behind their new, in-house model portfolio.

McCurdy noted in the white paper that Ares “believe[s] risk-based diversification (also referred to as “factor risk budgeting”) is key to building more effective portfolios utilizing private markets and unlocking wealth creation.”

The white paper illustrates the challenges with a traditional 60/40 portfolio: that risk is often driven by the equity allocation.

But, Ares notes something interesting: “many of the asset classes outside of core equity are still driven by core equity risk factors.”

And, it’s not only small cap or emerging market equity that’s closely tied to how core equity performs, McCurdy shares. He notes that “even the risk of a fixed-income asset class may be partially influenced by what happens in the equity markets—for example, more than a third of high yield’s ups and downs are driven by the same factors that impact core equity!”

McCurdy argues that different asset classes might still possess “overlapping sources of risk.”

McCurdy proposes a different framework — one based on factor risk budgeting.

Based on a framework that evaluates risk through a different lens, McCurdy suggests a 50% allocation to private markets.

How does Ares’ model stack up against the traditional 60/40 portfolio, in their view?

Data they share illustrates almost double the cumulative returns with much fewer drawdowns.

Ares then shares some frameworks for how investors can approach a 50/50 model portfolio.

Ares’ approach is but one framework for allocating across public and private markets. Every asset manager and every advisor might have a different framework for how to approach asset allocation. But it’s an exciting development for the space to see investors push the frontier of asset allocation frameworks that incorporate private markets and ask the weighty questions about risk and liquidity.

The next evolution? Firms building their own models or partnering with willing collaborators to create thoughtfully constructed model portfolios that combine the best ingredients of public and private markets exposures.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

EQT shared a video featuring Chief Commercial Officer Suzanne Donohoe on why private markets are an increasingly popular option for the wealth channel.

AGM News of the Week

Articles we are reading

Apollo bringing sunlight to the markets as public and private converge?

📝 Apollo chief predicts wave of asset partnerships will shake up Wall Street | Antoine Gara, Financial Times

💡Financial Times’ Antoine Gara reports on remarks from CEO Marc Rowan on Apollo’s earnings call from last week. Gara reads into Rowan’s comments that the Apollo chief “sees a very good marriage between our industry, our company, and the public or traditional asset managers who I believe are going to reinvent their businesses spurred on by competitive forces.” Rowan called BlackRock’s acquisitions of private credit manager HPS Investment Partners and infrastructure firm Global Infrastructure Partners should be taken as a “wake-up call” to the investment industry. He characterized those deals as foreshadowing of the “convergence” between public and private investment portfolios. Rowan said that alternative asset managers like Apollo could create co-branded investment funds or “massive managed accounts” with traditional asset managers. “Our industry and our firm will be a supplier of products similar to traditional asset managers as they seek to make their products more competitive given the incredible amount of indexation and correlation.” Gara cites loan origination partnerships on the credit side, where there’s an increasingly blurred line between activities of alternative asset managers and banks in areas like direct lending.

💸 AGM’s 2/20: Rowan’s comments in Apollo’s earnings call from this past week highlight a number of critically important — and converging — trends happening at the intersection of public and private markets. The largest alternative asset managers have raised record private credit funds, in part due to investor demand for private credit and in part due to a shift in how both investors and alternative asset managers view the conceptual framework of what’s risky and what’s safe. Private credit’s size and scale means that private credit firms can do deals on their own, devoid of bank syndication. That has put banks in a position where they need to partner in order to be part of the transaction flow. Even if banks have moved away from certain lending activities due to regulations and capital constraints, they still have plenty of origination capabilities. This feature enables banks to partner with private credit firms to distribute loans they originate.

Rowan mentioned the convergence of public and private. It’s such an important and notable development for private markets that I’ll share his comments from the Earnings Call Transcript:

… I think personally the most important driver of our business, is an entire rethink of public and private. And what I mean by that is our industry grew up where I think people thought private was risky and public was safe. And when something is risky, you put it in a small bucket and you call it an alternative, and you want very high rates of return from it. And 40 years later, after our industry start, I think that professionals in our industry now understand that private is safe and risky, and public is safe and risky. And if people are not watching closely, the largest asset manager, the traditional asset manager in our industry, has delivered a wakeup call to their entire peer set that private is going to be an important part of client solutions going forward.

The wake-up call Rowan is referring to? The chess moves by the world’s largest asset manager, BlackRock, with their acquisitions of HPS, GIP, and Preqin.

Rowan goes on to comment:

… BlackRock made a number of very significant acquisitions in 2024. Those acquisitions lay a foundation for an integration of public and private. I continue to believe this convergence of public and private will be a very important source of demand for private assets. I see private assets in any number of forms. Our industry and our firm will be a supplier of product to traditional asset managers as they seek to make their products more competitive given the incredible amount of indexation and correlation, and quite frankly, just data that exists in the market.

We envision that traditional asset managers will evolve their businesses to include products that are public and private. Some traditional asset managers will actually want to launch new products that are co-branded. We are doing that as well. And some will seek to augment their business with massive managed accounts, where they have access to private assets from a variety of different players. I think this is good for our entire industry.

We will not, as an industry, serve the vast majority of clients around the world. We simply don't have the resources, we don't have the efficient systems, and we don't have the relationships. What we do have, so long as we're good at it, is products that offer excess return per unit of risk. I see a very good marriage between our industry, our company, and the public or traditional asset managers who I believe are going to reinvent their businesses spurred on by competitive forces.

Rowan makes some notable observations about how both alternative and traditional asset managers can co-exist in the ever-evolving private markets landscape. He notes that resources and relationships are key to serving clients around the world. He observes that traditional asset managers have these relationships, efficient systems, and resources to prosecute these challenges at scale, globally. And that alternative asset managers are good at creating products and investment strategies that “offer excess return per unit of risk.” Therefore, he sees partnership opportunities between traditional and alternative asset managers.

I agree with Rowan that the industry will likely see an increasing number of partnerships form — both between alternative asset managers and between traditional and alternative asset managers. But where I see challenges for traditional asset managers is that they will need to upskill and educate salesforces and distribution teams to be able to resonate with the wealth channel. Some will be able to do this, but for others it could prove to be more challenging than it might seem. The largest alternative asset managers are marshaling resources to build scale with both distribution and brand that can compete on a global scale. It doesn’t mean they won’t forge partnerships with traditional asset managers, as Rowan says, but it means they will have a puncher’s chance at winning on their own. Apollo certainly has begun to develop traction in the wealth channel, reporting in this past week’s earnings that they raised $12B of capital within their global wealth business.

The big question, as I discussed up above in the main piece: Will brand win out in the end?

📝 Apollo Plans to Build the First Marketplace for Private Credit | Laura Benitez, Bloomberg

💡Bloomberg’s Laura Benitez reports that Apollo is looking to build a marketplace that would enable investors to buy and sell private credit assets in a more seamless, transparent way. According to Eric Needleman, Head of Apollo Capital Solutions, the firm is reportedly in discussions to partner with banks, exchanges, and fintech firms to deliver real-time information and intraday prices for private credit deals. A marketplace model would enable Apollo to trade and syndicate the debt it originates in a bigger way. “We are engaging daily with top-tier counterparties, deepening market connectivity, and expanding liquidity solutions and offerings,” Needleman said. “The conversations have been highly constructive at the highest levels.” Needleman went on to say that they are looking to build an open architecture marketplace. Apollo’s origination engine is in full force. The firm often places investment-grade products it originates on the balance sheets of its Athene insurance arm and third-party insurers. A trading function would enable Apollo to earn fees from trades and bolster its liquidity. The marketplace looks like it will be operated by Apollo Capital Solutions under its broker-dealer and the firm recently hired John Maggiacomo, who was previously Head of US Credit Sales at RBC Capital Markets.

It also appears that some other alternative asset managers see value in a marketplace model for the private credit space: “There’s a clear use case and demand for secondary markets to develop in these instruments, but to do so we need sophisticated partners with expertise in both private and syndicated domains,” said Brendan McCaffrey, head of capital markets and trading at TPG Angelo Gordon’s corporate-credit business.

💸 AGM’s 2/20: It appears that private credit and public credit are heading for a collision course, and Apollo is looking to position itself at the epicenter of the action. A marketplace would enable the firm to benefit from its own size and scale in loan origination — Apollo originated $222B of loans last year — while also creating more transparency and efficiency in the private credit ecosystem. The ability to syndicate out loans they or other partners originate offers the opportunity to match this supply with investor demand from the likes of insurers and private wealth, both of whom are increasingly active participants in private credit. Alternative asset managers are continually looking for ways to become solutions providers to companies in both equity and credit markets, and Apollo’s creation of a marketplace for private credit would help to further that ambition.

The other interesting aspect of Apollo’s move to build a marketplace is that they have already built a structural advantage in private credit through the partial or majority ownership of 16 origination platforms across various categories of credit.

Apollo’s origination engine enables them to create and offer yield assets that those both within and outside of their ecosystem can buy. Apollo’s strategic moves have given them a captive origination and distribution engine, which has helped them to create a structural advantage in a number of ways.

A marketplace, likely a consortium amongst other originators, like banks, and buyers of debt assets, like private credit and insurance firms, would mirror other consortium models that have been created by and for capital market participants.

As I’ve said before, private markets is undergoing a market structure evolution that mirrors that of equities, fixed income, and derivatives. Apollo’s marketplace move brings private markets one step closer to achieving this evolution.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Senior Video Producer, SVP - Marketing. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Senior Public Investor Relations Professional. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Head of Business Development, Family Offices - Senior Vice President / Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click hear to learn more.

🔍 BlackRock (Asset manager) - Aladdin Wealth Tech - Vice President, Implementation Manager. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Hightower - Crest Capital Advisors (Wealth manager) - Private Wealth Associate - Crest Capital Advisors. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Edward Jones (Wealth manager) - Director, Alternative Investment Strategy. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Keith Jones, Senior Managing Director, Global Head of Alternative Investments Product at Nuveen live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.