👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from London. I’ve just returned from a busy week in Berlin and Zurich (some pictures below), meeting with VCs (including AGM guest Filip Dames of Cherry Ventures, listen to his podcast here), attending Motive Partners’ portfolio day (thanks to Ramin Niroumand from Motive Ventures for the invite), seeing some of our portfolio companies and funds (👋 Levent Altunel from bunch and Philipp Moehring from Tiny VC) and speaking at SuperInvestor in Zurich.

As a venture investor, unearthing trends before they become mainstream is both core to our work and one of the most energizing aspects of the job. Alts are no doubt becoming commonplace in an investor’s portfolio. But there are corners of private markets that have yet to hit the mainstream, particularly for the middle-market alternative asset managers and a large number of LPs, including many in the wealth channel. Friday’s panel at SuperInvestor in Zurich with Catherine Haumesser from Armen, Nicolas von der Schulenberg from Portfolio Advisors, and moderated by Thomas Liaudet of Campbell Lutyens on GP staking, certainly had that feel.

At SuperInvestor, I represented Cantilever, the GP stakes fund we are helping to build at Broadhaven Ventures with one of our Broadhaven Capital Partners colleagues, Todd Owens.

Cantilever was founded by Todd, a former Goldman Sachs Partner who took Oaktree, amongst others, public as the Head of West Coast FIG, and David Ballard, a 30-year Wall Street veteran with experience structuring derivatives. Todd and David have built a GP stakes fund along with industry veteran and first hire, Ben Drylie-Perkins, in partnership with BTG Pactual and Broadhaven that focuses on providing flexible, passive, minority, and strategic capital to lower middle-market alternative asset managers who are looking to grow their businesses.

Large GPs, particularly those who are public, have access to many different types of financing instruments that can help them: grow their business, solve for long-term succession planning, recapitalize the business, or solve for a GP commitment. Todd, David, and Ben have built Cantilever to fill a gap in the middle-market that exists by building a solutions provider for smaller funds.

GP staking is by no means a new concept in private markets. Firms like Dyal (Blue Owl), with over $50B AUM, and Petershill, the Goldman Sachs affiliated stakes fund, have paved the way in the GP stakes space by building large franchises, working with many of the industry’s established asset managers, and going public (Dyal merging with Blue Owl and going public at the management company level via SPAC and Petershill’s funds going public in London).

But it’s certainly in its early days of an industry evolution.

Beyond a few dedicated GP stakes firms that focus on taking minority ownership stakes in large asset managers like Silver Lake, Clearlake, CVC, Francisco Partners, and General Catalyst, there aren’t many GP stakes funds that focus specifically on the middle-market. That has begun to change.

Friday’s panel at SuperInvestor had two new entrants represented — Catherine Haumesser from Armen, a newly formed European middle-market focused GP stakes fund, and Cantilever. This panel follows the news from Bloomberg that Dyal, who previously focused on the top end of the market, will make its move to the middle market with the launch of a $2B AUM stakes fund.

Friday’s panel felt like the early days of something that will feature as a much bigger part of private markets in the future — for both GPs and LPs.

Panel moderator Thomas Liaudet, a Partner and Global Head of GP Capital Advisory at Campbell Lutyens who works on many of the transactions in the stakes space, remarked at the outset that the GP stakes space feels similar to the way secondaries felt ten years ago. Ten years ago, Liaudet said, LPs would question why GPs were doing secondaries and what the fallout of that would be for LPs. Today, LPs are sometimes skeptical of GPs giving up an equity stake in their business.

Nicolas von der Schulenberg, Managing Director at $40.8B AUM Portfolio Advisors, asked the right, if not provocative, question: “Why would a LP want to be an investor in a fund where the manager has taken an equity investment into their business?” Nicolas’ concern is that once a manager takes an equity stake, they become more focused on growing AUM at the expense of performance. Very valid question. This point is particularly acute when the goal of the GP stake is to provide liquidity to an exiting partner or to the existing GPs. A fair concern — and one that managers must deal with when fundraising.

The counter to this point is twofold:

One, VCs and PE firms invest in founders and help them grow their businesses. Fund managers are founders, too. They just happen to be founders of asset management businesses. Why shouldn’t they, too, take strategic capital from investors to help grow their business?

Two, Nicolas may have quite a valid point as managers evolve into asset gatherers (and, even still, some of these large, multi-strategy alternative asset managers continue to generate strong returns for their LPs, at times, in certain strategies due to the very scale they have). That concern should be more muted in the middle-market. A $2B firm will still have to generate strong investment performance for LPs in order to earn the right to grow to $10B AUM.

Additionally, deals with middle-market firms often provide capital into the business, not liquidity for GPs to take out. Catherine from Armen highlighted this point on the panel, as Armen focuses on providing capital to help European middle market firms grow rather than achieve liquidity events.

Some other themes emerged from our conversation:

Private equity exposure with private credit-like (and possibly private equity-like) returns: GP stakes investing provides current income and capital back to investors much faster than traditional private equity investing. Stakes funds either own a portion of the management fee revenue and carried interest stream or a stake in the Management Company of the alternative asset manager, where they receive a portion of the bottom line revenues from the firm on an annual basis.

Many investors, particularly those newer to private markets, are often reticent to invest in illiquid strategies. That’s partly why secondaries have proven so popular in the current market. And it’s why stakes funds could, too. Stakes funds can possibly see return of capital faster than private equity funds, reducing the J-curve for investors.

The carry and growth in AUM represent upside for stakes fund investors, which can put returns, particularly in the middle market, in the 20%+ IRRs when done right.

With stakes investing, investors have exposure to growth of the asset class as firms grow AUM, but, unlike investing in a private equity or venture fund, they don’t have to wait until a portfolio company liquidity event from the fund to see capital back since management fee revenue provides stake in the ground yield from day one. The panel all echoed that one could view GP stakes investing as private credit-like returns in the private equity space, with the possibility of additional upside if the carry is crystallized.

The middle market is underserved: Even with new entrants to the middle market like Dyal, Hunter Point (founded by the former head of Blackstone’s GSO Group, Bennett Goodman), Armen, and a few other firms who have focused on the middle market like Investcorp, Bonaccord, et al., there is plenty of room for everyone. Cantilever estimates that there are 1,500 firms between $500M-$8B AUM who have not taken a GP stake investment. Investcorp recently pegged the market as having $21 of supply in North American and Western European GPs that have yet to take investment from GP stake funds for every $1 of demand (mid-sized GP stake fund dry powder).

Liquidity, a looming question: Liquidity for large stakes funds and funds focused on the middle-market looms large. It’s still very much a question for the space. Funds will need to figure out how to achieve liquidity, either by taking their portfolio of funds public, as Petershill did in London, or via sales to other investors. As an allocator of capital across various investment strategies, Nicolas made the astute point that investors would have been better off allocating to the stock of large alternative asset managers like Blackstone, Apollo, or Ares, rather than investing in the stock of Petershill. Five year stock prices for Blackstone, Apollo, and Ares have performed quite well — Blackstone up 3.16x, Apollo up 3x, Ares up 4.84x. There’s certainly a place in a portfolio for an allocation to an illiquid strategy from one of these managers, but their stock price performance certainly begs the question of whether the best option for exposure to alts, but with the benefit of liquidity, is to invest into the alternative asset manager’s publicly traded stock.

There is no one right answer when it comes to asset allocation decisions. Both liquid and illiquid strategies can play a role in a portfolio — that’s why playing across the spectrum of private markets to get exposure to both the dislocations and inefficiencies in areas where illiquidity is a feature and return enhancer and also to the growth of private markets more broadly as more AUM comes into the ecosystem.

What do I expect to see with the growth of GP stakes within private markets beyond what we discussed on the panel at SuperInvestor?

1/ More funds will consider — and take — investments from GP stakes funds: For some time, stakes were generally viewed as a negative signal for LPs, so many GPs didn’t pursue stakes as an option. This sentiment has evolved in recent years as many of the large alternative asset managers have explored or received stakes from firms like Dyal or Petershill. Fundraising is particularly challenging in the current environment, so funds having an aligned partner who can help them grow their business can be an accelerant to firm-building and growing AUM rather than going the traditional placement agent route. Sure, there are a number of considerations for a fund to decide to work with an equity partner rather than a fee-for-service agent, but I believe that there will be some funds that choose to work with a stakes fund that can help them strategically and holistically rather than with a placement agent in certain cases.

I anticipate that the industry will move towards more of the venture or private equity mentality of partnership between founders and investors, where GPs are founders and stakes funds are VCs / PE firms helping fund managers grow their businesses. Both GPs and LPs will view stakes as an opportunity for firms who want to build into a larger, possibly multi-strategy, franchise, to bring on board an investor who can help them grow their business tactically and strategically. Some firms have already gone this route. More will over time.

I do think that certain strategies within private markets will be more likely candidates for stakes investments. Private credit, which is experiencing a fundraising boom and is easier to scale AUM and fund size without sacrificing returns, will come into focus for many stakes funds. Private credit funds also make for good candidates to be acquired by larger, multi-strategy alternative asset managers that want to diversify, as Man Group did recently with their acquisition of Varagon. The exit opportunity represents a compelling upside case for stakes funds, which not only will generate returns from the fund’s management fees but also generate a possible return at exit.

Venture is a bit trickier. We saw Thrive take a stake initially from Petershill — and more recently from a consortium of investors that included Henry Kravis, one of the founders of KKR. General Catalyst and Industry Ventures have also taken stakes from Petershill in the past. I anticipate that some venture funds will evaluate stakes investments, particularly where there’s a strategic angle around fundraising, firm-building, or expanding into other asset classes, but generally, venture is a more difficult part of the market for stakes investors to wrap their head around. One is because fund sizes can be smaller and provide less potential for scaling AUM than other private markets strategies. Two is because carry can be more difficult to value given the unknowns around early-stage technology investments and their exit path.

The advent of stakes as an investment opportunity may also present a compelling asset allocation strategy to private markets for LPs. We see it through our own lens as LPs, particularly in venture where smaller fund sizes can drive returns. We’ve conceptualized different return streams in private markets with a barbell: invest as a LP into smaller managers, particularly in venture, as being a LP can drive outsized performance and invest into the GP of asset managers who want to scale their business as owning a stream of their management fee income (and carry) may be the more attractive than investing into their fund from a returns perspective.

2/ Crossing the $1B AUM chasm: $1B AUM will be a threshold where GPs start to think about their growth strategy as a business. At $1B AUM and, generally, a few fund vintages into their journey, GPs will start to evaluate the direction in which they want to take their firm. Sure, firms actively thinking about the business they want to build from day one, but growing to $1B AUM opens up the door to think about scale in a different way. Topics such as future fund size, becoming multi-strategy versus staying single strategy, adding partners, adding different investment products, and adding IR staff will all be top of mind as firms determine if they want to grow into a large platform or stay small.

There is no right answer — some LPs may want teams and fund sizes to stay small in order to focus on a specialization in order to drive returns. In certain cases, this path is absolutely the right move for a fund. But, in other cases, GPs may be driven to grow their business into a platform. Based on fund sizes and strategy, that could be the right decision for them, their firm, and current or future LPs.

Asset management businesses at scale are fantastic businesses in and of themselves. We need to look no further than publicly traded firms like Blackstone, Apollo, Ares, Blue Owl (some of which I profiled here a few weeks ago when they announced their quarterly results) to see that these firms have built incredible, enduring businesses.

Smaller GPs will see this and look at the trend of managers taking stakes to accelerate their growth and evolve their business accordingly as well. LPs will also see this evolution in private markets as an opportunity to work with fund managers in other ways and have different types of exposure to private markets strategies specifically and the overall growth in private markets more generally.

Stakes are in the early days of their evolution, but it’s clear that we are in an exciting time in the market as more entrants see the opportunity in the space. That much was very evident in the room in Zurich this week.

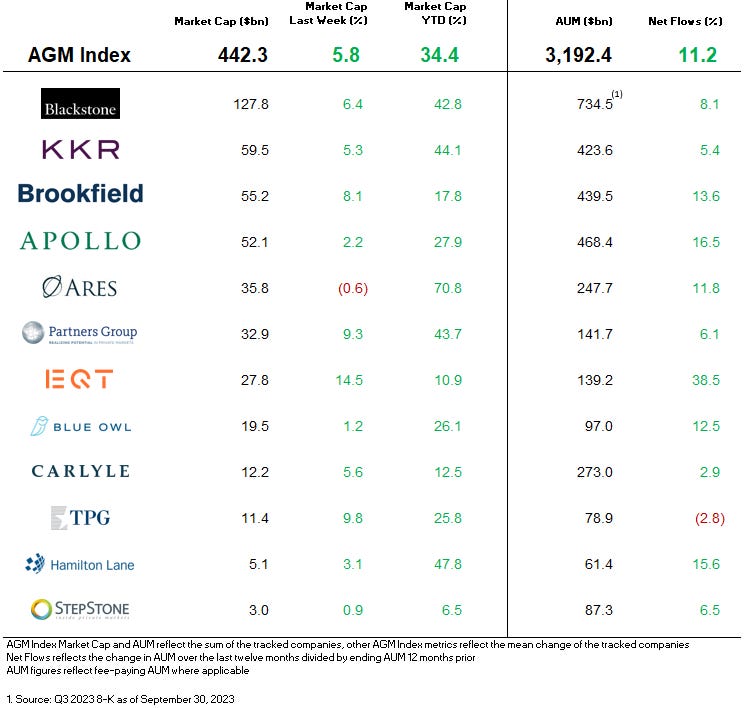

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 PE giants back wealth channel and credit funds to drive growth | Selin Bucak and Margaryta Kirakosian, Citywire

💡Unsurprisingly, the largest publicly traded alternative asset managers are keying in on private wealth as a growth area for their firms. Third-quarter earnings for these firms demonstrated a continued focus on private wealth as a channel to raise capital and provide access to private markets for a swathe of new investors. Blackstone, Apollo, Ares, KKR, TPG, and Carlyle all brought in new capital in Q3. Only Ares and KKR, however, surpassed the amount raised in Q2. Part of that new capital came from the private wealth channel, while the groups’ private credit divisions attracted inflows at a time when investors were being more cautious about private equity allocations. Apollo has gathered the most private wealth capital of the big alternative asset managers, adding $33B (including inflows from its retirement services business Athene) during the third quarter. The firm, which had a $6B fundraising target for its wealth segment, today offers seven types of perpetual products for both US and non-US global wealth investors, with a handful more in the pipeline. Ares saw the second-highest fundraising quarter in the history of the firm with $21.9B, an increase from $17B in the second quarter. Ares Chief Executive Michael Arougheti said on an earnings call that the firm continued to attract new investors to its funds and saw an increase in flows from the wealth management channel, boosted by its newly launched non-traded BDC. Blackstone, meanwhile, raised $25.3B — more than many of its publicly traded counterparts, but lower than the $30B gathered during the second quarter. Private wealth clients remain a long-term focus for the firm, which has nearly 25% of its $1.1T asset base in the space. In the third quarter, it raised $3.3B across funds offered via the private wealth channel. KKR CFO Robert Lewin said momentum across the group’s private wealth strategies is strong, with the firm raising $13B of total new capital over the quarter and the private equity and infrastructure funds raising approximately $500M a month from the segment. Carlyle, which has struggled this year amid succession turmoil, raised just $6.3B across its funds. It closed its most recent flagship buyout fund at $14.8B - far lower than the original $27B target. The firm is looking at the private wealth channel to deliver growth for its business. So far, it has raised $45B across closed and evergreen funds, but CEO Harvey Schwartz said it is continuing to invest heavily in product development and the growth of the wealth team. Lastly, TPG raised $3.4B in the third quarter, up from the $1.5B raised in Q2. The private credit ambitions of top private markets groups came through strongly in their Q3 results. KKR raised $1B of capital in credit and liquid strategies. Ares CEO Arougheti said the firm’s global direct lending business “continues to have significant white space as the private credit markets are meaningfully undersized compared to the $5T of private equity AUM.” Apollo has nearly $500B of assets in private credit, and CEO Marc Rowan noted that direct lending is “a fraction of a fraction” of what the move away from bank lending will produce.” Blackstone saw client demand for private credit accelerate across all channels — institutional, insurance or individuals — which constituted 50% of total inflows for the quarter. Blackstone has recently integrated corporate credit, asset-backed finance and insurance groups into a new single unit called BXCI in order to be able to offer a one-stop solution across corporate and asset-based private credit. With these changes, CEO Steve Schwarzman believes the unit can increase its AUM from $270B today to $1T over the next decade.

💸 AGM’s 2/20: Two major themes keep emerging from the large alternative asset managers: credit and wealth. Credit continues to go from strength to strength as many of the large players are able to raise funds in this strategy, particularly from the wealth channel. The wealth channel is also a major focus for these firms as they look to grow AUM. All of these firms highlighted the importance of private wealth as a growth driver for their firm on recent quarterly earnings calls. The focus on the wealth channel is leading to product innovation. These firms are all thinking about ways to serve the wealth channel, as Stephanie Drescher of Apollo shared on stage at Future Proof a few months ago. Blackstone’s newly formed group, BXCI, is now a one-stop solution that integrates corporate credit, asset-backed finance, and insurance teams into a single unit. Blackstone’s move to consolidate these investment strategies highlights the demand for credit investment strategies, particularly from the wealth channel, to firms like Blackstone. Blackstone’s Co-Founder, Chairman, and CEO, Steve Schwarzman, said in their announcement that he believes BXCI can reach $1T AUM in the next ten years. Blackstone’s President & COO Jon Gray echoed those sentiments, remarking that it’s due to meaningful demand in credit from their clients that’s driving their decision to create this new unit. Gray highlighted the wealth channel’s interest in this investment strategy as a reason for why Blackstone decided to consolidate these groups. This trend also echoes my comments above about GP stakes funds. Credit appears to be very much on the menu for LPs, so it’s a major growth driver for firms looking to grow their AUM.

📝 Private Debt Was Supposed to Collapse When Rates Rose. Instead It Is Everywhere. | Jon Sindreu, WSJ

💡Some on Wall Street have spent years sending out warning shots that private lenders would be the next bubble to burst when central banks tightened policy. Instead, the funds are becoming even more ubiquitous as companies scramble to refinance debt in a higher interest-rate environment. Westport, CT.-based PetVet Care Centers, which operates 450 veterinary clinics and hospitals across the US, is one example. The company has been owned by KRR since 2018, and while the business has grown, it is now facing a wall of debt maturities that can only be refinanced at a higher cost. KKR is providing $600M of additional equity to ease the burden, and Blue Owl will extend PetVet a $2.3B senior loan. Between KKR, Blue Owl, and Park Square Capital, the three firms will commit over $100M in preferred equity to the deal. This deal illustrates how “mezzanine” strategies are keeping the private credit boom alive. Even as M&A has ground to a halt, higher rates and a challenging exit market for private equity have opened up new opportunities to lend. The “shadow banking” market fostered by the regulatory constraints on traditional lending will continue to benefit as officials look to mandate tighter restrictions on US regional banks, which often finance the leveraged buyouts of middle-market businesses. Deal-making has slowed markedly due to higher rates, yet direct lending for deals has been affected far less than bank loans. Other private debt strategies can weather the high-rate environment better, in part due to floating rate loans. For example, the retreat of banks is bringing private lenders into asset-backed financing, including residential mortgages, credit cards, and auto loans. KKR believes this market will expand from $5.2T in 2022 to $7.7T in 2027. Then there are corporate refinancings, which made up 15% of total private credit deals through September this year, up from 12% in 2019, per PitchBook. Deals that are neither mergers nor refinancings are now 34% of the total, compared to 23% in 2019. These include recapitalizations through mezzanine lending — at today’s interest rates, preferred equity in a company like PetVet is expected to generate a return between 15% and 20%. Private equity sponsors aren’t just refinancing portfolio companies’ maturing debt — they need to buy time themselves. Asset managers are turning to continuation funds to extend the “true” exit from investments while they wait for volatile markets to turn back towards higher valuations seen in years past, while some LPs call this a concerning development since they view it as leverage on these funds.

💸 AGM’s 2/20: Perhaps there’s a reason why private credit continues to be a popular investment strategy amongst GPs and LPs. Alternative asset managers have raised significant capital through private credit funds, in part because they view the higher interest rate environment as an opportunity to step in where banks are pulling back. As companies face potential refinancing of their current debt, private credit funds are stepping in to provide capital. The part of the capital structure, in some cases? Mezzanine tranches, where these firms can structure deals as preferred equity transactions. This means that they can, at times, generate 15-20% returns on these mezzanine financings. Private credit investors argue that the current environment makes for quite an attractive investment case. There are private equity-like returns to be had, but with private credit-like risk. In their view, what’s not to like about that risk reward trade? Private credit investors certainly have a point here, and it’s likely making many private equity firms who are currently out fundraising or are planning to fundraise think about how they position themselves against this argument from the private credit world. Strategy officers within many of the larger, multi-strategy alternative asset managers are also very likely thinking about how they can launch private credit funds or acquire private credit funds. So, in short, it’s a good time to be a private credit manager … with one caveat. Will higher rates impact defaults to the point where private credit funds may suffer? That remains to be seen, but for now the private credit party goes on.

📝 Apollo and JP Morgan unveil tokenisation project | Selin Bucak, Citywire

💡Tokenization is coming to private markets — and some of the industry’s largest firms are leveraging this technological infrastructure. This week, Apollo and JP Morgan announced a project to continue to unlock private markets for more investors — through tokenization, instead of through retirement accounts or semiliquid vehicles. The collaboration has been led by Apollo and JP Morgan’s Onyx digital assets team, which collaborated with Axelar, Oasis Pro, and Provenance Blockchain under the Monetary Authority of Singapore’s (MAS) Project Guardian. Project Guardian was launched by MAS in 2022 to test the viability of asset tokenization and decentralized finance. Other regulators, including the UK’s Financial Conduct Authority, joined MAS on the project last month. The proof of concept (POC) was developed to enable fund managers to tokenize funds and allow wealth managers to buy and rebalance positions in tokenized assets across interconnected blockchains. The goal of the POC was to enable managers to tokenize funds on their chosen blockchain and to enable wealth managers to purchase and rebalance positions in tokenized assets across multiple, interconnected blockchains. J.P. Morgan’s Onyx Digital Assets leveraged the Axelar network to create interoperability with a private, permissioned Provenance Blockchain Zone. Oasis Pro enabled the tokenization of assets, in this case the Apollo funds, on the Provenance Blockchain Zone.

Tokenization can improve a challenging feature of private markets — the ability to enable investors with lower minimum investments to access certain investments and to enable more liquidity of investment products. Other firms are also trying their hand at tokenization. Italian asset manager Azimut tokenized a private debt fund in collaboration with Allfunds Blockchain and BNP Paribas. KKR and Hamilton Lane have also offered tokenized funds. To deliver the POC, Apollo and JP Morgan brought together a group of fund managers, blockchain infrastructure providers, and tokenization platforms to create an end-to-end ecosystem of assets and connected networks. They designed a portfolio construction and management prototype called Crescendo. They found that asset managers, wealth managers and distributors could potentially capture $400B in new annual revenue through the broader distribution of alternative investments to high-net-worth clients. They also found that a wealth management firm with a 100,000 client portfolio could reduce its monthly rebalancing process from more than 3,000 operational steps to just a few clicks.

💸 AGM’s 2/20: Tokenization could be inching closer to having a major impact on private markets. A collaboration by two of the largest firms in their respective corners of financial services — J.P. Morgan and Apollo — sends another signal that tokenization will become a feature of private markets. This appears to be a net positive for investors and funds. Tokenization should create both efficiency and access. Blockchain technology has the potential to transform the market structure of all different asset classes and certainly alternatives. If this project realizes its promise, it could help streamline and standardize investment and trade settlement across different asset classes. This project could be a landmark development for the alts space, particularly if it can help wealth managers create, deploy, and rebalance portfolios that include alternative investments. This could solve many of the challenges that wealth managers face with illiquidity with their private markets investments.

📝 56% of European VCs haven’t returned capital to their LPs in the last 12 months | Amy Lewin, Sifted

💡Amidst the backdrop of a difficult fundraising environment, European VCs are on track to raise meaningfully less capital than in the prior year. In the first nine months of 2023, European VCs raised €13.9B, meaning the industry will likely raise less than the €27.6B raised in 2022. There are a number of reasons why this could be the case. A lack of distributions back to LPs are a major reason. According to a Sifted survey of 111 VCs investing in Europe, 56% of European VCs haven’t returned any capital to their LPs in the past 12 months. Many VCs expect to return capital to LPs over the next 12 months, with 72% of survey respondents saying they plan to return capital to LPs in 2024. With the emergence of secondaries funds, perhaps liquidity will be on the horizon in 2024.

Some other interesting datapoints emerged from the Sifted survey: many VCs are in market raising for a new fund, with 60% of respondents saying they are out raising capital. Where is the capital coming from? Family offices and HNWIs are the most active participants, particularly in early-stage VCs, which represented the majority of the survey respondents. 95% of VCs said they already have family offices or HNWIs as LPs already. Corporates and fund of funds are also active participants in the early-stage VC market, with 43% of VCs saying they have corporates as LPs and 42% saying they have fund of funds as LPs. Pension funds and sovereigns are still a difficult corner of the LP market for VCs to raise from, with under 10-15% of these VCs’ LP base coming from these constituents.

💸 AGM’s 2/20: It’s no secret that liquidity is top of mind for GPs and LPs, particularly in Europe, where the exciting promise of the ever-growing tech ecosystem is balanced by the more muted exit record. Thus, it’s not surprising that many GPs have been looking for liquidity options and that secondary funds have been a favorable part of the market for LPs. The question is: where will those returns come from? Will it be from exits in the European tech ecosystem? Perhaps in some cases, with IPO candidates like Klarna, Flixbus, Monzo, Zopa, and Revolut, amongst others potentially on the horizon. But it could also come from secondary funds. We’ve started to see a number of new secondaries funds crop up, particularly focused on European venture. This development is likely in response to the desire for both GPs and LPs to generate DPI so that they can generate liquidity to either reinvest into the ecosystem or to have cash on hand. I’d expect that we’ll see exits in Europe in 2024, in part due to an IPO market that could begin to open, particularly for companies that have strong unit economics and have reached profitability. If the European ecosystem is able to achieve some big exits, it would represent a big win for the promise of European tech in the eyes of investors. These wins could begin to attract the attention of institutional and international LPs as it would validate the ecosystem’s ability to achieve large exits, which looms large as a question for many LPs.

📝 Are the NFL, Women’s Teams, and Stadiums Next for Sports Private Equity? | Dan Weil, Institutional Investor

💡With major teams across different sports and geographies changing hands for as much as $6B with the recent transaction of the NFL’s Washington Commanders, it’s unsurprising that private equity has looked to become a major player. PitchBook reports that 63 North American sports teams (with a combined value of $206B) have private equity funds or owners with ties to private equity funds. The National Football League does not contribute to that figure — it’s famously holding out against private equity fund owners. One active investor in sports private equity is Blue Owl Capital, which does so through its HomeCourt Partners Fund. The Fund managed $600M in assets as of Q2 this year, and currently has stakes in the NBA’s Sacramento Kings, Atlanta Hawks, and Charlotte Hornets. Institutional Investor recently spoke with Andrew Laurino, senior managing director of Blue Owl Capital, about issues for sports investors and its own involvement in the sector. Some highlights are below:

Private equity investment in sports will continue to grow:

Laurino: “Yes, it’s a high growth business in need of capital to scale. Barriers to entry — regulations from leagues — should continue to come down as private capital comes in. The minority equity-stake structure has taken hold. Structured equity, credit, and real estate capital will come in a major way. This is the tip of the iceberg.

The NFL, team real estate as most promising areas:

Laurino: “The NFL is the white whale. It has a large, well-structured ecosystem. All teams are profitable. It’s in a better position than almost all the other entities out there. There’s untapped upside, and ultimately it will need an increased pool of capital given where team valuations have gone. They are talking about how to let capital in, and it will be a big opportunity as it evolves.”

“Real estate is another attractive area. Teams are investing in stadiums, arenas, and the real estate around them, often in public-private partnerships. There is an opportunity for private capital, so that teams and governments can keep their capital commitment light. And local governments still get the tax revenue. The properties around the arenas can be residential, commercial, retail, or entertainment districts. We’re looking at a lot of those opportunities through other parts of the Blue Owl platform.”

Growth in investment in women’s sports:

Laurino: “The emerging growth of women’s sports is an interesting area. Soccer is attracting investment as the game continues to take hold. The US is leading the market for women’s soccer. The WNBA is becoming quite attractive, and there’s potential for more upside there.”

Walue of sports media rights continuing to increase:

Laurino: “There’s an evolution of the old way of distribution through broadcast and cable to the new way — streaming. The streaming ecosystem is amassing capital and content. There’s continuing tension between the old guard and the new [guard] for eyeballs. There are opportunities for streaming to grow, but it’s not limitless. But at some point, the economic math doesn’t work and you hit your limit.”

💸 AGM’s 2/20: Laurino’s interview covers many of the major themes featuring in sports investing right now. His comments highlight the diversity in the ways in which sports investing covers different types of investment structures, asset classes, and geographies. While this can make sports investing challenging for both fund managers and prospective LPs, it also makes the space potentially attractive as an investment opportunity. Exposures to different leagues and teams can offer diversification — an investment into a NFL team can provide an annuity-like exposure since the teams are profitable, but possibly less upside than an emerging league or team in, say, women’s soccer or pickleball. The development of sports as an investment opportunity should make for interesting opportunities for allocators who are looking for diversification away from other asset classes. So it’s no surprise that we are seeing funds be created and raised, in some cases with large institutional LPs, to take advantage of this growing opportunity in various sports as the game continues its evolution into the business of entertainment.

📝 Blackstone borrows to boost lending power of $52B credit fund | Eric Platt, Financial Times

💡Blackstone is pursuing a capital raise in the form of a collateralized loan obligation (CLO) in a bid to provide its flagship credit fund added investment firepower. Blackstone is in the final stages of raising around $400M through a CLO structure that is secured by the loans held in its $52B Blackstone Private Credit Fund, BCRED, according to documents obtained by the Financial Times. This news represents a significant trend of large private credit funds issuing CLOs backed by private loans as they look for new sources of leverage. As banks are retrenching from this part of the market in a more difficult investment environment that is punctuated by higher interest rates and riskier underwrites, private credit funds are looking for additional ways to receive financing to supplement their investing capacity. By borrowing from CLOs, in addition to banks, one investor who looked at the Blackstone deal said that it would provide the firm with a more “efficient source of capital” and “… a more stable source of funding.” Blackstone, as well as peers like HPS and Blue Owl, are hoping to create a new market with these deals. CLOs are not a new investment structure, but it is a relatively new development for private credit managers. Bank of America expects private credit CLO issuance to grow in 2024, possibly up to record levels, surpassing the previous high of almost $200B of annual issuance of US CLOs in 2021. A major driver of private credit firms’ desire to issue CLOs to investors is that they hope it will enable them to secure lower costs of capital than middle-market CLOs. The triple-A tranches of Blackstone’s BCRED CLO is expected to price with a yield around 2.3% above the floating interest rate benchmark, which is below the 2.4-2.5% spread where traditional middle-market deals are often priced.

💸 AGM’s 2/20: Blackstone’s move to create a CLO affiliated with their credit fund is a signal that the private credit space is going to use new ways to finance their activities, which could include using leverage. This development is not surprising given that banks are pulling back from lending in the middle market. However, it does create a cause for concern, particularly for LPs. Leverage could become a cause for concern in the private credit markets, where defaults may spike due to higher rates. CLOs have their place in financial services, but they’re typically not featured in private equity and private credit. That’s about to change with the behemoths in the space, like Blackstone, HPS, Blue Owl, looking to securitize loans. Earlier on AGM, I wrote about how many of these large alternative asset managers are increasingly looking more like their more traditional counterparts, such as banks. This move punctuates this possibility, yet a further signal that alts are truly going mainstream.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Commercial. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Epic Funds (Private markets investment platform) - Director of Investor Relations. Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Client Associate, Relationship Management (Remote). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chase Griffin, a QB at UCLA and the NIL Male Athlete of the Year, share thoughts on how private equity and the NIL are changing the game for collegiate and professional sports. Listen here.

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fourth episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.