👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

LemonEdge is a leading fund, partnership, and portfolio accounting solution for private markets investment firms with backing from Blackstone Innovations Investments, amongst others. LemonEdge helps GPs, VCs, Family Offices and Fund Administrators transform their back-office operations, through making the complex, simple.

LemonEdge helps firms manage equity, real estate and infrastructure across closed-ended, open-ended and hybrid structures of any variety, with all management fee, waterfalls or other typical Excel based calculations all embedded in LemonEdge. Scale your operations with high efficiency and deliver exceptional LP / GP service.

Good afternoon from London, where I’m here for a week of meetings and to moderate a panel at IPEM Wealth in Cannes on “How fund managers are adapting to seize the wealth opportunity” with Alisa Amarosa Wood from KKR, Peter Beske Nielsen from EQT, Erwan Paugam form Ardian, and Jose Luis Gonzalez Pastor from Neuberger Berman. If you’re at IPEM Wealth and would like to get together, feel free to reach out.

First things first, though. Let’s go Commanders. Keep making miracles happen tonight against the Philadelphia Eagles in the NFC Conference Championship game. After all, “anybody, anywhere, anytime.” It’s such a big game that my mom flew all the way to London so we could watch together and share in the experience of something that hasn’t happened in over 33 years for Commanders nation.

The seeds of evolution

News this week out of Chicago might not have sent shockwaves through the private markets industry in the same way that developments like BlackRock’s multi-billion dollar acquisitions of GIP, HPS, and Preqin shook the earth.

But the largest ever debut GP seeding fund closed this past week shines a light on just how much private markets have evolved in recent years.

This week, GCM Grosvenor’s Elevate fund, a GP seeding fund, closed on $800M. This figure makes it the industry’s largest debut private equity seeding fund. The fund makes catalytic seed investments in small and emerging lower- and middle-market buyout private equity firms.

Some of the industry’s largest LPs have committed meaningful capital to the fund, with behemoth $500B+ pension plan CalPERS helping to launch the fund with a $500M commitment.

As the alternative asset management industry matures, it’s not a surprise that fund seeding is also growing in lockstep.

Growing quantum of capital are entering private markets as the opportunity set grows, more investor types (i.e., wealth channel and insurance companies) increase exposure levels to private markets, and as more talent in the industry looks to spin out of larger firms and create enterprise and equity value for themselves, but often managers lack the capital themselves to put meaningful principal capital to work as part of their GP commitment.

As the market becomes larger, fund size must grow to match the opportunity set. So, even first-time funds must be right-sized in a specific strategy or market to win deals and move quickly on investment opportunities without requiring syndication with other funds or co-investors.

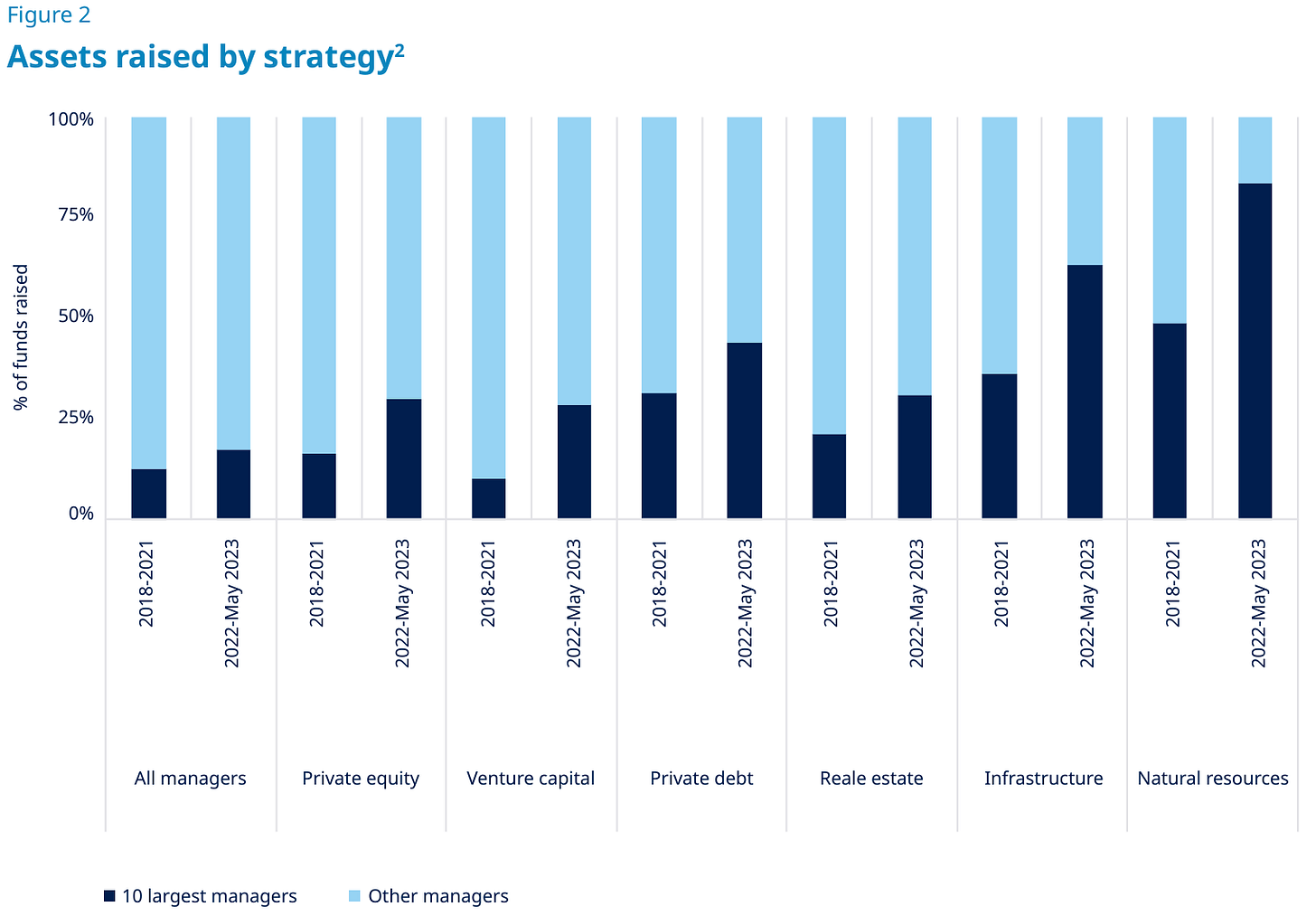

This fact is particularly true in certain private markets strategies, where scale matters even more. A chart from Blue Owl 2024 GP Strategic Capital Outlook highlights this point: the top 10 largest managers raise the majority of the capital relative to their peers in a given strategy. This is particularly true in private credit, infrastructure, and natural resources.

But fundraising has never been more challenging, in part due to macro forces and industry dynamics.

Fundraising headwinds

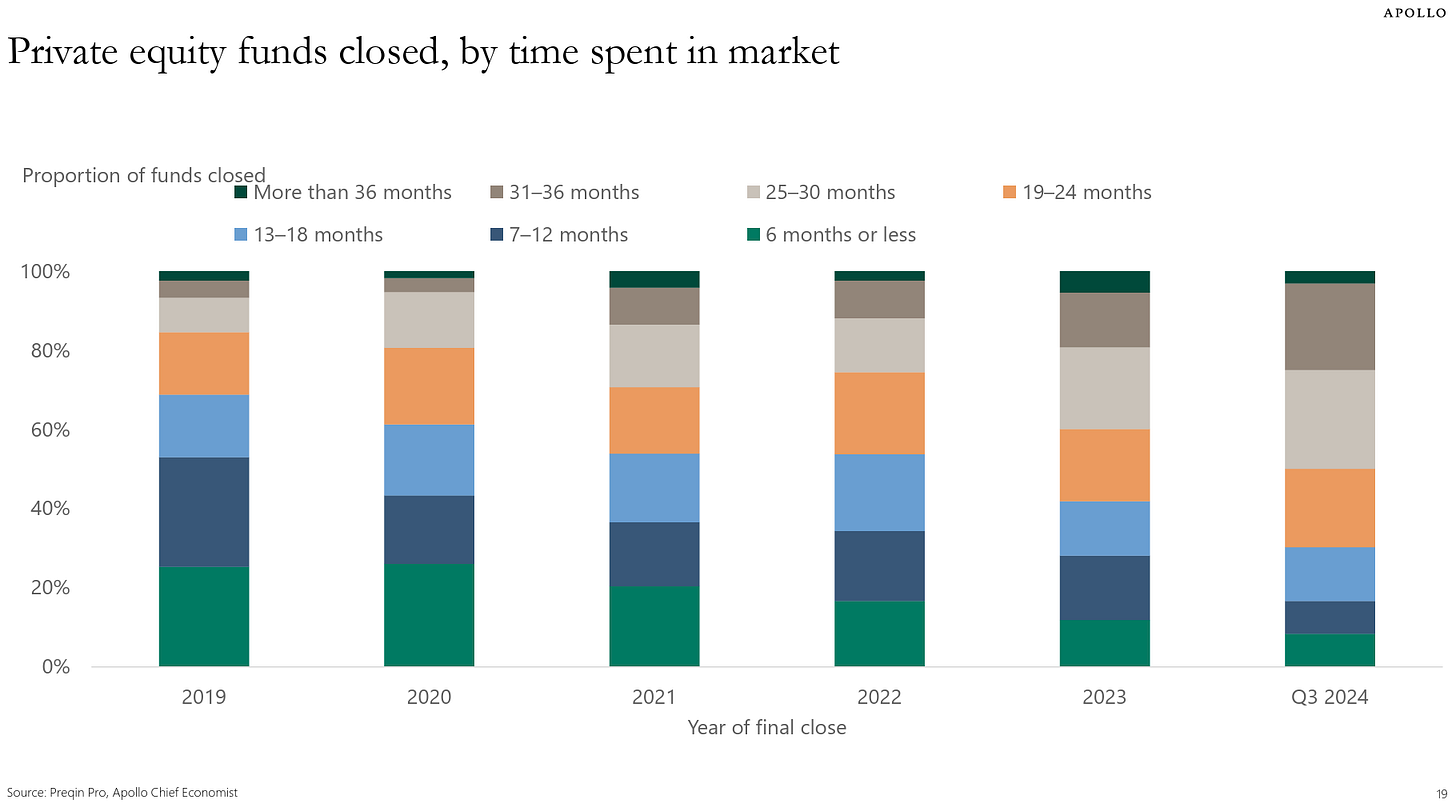

A chart from Apollo’s 2025 Outlook for Private Markets illustrates just how difficult fundraising has been for many funds (note: the chart below is based on data about private equity funds).

The data above paints a sobering picture for many private equity fund managers. The number of funds that successfully completed a raise in under 12 months has seen a sharp decline since 2020. Conversely, the number of funds that have needed 19 months or greater to raise a fund (and 25-30 months, in particular) has increased meaningfully over the past few years.

Fundraising challenges are particularly acute for first-time fund managers.

LPs, particularly newer LPs to private markets, often favor larger funds and brand-name managers with track records that span over multiple vintages and economic cycles.

For good reason, too. It can be a much riskier proposition for LPs to allocate to first-time managers. LPs must not only reconcile the unknowns of investment risk with a new manager, but also operational risk and team risk. A first-time manager must navigate investing out of a new platform, unestablished brand, and (often) with fewer resources. They also have to simultaneously fundraise, run the firm, and make new hires, all of which take time and focus away from investing.

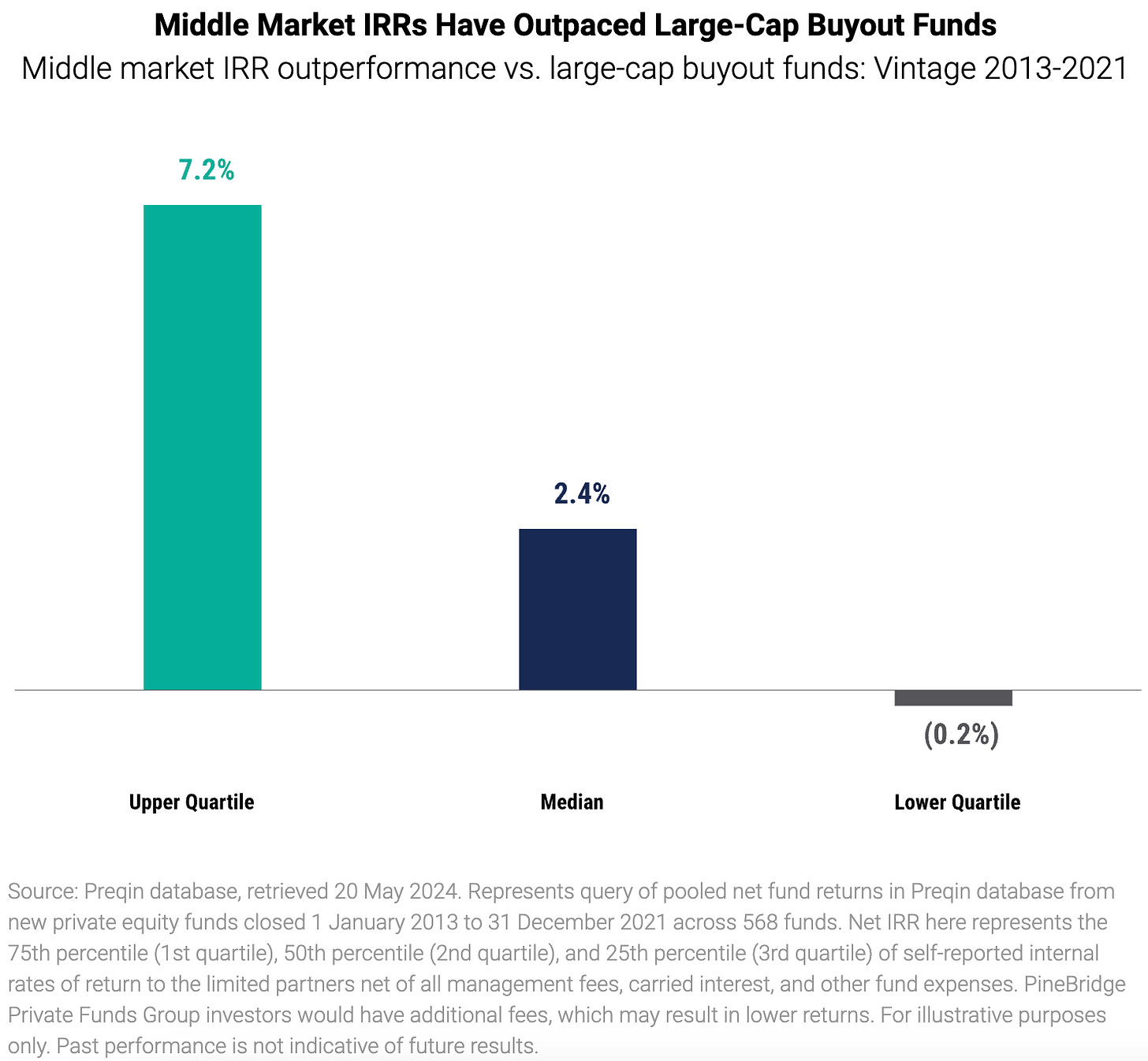

But therein lies a conundrum. Data shows that emerging managers often outperform their more established peers. While larger funds can certainly generate strong performance relative to their peers and relative to public markets, returns can be a function of fund size. Smaller funds can generate better returns than their larger counterparts because of fund size and valuation entry points. I wrote about how “the middle is far from middling,” digging into the virtues of middle-market private equity in the 8.11.24 AGM Alts Weekly.

The below chart from Pinebridge highlights the difference in returns between middle-market buyout versus large-cap buyout funds.

Flexstone Partners, an allocator to fund managers and an affiliate of Natixis Investment Managers, highlighted a similar trend. Flexstone Managing Partner and Co-CIO Nitin Gupta wrote in an October 2024 white paper that “based on our analysis of 25 to 30 years of industry data, emerging private equity managers tend to outperform more established managers.” Gupta goes on to write that “rather than avoiding emerging managers, [they] look for opportunities to capture additional alpha from them.”

Manager selection matters even more with less established managers, so partnering with the right firm is critical.

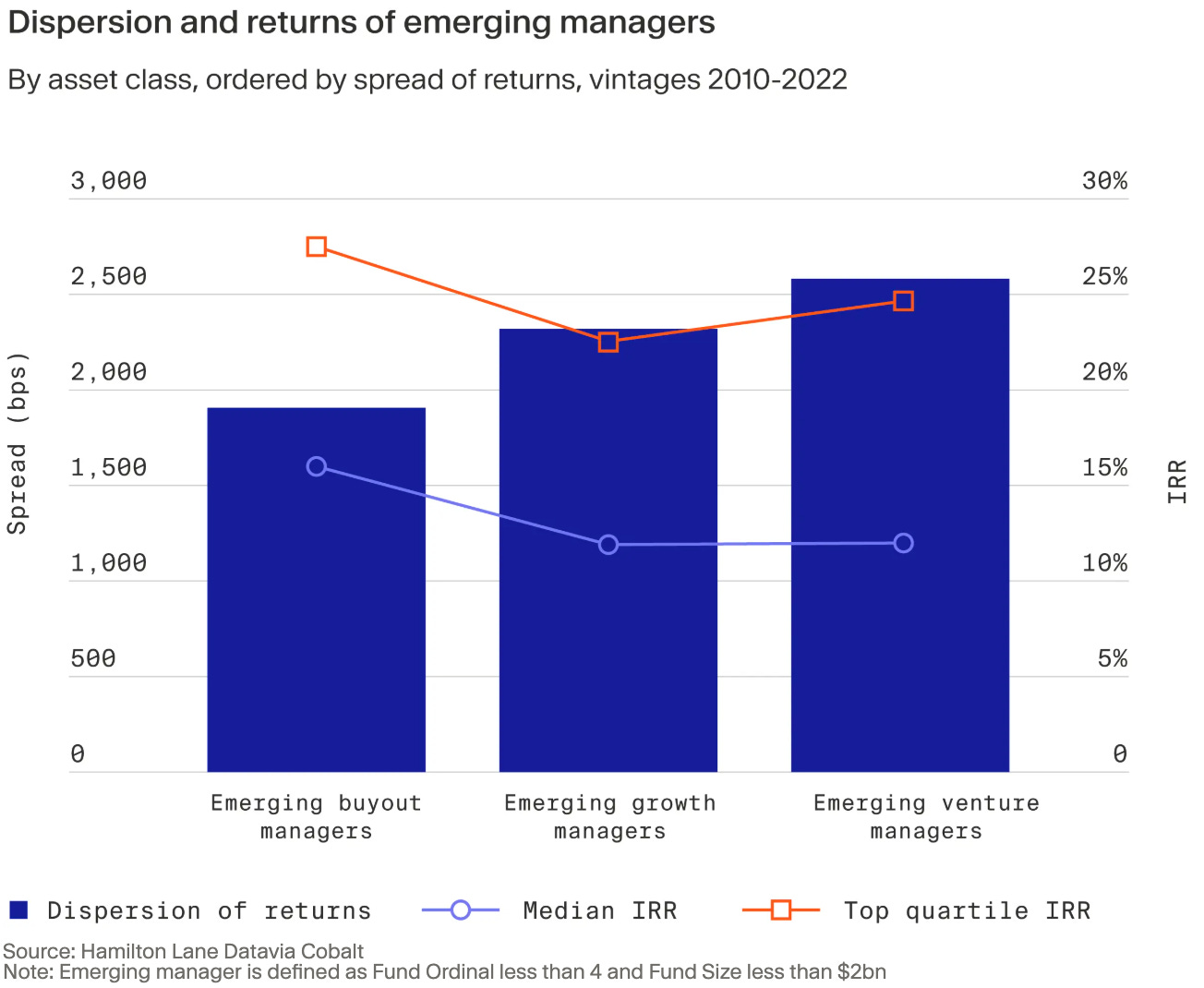

The chart below from Moonfare highlights that dispersion of returns for emerging managers in private equity and venture is even more acute.

LPs know that emerging managers can outperform. But that doesn’t make it any easier to be the first — or an early — allocator to a new fund.

That’s where GP seeding comes in.

Catalytic capital

With fundraising cycles extending longer, catalytic capital from seeders and institutional LPs becomes even more critical early on in a fund manager’s life.

Seed capital can be a critical component of the foundation to enable an asset manager to grow. While alternative asset management business models have very healthy EBITDA margins at scale — often 50-60%+ — the early days of building and growing an alternative asset manager paint a very different picture.

Initial working capital costs are often high. Funds must contract with a cadre of high-quality service providers across fund formation, legal, accounting, audit, and tax. GPs must commit as much of their own capital as possible to show alignment with LPs. They also must hire the highest-quality investment professionals possible.

Investment talent is one of, if not the most, critical advantages a fund manager can possess. Former Blackstone CFO and Managing Partner of $8B AUM WestCap Laurence Tosi said as much in his Alt Goes Mainstream podcast, when talking about something Blackstone Co-Founder Steve Schwarzman would say when talking about the importance of scale.

L.T.: I remember when Steve said that. That scale is niche. I'm going to add a second part, Michael, to that statement, which I guess gets less covered than he would say. He would also say that scale begets skill. And the more skill you can put against creating value, the more you can justify the scale [author emphasis].

Evercore’s Glenn Schorr echoed a similar sentiment in the first episode of the Going Public podcast series when answering a question about the moat that fund managers have in their business.

Glenn Schorr: Success is a really good moat. You work at a good firm. You get paid good money. You have some of the stock. You have carry in the funds. All right, how about this? And by the way, success breeds success. And you have a whole lot of money sitting in there. You're leaving? Where are you going? And who's taking you out of that? When I'm having this conversation, I'll say, how about all those traditional asset managers that used to trade at 20, 25 times, T. Rowe Price, Franklin, Invesco? All of them. Excellent companies in their day. I asked the rhetorical question, why are none of them, big private markets managers today, built organically? The answer. Because it was really expensive. They were public. They had to be careful of their expenses. And they weren't ready to front-load 10-plus years of investment to be a big private markets player today. That's why it takes vision and money to build the right technology. To build these brands. To get the right people. To groom and cultivate these strategies. Like you raise a little money in your first vintage. You prove to the world that you can do this and put up good returns over the first five or six. Then you can raise a second vintage. And then you do that. Wash-rinse-repeat. Maybe by the third or fourth vintage, you've shown it over the last 10 years that you can do this and scale. And the LPs notice and they're starting to write bigger and bigger checks. That's how you build the business. And so not everybody's willing to do that.

Therefore, the role that fund seeding platforms like GCM Grosvenor, TPG Next, and Stable, amongst others, can play in helping managers establish a foundation for their first fund and build into a full-fledged firm is crucial to entrepreneurial success.

Speaking of building an asset management business to scale, Owl Rock (now Blue Owl) is a poster child for how alternative asset managers can grow their business.

Rocking and rolling

Owl Rock’s rise is emblematic of the evolution of the industry.

Their growth in a short period of time highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth.

Co-Founders Doug Ostrover, Marc Lipschultz, and Craig Packer were practical and resourceful in their approach to building Owl Rock from its inception.

Their backgrounds as experienced investment professionals at the industry’s behemoths — Ostrover a Co-Founder at Blackstone’s GSO, their alternative credit unit, Lipschultz the Global Head of Energy and Infrastructure at KKR, and Packer a Partner and Head of High Yield Capital Markets at Goldman Sachs — no doubt helped their new firm, Owl Rock, raise capital and navigate the challenges of being a first-time fund manager.

But they also understood something critical about private markets when founding Owl Rock: scale matters. And scale matters even more in certain areas like private credit and direct lending in order to be able to successfully fundraise and win deals.

Ostrover, Lipschultz, and Packer realized they could achieve scale faster in their capital raising endeavors by offering investors in their early BDCs lower fees and a portion of ownership in the Owl Rock management company. They went to some of the industry’s large institutional allocators, like the University of California and Brown University, to raise capital for their early BDCs.

One of Owl Rock’s early investors (who is now Global Head of Blackstone’s Multi-Asset Investing unit), Joe Dowling, who at the time ran Brown University’s $4B endowment, said this move captured the foresight of Ostrover and team: “This was the genius of Doug—he’s long-term greedy. He understood it was more important to get the money quickly than to spend years slugging it out to raise capital.”

The move certainly paid off. Four years after founding Owl Rock, they achieved scale. In December 2020, when they merged with Dyal Capital Partners, a GP stakes firm with $23.3B of AUM, and announced that the combined firms would go public, Owl Rock boasted $23.7B in AUM, with almost $20B of the $23.7B in permanent capital.

Once seen as something that was a concern for LPs, GP seeding and GP staking is now becoming more commonplace.

Some investors, such as Erik Serrano Berntsen of seeding firm Stable Asset Management, has said that seeding “partnerships [between asset owners and asset management founders] can provide long-term economic alignment.”

Blue Owl GP Strategic Capital’s Senior Managing Director and Blue Owl Board Member Sean Ward echoed this sentiment on his Alt Goes Mainstream podcast. When asked why a fund manager might entertain ceding a portion of the equity in their business to a GP seeder or GP staker, Sean said that stakes, particularly at the upper end of the market, align LPs and fund managers, in large part because of the quantum required to fulfill the GP commitment. This is particularly acute for larger funds.

So yes, you're absolutely right. It took a while to convince LPs. And on the GP side, you're also right, because I think a lot of folks were worried, well, what are my investors going to think? If I sell a piece of my business, are they going to think I'm cashing out? I'm going and hitting the beach? I'm not aligned with them in the right way? It's been an education process, not just for investors but for the GPs as well. Thankfully, over the past decade and a half, I think it's become, at least at the upper end of the market, a very accepted part of a firm's maturation that they might sell a stake over time. Investors recognize that private equity is a weird business in that it consumes a lot of capital. Compare a private equity business to a traditional asset management firm. Think about BlackRock. $10.2T of AUM, give or take. How much of that is BlackRock's own proprietary capital? A vanishingly small percentage. I don't know the number, but I would wager that it's less than a basis point of that total. And, as these businesses get big, the capital intensity measured by how much of their own proprietary capital is invested tends to go down. With private equity, as I'm sure most of your listeners know, every time you raise a fund, you have a GP co-investment obligation — the GP commitment to that underlying fund. Two percent is what people bandy about as being typical. Sometimes it's more. Sometimes it's less. But when you're talking about big firms, the numbers get very, very large. One of our managers, now a public company called CVC, their last fund was 26B Euro. If you assume a 2 percent GP commitment, that's 520M Euros in one fund across their $200B platform. So, having someone like us that can inject institutional capital onto the firm's balance sheet — this is not a cash out. This is actually equity for the firm to continue to fund those commitments and grow in various ways. It's become something that I think people understand and that's become a more accepted part of the landscape.

The evolution in the understanding of the interest alignment between GP and LP is starting to take hold.

Increasingly, investors are understanding why having exposure to GP seeding and GP stakes can be part of a private markets portfolio — and own a piece of the growth of the private markets industry.

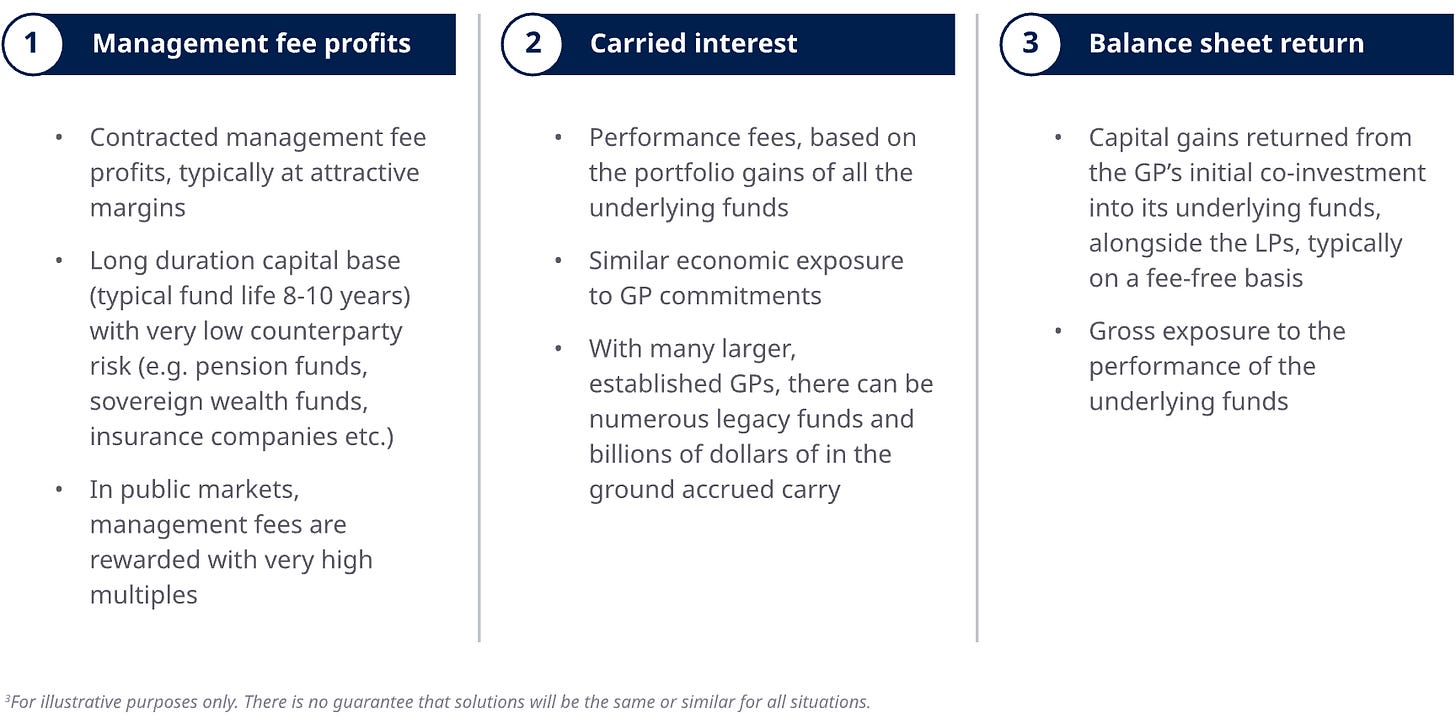

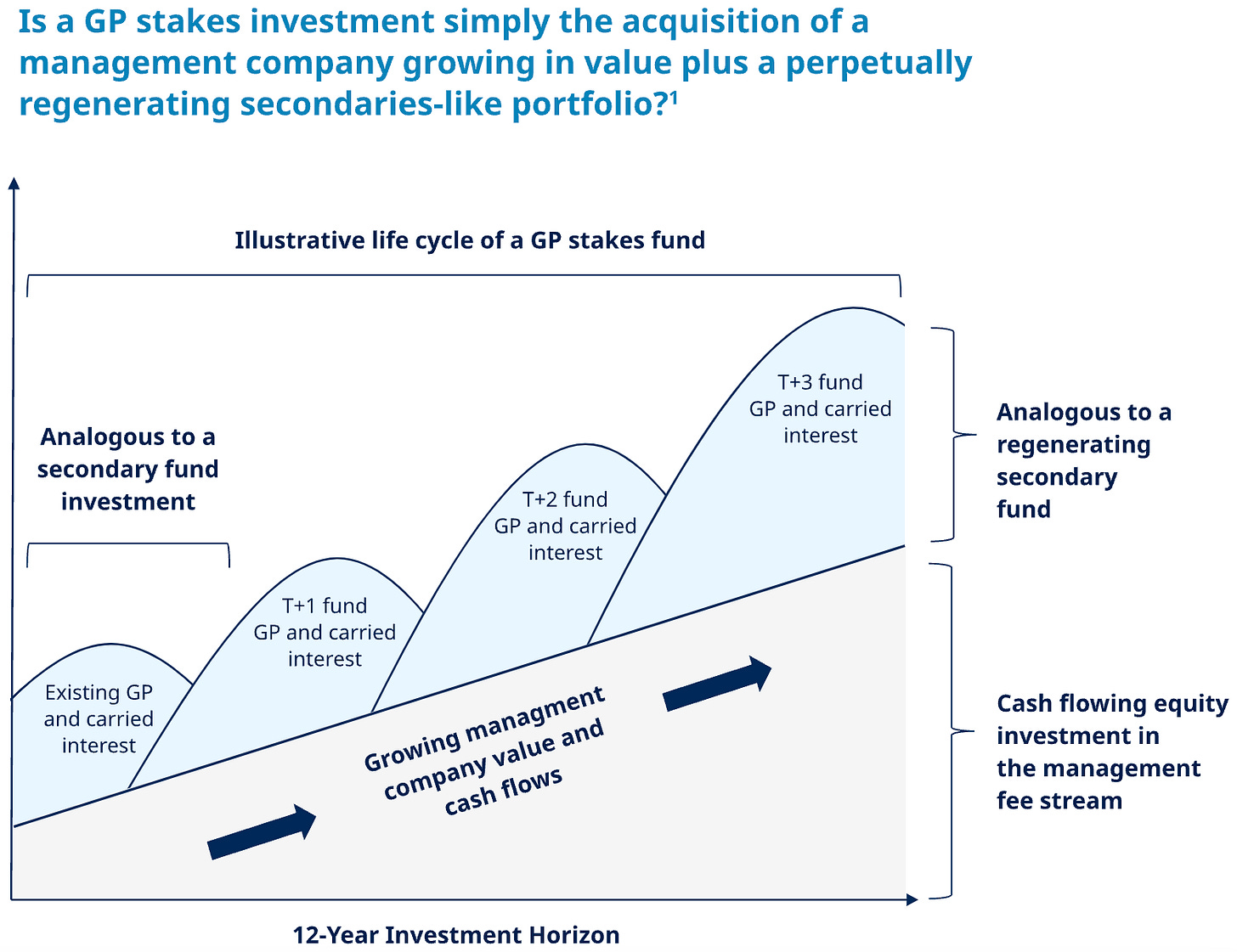

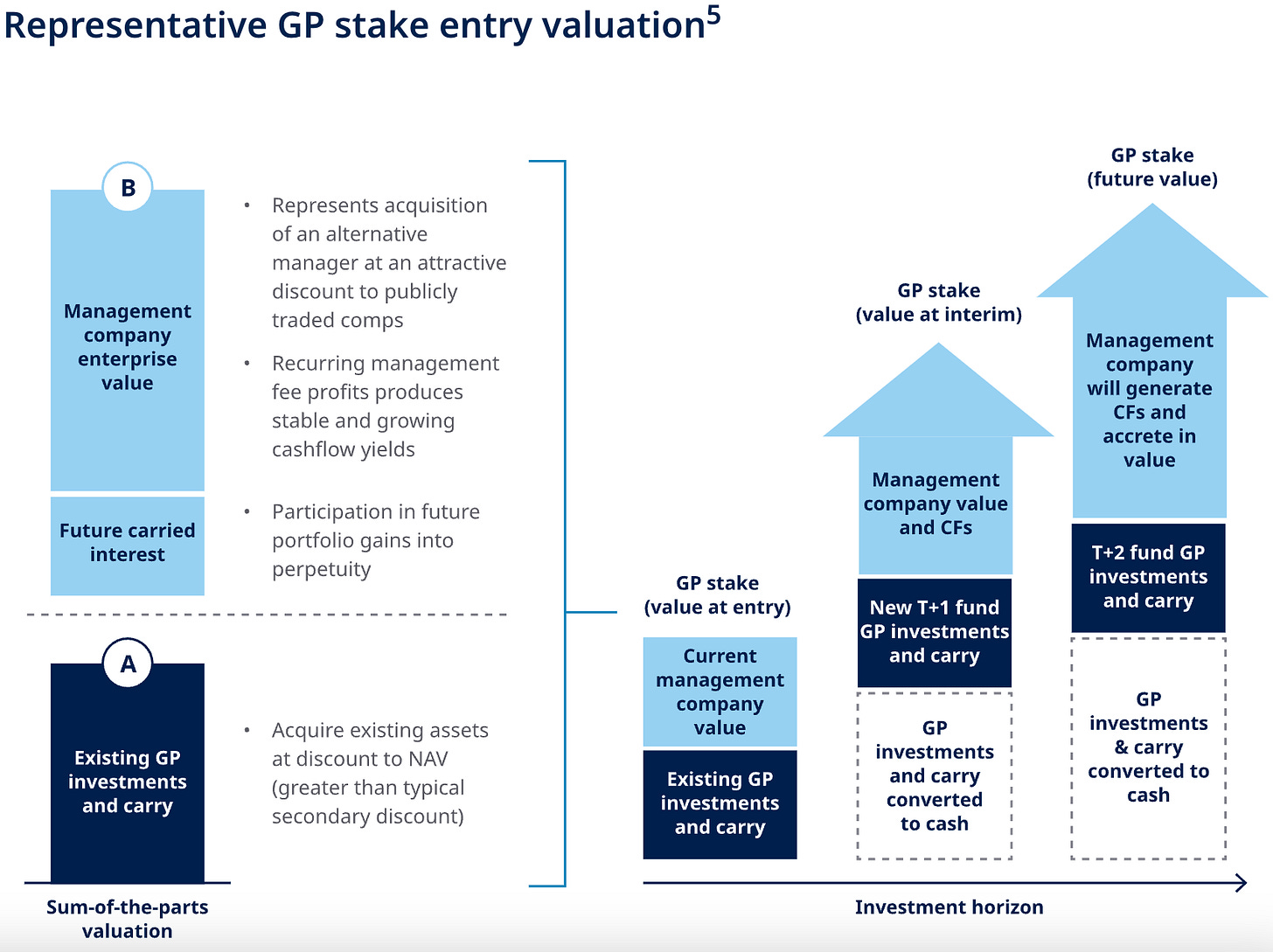

Blue Owl’s December 2024 white paper, “Investment for All Seasons” illustrates the economic exposure available to investors in the management company of an alternative asset manager.

Similar to secondaries, Blue Owl highlights, GP stakes investment provides investors with exposure to a firm’s multiple vintages and return streams. But better yet, GP stakes investments regenerate with each successive fund raised, giving investors exposure to new funds as time goes on.

As firms grow their AUM, investors in the GP’s management company can also see an increase in cashflows to the management company.

Yes, an investor might argue that as a fund grows AUM, the fund’s returns might diminish due to fund size. That could, in certain cases, be a fair argument. However, owning a part of the firm’s AUM growth and exposure to the firm’s carry can make up for diminishing returns as a LP as fund size increases.

GP stakes investments also provide exposure to multiple types of return streams, all wrapped into a single investment.

Blue Owl’s report highlighted this feature of GP stakes: “Individual components of a GP stakes strategy have been likened to private equity, private credit and secondaries strategies, with these combined characteristics offering investors a differentiated returns profile that is arguably impossible to replicate in any other single investment.”

I shared a similar perspective in a May 2024 post on Alt Goes Mainstream: “When funds become firms: Our partnership with Cantilever Group, a GP stakes firm.”

GP stakes, in effect, have shades of private credit, private equity, and secondaries strategies in a single investment.

Cash yields from revenue sharing on the GPs’ contractual management fees and / or earnings, often resulting in a reduced J-curve and a faster path to distributions, have characteristics of private credit.

Exposure to a GP’s carried interest offers private equity-like upside, as does exposure to the growth in returns from the GP’s capital commitment. And, with consolidation amongst alternatives managers an increasingly popular trend, there’s possible private equity-like upside from a potential exit.

Add in diversification across strategies and vintages across a portfolio of GPs, and GP stakes funds have shades of secondaries strategies.

Just as any market undergoes an evolution, the GP stakes market is no different.

The fact that LPs, like CalSTRS, believe that the seeding market can handle an $800M fund size that GCM Grosvenor just closed on hammers home that LPs believe the market has reached a level of maturity across the spectrum of GP seeding and GP staking that means the seeder will have sufficient exit opportunities as their affiliate firms grow.

From seed to scale

Different stages of investing will have varying risk-return profiles.

GCM Grosvenor believes that seeding represents an attractive risk-reward proposition. Based on aggregated data for buyout funds for vintages 2000-2019 from Preqin Pro through May 2023, GCM Grosvenor finds that a Fund I net IRR outperforms established private equity funds by an average of ~280bps. Therefore, they state, “investing in a first fund alongside a management company investment can offer LPs a doubly compelling return opportunity.”

If GP seeding is akin to venture capital for the alternative asset management industry (but, unlike venture capital, can include cashflows and yield from ownership of a GP’s management company), then investments to own minority stakes of $1B+ alternative asset managers represent a different, but equally compelling risk-reward proposition for investors.

Unsurprisingly, the stakes space is beginning to attract more funds to the middle-market GP staking universe. Newer entrants like Hunter Point (raised a record $3.3B for their debut GP stakes fund in March 2024), Arctos’ Keystone strategy (recently participated in the management buyout of €31B AUM Hayfin Capital Management), Blue Owl’s new $2.5B fund in partnership with Lunate, Cantilever (a new fund launched in partnership with BTG Pactual), and Armen (founded by senior members of Armen and Capza to focus on European mid-market asset managers) have all entered the market in the last two years.

Different features of alternative asset managers’ businesses will lend itself well to certain types of strategies and risk-return profiles.

Strategies like private credit, infrastructure, natural resources, and real estate are very much a game of scale. Owning stakes in managers that have funds for these strategies means owning part of a firm that will have the possibility of scaling AUM. Here, it can be just as beneficial to own the GP as it is to be an LP.

Smart wealth managers and insurance companies are starting to think like institutional allocators when it comes to GP stakes. The large and sophisticated LPs are partnering with GP stakes firms as a way to access deal sourcing of alternative asset managers at scale, in addition to already owning part of the manager’s growth and investment returns.

The inevitable

A few inevitabilities exist in private markets today.

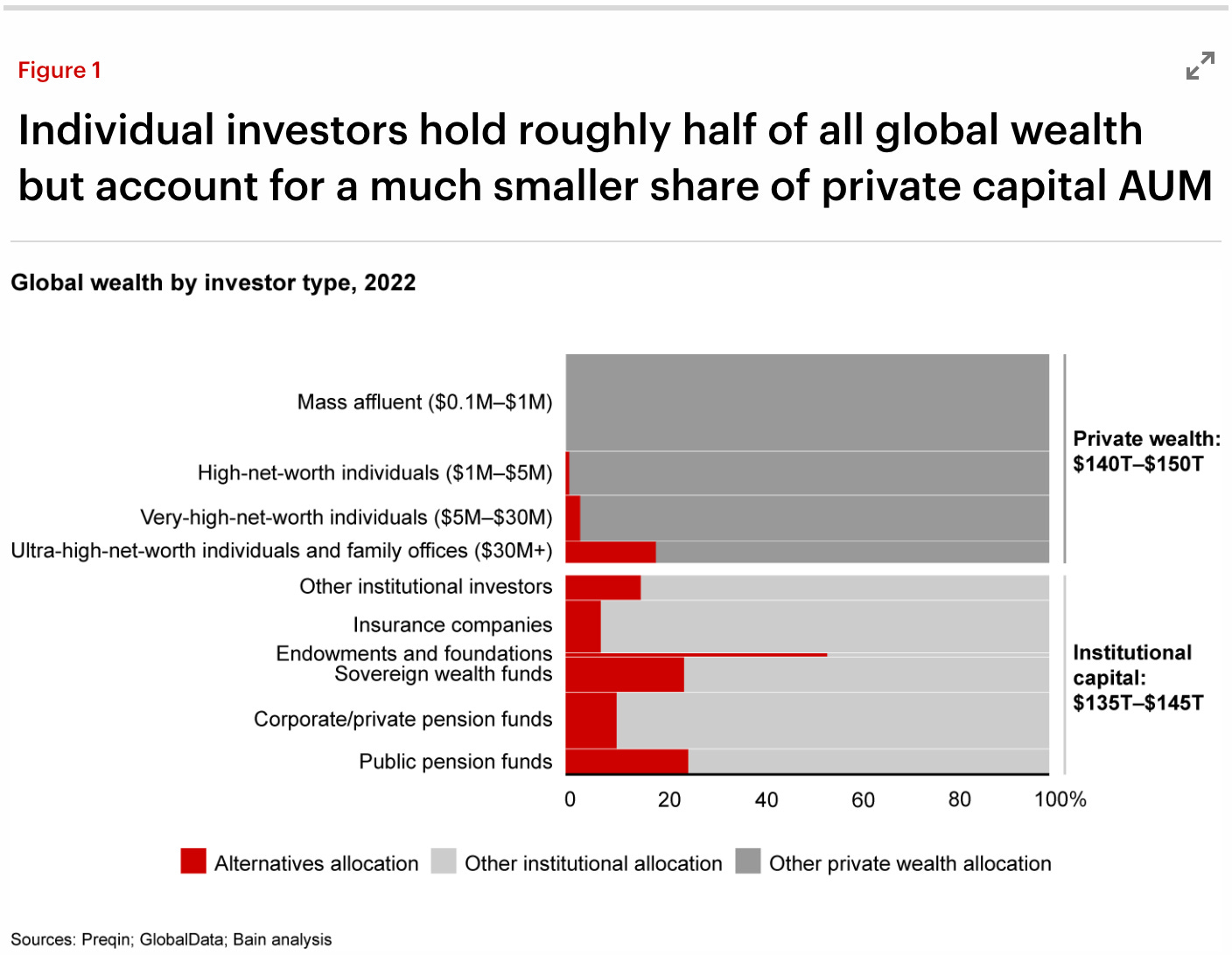

Private markets should continue to grow their AUM. That should benefit the largest of firms that have the ability to handle and build relationships with new and existing LPs at scale, particularly as more investors from the wealth and insurance channels come into the space, as the below Bain & Company chart illustrates.

The next wave of managers seem particularly well-equipped for the next phase of private markets’ maturation.

There will be a trickle-down effect of the growth in AUM in private markets, which Preqin expects to hit $30T by 2030. Smaller managers should also be able to grow their AUM. Technology innovation will also catch up, as solutions to help smaller GPs raise and manage investors at scale will deliver value to alternative asset managers and LPs alike.

Large alternative asset managers are becoming bigger and bigger businesses. Their ability to grow AUM should serve to increase the size and scale of their business, revenues, returns on an absolute basis, and margins.

More investors and allocators seem to be thinking, why not own a piece of this growth?

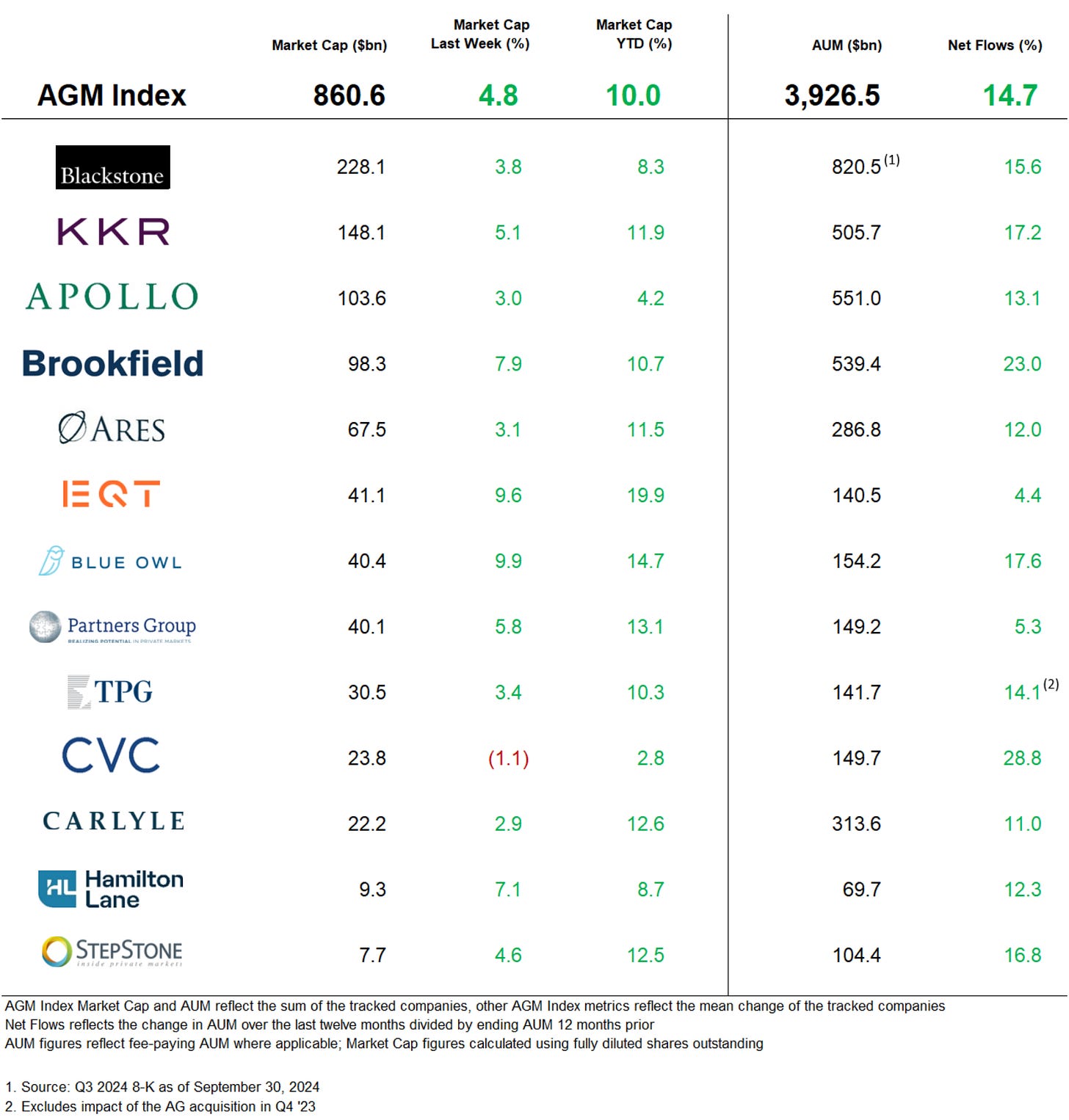

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

Apollo’s Chief Economist Torsten Slok and Partner & Global Wealth Strategist Alex Wright discuss the challenges with the traditional 60/40 portfolio and how private markets can balance out high valuations in public markets.

AGM News of the Week

Articles we are reading

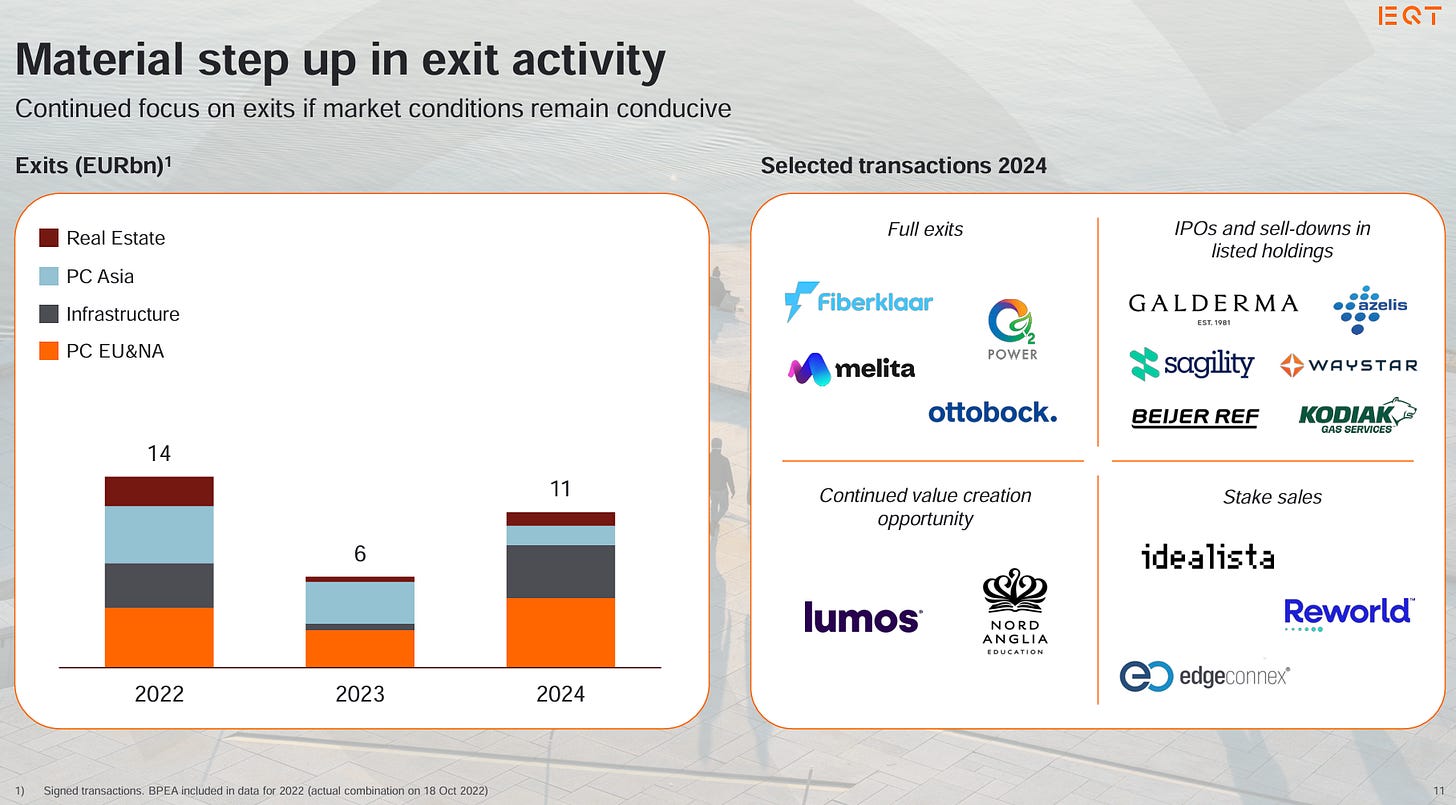

📝 EQT exits jump €11B in sign of private equity recovery | Alexandra Heal, Financial Times

💡Financial Times’ Alexandra Heal reports on EQT’s “accelerated exit activity” as a possible sign of things to come for the private equity industry heading into 2025. EQT saw a 72% increase in proceeds from existing companies compared with the prior year, in large part because it had two high-profile IPOs from portfolio companies in Europe and New York. EQT’s CEO Christian Sinding expressed optimism for the industry when discussing these results. “Private markets are returning to their long-term growth trajectory,” he said. “The global economy is growing, paced by Asia and the central banks of cut interest rates, and capital markets are robust, albeit volatile.” Exits have been hard to come by for private equity firms over the past few years. Rising interest rates put IPOs and exits on ice. EQT’s big exits in 2024 include the Swiss listing of dermatology group Galderma, which raised $2.53B in march and is up 104% on its IPO price, and healthcare technology business Waystar, which listed in New York in June and is up 77%. The uptick in exits also mirrored an increase in deployment, with EQT investing €11.3B in the second half of 2024. Shares of EQT rose more than 10% in Stockholm by mid-afternoon on Thursday, signaling a positive reception by public markets investors.

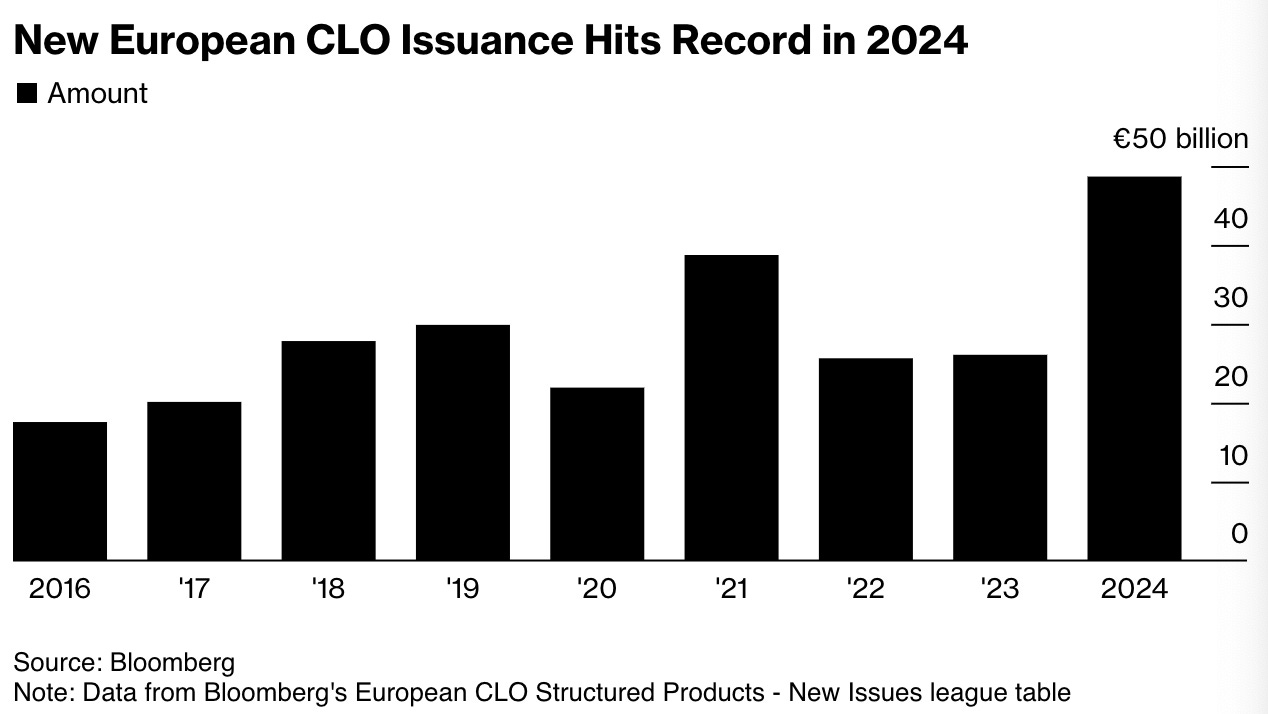

💸 AGM’s 2/20: Could EQT’s be a foreshadowing of what could be to come in private markets with regard to an opening exit market? Perhaps the backlog of exits will start to thaw in 2025. The private equity industry could certainly use exits. In a Bloomberg article from this week, KKR Partner and Global Co-Head of their Debt Capital Markets unit Cade Thompson referenced the pressure on private equity sponsors: “pressure on the sponsor community to return capital is expected to persist in the near-term.” It appears sponsors have found other ways to generate exits. Continuation vehicles has been one avenue. Leveraging dividend recapitalizations has also been an increasingly popular trend. Bloomberg cites a strong credit market as support for managers utilizing dividend recaps to return capital. CLO issuance has also been a part of the story. Bloomberg highlights a strong year in new European CLO issuance as a reason for growth in dividend recaps as a way to generate returns for LPs.

For its part, EQT has seen a material step up in exit activity. Their recent earnings call presentation highlights the near doubling in exit value from their portfolio from 2023 to 2024.

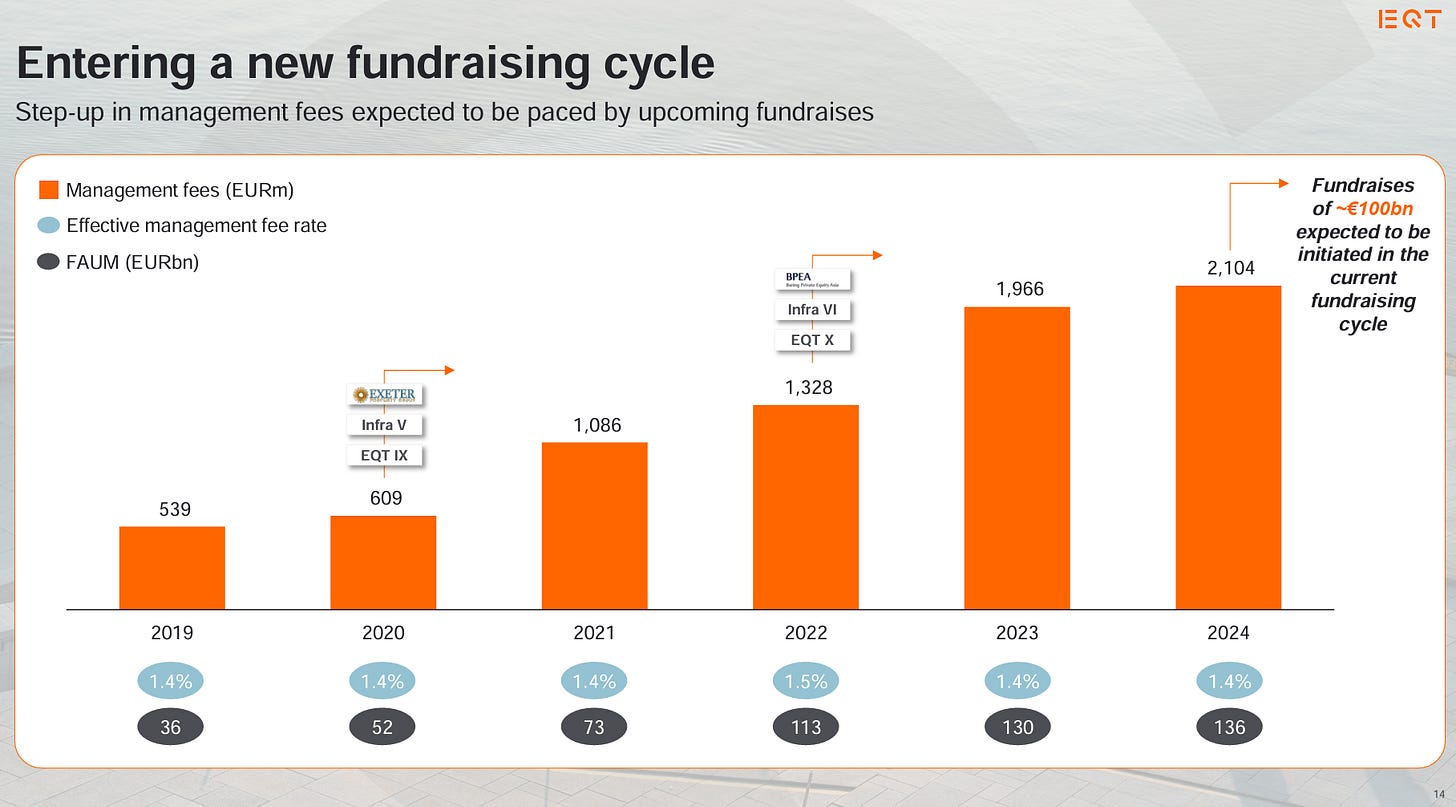

This exit track record over the past year should bode well for them as they look to enter a new fundraising cycle — one where they anticipate to raise over €100B.

With €269B AUM and €136B of fee-paying AUM under their belt, a €100B increase in AUM would represent a step-function change in the size and scale of their platform. Will they do it? An exit record like 2024 going forward certainly won’t hurt their prospects of doing so.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Investor Services Onboarding, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Senior Public Investor Relations Professional. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Head of Business Development, Family Offices - Senior Vice President / Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click hear to learn more.

🔍 BlackRock (Asset manager) - Vice President, Model Portfolios Business Development - EMEA. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Sagard (Alternative asset manager) - Head of National Accounts, Private Wealth Solutions. Click here to learn more.

🔍 Nuveen (Asset Manager) - Global Client Group, UK Family Office Business Development, Vice President, Based in London. Click here to learn more.

🔍 Vega (Private markets infrastructure company) - Product Associate. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

What AUM range fits under middle market in the context of GP stakes? ~$3bn-8bn?