👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from New York.

Last week’s post was about connecting dots in private markets from a technology perspective. This week, it’s about connecting dots in venture capital.

Private equity’s evolution can offer some clues about where venture is headed as an industry: institutionalization.

While private equity itself is still a relatively young industry in the scheme of broader financial markets, it has gone through its moment of institutionalization. The big are becoming bigger. They are acquiring other firms (as General Atlantic just did with Actis) or launching new strategies to become one-stop shop, multi-strategy funds. They are going public. And it makes sense. Kyle Harrison’s post on “The Blackstone of Innovation” includes a quote from Blackstone’s Stephen Schwarzman that captures the essence of this mindset:

"[One] way we thought about building our business was to keep challenging ourselves with an open-ended question: Why not? If we came across the right person to scale a business in a great investment class, why not? If we could apply our strengths, our network, and our resources to make that business a success, why not? Other firms, we felt, defined themselves too narrowly, limiting their ability to innovate. They were advisory firms, or investment firms, or credit firms, or real estate firms. Yet they were all pursuing financial opportunity."

In his post, Harrison also highlighted another aspect of asset management that’s worth noting:

I had a friend articulate the asset manager business model perfectly: any asset manager is in the business of multiplying 2% by as large a number as possible. Just about every investment firm follows the same model, whether they're investing in hyper-growth startups, cash-flow generating SMBs, or otherwise. Once you get into public equities, or debt, it gets a little more nuanced, but dedicated funds are all very similar.

I raise $1B from endowments, pension funds, and sovereign wealth funds. I go invest that money into [insert differentiated fund strategy here]. As a fund manager, I earn money in one of two ways: (1) fees, and (2) carried interest (aka carry). Fees can range, but a typical fund collects 2% of the entire fund size every year. In this case, that would be $20M a year ($1B x 2% annually). Carried interest is your share of the upside. So if I deploy my full $1B and generate a 3x return, that's $3B. I give my investors back their $1B, and then for the $2B in returns, I get rewarded with 20% of it for $400M (again, that percentage can vary).

Kyle’s observation highlights something that’s clear: asset management businesses can be very good businesses, especially at scale.

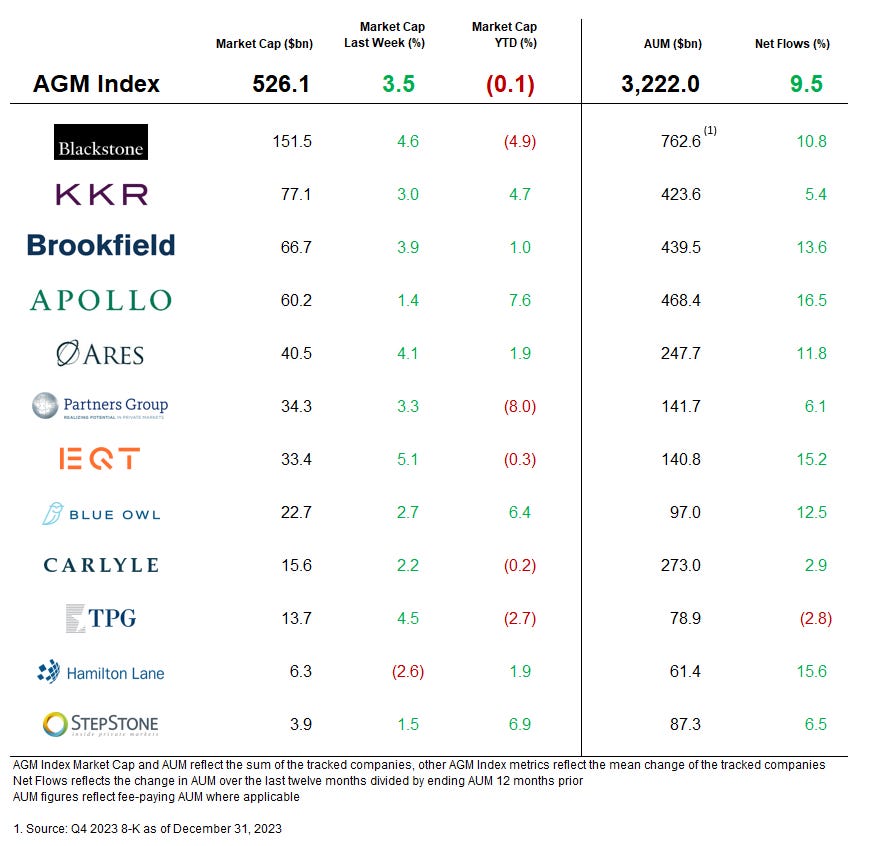

As the AGM Index (below) shows, the public markets seem to agree, particularly when you consider that Blackstone’s ~$151.5B market cap is larger than the market cap of many global investment banks.

I won’t comment on whether this trend in private equity and VC is good or bad. The reality is the answer to that question depends on a more nuanced set of questions for both GPs and LPs to determine depending on what they are after. There isn’t necessarily a right or wrong here. But there is a question of “fit.” Certain fund sizes will fit an LP’s allocation mandate or portfolio construction goal. Certain fund sizes will fit a GP’s skillset or desire to run and build a firm a certain way. Certain fund sizes will fit the investment opportunity for a company or an industry, whether it’s early-stage venture capital or real estate or private credit or infrastructure. Certain firm structures will fit the way a founder wants to partner with a VC fund to build their company.

The answer — for GPs, LPs, and founders — isn’t that there’s one model or optimal fund size of a venture firm that works for the industry. The reality is that the industry, much like private equity, has matured.

Capital and Capitol: Capital has shifted the Capitols of Venture

What I will posit is that it’s part of an industry evolution. An industry evolution that is turning into a tale of two cities, increasingly so in venture capital. A tale of cities where the road diverges — one path down a rural road in a countryside to a small house in a quaint town (or maybe as some VCs would like to characterize it, to a Wander) and another path down Park Avenue or Piccadilly, where big buildings stand tall. Ok, perhaps even the largest of multi-billion dollar VC firms will still choose their home to be Sand Hill Road or South Park in SF or Shoreditch or Mitte in Europe, but their size and scale by AUM may match private equity firms that inhabit large buildings along the streets of Park Avenue or Mayfair.

That tale of two cities was evident in a few newsworthy events and articles from this week. StepStone Group published a fantastic post — replete with data — that illustrates venture capital’s evolution, “shedding the ‘access class’ label,” as they say. This report coincided with news of Lightspeed using an instrument that has been commonplace in private equity, the continuation vehicle, to sell up to $1B of their current holdings to achieve liquidity in certain funds for LPs but retain the management of those assets via a new vehicle with new (and possibly some existing) investors, according to the FT’s Ivan Levingston and George Hammond.

Data from StepStone’s post illustrates just how far the VC industry has come from what they characterize as a transformation “from a cottage industry to a fully institutional asset class.”

VC grew its AUM from $300B in 2008 to over $3.5T in 2022, representing almost 25% of total private capital AUM.

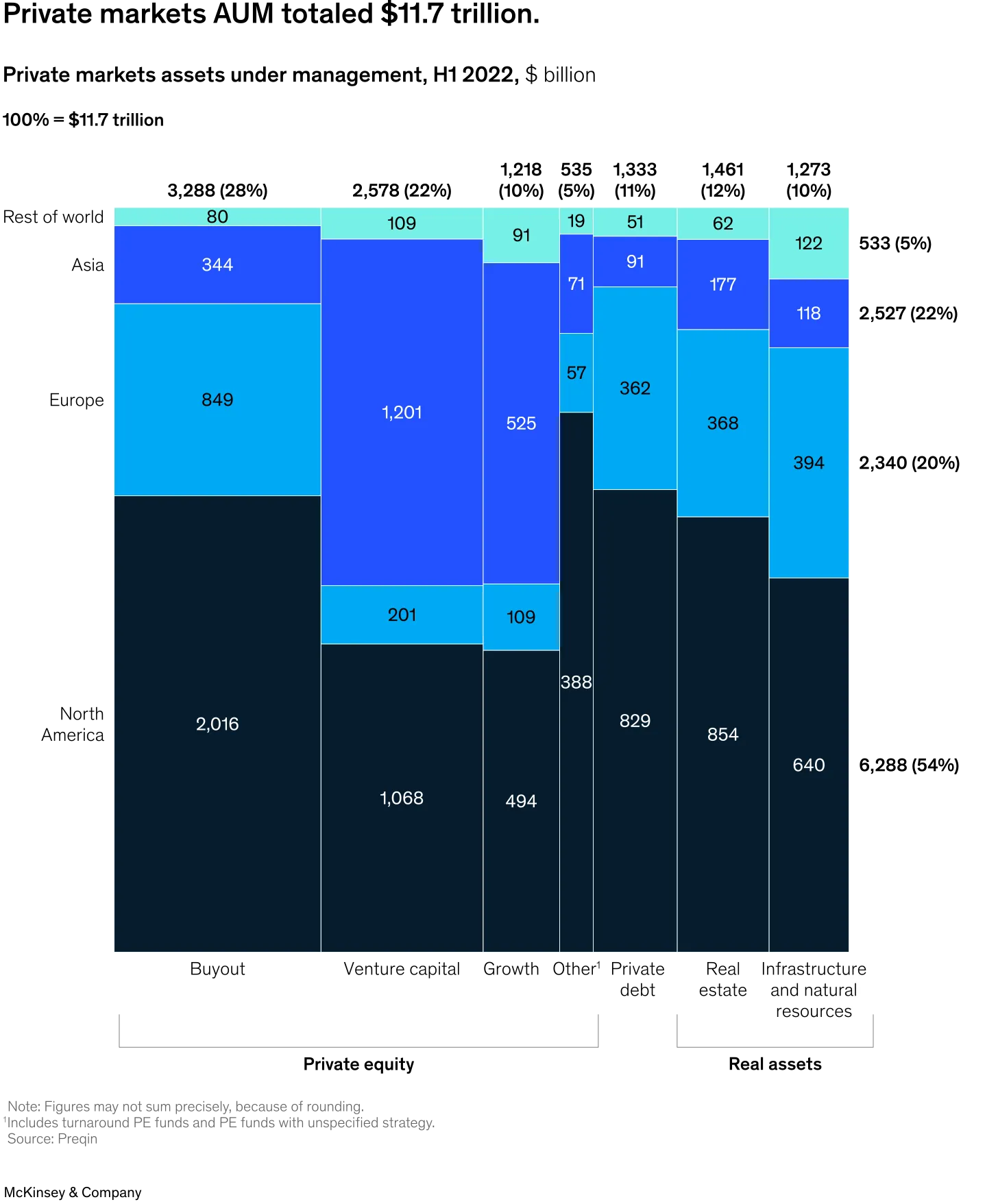

A chart from a McKinsey report in 2023 comparing AUM across various private markets asset classes hammers home just how big VC has become. VC represents more total AUM (as of H1 2021) than all but Buyout strategies, besting Growth, Private Debt, Real Estate, and Infrastructure.

This data from StepStone and McKinsey highlights that VC has very much moved into the mainstream as VC has become an increasing share of both AUM raised by strategy and by the number of new funds created.

With growth in an industry’s size comes maturation. VC has very well left its home on Sand Hill Road to become a global phenomenon and hang their office logos in closer proximity to their Park Avenue private equity counterparts. But it doesn’t mean that the VC industry can’t live in both the city and the country in equal parts.

StepStone’s teardown of performance by VC fund size illustrates this fact. Data from StepStone’s SPI Research shows that smaller funds, defined as less than $500M in size, tend to outperform on average.

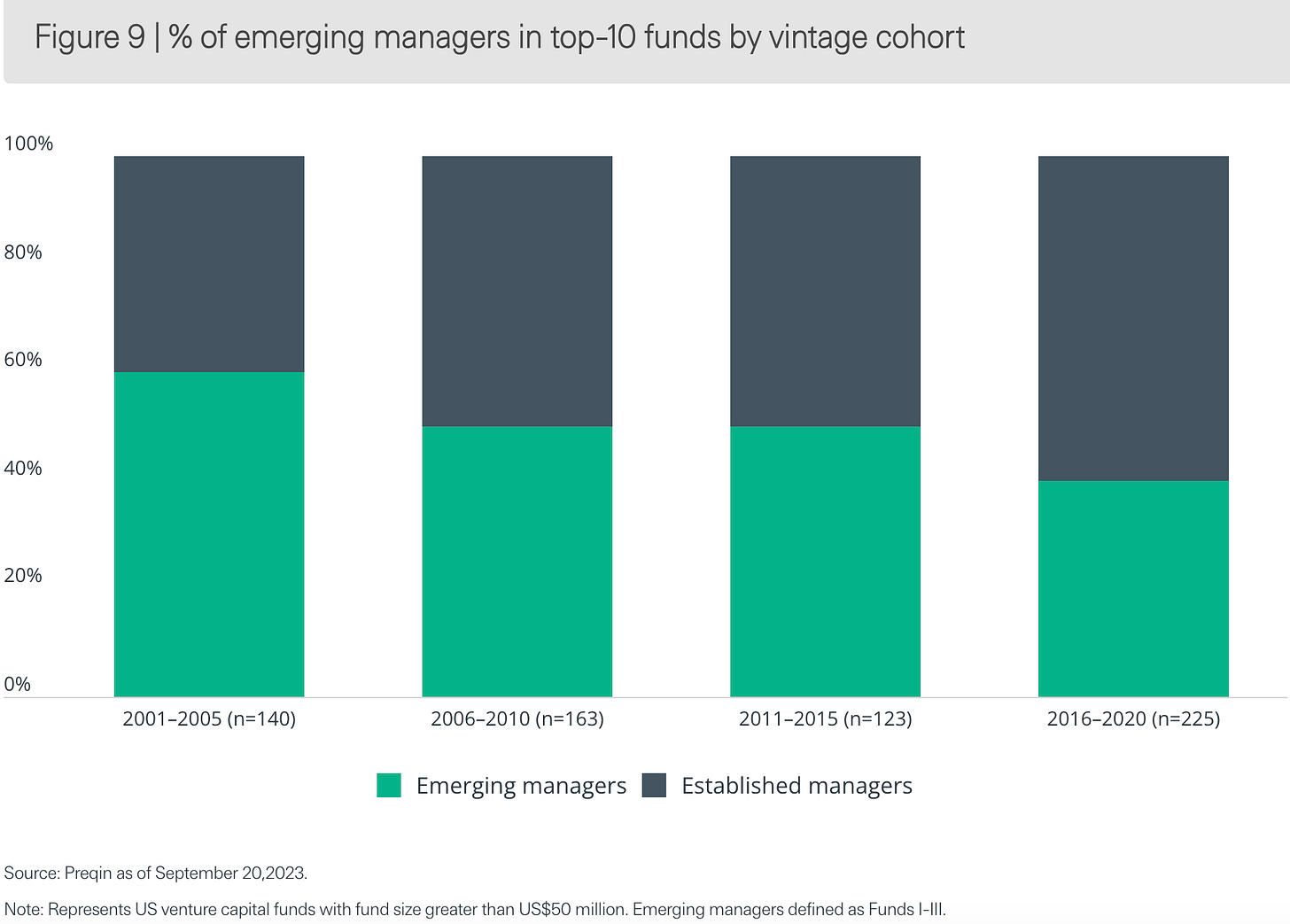

It would be easy to conclude from StepStone’s data that every investor should choose to allocate to an emerging manager if they outperform relative to larger funds.

Country roads and city lights can both shine bright

But, not so fast. There are a number of complicating factors that still have LPs going to the city rather than visiting the countryside. You see, the countryside can be hard to find for many LPs, and it may be hard to stay on the path. Larger institutional LPs can’t always invest in a $100M fund due to the allocation size they may have to deploy to a single fund. Emerging managers also have more variability in outcome, making it more challenging for allocators to partner with an emerging manager over a larger fund from a risk management perspective And, certain industries or markets require large investments to build winning companies, meaning that in certain cases, a bigger fund may be the right choice for exposure to those types of opportunities.

The above chart from StepStone also highlights it could be better to allocate to an established manager rather than an emerging manager in certain vintages.

It’s worth noting that an established manager could be a smaller fund like Benchmark or USV, which are sub $500M in fund sizes by design but are beyond the Fund III classification that defines emerging managers in StepStone’s dataset. Those would certainly be funds that virtually any LP would want to allocate to, despite being far beyond funds I-III.

Now, there are ways for institutional LPs to go to the country and access smaller, emerging managers: allocating to a VC fund of funds or creating a separately managed account for VC funds in partnership with a fund of funds as CalSTRS did with Invesco Private Capital and many other institutional LPs have done.

In fact, Cendana Capital’s Michael Kim said in Allocate’s 2024 VC Outlook that he believes that institutional LPs will “realize that the early stage VC exposure is a lot less than what they expected … as they review their commitments to the large platform VC firms … and will seek new relationships to increase early stage VC exposure.”

This sentiment was echoed on both an AGM podcast last year with Pejman Nozad of Pear VC, who found in the fundraising process for their most recent $432M seed fund that many institutional LPs now view Seed as a distinct category within VC and look to have new relationships with Seed focused managers, and in a tweet this week by Altimeter’s Head of Capital Formation Meghan Reynolds.

So, if VC is at the crossroads between country and city on the journey to institutionalization, where does that leave LPs and GPs?

Living in the country or the city

“Knowing yourself is the beginning of all wisdom” - Aristotle.

As the road in venture capital diverges, business builders will have to figure out who they are and who they want to be.

There’s no one right answer — successful venture capital firms and brands can be built with smaller fund sizes that consistently generate strong returns via carried interest or by building and scaling a platform and growing AUM. It simply depends on who they want to be.

VC clearly seems to be going through its transformational moment. VC is becoming PE in many respects. According to Cantilever Group’s Managing Director & Head of Investments Ben Drylie-Perkins, VC typically hasn’t been a high-margin business when compared to other asset management businesses.

But, as Ben notes, at $25B AUM, a firm like Lightspeed likely has attractive margins. He makes an astute observation about scale:

“Cost bases, excluding carried interest allocations to investment teams, become relatively fixed above a certain fund size. So even if large managers reduce management fees by basis points to raise more capital, the incremental margin on new fees can still be close to 100%. At that point, raising more capital at 1.85% vs. holding the line at 2.00% is an accretive trade off.”

Savvy asset management business builders in venture capital will recognize that scaling AUM offers the opportunity for a healthy valuation on the enterprise value of their VC firm. Fee-related earnings (FRE) valuation multiples are much higher than multiples assigned to investment performance. PwC Deals Partner Gregory McGahan highlighted this point in a LinkedIn post in October 2023, noting:

“A big reason FRE is so heavily valued is that it receives, on average, a three times higher valuation multiple compared to the multiple assigned to earnings from investment performance, which can be more volatile.

Also important to a firm’s valuation multiple is FRE quality, which looks at the diversification of a manager’s asset classes and distribution channels, as well as the portion of FRE that is derived from third-party management fees. Higher FRE multiples are also supported by a strong fundraising pipeline and the forecast of assets under management (AUM) converting into fee-paying AUM in the near term.”

VC can live in both the country and the city. There will just be ways in which they’ll have to think about the type of road they’re traveling on.

(1) There’s a right customer for each type of fund. There will be a place for large city funds that are multi-strategy platforms within both institutional and individual LP portfolios. Perhaps it makes sense for LPs to access a top-brand name manager who can deploy significant amounts of capital into a sector. There will also be a place for smaller emerging manager or smaller but high-performing funds like Benchmark or USV (if they were to ever open their funds to new investors). As business builders, GPs will have to think about who they want to be and what type of LP customer they are serving.

Of course, venture is a returns-focused game from the LP perspective, but there are nuances to this point. Not every LP can access every top venture fund. Some LPs will choose to sacrifice some risk for slightly later-stage exposure or a more likely solid return than play for a boom or bust outcome. Some LPs will aim to find a way to work with emerging managers, but that either requires investing in a fund of funds or resourcing appropriately to adequately cover a more challenging, fragmented market. Equally so, every vintage offers the opportunity for a new emerging manager to become the brand of tomorrow. Very few firms turn into the new emerging brands, but the past decade of venture has a number of examples, whether it be the likes of Felicis, Ribbit, or Goodwater, to name a few.

(2) VC will see a barbell occur — smaller, specialized funds and large platforms will benefit from this industry evolution while the middle will face challenges. LPs will allocate to smaller funds that have the potential to outperform due to fund size and some demonstrable advantage in finding, picking, winning, or helping, and other LPs will allocate to larger platform funds who provide the breadth of various strategies to serve as a one-stop shop for allocators. The middle will wither — funds that are of medium size and lack a special edge, likely of the generalist category, will struggle to raise from LPs who now look at venture as an institutionalized asset class where they aren’t just looking for access to the category, but are looking for a specific type of fund to cover a specific strategy or goal.

(3) As more successful entrepreneurs and operators build VC funds, we’ll see more VC funds turn into businesses — and look like high-margin alternative asset managers as a result. The historical knock on VC from a business and enterprise value perspective is that the majority of the value sits in the carried interest, which can be more challenging to value than management fees (fee-related earnings). As an increasing number of VCs scale into large, multi-strategy platforms across early-stage, growth, and even private credit, a $25B AUM Lightspeed or a $35B+ AUM Andreessen Horowitz probably have pretty high margins.

Many successful entrepreneurs have the hunger — and the know-how — to scale businesses. They are predisposed to create businesses that can grow. Successful entrepreneurs (and savvy investors) who are now building venture funds will understand that AUM at scale can make for a high-quality, high-margin asset management business. With the addition of enabling technology like AI, which is making its way into the internal operations of alternative asset managers in a number of ways, we’ll see venture capital asset management business builders find ways to scale their operations in manners that reduce costs, all while growing AUM. The combination of these two features of business building will create a recipe for business success — high-margin alternative asset managers in venture.

(4) VCs will be seen as businesses, making GP staking / solutions in various forms more commonplace, just as it has in private equity. To date, GP staking has been largely the domain of large, multi-strategy private equity firms who have built large platforms and expanded across multiple strategies and asset classes. There have been a handful of GP stakes deals in the venture space, notably with Thrive, General Catalyst, NEA, Industry Ventures, and a few others. However, the majority of stakes deals have occurred with large private equity or private credit firms. Some LPs have been reticent to see VCs take stakes deals. This sentiment will change as (1) VC is viewed through a more institutional lens and (2) larger VC platforms take stakes because they begin to look more similar to their private equity counterparts.

(5) A large multi-strategy alternative asset manager will acquire a VC fund in the not-too-distant future. VC is one of the remaining strategies that has yet to be part of a large alternative asset management platform. Firms like Blackstone, Goldman, and Apollo have gone into VC in their own ways — Blackstone has a Growth fund, as does Goldman. Apollo has taken a meaningful GP stake in financial services private equity and venture firm Motive Partners. However, none of these firms have acquired or built a VC firm for their platform. That will change as large alternative asset managers increasingly view VC as an institutional asset class rather than a cottage corner of private markets.

(6) A large brand-name VC firm (Sequoia? Andreessen Horowitz? General Catalyst?) goes public at some point. Firms like Sequoia at $85B AUM, Andreessen at $35B+ AUM, and General Catalyst at $35B+ AUM aren’t significantly smaller — or in some cases bigger — than some publicly traded alternatives managers. Could we see a VC firm go public at some point as managers in private equity and private credit did?

Absolutely. Then, VC will really be seen as institutional.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Lightspeed taps private equity playbook as it eyes $1bn asset sale | Ivan Levingston & George Hammond, Financial Times

💡Liquidity is still very much weighing on the minds of LPs. The Financial Times’ Ivan Levingston and George Hammond report that Lightspeed is thinking about using a continuation vehicle to free up liquidity for existing LPs in current funds and roll $1B of value in 10 portfolio holdings into a new vehicle. Lightspeed is expected to use a strategy that’s commonplace in private equity: the continuation vehicle. This strategy is becoming increasingly popular amongst funds looking to solve for LP’s liquidity needs as they try to return capital and raise new funds. As more normal paths to liquidity — IPOs and trade sales — have been more muted in recent years, VCs have had to look for alternative ways to return capital to LPs. Lightspeed’s Chief Business Officer Michael Romano highlighted the importance of understanding LP’s needs, saying, “We think VCs can’t just use the excuse that the IPO window is closed, they need to take a page out of the private equity playbook and build more consistent liquidity that LPs can count on.” DPI (distributed to paid-in capital) is top of mind for VCs, particularly as they go out to fundraise for new funds. Many LPs are focused on distributions — and a fund’s track record of distributing capital back to investors is what LPs are evaluating as they look to allocate to new funds. LPs’ focus on DPI has caused GPs to find ways to distribute cash to investors. One partner at a multi-billion dollar US venture firm remarked, “if you have poor DPI you’re dead … you aren’t going to raise a nickel.” Continuation funds have increasingly become the tool of choice for many funds to solve the liquidity challenge. Lightspeed isn’t the only firm to be thinking about a continuation vehicle. Insight Partners reportedly raised a continuation fund, and NEA has been in talks to raise a continuation fund. While continuation vehicles provide a solution for the liquidity problem, they aren’t universally popular amongst LPs. LPs have to decide whether or not they want to lock up capital with the VC — at a fee — in the CV or take the liquidity on the existing investment at a potential discount.

💸 AGM’s 2/20: News of Lightspeed’s decision to raise a continuation vehicle for a portion of their portfolio holdings highlights a number of trends swirling around the VC industry. Certainly, liquidity is still at the forefront of many GPs and LPs minds as they think about fundraising for new vehicles. Lightspeed is far from the only VC to have significant paper gains currently locked up in private markets, so it won’t be a shock to see a number of VCs pursue the continuation vehicle as a way to still maintain optionality in the upside of some of their top private companies in their portfolios (and generate a management fee in the process) while also giving LPs the option of liquidity. The public markets could very well have a tail that wags the private markets dog. How exits play out over the next year, either with IPOs or via trade sales, will have a significant bearing on how VCs look to navigate providing liquidity for LPs. The concept of the continuation vehicle also highlights another trend in venture: that VC is looking increasingly like PE. VC is institutionalizing as an industry, particularly as large firms evolve into multi-billion dollar platforms. As a result, we’ll see more firms beginning to do things that look like their PE counterparts. Continuation vehicles are one such area where we’ll see VC look more like PE. And as I highlighted above, there are other ways that VCs, if they choose to go down the path of multi-strategy managers, will begin. to look like private equity firms.

📝 Insurers Are Keeping a Trend Alive, Swapping Public for Private Assets | Michael Thrasher, Institutional Investor

💡Insurers are far from moving dollars from public to private assets, reports Institutional Investor’s Michael Thrasher. Thrasher analyzes a 2022 study by Conning, the $214B asset manager that surveyed a few hundred investment professionals at insurance companies about their allocations. The survey found that, in 2023, insurers did what they said they would do, which was continue to invest in more private assets. Conning’s 2023 survey of 300 insurance professionals found that they plan to do more of what they did in 2023 in 2024. According to Conning’s latest report published Tuesday, out of 300 insurance professionals surveyed in the fall, 80 percent were optimistic about markets and 62 percent plan to increase their risk tolerance again in 2024. Conning’s survey found that the majority of insurers plan to increase their allocations to private equity and private debt by as much or more than they plan to increase allocations to stocks. Conning’s Managing Director and Head of Insurance Solutions Matthew Reilly said, “There continues to be an interest in allocating more to private assets. So whether that be real assets like real estate debt and equity, infrastructure, or whether that be private fixed income in the form of private placements or private credit or private equity, even in a landscape of higher interest rates, there continues to be interest in that.” Other points of note in the survey centered around rates and inflation. Some insurers, who didn’t have the cash or liquidity to lock in higher yields before the Federal Reserve potentially begins cutting the benchmark rate, have said they will look to find ways to do that outside of public markets now that yields have dropped. Inflation remains a top concern amongst many insurers, highlighting how the macroeconomic environment will continue to impact private markets.

💸 AGM’s 2/20: Insurers represent an interesting and important perspective on private markets allocations for the industry. They have large pools of capital that are looking to match liabilities, and in some cases are looking for specific return targets. Private markets can offer insurance companies solutions across different investment strategies that provide qualities that match both their desires from a return objective as well as a risk objective. The other area within insurance that will be interesting to monitor is the extent to which insurers look to form strategic partnerships with alternative asset managers beyond simply being a LP, much like large pensions or sovereigns have done. Some insurers have already gone down this path (as well as many private equity firms either acquiring or investing in insurance companies), but it will be interesting to see continued evolution of this theme.

Reports we are reading

📝 Ten considerations for private markets in 2024 | Fredrik Dahlqvist, Alastair Green, David Quigley, John Spivey, Brian Vickery, McKinsey

💡McKinsey released a report highlighting ten considerations for private markets to be thinking about as they head into 2024.

(1) A return to more normal dealmaking: McKinsey expects dealmaking to pick up as both LP-driven pressure to return funds meets a rebounding valuation environment.

💸 AGM’s 2/20: Something has to give in 2024. There will be tools that enable GPs to return capital to LPs, such as through continuation vehicles, and a more normalized valuation environment should lead to exits. Perhaps not a thriving exit environment that the industry may be hoping for, but certainly more movement than in 2023.

(2) Fundraising will remain tough as the “numerator” effect prevails: New LP commitments will remain muted — not just due to the denominator effect. The numerator effect will grow as a result of slow PE exit velocity, continued capital calls, and valuation growth that pushes NAVs higher.

💸 AGM’s 2/20: The numerator effect meets the denominator effect. The combination of both numbers impacting each other should make fundraising challenging, especially for new commitments for LPs. It will be interesting to see what moves the needle in fundraising in 2024.

(3) Continued concentration among larger and better-known names: LPs will continue to favor larger brand-name funds

💸 AGM’s 2/20: This is not a surprising possibility, particularly given (1) the fact that many LPs are constrained on new manager allocations and (2) the entrance of the wealth channel in a bigger way into alts. On the latter, new LPs will likely focus on a flight to quality and brand as they dip their toes into private markets for the first time. This coincides with the fact that the largest GPs are well-equipped to work with the wealth channel. They have large teams and the infrastructure to handle finding, selling to, and managing a larger number of smaller LPs.

(4) Value creation is the “new old thing”: Low rates and expanding multiples appear to be a thing of the past. McKinsey believes that value creation will once again move to the forefront of private equity investors’ minds.

💸 AGM’s 2/20: This phenomenon has been oft-discussed, with Apollo’s Marc Rowan recently saying that the current industry environment will require a return to skill when it comes to generating investment returns. I agree with Rowan — firms will have to rely on both sharper investment underwriting and astute, focused post-deal value creation in a world where investors can no longer rely on low rates and multiple expansion to generate returns.

(5) Evolving talent challenges: McKinsey foresees many firms facing talent development and retention challenges, particularly with professionals who yet to experience a downturn.

💸 AGM’s 2/20: Talent is a question across the firm of an alternative asset manager. The industry has covered the talent question as it relates to the education and staffing up of distribution professionals (I’ve covered in a prior Weekly newsletter here and in Citywire here), but McKinsey makes the astute point that this will be a question across the entire firm.

(6) Sourcing gets creative: McKinsey believes sourcing will get more creative, particularly as family-owned businesses look to go through generational transitions or as corporates look to carve out specific assets as they trim down their businesses in an effort to focus.

💸 AGM’s 2/20: McKinsey’s point here highlights a few notable trends. One is the increasing involvement of family offices and family-owned businesses in private markets, both from a buyer and seller perspective. This trend could be an interesting addition to private markets. Corporate carveouts also represent another interesting trend that could provide different types of investment opportunities for sponsors and business owners.

(7) Infrastructure investing will accelerate (through both infrastructure GPs and others): Infrastructure is a hot topic right now, in large part due to the capital required to help facilitate the energy transition to decarbonization. Recent news coming from BlackRock’s acquisition of Global Infrastructure Partners for $12.5B and General Atlantic’s acquisition of Actis puts an exclamation point on this trend, illustrating just how integral infrastructure investing is to the industry’s largest asset managers.

💸 AGM’s 2/20: This prediction does not come as a surprise given recent industry events with the consolidation of large infrastructure managers. I’d say that infrastructure investing will start to see large amounts of capital, particularly as the wealth channel allocates to this space to help facilitate the opportunity for a transition to decarbonization.

(8) Private credit continues to accelerate: Like infrastructure investing, this one seems to be highly likely. With banks pulling back on lending, private lenders will fill the vacuum. McKinsey highlights some of the issues that could put a damper on private credit, such as the volume of dollars going into the space reducing spreads, and an inability for many firms to find competitive differentiation.

💸 AGM’s 2/20: Private credit will continue to be a big theme in 2024, both as an investment opportunity and as an area that many allocators will monitor to see if the continued growth of the space will match where they believe the right risk / reward lies for returns. The large firms, like Apollo, who have clear and demonstrable expertise in this space (see below for Apollo’s Deputy CIO John Zito share his thoughts on private credit with Pension & Investments’ Jennifer Ablan) should continue to benefit both from fundraising and investment perspectives.

(9) Real estate deal volume picks back up: McKinsey believes what was a frozen real estate deal market will likely thaw in 2024 as greater predictability and tightening bid-ask spreads could lead to more deals getting done.

💸 AGM’s 2/20: The real estate market appears ready to start moving again. The question is where. Blackstone’s Stephen Schwarzman recently discussed Europe being an attractive opportunity from their perspective, so it will be interesting to see where firms go to find value. As with private credit, size will matter, and firms with the scale to capitalize on attractive investment opportunities will accrue the most benefits.

(10) Secondaries growing and enabling liquidity for GPs and LPs: Secondaries are still coming first. McKinsey sees the near-record secondary fundraising will enable sponsors to achieve liquidity for LPs via continuation vehicles so that those assets can crystallize full value and LPs can generate liquidity to invest into new vintages. Secondaries will become more prominent as solutions providers for GPs as there are a cadre of different opportunities for a secondaries firm to help GPs.

💸 AGM’s 2/20: This view appears to be happening in real-time, as evidenced by this week’s news of Lightspeed’s reported continuation vehicle. I agree with this take and would add that GP stakes / solutions firms will also feature in this market as they, too, can provide various solutions for GPs looking to manage the contours of their growth from a business-building perspective.

Videos we are watching

🎥 Part I: Apollo’s John Zito on the explosion in private credit and how the firm’s riding the wave | Jennifer Ablan, Pensions & Investments

💡Pensions & Investments Editor-in-Chief Jennifer Ablan sat down this week with Apollo Global Management’s Deputy CIO of Credit, John Zito, to learn more about how Apollo is navigating the current environment in private credit, currently seen as one of private markets’ growth areas. Apollo reported $631B in AUM as of Sept. 30, a 21% increase from Q3 2022. Apollo is part of a group of private credit firms that are reconceptualizing where and how allocators should think about private credit in a portfolio, talking with institutional investors about supplementing fixed income with private credit, which in theory should produce higher returns than plain vanilla bonds.

Some highlights from their interview below:

Apollo’s Zito answering Ablan’s question, “what exactly is private credit? I've heard Apollo's views that this is an addressable market as a $40 trillion opportunity. Walk us through that.”

Private credit is going through a big change in terms of what it is, what it is to certain people. Obviously for a long time post the financial crisis, it was really providing capital to small and medium-sized businesses in the middle-market direct lending space. So effectively servicing sponsors that generated EBITDA somewhere between $10 million and $50 million.

What's happened in the last 15 years, for us, we're trying to get everybody to agree on what private credit is. For us, it's everything that doesn't have a CUSIP that sits on a bank balance sheet, that sits on an insurance company balance sheet. (A CUSIP number identifies most financial instruments, such as stocks, commercial paper and government bonds as well as the issuer.)

Historically, it's majority of which is investment-grade. And that marketplace is much larger than the traditional, what people would call the direct lending space for sponsors, which is subinvestment-grade. So I think our first step is just really trying to educate and just get some consensus around the market, around what private credit is, and then we can talk about the risk associated or potential risk associated with it. But we view it as majority investment-grade, and that's where we've been spending almost all of our time.

Zito on what has contributed to the growth of private credit in recent years:

It's always been very big. It's providing capital to the entire economy. So it's mortgages, financing cars, financing any sort of real estate. Receivables finance, solar finance. You name it, it touches the economy, we're probably providing capital. The banks have historically provided that capital, and insurance companies have provided that capital.

And so historically, it's set within those balance sheets. Our retirement service business is growing really quickly. And so today we're $450 billion, $300 billion of which is our own balance sheet. And of that $450 billion, about a third is asset-backed, which is what I'm describing. And the other two-thirds, the other $300 billion, is our corporate business.

Zito on why Apollo is well-positioned to take more market share:

We've built 16 different origination platforms, which, the largest and most recent was acquiring Credit Suisse's warehouse finance business (Atlas), which we acquired about a year ago. We've spent just under $10 billion of our own capital to acquire or build our own capabilities. So you look at our employment numbers, today we have about 2,500 people who sit at Apollo, another couple thousand who sit at Athene. People don't realize we have 4,000 originators that sit out there outside of affiliated companies that are actually just originating assets on behalf of Apollo. We really touch almost all parts of the economy, and we built direct source to service our own balance sheets.

Zito on why their acquisition of Atlas was so critical for the firm:

Yeah, so I think we'll look back at the Atlas transaction as one of the most innovative transactions that we've probably done as a firm. I'm most excited about the ability to grow that balance sheet. We touch over 200 originators, where we provide warehouse financing. So when they originate a loan, we'll provide a short-dated one- to two-year financing, and then we'll securitize that pool of loans.

Three hundred employees, over 200 origination relationships, just under a $40 billion balance sheet, which I think could double over the next five years. Super excited about just being able to scale that business. And I think from everything I can tell, having now owned it for nine months, it's vastly exceeded what we think we could have built on our own, so we're pretty excited about it.

Zito on the impact of higher rates:

There's no doubt that, historically, higher rates should slow down the economy. We've seen it slow in certain pockets, but by and large, the economy's held up thus far. There's been a couple episodic forced refinancings, where you've seen amend and extends, or things like that happen in the marketplace. But by and large, that refinancing wave is coming in the next two years.

Zito on how he views what the market could look like:

Look, I suspect you're going to see lots of lenders participate or assist sponsors to help them extend their option to see if the interest rate environment changes, or access to capital changes, or the IPO market changes. In many situations, it's not so much that the debt would be impaired, it's just there's too much debt. And it's more of an equity problem than it is a debt problem.

Zito on why he likes direct lending:

I'm very bullish on recent and new direct lending, where you're doing it in this environment. Any sort of direct lending that happens, that's happened now in the last 12 months, you've assumed that the economy probably slows, and you've assumed that interest rates are at 5% forever. So you're building those capital structures with more equity, and in businesses that are less cyclical. We're pretty excited about that.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Vega (Digital wealth manager with a focus on alternative investments) - Senior Software Engineer (Backend / Frontend). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Fred Destin, the founder of Stride VC, discuss how to build trust in a competitive, chaotic world. Listen here.

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the sixth episode of our monthly show, the Monthly Alts Pulse. We discuss what will make the industry move forward in 2024. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.