👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London. I’m in town to speak at both the LSE Alternative Investments Conference and the 2024 Private Markets Trends event with Schroders, Pangea, and Illuminate Financial, and to meet with managers, investors, and founders.

Some of the industry’s largest alternative asset managers reported their Q4 2023 and FY23 earnings this past week. Apollo, Ares, and Blue Owl all continued to show strong performance, which appeared to be evident in the market’s reception after their respective earnings announcements. These firms continue to be well-positioned for growth, particularly as new investors (HNW channel and, possibly, the 401(k) market) enter the space and as they continue to innovate on new product structures that will drive their AUM and platform scale.

What was said in the earnings transcripts was perhaps as important as what was reported in the results.

There is no alternative

Apollo CEO Marc Rowan’s remarks on Apollo’s earnings call offers an illuminating window into where both Apollo and private markets are heading. His sentiment makes clear in no uncertain terms that the industry is in the midst of another seismic shift — and one that favors alternatives managers.

First, let’s look back to go forward. Rowan highlights just how much private markets — and Apollo — have grown since 2008. When measured against some of the largest companies in the world, Apollo’s revenue growth is quite remarkable.

We've just come back from our Partners Retreat, where all 201 Apollo partners get together and we discuss the outlook. And I began those remarks by anchoring people in history. In 2008, we were $44 billion of AUM. If you fast forward, we've grown 14 times; that's faster than Apple's revenue, that's faster than Microsoft's revenue, that's faster than semiconductors. Truly extraordinary [author emphasis].

I'd like to think that was all as a result of management acumen and management positioning, but we are the beneficiary of macro industry factors that drove not just us, but our entire industry. Dodd-Frank, substantial money printing, a research for excess return in a low rate environment, and the commoditization of debt and equity markets – public markets through indexation and correlation, were the powerful tailwinds that drove our industry and allowed us to grow 14 times.

Rowan notes that some of the macro trends and industry tailwinds that have helped push Apollo and its peers forward. But, he also makes an important observation about a seismic shift that’s occurring in how investors think about private markets.

Many investors believe that the industry has moved beyond the 60/40 portfolio. Rowan makes that clear here. We’ve moved from pieces of the pie to buckets and spectrums. Buckets of equities allocations, whether private or public. The question now becomes the spectrum — where on the spectrum of liquidity do investors want to fall as they think about their liquidity features in the context of the type of returns they are being paid for the liquidity risk they are taking. Rowan states that both public and private markets are now seen as safe and risky.

There’s no distinction between these two markets, other than liquidity. Which means, now, there’s no alternative.

Some of these factors are still here, but I have to say, the factors that are going to drive us going forward are different than the factors that in fact got us to 2023. As I think about the big drivers of our business, first, I think there is a fundamental rethink going on as to the difference between public and private. Most of us have grown up in an investment world where private was risky and public was safe [author emphasis]. We had a private allocation and alternatives bucket and liquid allocation, and it was generally a relatively small portion of an institution or an individual's total strategic asset allocation and with good reason.

Private, at least in the old days, was risky. Private equity, venture capital and hedge funds dominated the private bucket. On the other hand, public was perceived as safe. Stocks and bonds, 60/40 portfolio. I believe we're moving to a world where public is both safe and risky, and private is safe and risky; and the difference is only a matter of liquidity [author emphasis].

I believe we are going to see a substantial pivot from institutions where they begin to think about private, not just in a traditional alternatives context, but they think about private as just another investment that has a little less liquidity. And the question they'll be asking is, am I being compensated for slightly less liquidity? I think that is nothing but a positive for our industry and for our firm.

Rowan highlights that there is no alternative. Private markets represent a foil to the new world order of public markets: indexation, concentration, and correlation. This issue is particularly acute for individual investors who, to date, have had virtually no other option outside of investing into stocks and bonds. Apollo, along with many others, see the individual investor as a market that should now roll some of their investment exposure into private markets.

Not surprisingly to those who follow the alts space, Rowan’s characterization of the HNW channel illustrates just how big he and his peers view the space.

The second is, this continued commoditization of public market returns. We are at an extreme of indexation and concentration and correlation not just between debt and equity markets, but so much of our equity market is dominated by a handful of companies that – with outsized valuations and outsized PE, that really do drive the public indices. While that's going up, that feels great. That can just as easily go in the other direction.

Sophisticated investors, institutional and individual, understand this. And if they are seeking to separate themselves from the beta of the public markets and look for alpha, they will need to look for other solutions other than those in the public markets and through indexation. High net worth and the entry of individual investors into the private markets and alternatives, we are in the earliest early days of this. This hasn't even started. This is a $65 trillion market that ultimately has the potential for private markets' investors such as ourselves and our peer group to be as large, if not larger, than our institutional market.

The next seismic shift beyond the wealth channel, the 401k market

Rowan calls the size of the HNW market as large as the institutional market, justifying these firms’ focus on this channel. What he says next, though, takes the opportunity set in the individual investor channel to an entirely new level.

For us to get there, it's going to take education. We are evangelical in this, because what private investments can do for an investors' portfolio is well substantiated academically and through financial records. But the level of understanding of how private investments can be incorporated into these portfolios is very, very immature. I look at the largest pool of investable capital anywhere in the world, some $12 trillion in 401(k).

These are the people in our country who need returns the most, and we force them to be daily liquid for 50 years. Why? I don't know why. I don't think there's a good reason why. And we're beginning to see cracks even in the 401(k) market of an allocation to private, which is different than an allocation to risk. But again, I think this is a very powerful trend that bodes well for our firm and for our industry.

Private markets have been on a secular growth trend. Since 2008, the industry has witnessed a few seismic shifts with regards to how alternative asset managers characterize and work with their LP customers.

In the early 2010s, institutional LPs culled GP relationships, built in-house investment programs, and focused on co-investment opportunities with their large GP relationships (i.e., CPPIB and Silver Lake, amongst others). This trend forced GPs to figure out where they could scale with institutional LPs and where they would find their next wave of AUM growth.

Then, a raft of what are now the firm’s largest alternative asset managers went public, which has led to continued growth objectives for these firms and an increase in their size, scale, breadth, and depth of both their investment strategies and LP relationships.

Then, since 2013-2014, the industry’s largest firms began to build the solutions and infrastructure to work with the next area of growth for private markets: the wealth channel.

However, a large portion of individual wealth is still untapped by the alternative asset managers for a number of reasons. And there’s one area that has yet to be unlocked fully: retirement assets. If retirement assets become a pool of assets that can flow into private markets, then that adds both trillions of dollars and an investment structure that fits the illiquid nature of private markets well. Adding trillions of dollars is meaningful to a market that’s $14T in AUM. And, as we’ve discussed before, the largest firms stand to be the biggest beneficiaries.

And yet, despite meaningful growth over the past 15 years, alternative asset managers are still relatively small entities in the scheme of asset management, as Rowan points out.

In short, we find ourselves at $650 billion as a relatively small entity in the scheme of asset management, surrounded by four massive markets. The market for fixed income replacement. Think of this as a rotation from institutions and individuals, normal fixed income portfolios into private as well as public, so-called private investment grade. The second is the high net worth market, moving from traditional out 60/40 allocation into private market allocation. The third is rotations out of active management and into other products. And finally, the retirement market.

Each of those markets offers us the opportunity to double our firm over a number of years. We just have to make sure that we are well positioned. We make the investments today and accept that the tailwinds that powered us to 2023 are not the same as the tailwinds that are likely to power us going forward, that the products that powered us to where we are, are not exactly the same as the products that are going to power us going forward.

Rowan highlights the case for Apollo’s growth on four vectors. If any of those vectors see growth, which would be entirely plausible, then Apollo’s size and scale should only continue to trend upward. Perhaps it shouldn’t come as a surprise that Apollo executed $800M in share buybacks in 2023.

Capital formation. Not only do we need to continue to build out our high net worth coverage, but if we are going to serve fixed income replacement, so-called private investment grade, the sale, the way things are sold, the client base is actually completely different than the traditional client base of an alternatives firm, building out a fixed income replacement sales force that speaks to clients in a language that they are used to speaking in, necessary ingredients to scale this and not just pick around the edges.

What are the key questions and themes going forward?

(1) How private markets products are structured: As the investor type and their requirements, both from a regulatory and investment objective perspective, change, so too will how products are structured. It shouldn’t come as a surprise that many alternative asset managers are innovating with product structuring, particularly as they look to serve the wealth channel.

I expect we’ll see more evergreen or semi-liquid structures to, as Rowan says below, provide a “hybrid between debt and equity” in large part due to his observation that HNWs aren’t going to move into 10-year locked private partnerships.

(2) How products are sold (and to whom): Rowan references education as a major component of how they plan to work with the HNW channel to help them better understand the merits and risks of private markets and their investment products. The alternative asset managers who have made an investment in working with the wealth channel know well that they must do things differently if they want to work with a new client base. And they are well aware that it won’t be easy. I expect we’ll see increased investment in education and the building of the right type of distribution teams to work with the wealth channel.

For us to get there, it's going to take education. We are evangelical in this, because what private investments can do for an investors' portfolio is well substantiated academically and through financial records. But the level of understanding of how private investments can be incorporated into these portfolios is very, very immature.

(3) How they are reported on: As product structures change (i.e., away from illiquid private partnerships to hybrid liquid products), so too will reporting structures. Firms will have to calculate investment performance, marks, and valuations on a more regular basis. That’s one reason why I’m a big believer in companies like 73 Strings, LemonEdge, Canoe, and others, that are enabling firms to more efficiently manage their post-investment valuation and reporting functions. 73 Strings, for example, enables alternative asset managers to more easily strike monthly NAVs, which is critical for evergreen or semi-liquid structures as firms like Blackstone launch fund structures like BXPE, BCRED.

Finally, new products and product creation are the heart of financial services. If I go back and look at the beginning of my 40-year career now, levered loans, high-yield bonds, ETFs, securitized product either did not exist or in their infancy. We take for granted these four products as completely mainstream and dominant products, but we should not be naïve to think that they are going to be the products that dominate 15 years from now [author emphasis].

Clients and high net worth individuals are going to move out of public equities. I do not believe they are going to move into 10-year locked private partnerships. I believe they are going to move into things that are more hybrid [author emphasis]. Hybrid, again, is the midpoint between debt and equity. Hence, to offer clients non-binary outcomes, while still providing attractive rates of return.

Financial services has seen a number of innovative product creations, ETFs being one of them, that mainstreamed the way in which investors accessed equity markets. What will be the products of the future that mainstream access for private markets?

The answer, as Rowan says, probably lies somewhere in between illiquid and liquid as liquid managers are going semi-illiquid (BlackRock buying GIP, Franklin Templeton buying Lexington Partners) and illiquid managers are going semi-liquid (Blackstone’s BXPE, BCRED, etc.).

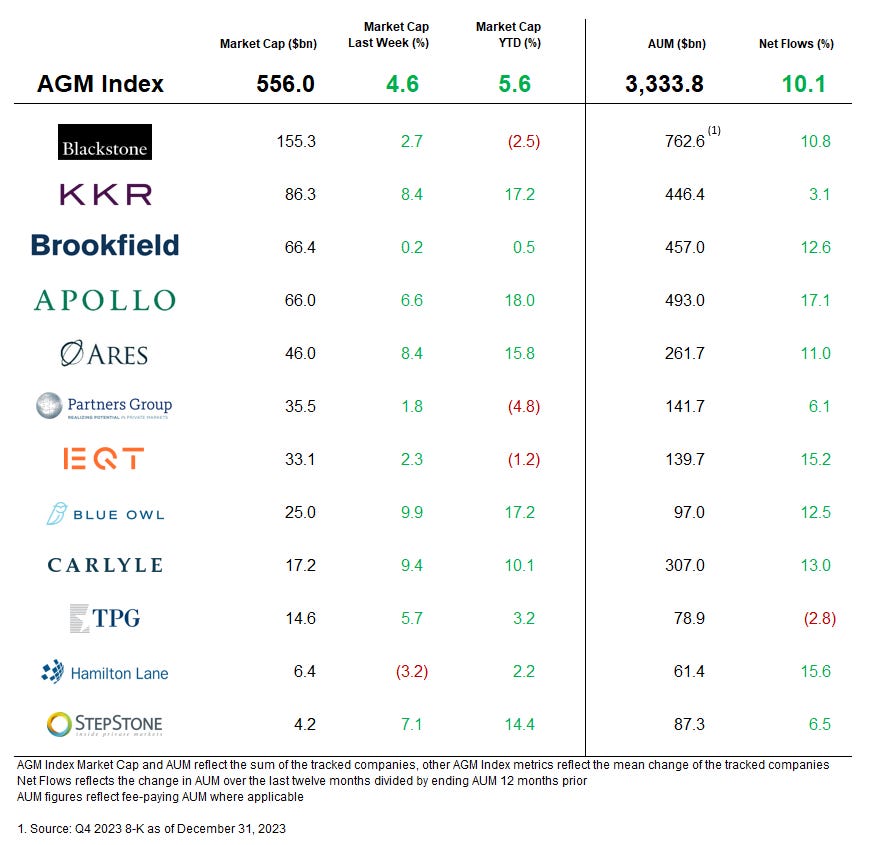

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 The crowding-out effect | Jessica Hamlin, PitchBook

💡 PitchBook’s Jessica Hamlin reports on a fascinating trend — how product innovation in the wealth channel may, in fact, crowd out large institutional investors of co-investment opportunities. Semi-liquid vehicles are innovative not only because they enable alternative asset managers to work with individual investors but also because they are a pool of capital that enables GPs to finance deals directly. Hamilton Lane’s Head of Private Wealth Solutions posits that the inflows of private wealth capital will push managers to increase their deal flow. If GPs are unable to deploy fund capital at a fast enough pace, they will look to co-investments to fill the gap. Brennan said, “These managers are going to need to increase their deal flow significantly in order to invest their semi-liquid or evergreen funds and provide co-investment deal flow to their large institutional investors. If they can’t make this happen, it will be the “co-investment deal flow that will dry up first.” The addition of evergreen funds for GPs means that they will allocate to the investment both out of their main fund and their evergreen fund before moving to co-investments. This trend could cause a crowding-out of co-investment opportunities, which have historically been made available to institutional investors with the size, scale, and speed to move quickly to diligence and allocate to those opportunities.

Incentives could drive how this trend unfolds. Fees generated from evergreen funds for the GP may be more favorable than those generated from co-investment opportunities. Casey Quirk Principal Kevin Gallagher said that the wealth channel-focused funds could signal an end to the fee concessions and favorable terms managers use to attract large LPs. GPs could have less of an incentive to provide more attractive terms to institutional investors with the fee structure from the continuous, periodic fees generated from semi-liquid funds. Gallagher noted, “evergreen funds and large institutional investors could become on par with each other,” in terms of fee negotiation and co-investment opportunities. Co-investments have become a major feature of the buyout world. Over the past decade, 30% of all global PE deals have included co-investors, according to PitchBook data. Some of the industry’s largest deals have featured co-investors. Last year’s mega-buyout deal, the $12.4B take-private of Qualtrics, was completed when PE firm Silver Lake partnered with the Canada Pension Plan Investment Board. In 2021, Blackstone, Carlyle, and Hellman & Friedman bought medical supply company Medline Industries for over $30B, including sizable co-investments from Abu Dhabi Investment Authority and GIC. It’s possible that the rise of semi-liquid, evergreen funds could limit the capacity for co-investment, but it’s also too early to tell, according to EY-Parthenon’s Head of US Wealth and Asset Management Strategy Gaurav Joshi. He observes that “the direction of travel is clearly from single-source co-invest opportunities to a portfolio approach.” Some of the industry’s larger GPs believe it will enable them to size up and write even bigger checks. Head of Brookfield Oaktree David Levi said that larger managers will now be able to write even bigger checks armed with individual investor and co-investor capital. “If you’re a smaller manager, it’s possible that co-investors get eaten up by the semi-liquid fund, or vice versa,” Levi said. “At Brookfield, we are running massive, massive checks. Our investment size is such that that’s not a concern for us.”

💸 AGM’s 2/20: A few weeks ago, my featured weekly piece in AGM and in Citywire was about how the wealth channel is the new institutional LP. Recent articles have made this characterization look increasingly on the mark. Wealth has certainly been winning the mindshare of alternative asset managers as they see both the need and the opportunity to work with a new investor cohort. Now, it appears that wealth could also be winning deals. The move to innovate for the wealth channel with products like semi-liquid, evergreen funds has major impacts not only on what it means for the wealth channel but also on what it means for institutional LPs. Evergreen funds may end up receiving allocations to larger deals before co-investments, which could change the dynamic of the relationship with institutional investors. Co-investments have been a defining feature of private equity dealmaking over the past decade, in large part due to pension plans and institutional investors looking to deepen relationships with LPs and blend down their overall fee load with a given manager relationship. At times, large GPs had to make fee concessions to size up into deals that were larger via co-invests or to win or maintain a relationship with a large institutional LP. That now may change, so it looks like the wealth channel could very well be the new institutional LP.

A few major questions arise from this new trend. There are questions as to how the semi-liquid nature of these product structures will impact the staying power of this capital. Will the ability of wealth channel capital to call for liquidity from these products impact GPs ability to invest in certain deals or plan for certainty with the availability of capital? Perhaps so, which would mean that co-investment relationships with large institutional LPs will still have their time and place. The other question is how the effect of more capital flowing to private equity firms will impact both their deal size and deal activity. Professionals in the PitchBook article believe that the increase in capital inflows from evergreen funds will enable GPs to write larger checks. Will private equity firms then write larger checks into a similar number of deals but just increase their size? Will GPs invest in more deals? Either way, this trend could have an impact on entry price, valuation, and exit multiples, all of which bear watching.

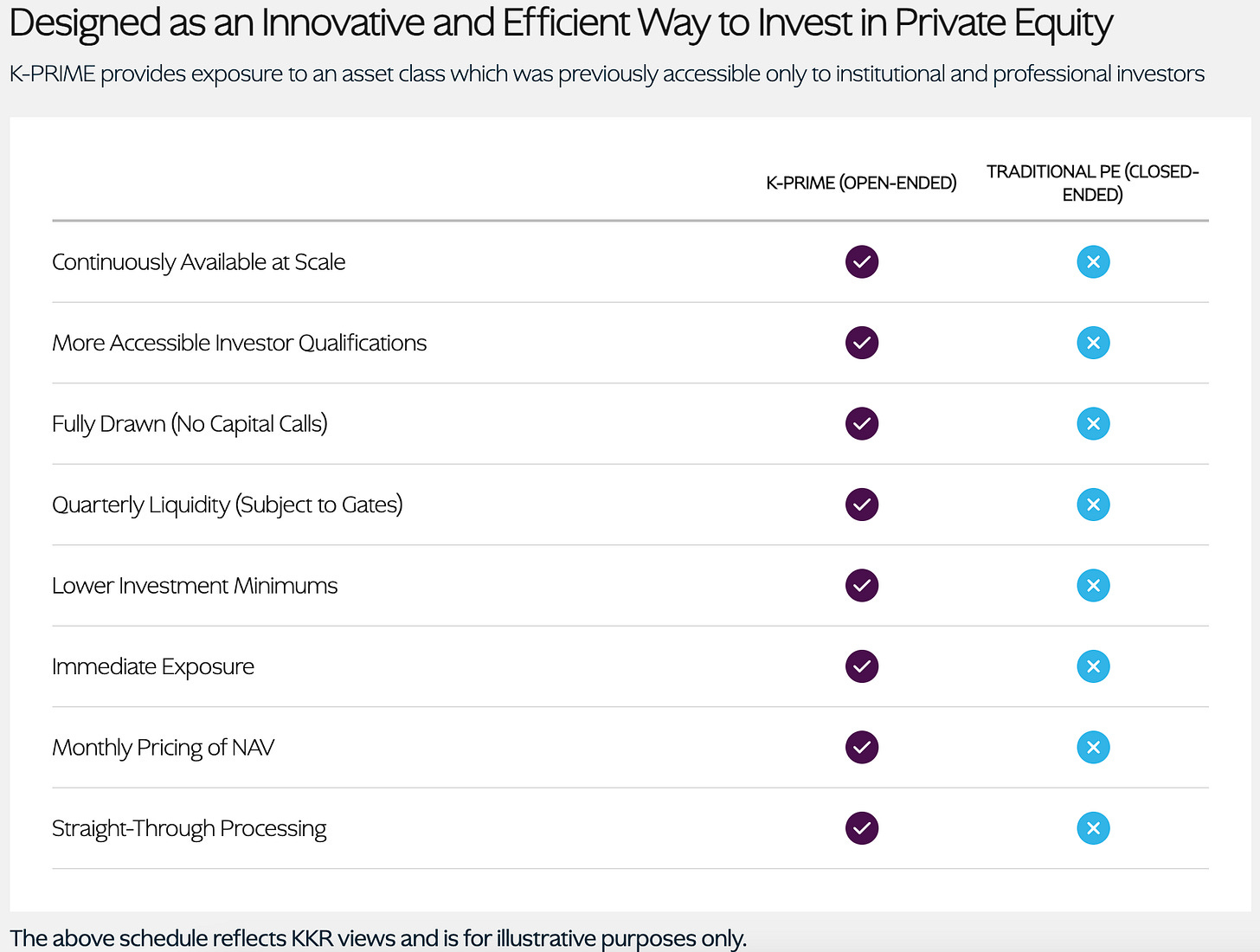

📝 KKR sees ‘trillions’ of retail investor dollars moving to alts | Bruce Kelly, InvestmentNews

💡InvestmentNews’ Bruce Kelly reports that KKR is raising close to $500M per month from the wealth channel as they have launched a number of new fund structures to serve this investor cohort. Industry insiders characterize these initial results as a success. “Those are good numbers,” said a senior industry executive who spoke privately to InvestmentNews. “The analysts covering KKR are focused on retail sales because that’s often permanent capital.” Last year, KKR launched a series of funds built specifically for the wealth channel, marketing it as the K-Series. KKR’s Private Markets Equity Fund, or K-Prime, has received significant uptake from the wealth channel. KKR appears to be encouraged by the initial traction. “We’re in the early days, but we feel really good about the progress” regarding sales to mass affluent investors, or those with at least $500,000 to $1 million in assets, Craig Larson, Partner and Head of Investor Relations at KKR, said during a conference call with analysts on Tuesday to discuss fourth-quarter earnings. “As we look at some of the underlying statistics, that’s particularly true as it relates to infrastructure and private equity, which are newer asset classes for more mass affluent investors. As we’ve mentioned historically, we’re raising about $500 million a month as we look at the K-Series suite.” KKR’s Larson sees the wealth channel can grow to trillions of AUM over time. “Mass affluent individual investors historically have not had an easy way to access these types of products and strategies,” Larson said. “And so over the coming years, if we’re correct and you start to see allocations go from the low single digits to the mid-single digits, that literally is trillions of dollars that have the potential to move to alternative products.

💸 AGM’s 2/20: Kelly’s article provides concrete evidence of Hamlin’s PitchBook article above on the increasing focus and investment that large alternative asset managers are making in the wealth channel. And the early returns appear promising. KKR is raising $500M per month from the wealth channel for their K-Series. A run rate of $6B in capital raised per year isn’t bad. For context, Ares, a firm with over $418B of AUM, raised $21.1B in Q4 of 2023 across investment strategies and raised $1.5B for their 7th corporate private equity fund. Yes, I know that this isn’t an entirely apples-to-apples comparison because the K-Series funds provide HNW investors with one-stop-shop access to a broad range of KKR investment strategies rather than a single investments strategy like buyout private equity, but I share these numbers to put in context the size and scale of the capital raised in these new fund structures. And it’s just getting started.

Another interesting thought arises from the creation of these evergreen funds. How will firms handle the “semi-liquid” component of the fund structures? KKR’s K-PRIME provides one such answer. They have an illiquid sleeve, which includes exposure to their various illiquid investment strategies. They also have what they call a “liquidity sleeve,” which includes a portion of the vehicle allocated to KKR Liquid Credit Strategies. What’s interesting about this is that a product structure like K-PRIME enables the firm to allocate some of the capital raised from this structure to be allocated to their other strategies. This feature should stand to benefit the multi-strategy firms like KKR and others who have more liquid products and strategies on their platform rather than the single-strategy firms who can’t include their own managed credit strategies in a product structure like this.

📝 First order of business for Franklin's new top gatekeeper: Private alts | Tania Mitra, Citywire

💡Citywire’s Tania Mitra reports on Franklin Templeton’s continued push in alts. She covers how Franklin Templeton Investments Solutions’ (FTIS) newest manager research head, Andrew Buck, is zeroing in on private markets. One of Buck’s top priorities is to figure out how to use alternatives. “It’s an area that we are really focused on and excited about,” Buck said. Franklin Templeton is heavily focused on two areas within private markets: private equity secondaries funds and private credit funds. Buck added that the risk and return profile of these asset classes makes them attractive, and given the team’s current macro views and present valuations in markets, they will be “allocating incremental capital [to them] in the near term.” These comments follow the successful fundraise for secondaries firm Lexington Partners, which closed on a record $22.7B of AUM a few months ago after being acquired by Franklin Templeton in 2021. Buck is focused on the “democratization of alts,” aiming to figure out how to expand the availability of alts for the wealth channel. His team has been investing time and effort to figure out how to bring private alts to more types of clients so that they can also access the growth and portfolio diversification benefits associated with these funds, and how they can be included in the broader range of portfolios managed by FTIS. As part of their exploration in private markets, Buck is exploring semi-liquid interval and tender offer funds as a way to provide clients with access to alternatives.

💸 AGM’s 2/20: Franklin Templeton has been innovative in both their focus on alts and their desire to invest in the space. Their acquisition of Lexington Partners offered a glimpse into just how important they view private markets to be core to their growth. Franklin Templeton CEO Jenny Johnson noted on the Alt Goes Mainstream podcast in November 2022 that the firm had 25% of its $1.5T AUM in alternative assets. That number should only stand to increase as they leverage both internal managers like Lexington, where their distribution of Lexington to the wealth channel ended up representing a meaningful portion of the $22.7B in capital raised, and external managers. Traditional asset managers like Franklin Templeton could have an advantage when it comes to navigating the alts space, in part because of their ability to assess both liquid and illiquid investment strategies. Jenny noted on the AGM podcast that “net of fees ins the most important question in the fee question debate.” Alternatives funds have tended to be more expensive from a fee perspective, so investors have had to think not only about which fund makes sense to allocate to from an investment perspective but also from a net of fee returns perspective. This question only becomes more protracted as more choice — and more hybrid alts products — come into the market, particularly tailored for the wealth channel. Investors will have to figure out where it makes sense to allocate to liquid products versus illiquid products — and firms like Franklin Templeton should be well-placed to discern that difference given that they have their feet in both the liquid and illiquid worlds.

📝 Blue Owl Lures Abu Dhabi’s Lunate for Wagers on Mid-Size Asset Managers | Sonali Basak and Gillian Tan, Bloomberg

💡Bloomberg’s Sonali Basak and Gillian Tan report that Blue Owl, one of the industry’s largest alternative asset managers and the market leader in GP stakes (via their GP Strategic Capital business unit), will partner with Lunate, an investment manager backed by Abu Dhabi sovereign wealth fund ADQ, to take minority stakes in mid-size asset managers. Blue Owl is the largest player in GP stakes, with $54.2B AUM in their GP Strategic Capital unit, with the majority of that capital going to managers in the upper end of the market. This partnership with Lunate will bring Blue Owl into the middle market. Lunate will reportedly contribute $500M to the fund, for which Blue Owl is seeking to raise $2.5B. The fund aims to back firms with less than $10B AUM of fee-paying assets under management. Blue Owl Co-President and Dyal Founder Michael Rees characterizes the joint venture as “complimentary to our existing strategy focused on larger manager.” Lunate offers experience as both an LP in alternatives manager as well as an existing investor in minority stakes. The $105B AUM firm previously collaborated with Blue Owl as a co-investor in CVC Capital Partners, where both firms worked together to take a minority stake in CVC. Blue Owl’s new venture will compete with firms like former Blackstone GSO Head Bennett Goodman’s Hunter Point Capital, Investcorp, Kudu, Bonaccord Capital, Azimut, RidgeLake Partners, newly launched Cantilever Group that is partnering with BTG Pactual, Armen (focused on European mid-market stakes), and others.

💸 AGM’s 2/20: With GP stakes market leader Blue Owl turning to the middle market stakes space, a new part of the market is heating up. This trend makes sense for a number of reasons. To date, the large cap portion of the market has seen over 35% of GPs with over $8B AUM sell stakes. There’s also significantly more capital that’s been raised ($34B+) competing for a smaller number of managers who would be sellers of stakes. Contrast that with the middle market, where Investcorp shared in a report (highlighted here in AGM’s Weekly on 11.5.23) that there’s $21 of supply in North American and Western European GPs that have yet to take investment from GP stake funds for every $1 of demand (mid-sized GP stake fund dry powder). With a large number of GPs who have yet to take stakes in the middle market and the ability for many of these firms to grow AUM, it makes sense that stakes firms are turning their focus to the middle market.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 73 Strings (Alternative asset management data / valuations) - Enterprise Account Executive - Private Credit. Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 bunch (Private markets infrastructure) - Product Manager. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Carlos Rodriguez Jr., Founder, President, and COO of Driftwood Capital, discuss how they built a $3B real estate hospitality investment platform. Listen here.

🎙 Hear Tyler Jayroe, MD and Portfolio Manager in J.P. Morgan Asset Management’s Private Equity Group, discuss how one of the world’s largest financial institutions approaches private equity. Listen here.

🎙 Hear Fred Destin, the founder of Stride VC, discuss how to build trust in a competitive, chaotic world. Listen here.

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the sixth episode of our monthly show, the Monthly Alts Pulse. We discuss what will make the industry move forward in 2024. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.