AGM Alts Weekly | 2.18.24

AGM Alts Weekly #39: Making private markets more public, every week.

👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London. This past week’s events at the LSE Alternative Investments Conference and the 2024 Private Markets Trends event with Schroders, Pangea, and Illuminate Financial centered around conversations of the evolution of the private markets industry — and how asset management businesses are reshaping themselves as they make sense of the ever-changing landscape of private markets.

Last week’s newsletter highlighted Apollo’s impressive growth in the broader context of CEO Marc Rowan’s comments about how the future of private markets could unfold.

In this week’s newsletter, I want to shine a spotlight on one of the biggest trends in private markets: the rise of perpetual fund structures. Not only are these fund structures changing the shape of firms’ fundraising, but they are changing the very core of these firms’ businesses.

Last week, Forbes’ Sergei Klebnikov and Matt Schifrin profiled the $80T opportunity globally that lies ahead for Blackstone and its peers. As Blackstone sets its sights on international wealth, having doubled its overseas headcount in the past five years, and as I walked through the pristine yet modern halls of 1 Soho Place this week, home to Apollo’s London office, this week, the irony is not lost on me that I write about alternative asset managers’ focus on the global wealth opportunity from London this weekend. The fertile grounds of Europe, as well as Asia and Latin America, are becoming race courses for firms staffing up their private wealth units to meet the growing demand of private wealth’s interest in alternatives.

Blackstone’s Steve Schwarzman understands the gravity of the opportunity. He highlighted just how big the gulf is between what the wealth channel has allocated to private markets on average and where many private banks would like to bring client exposures to:

“The distributors have, like, 2% in alternatives, and they want to get their customer base to 10% to 15%. So it’s another one of these explosive potential growth areas where we’re positioned as the number one firm in the world.”

How do firms like Blackstone and its peers plan to handle the demand from the wealth channel? With an increasingly popular fund structure: perpetuals, or evergreen funds.

To a more permanent place

Evergreen funds, which allow investors to enter and exit the fund on a periodic basis, have begun to transform the way in which the wealth channel accesses private markets.

It’s also changed the nature of how alternative asset managers are operating their businesses.

The below chart from a PitchBook article in Q3 2023 on perpetual capital is a bit outdated, but the visual should serve to prove the same point: the largest firms are raising an increasing percentage of their overall AUM in the form of perpetual fund structures.

A few weeks ago, I covered why this trend is occurring and why it means that the wealth channel is the new institutional LP.

The Forbes article is notable because it highlights two other areas where perpetual funds could have a perpetual impact on how alternative asset managers construct their businesses:

(1) How perpetuals have come to account for a large portion of Blackstone’s AUM and fee income: The Forbes article notes that perpetual funds now account for almost 40% of Blackstone’s $1T in AUM and an increasing lion’s share of their fee income. This figure is up from virtually nothing just a decade ago. And appears to be going only in one direction. Forbes notes that AUM from the wealth channel is growing at a 30% compound annual growth rate.

One of the key features of these fund structures is that they enable for both a continuous capital raising process and no end life to the fund, enabling firms like Blackstone to (1) raise more dollars in a given period than they might be able to with a traditional closed-end structure and (2) generate fees continuously rather than over a defined timeframe as they would with a closed-end vehicle.

Blackstone’s Head of Global Private Wealth Joan Solotar highlighted the importance of their structure from a capital raising perspective:

“We went from distributing our drawdown funds to now having a full suite of open-ended funds. They allow you to be out in the market every day, as opposed to episodically every few years.”

The other feature that these structures provide is more predictability of revenue and a shift of an increasing portion of the firm’s revenues to steady, fee-based revenues as opposed to the more difficult to calculate and unpredictable carried interest revenue, which should only serve to help public markets investors value alternative asset managers as businesses. As these firms continue to move into the limelight, the larger they become should have a positive impact on their ability to raise capital from the wealth channel and individual investors, who may look to brand as a sign of stability.

From PitchBook’s 2023 article on perpetuals, a few numbers stood out: Blue Owl reported 93% of its management fees in Q2 came from perpetual vehicles. During the same quarter, Blackstone registered roughly $328 billion in perpetual capital that generates fees, which accounted for 45% of its total fee-earning AUM.

(2) How evergreen structures can not only help alternative asset managers raise money, but also help them win deals: The Forbes article highlights how perpetual funds are enabling Blackstone to win deals, particularly with family-owned businesses.

Perpetual funds enable Blackstone (and peer firms) to sell the ability that they can hold investments for the long term, beyond the life of a closed-end fund.

Blackstone President Jon Gray highlighted how their perpetual vehicle structure has helped them partner with family-owned businesses:

“We partnered with the family that owned Carrix, the largest port operator in the U.S and Mexico. And with the Benetton family on the privatization of Mundys [formerly Atlantia], which is the largest transportation infrastructure company in the world with a bunch of roadways in Spain and France, and the Rome and Nice airports,” Gray says, referring to deals in Blackstone’s $40 billion infrastructure group. “These families love the idea of partnering with a perpetual vehicle. Because if we tell them we’re gonna buy it and in three years we gotta sell, they’re like, ‘I don’t want that.’ ”

Gray’s quote gets to the core of one of the most important features of perpetual funds: it’s changing the very operating model of alternative asset managers. These new fund structures are enabling firms to change the way they do business — with both of their customers — founders and LPs.

Evergreen thinking: from the trees to the forest

This post is meant to serve as a way to connect the dots between the different trends occurring in private markets. Borrowing from thoughts and themes I’ve written in recent weeks, we can follow a thread that runs through the how and why private markets have evolved this way.

(1) Buckets and Spectrums: Investors, particularly those in the wealth channel, have begun to rethink their model for portfolio construction. No longer do we live in the 60/40 world. The industry has moved beyond small slices of a pie to buckets and spectrums.

From the AGM Weekly on 1.14.24:

Are we moving towards a world where allocators live in buckets and spectrums rather than slices of a pie? What I mean by this is that allocators will look at their equity bucket across the spectrum of public equity and private equity and allocate accordingly, rather than think about their private equity exposure as a different piece of the pie than equities. Same with credit. This sentiment echoes what a number of others in private markets, including Apollo’s Chief Client & Product Development Officer Stephanie Drescher and iCapital’s Chairman & CEO Lawrence Calcano have said.

Investors have a different mindset about portfolio construction. Investors will allocate to both liquid and illiquid equities. They will do the same with credit. The defining question will be how much illiquidity can — and should — an investor tolerate?

Apollo’s Marc Rowan echoed a similar sentiment in Apollo’s earnings call last week.

From the AGM Weekly on 2.11.24:

Private, at least in the old days, was risky. Private equity, venture capital and hedge funds dominated the private bucket. On the other hand, public was perceived as safe. Stocks and bonds, 60/40 portfolio. I believe we're moving to a world where public is both safe and risky, and private is safe and risky; and the difference is only a matter of liquidity [author emphasis].

(2) Behavior change drives product innovation: Changing investor behavior is creating a wave of new product innovation. As investors’ views on portfolio construction have evolved, so too have both the types of investors alternative asset managers have looked to partner with and the types of vehicles alternative asset managers have looked to structure. A move to an investor base (read: wealth channel) that requires and desires lower investment minimums, reduced friction with operational and reporting features, and increased optionality for diversification and liquidity has led to a rise in new product structures.

Back in August 2022, I listened to a podcast with Hamilton Lane’s Mario Giannini, who made an eye-opening prediction.

From an AGM blog post in August 2022, “From 60/40 to 50/50”:

Mario said something that caught my attention. He said that in 10-15 years investors’ portfolios will be comprised of 50% public markets and 50% private markets exposure. That’s quite a far cry from the 60/40 portfolio (100% public markets exposure) of recent times.

Private markets of late has been defined by product innovation — both in terms of technology innovation and product structuring. Both technology companies and alternative asset managers are building the rails and trains that are enabling significant capital inflows into private markets.

(3) “The future is evergreen”: Private markets may be forever changed by the rise of the evergreen fund structure. iCapital’s Nick Veronis and Hamilton Lane’s Stephanie Davis wrote a fantastic piece that provided a window into why we should not overlook the forest for the trees. Not only do these product structures appear to be opening up the floodgates for the wealth channel to continuously and actively allocate to private markets, but it also appears that evergreen funds are also changing the way institutional investors think about allocating to private markets.

From the AGM Weekly on 1.14.24:

It appears that these new product structures are changing the mindset of allocators. iCapital’s Veronis and Hamilton Lane’s Davis note in their article that some of these evergreen fund structures are attracting the interest of institutional investors because of their product structure. Apparently, it’s the very features that traditional closed-end funds lack that are drawing institutional investors to the product. The ability to have instant exposure to seasoned portfolios of private investments with compounding returns and all the capital invested upfront (rather than over a capital call structure that draws down capital over a few years) is appealing to institutions. As such, GPs have begun designing evergreen funds for institutional LPs.

Sure, inflows to different private markets strategies will ebb and flow, but let’s not miss the forest for the trees. The continuous, evergreen nature of these new funds — at lower fees and with invested dollars put to work immediately — represents a huge growth opportunity for private markets, and a growth opportunity that will make private markets look more like public markets in a number of ways.

(4) Technology will need to improve to take private markets to the next stage: For private markets to become more efficient, technology solutions will have to improve in order to meet the needs of both funds and investors. Two areas where innovation would create step-function change for private markets are holistic portfolio construction tools that make sense of where alternative investments fit into a wealth client’s portfolio and post-investment reporting and valuation tools.

From the AGM Weekly on 2.11.24:

How they are reported on: As product structures change (i.e., away from illiquid private partnerships to hybrid liquid products), so too will reporting structures. Firms will have to calculate investment performance, marks, and valuations on a more regular basis. That’s one reason why I’m a big believer in companies like 73 Strings, LemonEdge, Canoe, and others, that are enabling firms to more efficiently manage their post-investment valuation and reporting functions. 73 Strings, for example, enables alternative asset managers to more easily strike monthly NAVs, which is critical for evergreen or semi-liquid structures as firms like Blackstone launch fund structures like BXPE, BCRED, and BREIT.

Where do the dots lead now?

A few questions arise from the merging of these trends.

(1) It’s likely that alternative asset managers will become easier to value if they have more predictable revenue streams, in some senses driven by the growth of evergreen fund structures. That could be good for those who own the stock of these alternative asset managers who are able to raise meaningful AUM from new product structures.

As product structures change, which will impact the fee and carry relationship that the management companies of these alternative asset managers have with their funds, will compensation structures change? Will firms begin to compensate their investment professionals in a different way? Will they be compensated more on stock-based performance or investment performance of the funds via carry?

(2) How will more AUM and new product structures impact returns? The nature of evergreen product structures suggest that funds may be able to raise more capital more often. This means that they may have to deploy that capital into either more deals or bigger deals. How will this impact returns?

CalSTRS’ CIO Chris Ailman said this past week in the Financial Times that “when I started we assumed that private equity would generate as much as 500 basis points over publics, then we lowered it to 300 … I wonder if now it’s more realistic to assume that private equity will really only generate around 150 basis points over publics.” He then goes on to mention that he deems that the net return is “still worth it.”

Chris’ thoughts bring up a few interesting questions for the future of private markets:

(1) As more money flows into private markets, do private markets still represent a risk worth taking for the returns over public markets?

(2) Does private equity need to have much higher returns than public markets to represent a portion of investors’ asset allocation?

(3) Is there a tradeoff between scale and returns?

(4) Will private markets have more “beta-like” return qualities?

As private markets looks to the $80T opportunity in the wealth channel, being cognizant of both the forest and the trees will be critical as the space continues to evolve.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Family Offices Are Boosting Allocations to Alts in 2024, KKR Says | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher dives into a survey of 75 family office CIOs conducted by KKR to report that family offices are looking to increase allocations to alternative investments in 2024. Thrasher reports that KKR’s survey finds that 93% of the family offices surveyed responded that they are investing to create wealth for future generations. The 75 family office CIOs surveyed, who each oversee an average of $3B in assets, believe they have enough capital and patience to allocate to illiquid investments such as venture capital and private equity. These family offices expect 52% of their portfolios to be invested in alts, up 10% from 2022. Other asset classes will seemingly bear the brunt of investors’ interest in private markets. The family offices said they expect allocations to cash to shrink from 11% to 9%, equities to drop from 32% to 29%, and credit to drop from 15% to 10%. For its part, KKR believes that this network of family offices may even increase their allocations to alts beyond the figures in their responses. KKR said in the report, “we actually think the percentage could drift a few hundred basis points over the next few years as public equities and cash are reduced.” The responses of these family offices would suggest the prevailing sentiment amongst many in private markets: that 2024 will be a standout vintage year. “They understand the benefits the illiquidity premium plays in compounding capital in a tax efficient manner to build wealth for future generations,” said the report’s lead author, Henry McVey, the Head of Global Macro and Asset Allocation at KKR and the CIO of the firm’s $39B balance sheet. Family offices in the survey noted highest levels of interest in private credit, infrastructure, and private equity. Sophisticated family offices appear to be proactive in the current environment. “Now is an interesting time to play offense, given that many others need liquidity, and we don’t. We are particularly keen on going direct, for example, in sectors where we have owned businesses in the past. At the same time, we increasingly want to partner with GPs in areas where we may not have regional expertise or industry expertise to further build out our portfolio,” a CIO, who declined to be named, told KKR.

💸 AGM’s 2/20: The chatter has been that 2024 is expected to be a strong vintage year in private markets, particularly for private equity and venture capital, where valuations, for the most part, have found equilibrium at more reasonable levels. The results from KKR’s family office survey make it clear that family offices are expected to put their money where their mouth is. These survey results aren’t entirely surprising. Strong vintages in private equity and venture usually come after periods of exuberance. What is a bit more surprising is how much these family offices expect to allocate to private markets. 52% is quite a high figure for allocations to alternatives, even amongst other institutional investors. As the above graph shows, family office allocations to alts are meaningfully higher than those of pensions and foundations when they were surveyed just a year earlier. What’s interesting about this figure is that it’s a number that some industry experts and insiders believe will be the number that many investors will reach for their overall allocation to alternatives. Hamilton Lane’s Mario Giannini made the prescient prediction in a 2022 podcast that in 10-15 years, investors’ portfolios will be comprised of 50% public markets and 50% private markets exposure. These figures echo comments that Apollo’s Management Committee Member and Chief Client & Product Development Officer Stephanie Drescher and HighTower’s Head of Alternative Investments Robert Picard sharing their views that investors’ portfolios could move closer to 50% allocation to alts in the AGM 2024 predictions. Both Stephanie and Robert’s comments look particularly prescient.

Apollo’s Stephanie Drescher said:

We continue to believe that we are on a trajectory where alternatives in our definition could make up 50% of individuals’ portfolios in the next five years, driven by momentum in areas such as fixed income replacement, IG private credit, equity replacement, and real assets, not just higher-octane private equity and venture offerings that have historically been associated with alternatives.

HighTower’s Robert Picard said:

As we approach 2024, two numbers stand out: 5% and 50%. The average billionaire and university endowment have over 50% allocated to private markets, while the average individual investor has only 5% allocated. We anticipate this gap to narrow in 2024 and beyond. This is due to better risk adjusted returns for portfolios with higher allocations to alternative investments.

CalSTRS’ CIO Chris Ailman has echoed similar sentiments. He said on a 2023 Alt Goes Mainstream podcast that CalSTRS has 40% exposure to private markets and said just this week in the Financial Times that he thinks their 40% allocation to private markets is “at the right balance [between illiquids and liquids] … and have achieved the sweet spot of where you want to be.”

Perhaps this survey from KKR is one bit of evidence that the space is inching closer to the numbers that some experts believe we’ll see in the coming years.

📝 FY2023 Ivy Report Card: Volatility Laundering And The Hangover From Private Markets Investing | Markov Processes International

💡Alt Goes Mainstream wouldn’t be what it is without sharing the diversity of perspectives on private markets. With that in mind, it’s important to highlight data and skepticism as well. The research outfit Markov Processes International published a report that showed no love lost for private markets this past week, on Valentine’s Day, no less. The research team at Markov Process cut the data on Ivy League endowments’ 2023 performance to find that their poor performance relative to other allocators was in large part due to their meaningful allocations to venture capital. Markov found that Ivy and elite endowments did poorly in 2023 (+2.1% returns), particularly relative to the global 70/30 benchmark (+11.1%) and smaller, less resourced endowments (+9%) that invest in less private markets assets and funds than those endowments that employ the “Yale model.” 2023 marked the first year where PE and VC moved in opposite directions with returns — PE was marked at +6.1%, VC was marked at -10.2% — since 2003. One of the key points from Markov’s reports is that when endowments look to allocate to asset classes that can be longer-term drivers of performance, they are also adding on more risk. Over ten years, Ivy and elite endowments show a clear relationship between returns and risk-taking. Markov views this as levered versions of a global 70/30 portfolio. All schools exceeded the ten-year return of a global 70/30 (+6.8%), with the average Ivy returning +9.8%, but with significantly more risk. Markov finds that the average volatility in an elite endowment portfolio is almost 50% higher than the global 70/30. This finding leads Markov to suggest that “laundered risk” is still risk. In their view, elite endowments have a significantly riskier portfolio than a balanced portfolio invested in 70% stocks.

💸 AGM’s 2/20: Markov’s research on elite university endowment performance in 2023 serves as a good reminder that there’s not necessarily one right answer on asset allocation, particularly when it comes to private markets. The prevailing wisdom at many of the Ivy League endowments is that the “Yale model” is the way to approach asset allocation. In years where venture in particular performed well, it performed very well, likely driving meaningful returns for those allocated in size and to top funds. But in a very rough year for venture, which also coincided with a bumper year for equities, returns for LPs who allocated to venture at the expense of an underallocation to equities saw their performance suffer.

Markov’s report provides some useful takeaways and generates a number of questions:

(1) Equity risk, even in private markets, is still equity risk. And at times, as in 2023 and in 2003 with venture, that risk can be even more protracted to overall portfolio returns.

(2) Venture is volatile. Venture can be a volatile asset class, particularly in years where interest rates rise sharply and when public markets course correct from high multiples for tech companies. The manager selection and access challenges further complicate the ability to successfully allocate to venture. Furthermore, venture has become much bigger. The asset class probably needs to shrink and right size again for the asset class to realize returns at a level with less volatility.

(3) It’s worth asking the question how venture (and private equity) will perform in a period where rates are higher. Since the Financial Crisis in 2008, investors have enjoyed a period of low rates relative to prior years and more or less a bull market in equities. What happens in a more volatile, geopolitically unstable, and higher-rate world?

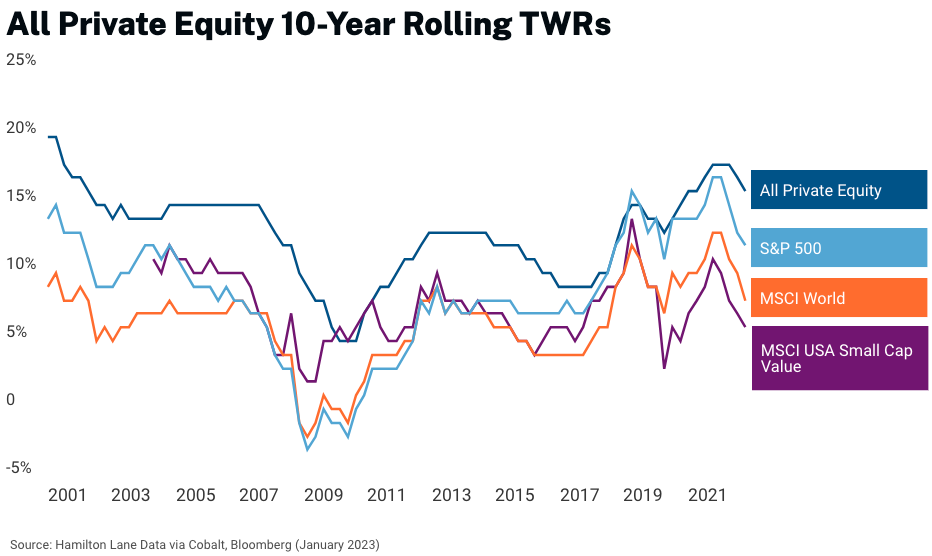

(4) Over the long term, private market performance has appeared to best public markets. Hamilton Lane’s 2023 report “The Truth Revealed: Private markets beat public markets — even after fees” illustrates that on every 10-year rolling basis since 2000 (with the exception of 2000), private markets have beaten public markets performance, even after fees. Hamilton Lane’s data includes all private commingled funds excluding fund-of-funds, and secondary fund-of-funds and yes, it appears to include venture too (“Private Equity – A broad term used to describe any fund that offers equity capital to private companies”). This data would suggest that private markets should be a major part of an investors’ asset allocation due to outperformance. Given the data from Markov’s report, perhaps it would be prudent to allocate more to private equity than venture due to the volatility in venture and more consistent returns in private equity.

(5) At the end of the day, I’m constantly reminded by a quote that Franklin Templeton’s CEO Jenny Johnson shared on an Alt Goes Mainstream podcast in 2022: what matters is returns net of fees. If returns net of fees are better with alternatives, then it’s the right alternative. If they are not, then allocators should look elsewhere.

📝 Coming to the Defense of Private Markets Valuations | White Horse Liquidity Partners

💡Now, diving into the White Horse Liquidity Partners analysis on private markets valuations, where the data they publish offers a volley back to Markov. White Horse Liquidity Partners sponsored a post in Institutional Investor to share their findings that private equity valuations (note: they make clear they are referring to buyout private equity, not venture capital or growth) are more rational and less volatile than public markets valuations. White Horse found that in the first three quarters of 2022, the S&P 500 declined by 25%. Meanwhile, private equity declined by only 5%, according to Burgiss.

White Horse analyzed nearly two decades of data covering 1,075 private equity exits across North America and Europe from 2005 to 2022. Their analysis found that the exit value of a private equity-owned company was, on average, 28% higher than the valuation two quarters prior. They view this as suggesting that private equity firms are in fact, undervaluing companies, not overvaluing them. We refer to this as the “valuation buffer.” Furthermore, they also find that even laggards generate a valuation pop (6%) at exit.

White Horse’s analysis offers up a few notable conclusions:

Private equity companies are generally held at a discount, not a premium, to their public market equivalents in normalized economic environments. They deem this to be the case based on evidence from a consistent “pop” at exit.

Private equity has a valuation buffer relative to public markets valuations. White Horse’s view is that only once the valuation buffer is fully eroded does private equity begin to decline in lockstep with public markets.

White Horse finds that private equity exhibits more relative stability than public markets when compared to the significant valuation swings in public markets.

Their view is that private equity has shown restraint in valuations relative to public markets.

💸 AGM’s 2/20: Detractors of private markets often point to the more irregular cadence of private markets valuations leading to a mirage of lower volatility. White Horse’s analysis would appear to counter the prevailing view that private market valuations are not much more than a “volatility laundering” opportunity. It’s important to note that White Horse’s analysis only includes buyout private equity, not venture capital or growth, where there could be more volatility in valuations. This would suggest that allocators should be very mindful of the type of private markets exposure they are inserting into a portfolio when they are adding private markets positions to their allocation. This data doesn’t mean investors shouldn’t include venture or growth in an allocation. It just means that allocators need to be mindful of how much venture and growth exposure they are adding to a portfolio at a given time. As the charts above from the Markov report illustrate, when venture does well, it does very well. But there’s also meaningful dispersion in performance, and when it suffers from poor performance, it has major volatility. All this to say, there’s no one right answer to asset allocation, but there is probably directionality in how allocators should navigate both their exposure to the various strategies within private markets.

📝 The Best-Performing Private Equity Funds Share These Two Attributes | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher explores the features of a group of private equity funds that have yielded “eyebrow-raising performance.” Thrasher analyzes a study by Mantra Investment Partners, a firm that tracks and invests in small private equity funds. In 2023, Mantra analyzed the historical IRR and MOIC across more than 5,000 deals, 500 funds, and 242 private equity firms. The analysis quantified what many in private markets have said anecdotally: private equity strategies that have less than $350M in assets and that focus on investing in esoteric industries or businesses meaningfully outperformed bigger funds. Data from 2011 to 2021 shows funds with a narrow investment focus delivered an average IRR of 38% and a MOIC of 2.3x net of fees. These numbers best broadly diversified funds of all sizes in North America over the same time period, which returned 18% IRR and 1.7x MOIC. Niche private equity firms even topped mainstream PE’s top quartile performers, as their 25% IRR and 1.9x MOIC far underperformed the mean of Mantra’s Niche Private Equity Index.

It appears that size really does matter. From 2017 to 2021, Mantra found that niche funds with less than $500M AUM had a 40% IRR, while funds with $500M-1B AUM had a 32% IRR, according to Mantra research and Preqin data. Herein lies the challenge for GPs and LPs. Strong performance often leads to more interest from LPs, often resulting in larger funds. GPs balancing business-building ambitions of larger funds with keeping funds small enough to generate outperformance is a constant tension.

💸 AGM’s 2/20: Mantra’s data reinforces the prevailing notion that smaller funds can outperform, particularly in venture and private equity. Therefore, it’s understandable that many LPs are trying to unearth and allocate to the cohort of smaller funds that they believe can outperform. There are some inherent challenges in sifting through the category of smaller funds. However, that looms large for LPs. One, it’s a challenge for many LPs to find smaller funds. LPs and GPs also face a conundrum once a smaller fund has performed well. A winner’s curse of sorts becomes a business-building question. Once a smaller fund performs well, they have earned the right to raise a larger fund. The data would suggest that a larger fund can lead to more muted investment performance, but from a business-building perspective it can make sense for GPs to grow their fund sizes to staff up and grow their AUM and revenues. I certainly don’t knock GPs that decide to grow their funds’ AUM over time. After all, asset management is a business. And a very good business model, I’d add. But as a LP, I also have a lot of respect for fund managers that decide to maintain size discipline. It certainly aligns their interests — maximum return generation — with those of the LPs. There’s no value judgement here, more of a recognition that as private markets evolves and asset managers evolve their own businesses over time, there will be the right LPs for the right investment products. That’s one reason why I believe investment strategies like GP stakes will become increasingly popular amongst investors because they can gain exposure to alternative asset managers as they grow their fund platforms with a different type of return stream and risk profile.

📝 Investors eye Europe’s untapped GP stakes | Andrew Woodman, PitchBook

💡PitchBook’s Andrew Woodman shines the spotlight on the GP stakes market in Europe, where appetite appears to be growing. Woodman reports that European-focused mid-market stakes fund Armen just announced a 32% ownership stake into deep-tech growth investor Jolt Capital, the second investment from Armen’s 2023 debut fund. Armen was formed by a group of former executives from French outfit Capza, becoming the first European-focused firm focused on GP stakes. “[Until now] there was no native European player to address the market gap of more than 800 European mid-market GPs,” said Deputy CEO and COO of Armen, Renaud Tourmente. Tourmente believes there “is a structural need for minority players to bring in cash, strategic and operational advice, expertise, and experience. GP stakes have become an increasingly popular investment strategy for both GPs and LPs alike as the alternative asset management industry has begun to increase in maturity and consolidation. PitchBook’s most recent US Public PE and GP Deal Roundup illustrated that the last peak in GP stakes deal activity was in 2021, where 136 deals worth a combined $14.1B were completed. After a slower two years, activity is expected to pick up this year. For his part, Tourmente believes the desire for GPs to build their businesses will persist. “Private equity and their managing partners are looking at ways to develop, ]so] they need backing. They’ve got two options: minority backing or majority backing.”

💸 AGM’s 2/20: It’s no surprise that GP stakes activity is on the rise, particularly in the mid-market. There’s plenty of supply relative to the quantum of capital raised with middle-market GP stakes strategies, even with the addition of Blue Owl’s new $2.5B fund focused on mid-market stakes. While the majority of stakes investing activity has occurred in the US, Armen’s launch illustrates that Europe represents ample opportunity as well. While the capital raising environment with both the institutional and wealth channels is different in Europe than in the US (i.e. more private bank dominated in Europe), increasing interest from the wealth channel in alternatives should serve to propel funds’ capital raising efforts in Europe. It’s interesting but also not surprising to see Armen take a stake in a deep-tech manager. Both the energy transition and hardtech require meaningful amounts of capital to solve — and represent areas where specialist managers should have an edge. These are also categories where significant participation of government capital should also reinforce the private capital sector’s participation in these industries, so it makes sense that funds in this area are both popular strategies amongst LPs and poised to take advantage of the opportunity from a returns perspective. Europe also appears poised for further consolidation in the alternative asset management industry. Just last week, French asset manager Amundi bought Zurich-based fund-of-funds manager €8.5B AUM Alpha Associates for $377M. This news follows news of CVC buying infrastructure manager DIF Capital Partners and Bridgepoint acquiring Energy Capital Partners. This consolidation trend should bode well for stakes players like Armen in the future.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Carlos Rodriguez Jr., Founder, President, and COO of Driftwood Capital, discuss how they built a $3B real estate hospitality investment platform. Listen here.

🎙 Hear Tyler Jayroe, MD and Portfolio Manager in J.P. Morgan Asset Management’s Private Equity Group, discuss how one of the world’s largest financial institutions approaches private equity. Listen here.

🎙 Hear Fred Destin, the founder of Stride VC, discuss how to build trust in a competitive, chaotic world. Listen here.

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the sixth episode of our monthly show, the Monthly Alts Pulse. We discuss what will make the industry move forward in 2024. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Always a lot to think about Michael!

Great write up as always! Keep it coming…