AGM Alts Weekly | 4.13.25: Brokerages going all in?

AGM Alts Weekly #98: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings and podcasts in NYC.

Brokerages going all in?

Last week, the topic was BlackRock going for blackjack.

This week, it’s brokerages beginning to go all in on private markets.

I’ll go easy on the casino analogies, particularly given everything going on in markets right now, but this week’s news of Charles Schwab announcing the rollout of its alternative investments platform to eligible retail investors is another big development for private markets and the adoption of private markets within the wealth channel.

In October 2024, I wrote about the prospective entry of brokerage and retail-oriented investment platforms as one of the next major milestones in private markets.

The firms that could completely change the dynamics of asset flows into private markets are the firms that are just beginning to dip their toes into the water. They represent trillions in AUM of self-directed assets.

Over the course of this year, Schwab and Fidelity have announced the buildouts of their private markets platforms. Vanguard already moved into the space a few years ago, partnering with HarbourVest to offer access to a HarbourVest fund to the HNW portion of their client base.

Charles Schwab has ~$9.41T AUM and ~36.5M active brokerage accounts (note: as of February 2025, Schwab had $10.28T in client assets and 36.9M active brokerage accounts).

Vanguard has ~$8.6T in managed assets and over ~50M active accounts.

Fidelity has ~$5.3T AUM and over ~50M active accounts.

They own the customer. They enable self-directed activity in brokerage accounts. They have conditioned independent investors to click to buy single stocks and ETFs.

Let’s unpack what Schwab’s announcement means for private markets.

Hundreds of billions of dollars at stake

Schwab telegraphed its desire to roll out private markets solutions to its clients in 2024.

A chart from the firm’s May 2024 Investor Day presentation listed alternative investments as one of the third-party products on offer to both individual investors and advisors in the Schwab network.

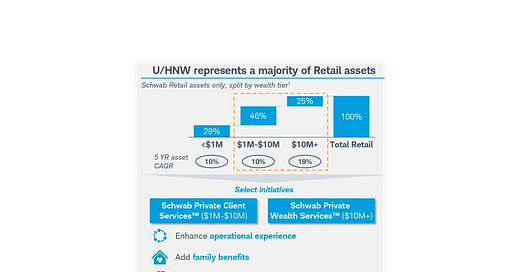

Diving deeper into Schwab’s Investor Day report reveals some noteworthy statistics on its Retail asset base.

In May 2024, 25% of Schwab’s Retail assets were held by investors in the $10M+ wealth tier. Another 46% of Retail assets resided in the $1-10M wealth tier. While not clear from the firm’s presentation how much of the 46% of the Retail assets in the $1-10M wealth tier are in the hands of Retail clients with $5M+ in assets, there’s a good chance that a meaningful portion of Schwab’s Retail assets are held by clients eligible for alternative investment offerings on its platform.

Schwab’s announcement this past week noted that the firm “serves more than a million multimillionaire investors, representing over $3T in assets at Schwab,” according to Jonathan Craig, Head of Investor Services.

That means a meaningful portion of Schwab’s assets are within the scope for its rollout of private markets products.

Schwab’s announcement this week also noted that a survey of its clients found that over half of them expect to have at least 5% of their portfolio allocated to private markets over the next three years.

Assuming 5% of the $3T in retail assets on Schwab’s platform shift into private markets, there’s at least $150B to play for on its platform.

What will be on offer on Schwab’s platform?

The announcement outlines a number of third-party alternative investment funds across the major asset classes in private markets, all of which will undergo due diligence reviews. The platform will be supported by iCapital’s technology, which will digitize and streamline the enrollment and investment experience for clients.

The offer includes a curated shelf of third-party alternative investment funds across select asset classes including private equity, hedge funds, private credit and private real estate. The funds undergo thorough ongoing due diligence reviews. As Schwab continues to expand the platform, the firm will add additional asset classes, including exchange funds, and broaden the menu of funds in each category.

It’s worth noting that Schwab also has had an alternative investments platform for advisors — OneSource and its Marketplace platform — as well as a history of custody of alternative investments on behalf of advisors to the tune of $58B.

Schwab’s announcement noted that over 37% of advisors who custody at Schwab leverage one of the firm's alternative investments platforms, including Schwab Alternative Investment OneSource, the fastest-growing platform among the firm’s RIA clients.

It appears that Schwab is meeting the demand of its clients, according to Head of Schwab Wealth & Advice Solutions Neesha Hathi.

“As our large and growing HNW and UHNW client base continues to turn to Schwab to meet a broad array of wealth, advice and investing needs, we are committed to continuing to expand our capabilities to serve their evolving needs and preferences,” said Neesha Hathi, Head of Schwab Wealth & Advice Solutions at Charles Schwab. “With the launch of Schwab Alternative Investments Select, we’re excited to now offer eligible retail clients access to a growing alternative investments platform, along with the specialized expertise, service and support we know they deeply value.”

Schwab’s Head of Investor Services Jonathan Craig also made a notable comment.

He said that the firm has a focus on “delivering low costs and great value, products and experience that make investing easy and accessible …”

I have not seen the products or fees on funds on Schwab’s Alternative Investments platform, but I can’t help but think that the words chosen by Craig were no accident:

“Delivering low costs and great value.”

Those words are quite notable — perhaps so much so that it signals a new era in private markets.

A new era?

I’ve discussed the downward flight of fees in private markets dating back to January 2024, driven by a few notable trends, including the rise of co-investments and strategic partnerships between alternative asset managers and large institutional investors like sovereigns, pensions, and insurance companies, and by the advent of evergreen funds, which in many cases have rendered 2/20 less commonplace.

I still believe fees will continue to remain high, certainly higher than public markets counterparts, for quite some time. Operational overhead associated with both paying investment talent and servicing more LPs means that fees will be required to continue to support investment and post-investment operations.

Apollo CEO Marc Rowan said as much in a November 2024 podcast episode with Norges Bank Investment Management CEO Nicolai Tangen.

Tangen asked Rowan what he thinks will happen to fees in the private equity industry.

Rowan said, “So fees have been remarkably stable over a very, very long period of time. And, I expect fees to be remarkably stable over a very, very long period of time.”

There’s a deeper layer to Rowan’s comments. Human capital is the more important asset that many of these investment managers possess. I’m constantly reminded of a quote by Evercore’s Glenn Schorr in the first episode of the Going Public podcast where Glenn discusses the importance of talent to an asset manager. Talent costs money, but if talent is what drives excess return for LPs, then it’s money well spent for both GP and LP.

Nevertheless, Jonathan Craig’s comments still struck a chord.

Expanding the alts superhighway of access

There are now many more ways for investors to access private markets.

Investors in the wealth channel can — depending on net worth — access private markets products directly on their own, assuming their investment size meets the fund’s minimum, or go through an intermediary, such as a private bank or an independent wealth management firm.

Schwab’s entrance into private markets unlocks investors’ self-directed ability to access private markets (provided they have $5M+ in household assets at Schwab).

Will Schwab be able to lower fees on private markets products so much so that investors will choose to be more self-directed in nature rather than advisor-led when it comes to private markets?

It will be interesting to see how investor behavior adapts to new offerings in private markets, such as Schwab’s rollout of private markets for individual Retail clients.

There are others that serve the individual investor client, such as Republic, which recently partnered with Hamilton Lane on a tokenized fund offering into HL’s Private Infrastructure Fund that enables individual investors to invest at $500 minimums.

Which brokerage firms could be next?

In addition to Schwab’s main competitors like Fidelity, perhaps newer entrants to the retail brokerage business, such as Robinhood, Public, or Revolut, make a push into private markets.

Robinhood CEO Vlad Tenev has mentioned recently the possibility of tokenized investments into private companies.

Public already dipped its toe into private markets, purchasing Otis, a platform that enabled fractionalized trading of “culture” alternative assets such as art, shoes, and sports cards, in 2022.

There’s also a push by capital markets infrastructure-as-a-service providers such as Apex, which in February 2025 announced that it will provide infrastructure to brokerage firms looking to embed private markets into its platforms.

Could more brokerage or retail-oriented investment firms and digital banks begin to embed private markets solutions and products into their platforms? Absolutely. SoFi has already done so — and I would expect to see other digital banks and consumer financial services apps do the same.

And, there are other firms solely focused on direct-to-consumer efforts in private markets already, such as Moonfare, Yieldstreet, and Arta. These firms have built out D2C offerings to serve the end individual investor directly where investors have the ability to pick specific products or choose multi-manager vehicles and managed portfolios, as Yieldstreet announced this past week.

A lot to play for

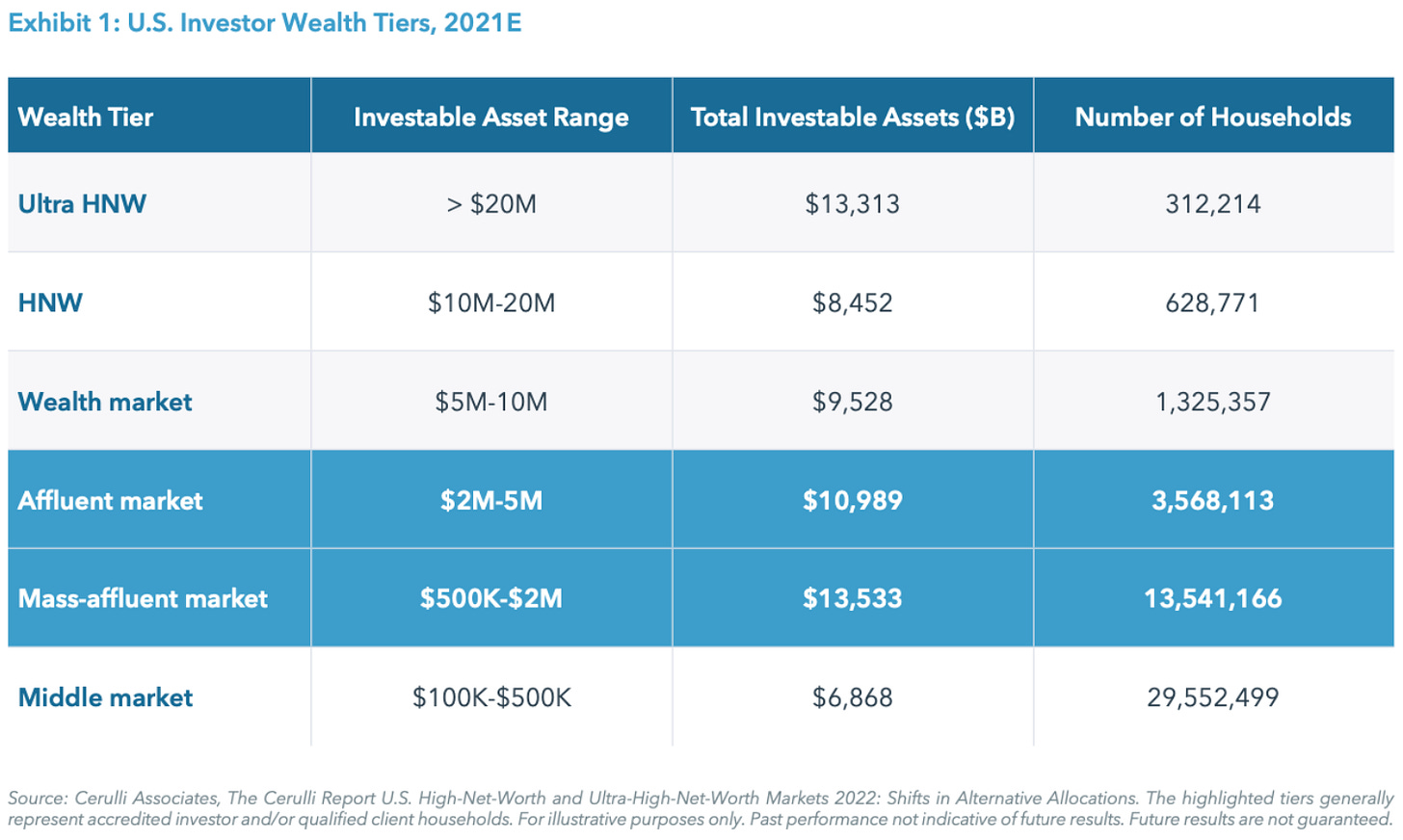

The affluent and mass-affluent market is one of the biggest opportunities for alternative asset managers but also one of the hardest to crack.

This market overlaps with the RIA / wealth channel. Some, if not many, in the affluent market ($2-5M in investable assets) and some in the mass-affluent market ($500K-2M in investable assets) will have advisors, and their investment decisions and asset allocation will be advisor-directed. Others, increasingly so, particularly younger cohorts, might look to their brokerage platforms or digital neo-brokers / neo-banks and others to gain access to private markets products.

The challenge for alternative asset managers is that they need to have the resources and scale to invest in product innovation and distribution. This channel will likely access private markets through evergreen and semi-liquid funds. Building, productizing, and distributing these products requires a serious lift of both distribution and marketing / branding efforts. Again, the benefits of scale mean that the largest funds will likely have the most success here, particularly those that are publicly traded, as they will have the brand that will resonate with the mass-affluent investor and the currency to invest in distribution resources.

There’s a lot to play for.

$24.5T across 17M US households, according to iCapital and Hamilton Lane, as they wrote in their white paper, The Future is Evergreen, last year.

Schwab’s move to offer access to the individual Retail client on its platform signals that private markets may have reached yet another frontier.

I still believe that the wirehouses will continue to provide the lion’s share of the assets.

The wires are plugged in — literally — as I wrote in the 3.3.24 AGM Alts Weekly.

Wirehouses will continue to provide the lion’s share of asset flows into alternative asset managers. Structural reasons persist. Alternatives are still very much sold rather than bought — and the structure that wirehouses have to diligence, onboard, approve, offer, and distribute private markets products through their advisor channels is much more uniform and structured than it is in many parts of the independent RIA channel. A September 2023 whitepaper and survey on advisor adoption of alternatives by Invesco, Cerulli Associates, and IWI highlight that the majority of branch network advisors are more likely to have access to an alternative investments portal (54% of advisors) than are independent advisors (21%).

It also shouldn’t be lost on advisors (and those selling to advisors) the power of a “recommended list.” Many advisors want to make fewer choices, not more, and also have to spend a large portion of their time focused on other activities that grow or maintain their business, like new client development, client service, and managing entire investment portfolios that span both public and private markets investments. Many independent advisor practices, particularly those that are smaller independent firms and even larger practices that may only have a few resources dedicated to manager research or private markets, aren’t equipped to handle the breadth and depth of the alternatives space across managers and strategies. Wirehouses and private banks certainly make it easier for advisors to find, evaluate, and allocate to alternatives products by providing a recommended list of curated products, education, research, and diligence support, and an investment portal. Sure, there are good arguments as to why an advisor would choose to go independent and why a client would want to work with an independent advisor, but in terms of alternatives distribution, wirehouses are plugged into all the right pieces of the alternatives puzzle to unlock flows into private markets products.

But it’s a very notable development that brokerage firms are enabling individuals’ self-directed access to private markets.

The market is undergoing two developments simultaneously:

One, a level of customization and differentiation at scale as the large independent wealth platforms (see this recent AGM podcast with Cerity Partners’ Tom Cohn and Amita Schultes for more) and insurance companies (as Lincoln Financial Group did with their recent partnership with Bain Capital and Partners Group) look to differentiate now that access to private markets is table stakes.

And two, unlocking access to a new set of clients — individual investors at scale — with recent developments like Schwab’s rollout of its alternative investments platform and Republic’s partnership with Hamilton Lane.

So, big questions still remain: What’s next? And how will investors access private markets?

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM Post of the Week

KKR’s Markus Egloff, MD and Head of KKR Global Wealth Solutions - International, posted on LinkedIn about KKR’s recent insight piece on “Staying on course in private equity,” written by his colleagues Alisa Wood, Matt Yates, and Bradlee Few.

AGM News of the Week

Articles we are reading

📝 CVC weighed deal for US private lender Golub Capital | Eric Platt, Harriet Agnew, Alexandra Heal, Robert Smith, Financial Times

💡Financial Times reports that publicly traded alternative asset manager CVC has explored acquiring $75B private credit firm Golub Capital. News of CVC’s overtures underscores the firm’s commitment to both expanding its credit franchise and deepening its footprint in the US. This report comes weeks after Bloomberg reported that CVC was in talks with $49B Fortress and its majority owner Mubadala about taking a control position in the firm.

Golub, founded by Lawrence Golub in 1994, has become one of the biggest players in the private credit space, carving out a reputation as a go-to direct lender. Golub was one of the early movers in direct lending, where private credit firms underwrite loans directly to mid-sized and large corporations, bypassing banks in the process.

Credit is a popular category for alternative and traditional asset managers to expand into — in part because of the industry dynamics that are driving borrowers to partner with direct lenders rather than banks and in part because credit is an area where asset managers can grow credit strategies in size and scale, particularly from the wealth channel and insurance companies. This perhaps explains recent moves by BlackRock to buy HPS Investment Partners for over $12B, TPG’s $3B acquisition of Angelo Gordon, Brookfield’s purchase of Oaktree, and Blue Owl’s purchase of Atalaya for up to $750M. Undoubtedly, moves in the private credit market have intensified focus on independent firms like Golub and Sixth Street.

The FT notes that firms like Golub and competitors, such as HPS, Ares, and Blue Owl, have been major beneficiaries of financial reform that has reined in banks in lending markets by restricting the types of loans they could underwrite.

Since 2004, Golub has originated over $150B in loans. CVC, which has a €45B private credit franchise, has been looking to gain an even stronger foothold in the US. CVC discussed merger talks with HPS before BlackRock decided to acquire the firm. And, more recently, CVC discussed buying the aforementioned Fortress.

Golub is no stranger to partnering with another firm to grow its business. In October 2024, Golub sold a minority stake to Mizuho. The Japanese bank took a stake of less than 5% of Golub in exchange for helping to distribute Golub’s investment products into the Japanese wealth channel.

💸 AGM’s 2/20: CVC’s focus on growing its private credit franchise by acquiring a blue chip private credit focused alternative asset manager with a major footprint in the US is emblematic of a few notable trends in private markets:

(1) Publicly traded firms know they need to continue to expand: CVC’s recent overtures with two of the industry’s largest privately owned alternative asset managers hammer home the point that publicly traded firms are on a growth path where consolidation is critical to ambitions of expansion. CVC knows that it needs to continue to grow its footprint in the US, particularly as a European firm with European DNA. In order to continue to compete with its publicly traded peers, it must grow AUM — and acquiring a major credit platform can help to achieve that goal. The credit marketplace is only becoming increasingly competitive, particularly after BlackRock acquired HPS and Blue Owl acquired Atalaya. Firms understand the need to position themselves in a way that continues to illustrate breadth and depth of a multi-strategy investment platform so that they can be solutions providers for private companies and LPs alike.

AGM’s Next Wave has highlighted a number of firms that could be in the crosshairs of larger alternative and traditional asset managers — if they don’t go public themselves.

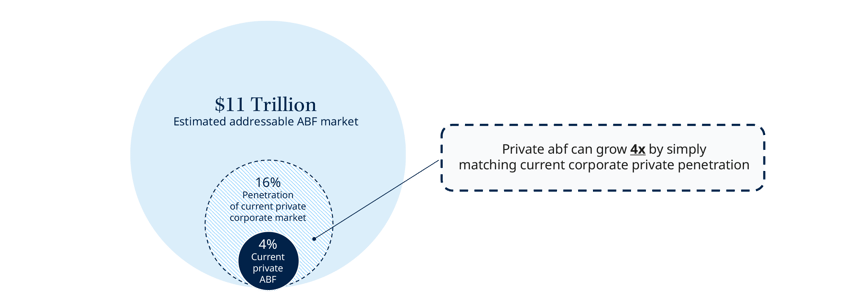

Credit has been the apple of acquirers’ eyes — and for good reason. It’s a rapidly growing market in a category where investors, particularly newer LPs to private markets such as the wealth channel and insurance companies, are looking to invest. Asset-based finance in particular, as Arcesium’s Cesar Estrada wrote this past week in an AGM Op-Ed, is the next big thing within private credit. Blue Owl’s President & CEO of Global Private Wealth Sean Connor and Blue Owl’s Head of Alternative Credit and Atalaya Founder and CIO Ivan Zinn also recently discussed why asset-based finance is private credit’s next chapter.

What categories could be next? Infrastructure, where there are major structural supply / demand imbalances between capital required to finance megatrends like decarbonization and digitalization / data centers, and secondaries, which could stand to benefit from market turbulence and denominator effect challenges of late. Both of these strategies, like credit, fit the bill for GPs looking to scale AUM. These respective strategies support large fund sizes, which is part of the business imperative for firms that are looking for sustained growth.

(2) The US is undoubtedly a major market for private credit. It’s no surprise that CVC is looking to firms like Golub and Fortress, both of which have US footprints and dedicated teams focused on the US wealth channel.

It’s also interesting — albeit understandable — that a European firm is looking to grow its private credit footprint in the US at a time when many US alternative asset managers are looking at Europe as a market of opportunity.

I’ve heard about a number of firms that are planning to expand efforts in European private credit due to the market structure in the region.

These views don’t surprise me. The proof is in the data.

Morgan Stanley’s recent white paper on the European private credit market highlights just how much the industry has grown in the region from 2013-2023. European private credit AUM has expanded over 5x during those ten years, from $93B to $505B.

Direct lending activity has experienced meaningful expansion in both the US and Europe, growing 48% since the Global Financial Crisis.

Return premiums over more liquid loans have been a major driver of interest in European private credit, where investors have been willing to trade illiquidity in exchange for higher returns.

A 2024 white paper by Goldman Sachs also highlights the less competitive landscape in European private credit. Goldman’s chart below illustrates that the region only has two funds over $10B in AUM as of July 2024.

But it only appears to be a matter of time before large alternative asset managers continue to move into the region. In fact, data suggests that the trendline shows that private credit is eating into the syndicated loan market in Europe, as the below chart from KKR illustrates.

Europe has structural imbalances in its bank market, in part due to regulations. That mean there’s more opportunity to eat into the credit market because European banks have further to retrench, as the below chart from May 2024 by European credit firm Hayfin shows.

European corporates are shifting away from public debt markets as well, in part due to fragmentation across regions and regulatory jurisdictions.

And Europe is currently a market that is dominated by a smaller number of players, with the top 5 private credit funds in Europe representing 32-37% of the market.

It also appears that the European private credit markets has some interesting deal dynamics that make it an attractive destination for funds looking for companies with higher margins and lower leverage per transaction.

Could Europe be the next big destination for private credit? It’s certainly possible. Arctos, a US-based firm, has read the tea leaves, recently taking a stake in Hayfin after helping the firm achieve a management buyout from British Columbia Investment Management Corporation. I expect other US firms to follow suit with an increased footprint in the European private credit market, either with boots on the ground or acquisition.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Investor Relations Professional. Click here to learn more.

🔍 KKR (Alternative asset manager) - Global Wealth Solutions - Investor Relations - Principal - Japan. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Credit Executive Office, Senior Associate / Associate. Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Head of Registered Alternative Products. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Hightower Advisors (Wealth management platform) - Merger & Acquisitions Associate. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e