AGM Alts Weekly | 1.12.25: Insurance, meet private credit

AGM Alts Weekly #85: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

LemonEdge is a leading fund, partnership, and portfolio accounting solution for private markets investment firms with backing from Blackstone Innovations Investments, amongst others. LemonEdge helps GPs, VCs, Family Offices and Fund Administrators transform their back-office operations, through making the complex, simple.

LemonEdge helps firms manage equity, real estate and infrastructure across closed-ended, open-ended and hybrid structures of any variety, with all management fee, waterfalls or other typical Excel based calculations all embedded in LemonEdge. Scale your operations with high efficiency and deliver exceptional LP / GP service.

Good morning from Washington, DC.

It might be a new year, but when it comes to insurance and alternative asset management partnerships, it’s looking a lot like a continuation of 2024.

This past week, Northwestern Mutual struck up a partnership with $100B AUM Sixth Street.

The strategic partnership will see Sixth Street initially managing $13B of assets for Northwestern Mutual as Sixth Street supports Northwestern Mutual’s long-term, diversified investment strategy for its $320B that is in its institutional investment portfolios. The $13B in capital will be invested across various strategies on Sixth Street’s platform, including asset-based finance and opportunistic investments in real estate and infrastructure debt and equity.

Northwestern Mutual will receive a minority equity stake in Sixth Street as part of the partnership.

The partnership looks like it will be mutually beneficial.

Sixth Street will have access to $13B in fresh capital, which is certainly a meaningful quantum in the context of the firm’s $100B in AUM and committed capital. They will also be working with a deep-pocketed LP in Northwestern Mutual that has the size, scale, and, likely, the appetite to commit more capital in the future.

Northwestern Mutual appears to be continuing to find ways to generate returns for its $321B general account. According to its 2023 Annual Investment Report on its General Account portfolio results, higher-risk assets contributed to 27% of net investment income despite being only 18% of the portfolio.

Northwestern Mutual (NWM) has managed to create a portfolio that comprised of more higher-risk assets than the industry average, but still generate strong returns while mitigating risk. They reportedly only had write-downs of 0.09% as a percentage of total managed assets.

While they managed to have a diversified portfolio, they constructed an asset allocation where 48% of their assets benefitted from the illiquidity premium. Private credit was a big reason for their increase in assets. In 2023, NWM see an increase of 10.8% in private bonds and preferred stock in their fixed-income investment category, which is not surprising given the focus on private credit by insurance company general accounts.

Insurance, meet private credit

Northwestern Mutual isn’t the only insurance company that has pursued a private credit partnership in recent months.

In August of last year, Guardian Life deepened its partnership with HPS Investment Partners in a big way. Guardian agreed to shift approximately $30B of assets to HPS, which spanned public high yield, investment grade private credit, and real estate debt and equity. Guardian also committed up to $5B in new investment grade investments in future years.

This enhancement of the partnership came two years after Guardian took a minority stake in HPS (when they were at $80B AUM), providing HPS with a meaningful amount of capital and reportedly working to co-develop bespoke investment strategies tailored for the insurance market. The partnership and minority stake seemed like it has proved to be a masterstroke after HPS was acquired by BlackRock for over $12B a few months ago.

HPS and Guardian were just two of a number of firms to create partnerships in recent years to enhance their footprint in private markets.

In December 2024, Metlife acquired $100B AUM Pinebridge Investments for up to $1.2B in cash and earnouts. The acquisition provides Metlife with a suite of products, particularly in private credit, that will enhance its investment management business. Pinebridge will add a collateralized loan obligation platform, a multi-asset business, a global suite of equity strategies, and direct lending and European real estate businesses to MIM’s platform.

In April 2024, Manulife acquired $13.5B AUM CQS to add an alternative credit strategy to its platform. And Prudential acquired Deerpath Capital in 2023, followed by Aflac acquiring a minority stake in Tree Line Capital Partners in May 2024.

Futureproofing the business

Why are insurance companies looking to buy or invest in private credit firms?

A few reasons.

One, it helps insurance companies invest in the right type of assets for their portfolios and their policyholders. Insurers need exposure to long-duration assets that are inflation resistant and have a low likelihood of default. Private credit, if allocated to the right fund managers, can fit the bill.

Two, many insurers have wealth management or broker-dealer businesses stapled onto their insurance platform. Take NWM as an example. They are a top five independent broker-dealer by revenue, making them amongst the fastest growing broker-dealers in the US. Client investment assets surpassed $281B in 2023.

Their sales and distribution capabilities are also formidable. $50B of sales by the firm’s retail investment business resulted in annual net cashflow of $22B.

Partnership with alternative asset managers means that insurance companies like NWM can co-create investment products for wealth clients, in addition to their general account, that can serve clients and generate revenues.

A third reason highlights the business imperative for insurers and is borne out of necessity more than choice. Reuters’ Jonathan Guilford penned an article in December 2024 diving into the marriage between insurance companies and private credit firms.

Low interest rates for years have hampered the US insurance industry’s net spread, making policies less attractive to customers. According to S&P Global, total US individual annuity premiums in 2020 were lower than in 2008.

The flagging net spread has forced insurers to look elsewhere to enhance their spreads and income generation.

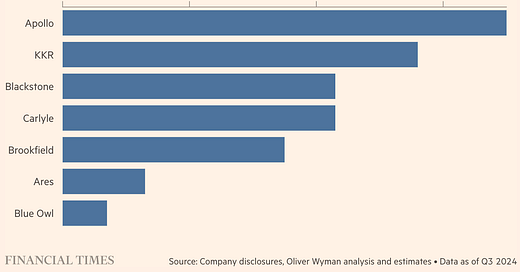

Apollo’s success with Athene has certainly opened eyes in the industry. Their net investment spread, which is over double the industry’s sub-1% average, enables Apollo’s Athene to offer more attractive annuities to customers. Other insurers don’t want to be left out in the cold. One remedy? Partnering with Apollo. Guilford notes that other insurers are paying Apollo to manage their investments. Apollo has reportedly booked $100B in business with third-party insurers.

The numbers appear to have become quite large.

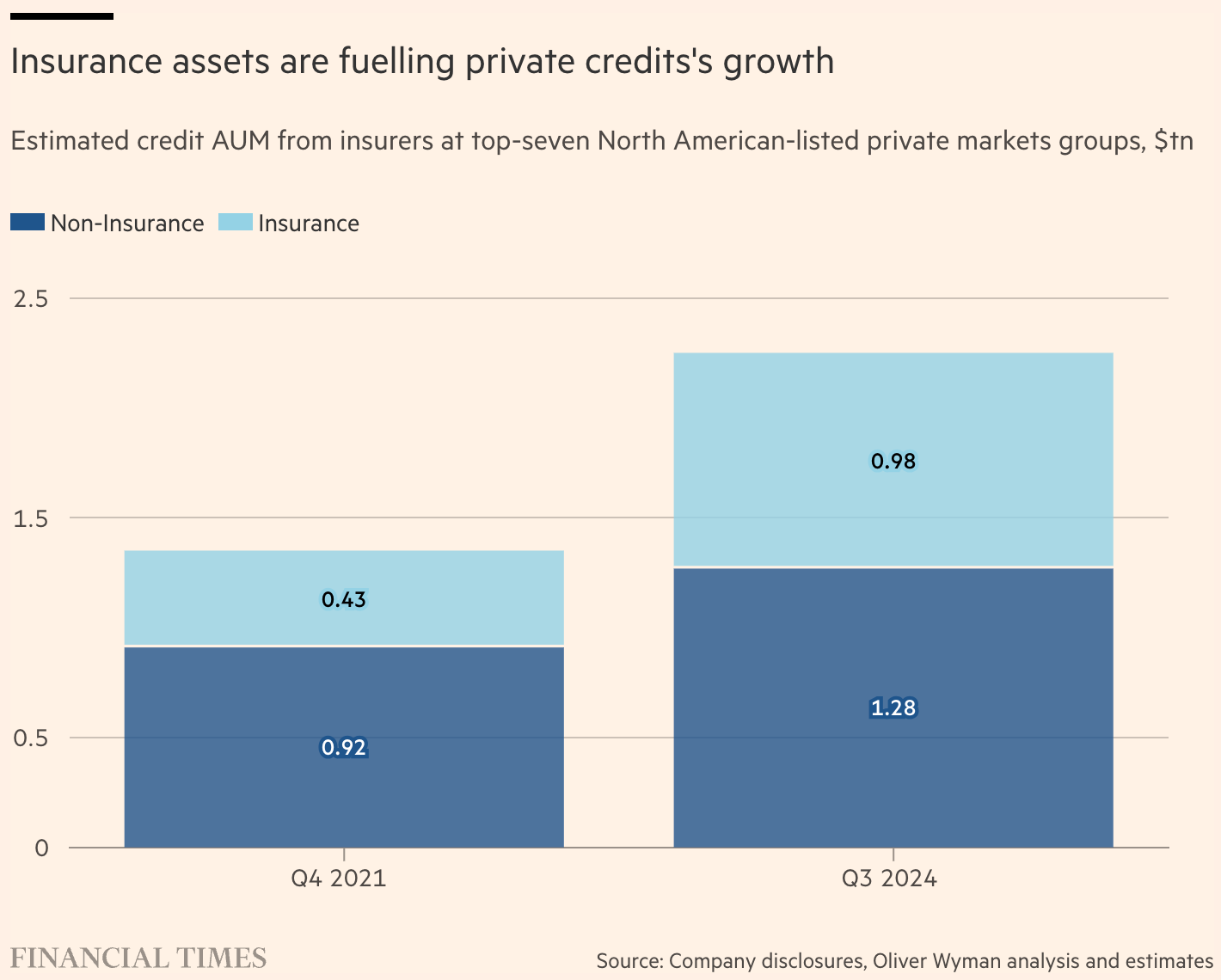

An article in the FT by Oliver Wyman’s Huw van Steenis notes that private credit assets funded by insurers at top-seven North American-listed private capital firms now account for 43% of credit assets held by these alternative asset managers. That’s up a staggering 11% since 2021.

Put another way, van Steenis writes, more than half of inflows in 2024 came from insurers.

That sure makes insurers integral to the growth of private markets. So much so, I would argue, that in addition to the wealth channel, insurance companies are the new institutional LP.

Ok, perhaps insurance companies aren’t “new” institutional LPs, but they are certainly more keen on allocating to private credit than in the past.

The data and surveys would certainly indicate that to be the case.

“No turning back”

KKR’s April 2024 survey of 50 insurance company CIOs yielded a telling answer about where insurance companies believe they need to invest in order to generate returns going forward.

64% of CIOs stated that they believe alternative investments will play a role in driving returns.

A Schroders’ survey paints a similar picture.

Their survey finds that 95% of insurance companies are now either invested or plan to invest into private markets within the next two years.

In addition to private credit being a popular strategy amongst the insurance CIO community, private equity, infrastructure debt, and bespoke solutions all appear to be on the menu for increased exposures.

When reading this data, perhaps it’s easy to make sense of why BlackRock paid over $24B for HPS (private credit) and GIP (infrastructure). Both strategies should fit quite well with what insurance companies appear to be interested in investing in.

BlackRock’s 2024 insurance survey, which collated the views of 410 senior insurance executives collectively responsible for $27T in assets under management, found a similar theme.

Many insurance executives are turning a focus to alternative investments, particularly private credit.

Equitable’s CIO Glen Gardner emphasized the importance of private credit in an insurance portfolio. He noted that they are “value capturing the illiquidity premium and investing in private assets to diversify our portfolio.”

“Enhance yield without increasing overall credit risk”

To that end, they are looking for opportunities that “enhance yield without increasing overall credit risk.”

Gardner’s answer puts private credit, particularly asset-backed finance and infrastructure debt, squarely in the crosshairs of insurers’ asset allocation strategies.

So perhaps unsurprisingly, many insurers appear to be focused on increasing their allocations to special situations / opportunistic credit investments.

This market trend seems to align quite well with the financing needs of many companies and mega-trends. Areas like infrastructure debt and commercial real estate debt appear to be in focus as decarbonization, digitalization, and data centers take center stage.

Some of these categories, like data centers, are already financed in large part by non-bank actors, as the chart below from Oliver Wyman illustrates.

But it appears that the market still has plenty of room to run for non-bank actors to subsume specialty finance assets.

One way that will make it easier for alternative asset managers to take up more market share? Access to capital.

That’s where insurers come in. Their interest and desire to allocate to private markets, particularly private credit, should feature going forward.

And it looks like it will bode well for the future of alternative asset managers and their business models if that’s the case.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

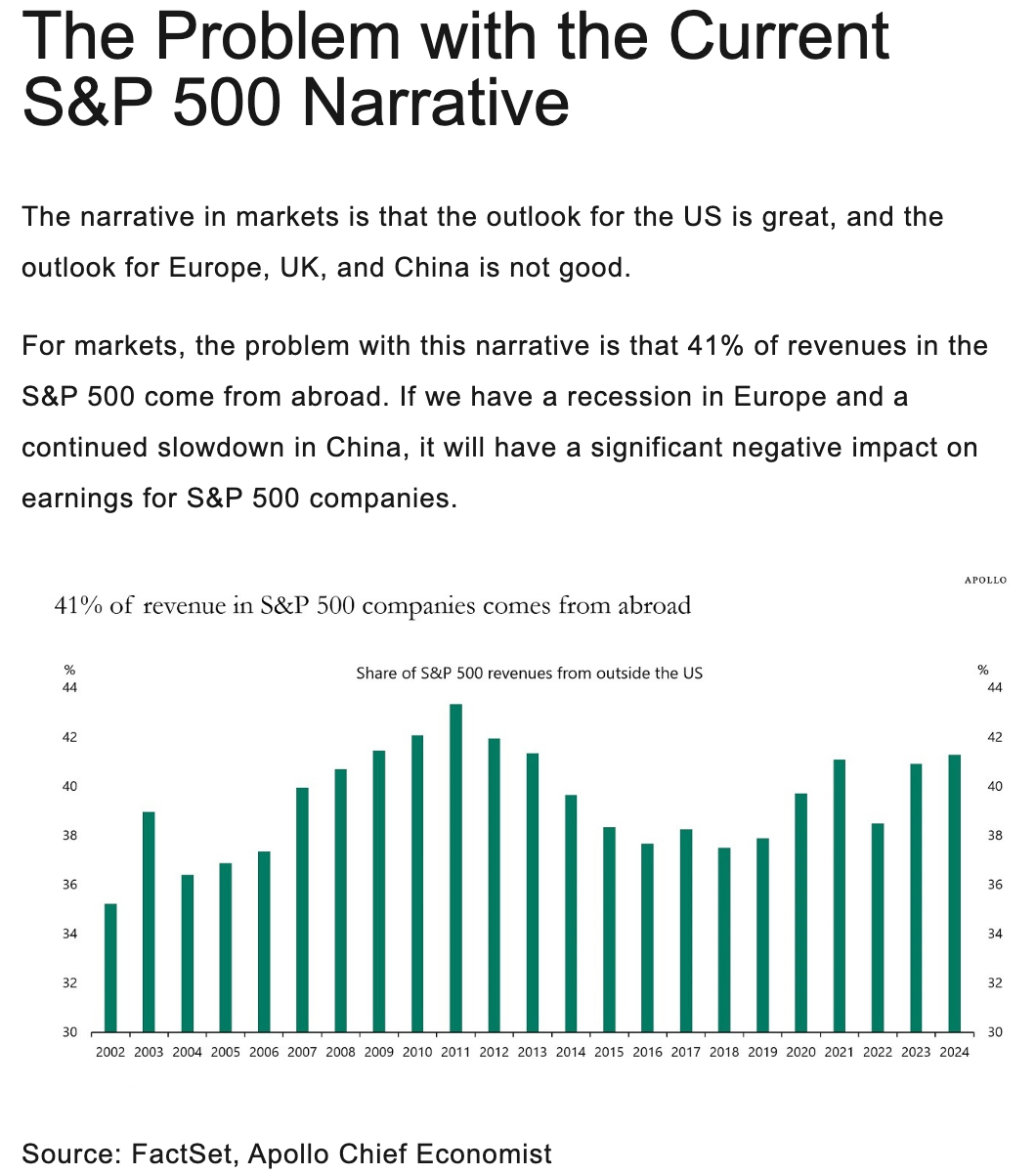

Apollo Chief Economist Dr. Torsten Slok made an interesting point in his Daily Spark email today. He notes that a good portion of revenues (41%) of revenues in the S&P 500 come from abroad. So turbulent economic times abroad could spell trouble for S&P 500 companies.

AGM News of the Week

Articles we are reading

📝 PE takes pick-and-shovel approach in AI gold rush | Madeline Shi, PitchBook

💡PitchBook’s Madeline Shi reports that private equity is getting in on the AI gold rush by focusing on the picks and shovels: data centers. Shi highlights the $20B pledge of an Emirati billionaire to build data centers in the US as an example of the increased demand for data centers. Data center demand, driven by the growth in AI and the need to finance cloud-based services, has driven infrastructure dealmaking. LPs, such as insurers, which are highlighted above, see data center projects as a relatively safe way to play the AI trend, according to Shi. Data center infrastructure development projects provide investors with cash flow from high-quality tenants like big tech companies. Unsurprisingly, digital infrastructure GPs completed a record-breaking $108.1B in deals for data centers. This figure is over three times the capital deployed last year.

DigitalBridge’s Global Head of Data Center Strategy Jon Mauck said, “in some ways, it’s like selling shovels to people looking for gold.”

Builders and operators of data centers are often able to command premium rents and secure long-term leases as a result of the insatiable demand for data centers.

The deal sizes are not small. Many data center deals are $1B or greater in size. It’s no surprise that many of the industry’s largest firms — Blackstone, Partners Group, KKR, Ardian, Pantheon, DigitalBridge and institutional investors like Canada Pension Plan Investment Board are the capital behind these projects.

Data center projects require alarge capital outlay up front. But the payoff can be worth it for investors. There’s such demand for data centers that developers are often able to secure pre-leases of new data center capacity with prospective tenants even before construction begins.

According to CBRE, nearly 80% of the 3,872 megawatts of new data center capacity that was under construction in the first half of 2024 was pre-leased, in many cases by cloud providers. Vacancy rate was a record low of 2.8%.

Investment returns appear to have a compelling profile, particularly for institutional investors and insurance companies that are looking for cashflows and cashflows backed by tenants with investment-grade credit ratings, like Microsoft, Amazon, Google, and Oracle. Average lease terms for data centers tend to range from five to 20 years, with hyperscalers often signing 10-15 year leases. These types of characteristics often result in high-single-digit to double-digit IRRs, making this an attractive investment opportunity for large LPs, who are either allocating to funds or becoming direct investors in the category.

💸 AGM’s 2/20: AI’s growth has created interesting adjacent investment opportunities. Data center investing is certainly one of them. The data tells a story. The rising demand for data centers, as the below chart from BlackRock’s “The New Infrastructure Blueprint” 2023 report highlights, will experience significant demand.

UK power company National Grid said as much. They predicted that the power demand of data centers in the UK will grow sixfold over the next ten years. All of this demand will require significant investment and capital expenditures. That makes infrastructure a compelling investment opportunity. Infrastructure investments often have long-term contracts with high-quality credits. In the case of data centers, it’s often with large hyperscalers that are investment-grade credits. These investments should generate cashflows that can serve as an inflation hedge and meet the needs of insurance companies and pension funds that need to solve for long-term liabilities.

So much of what’s happening in private markets is inextricably linked. Infrastructure investments and the increased participation of insurance companies in private markets is certainly one of them.

📝 Private equity targets Europe for big buyout deals | Alexandra Heal, Financial Times

💡Financial Times’ Alexandra Heal reports that private equity firms increased deal activity in Europe last year, capitalizing on lower valuations. According to a Financial Times analysis of Dealogic data, the total value of European buyout deals worth more than $1B increased by over twice the rate of the rest of the world. Over $133B of large deals were done in Europe last year, representing a 78% increase year-over-year. That figure far outstripped the increase in deal activity from the rest of the world’s 29% increase.

Big transactions included a $6.9B consortium agreement for investment management platform Hargreaves Lansdown, led by CVC, and a $5.5B deal by Thoma Bravo to take private cybersecurity company Darktrace.

Clifford Chance Partner Neil Barlow remarked that “certain more stable economies in Europe, such as the UK, the Nordics, and Germany [have become] a focal point for private capital providers.”

Take-private deals in Europe could, in part, be on the menu because European stock exchanges are dealing with an exodus of companies as European equities trade at significantly lower valuations than US -listed companies. The Stoxx Europe 600 now trades at a record discount to the US’s S&P 500.

Private equity firms see the opportunity in the European buyout market. Alexis Maskell of BC Partners said that the buyout market in Europe was “both fragmented and very diverse but … you can source market leading but relatively under-the-radar companies larger than $1B,” typically “at a discount to their peers in the US.”

💸 AGM’s 2/20: The current state of European private equity highlights a few important trends. The challenging backdrop of European public markets makes high-quality companies in Europe an interesting opportunity for take-private transactions. High-quality European private companies also look compelling due to lower valuations in Europe. All of this should lead to a flight to quality by European buyout shops. The data suggests that PE firms will focus on bigger deals. An October 2024 Reuters article highlights this rebounding trend.

While deals over $5B haven’t returned to 2021 and 2022 — or even 2019 levels — they have bounced back from 2023. There also appears to be a flight to quality. Insight Partners MD Henry Frankievich said in the Reuters article that “the current focus is on businesses with durable growth.” That should bode well for high-quality European companies that need both investment and time to grow. And then perhaps European equity markets will recover or we’ll see these companies look to list in the US or consummate another sponsor-to-sponsor transaction or continuation vehicle.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Product Marketing, VP, EMEA. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Vanguard (Asset manager) - Venture Investing - Senior Associate. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 BlackRock (Asset manager) - Vice President, Model Portfolios Business Development - EMEA. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Hightower Advisors (Wealth management platform) - Portfolio Management Solutions - Executive Director. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Sagard (Alternative asset manager) - Head of National Accounts, Private Wealth Solutions. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.