AGM Alts Weekly | 1.19.25: Make boring cool - maxims from Marks

AGM Alts Weekly #86: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

LemonEdge is a leading fund, partnership, and portfolio accounting solution for private markets investment firms with backing from Blackstone Innovations Investments, amongst others. LemonEdge helps GPs, VCs, Family Offices and Fund Administrators transform their back-office operations, through making the complex, simple.

LemonEdge helps firms manage equity, real estate and infrastructure across closed-ended, open-ended and hybrid structures of any variety, with all management fee, waterfalls or other typical Excel based calculations all embedded in LemonEdge. Scale your operations with high efficiency and deliver exceptional LP / GP service.

Good morning from Washington, DC.

Earlier this week, I recorded a fantastic podcast with Brookfield Oaktree Wealth Solutions CEO John Sweeney. In our wide-ranging conversation, John referenced “On Bubble Watch,” the most recent memo published by his colleague, Oaktree Co-Founder Howard Marks.

Amongst the many maxims he cited from Marks’ memo, one stood out:

Many of the industry’s best investors and storied firms that have consistently delivered for investors over decades and cycles have their own version of the concept that Howard lays out: purchase price matters.

A company or an asset can be high-quality. It can also be overpriced. Both of those things can be true.

Listening to John’s anecdotes and reading Howard’s memo were good reminders of how to approach investing at a time when some might consider certain aspects of the markets to be detached from reality.

Different views of an uncertain world

Investing in today’s world is certainly different than in years past.

Apollo CEO Marc Rowan laid that bare at the Norges Bank Investment Management Investment Conference last May, rattling off a few concerning trends in public markets: increased indexation and correlation, elevated multiples, and higher interest rates.

Howard Marks highlights a similar phenomenon in his recent memo, referencing research from Michael Cembalest, Chief Strategist at J.P. Morgan Asset Management. Cembalest’s research finds that the market capitalization of the seven largest components of the S&P 500, the “Magnificent Seven,” was 32-33% of the index’s total capitalization at the end of October, a figure roughly double the leaders’ share five years ago.

History doesn’t always repeat itself, but it often rhymes. If we are looking to history for answers, ominous signs appear for public equity markets.

The highest share of the top seven stocks in the last 28 years? 22%. What was the year? 2000, the height of the TMT bubble.

Marks and Cembalest aren’t the only ones calling into question forward-looking returns of U.S. equities over the next decade.

Marathon Asset Management CEO & Chairman Bruce Richard referenced Goldman’s updated forecast for U.S. equities in his recent LinkedIn post, noting that Goldman Sachs is projecting U.S. equities to deliver just 3% annual returns over the next decade.

Richards cites historically high S&P 500 P/E multiples and higher interest rates as culprits that will create a lower expected targeted return.

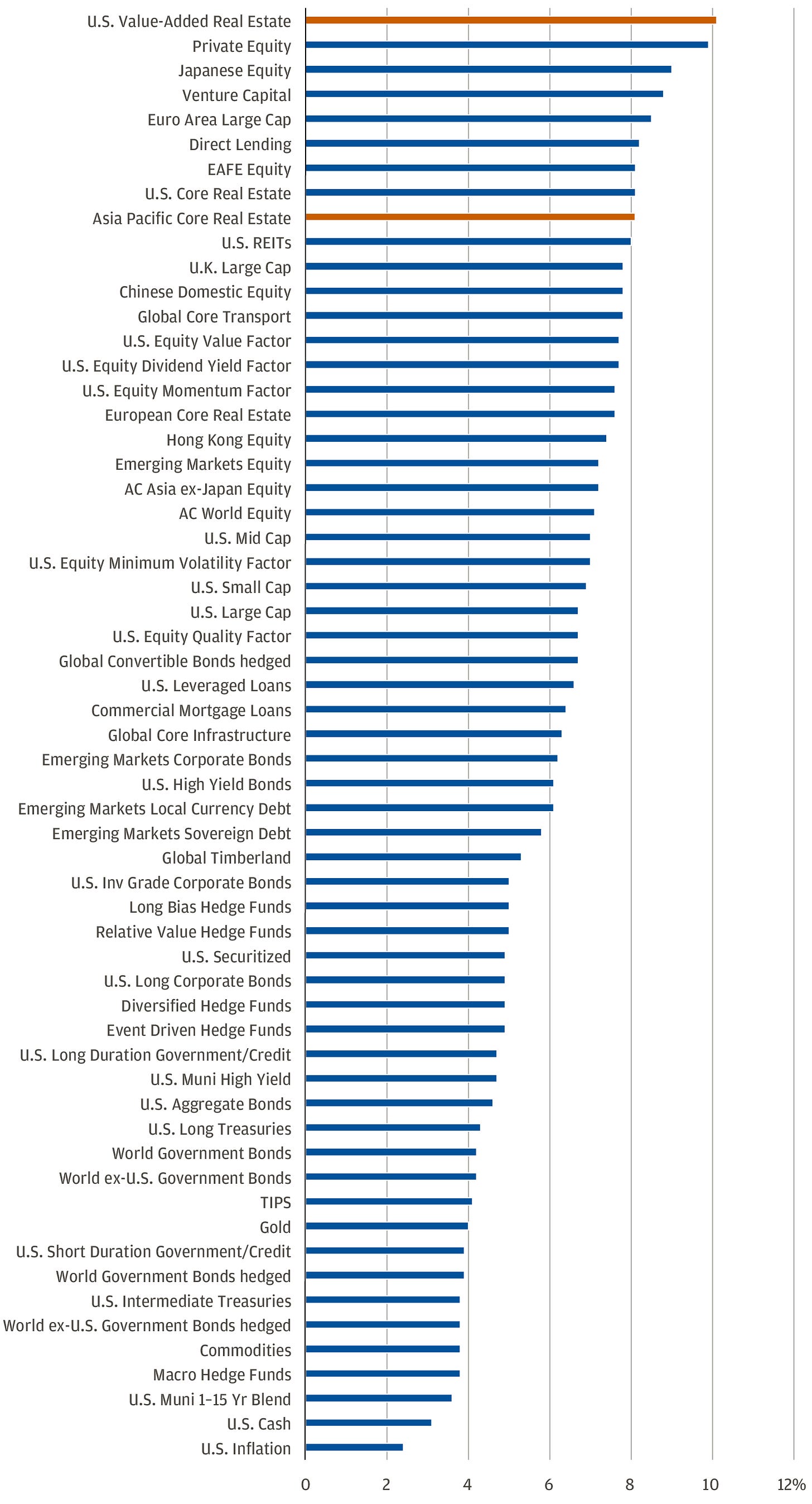

J.P. Morgan Private Bank’s Global Head of Alternative Investments, Strategy & Business Development Jay Serpe recently published a paper on their top five themes to watch in alternative investments. The bank’s projected annualized returns by asset class over the next 10- to 15-year time horizon paint an interesting picture.

U.S. Large Cap, Mid Cap, and Small Cap stocks are all expected to return in the 6-7.5% range annually. Notably, U.K. Large Cap equities sit higher up on the chart than U.S. Equities. I presume that has something to do with current prices and valuations of U.S. Equities relative to U.K. Large Caps.

Private markets strategies top the chart. J.P. Morgan projects U.S. Value-Added Real Estate to be the top performing strategy. Why? They cite the supply-demand imbalance as a major driver of return potential. According to J.P. Morgan, there’s an estimated shortage of two to three million homes in the U.S. This market dislocation is seemingly presenting a “structural opportunity” to generate returns.

Private equity, venture capital, and direct lending all reside in the top six in J.P. Morgan’s chart.

Private equity, particularly in the middle market, also seems to benefit from lower entry-level multiples.

As I wrote in the 8.11.24 AGM Alts Weekly “The middle is far from middling,” data suggests that middle-market funds can generate higher returns, in part because entry-price multiples are lower. A June 2024 paper by J.P. Morgan Private Equity Group MD Tyler Jayroe (and Alt Goes Mainstream podcast guest) highlights the stark difference in median purchase multiple between companies of different enterprise value.

This chart from the recent J.P. Morgan paper citing PitchBook data highlights just how far valuation multiples have dropped in the growth equity market since 2021.

It’s worth pondering how much of an aberration 2021 growth equity valuation multiples (valuation / sales) were relative to other years. Compared to 2021, 2024 entry-level multiples are down almost 50% from their 2021 peak. Now, perhaps 2021 levels are something that markets won’t see again for quite some time, if ever. So, are 2024 multiples not as cheap as they might seem if one removes 2021 multiples?

However, one feature appears to be correlated with the ability to drive returns: purchase price.

Identifying opportunities - balancing risk and reward

Blue Owl’s recently released 2025 Market Outlook highlighted a critically important feature for navigating today’s market on pg. 30 of their report: “The ability to identify and structure opportunities in niche markets has become a critical franchise differentiator in a challenging fundraising environment.”

Direct lending is one of those markets where the “ability to identify and structure opportunities” can generate returns on an attractive risk / reward basis.

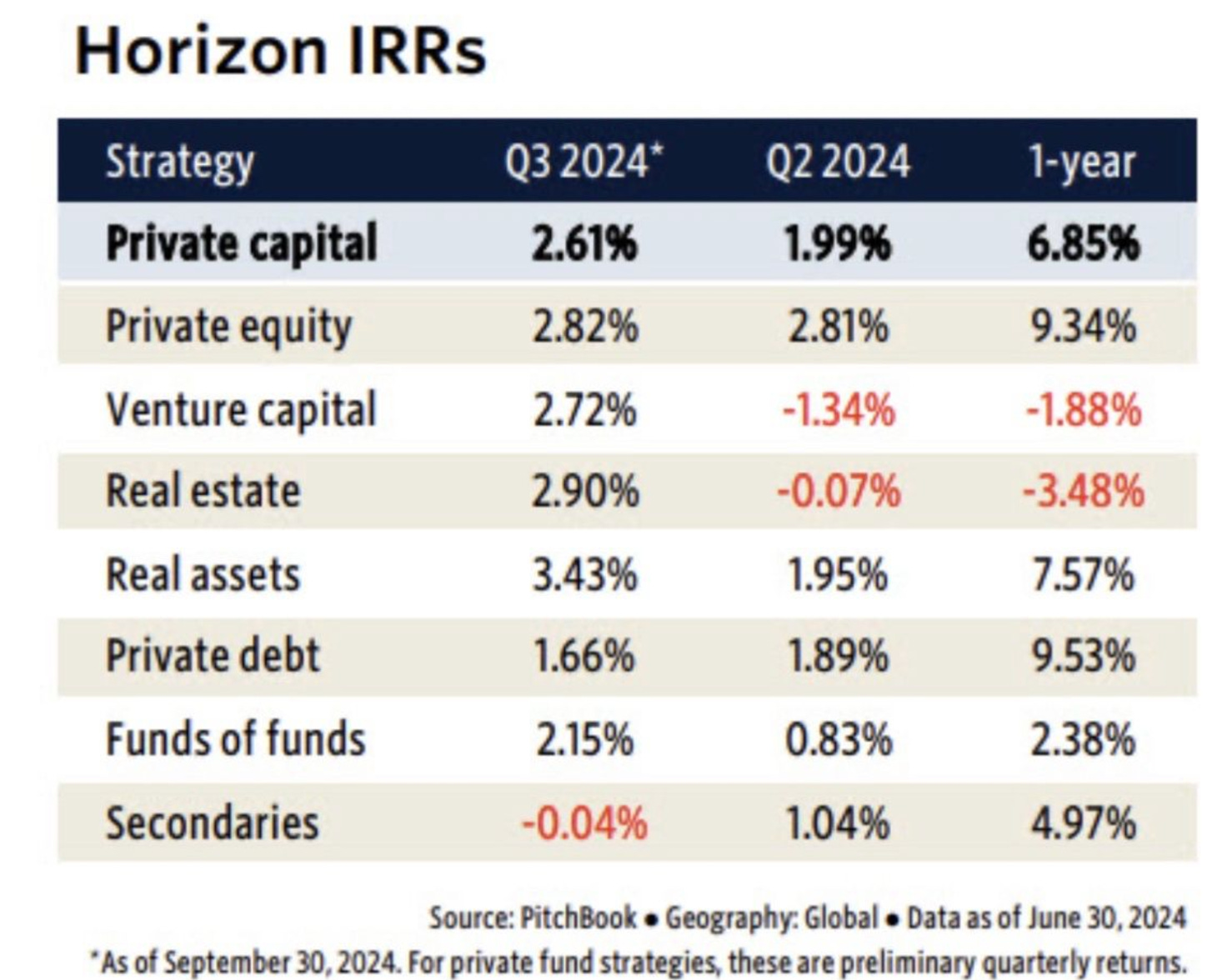

Marathon’s Bruce Richards points to a PitchBook chart highlighting returns of different asset classes over the past year. Into Q3 2024, private debt outperformed other strategies in private markets.

Investing is, in part, an exercise of determining opportunity cost. Investors can take more risk with the hope (expectation?) of generating a higher return. Or, they can take less risk with the idea of generating a lower return but with a higher degree of certainty. Discerning between risk and return is something that Howard Marks highlighted in a prior memo, “Ruminating on asset allocation.”

Balancing risk and return is an exercise that’s becoming more pertinent as investors increasingly have to choose between the opportunity costs of allocating capital to public versus private markets.

Blue Owl highlights the evolution in credit markets as an example of a category in which private markets represents an attractive risk / reward relative to public markets.

There’s a private credit yield premium versus the broadly syndicated loan (BSL) market, according to the below chart by Blue Owl. In private credit, Blue Owl has historically generated around 220 bps pricing spread above leveraged loans.

Why? Blue Owl believes that “scaled, pure play lenders with meaningful incumbency positions will be best positioned to benefit from an expected increase in M&A and therefore deal flow, allowing greater investment selectivity and, ultimately, better performance.”

Scale matters, particularly in a category like private credit.

Private credit is at the intersection of a number of converging trends.

High-quality companies in both public and private markets are looking to debt markets to finance their growth. By tapping into private credit markets, they can often deal with fewer counterparties than broadly syndicated loan transactions. In today’s market, there are private credit firms that have the size and scale to complete large deals on their own.

Private companies that are staying private longer certainly seem to see the appeal of private credit as a way to tap into financing markets. Take this past week’s news of Databricks raising $5B in debt financing from Blue Owl, Blackstone, and Apollo.

Fresh off a $10B fundraise that lifted their valuation to $62B, Databricks decided to tap the credit markets for additional financing that is tied to the company’s annualized recurring revenue.

Databricks is one of a number of examples where blue-chip private companies are tapping into private debt markets to raise capital. Private credit firms see this opportunity as a positive development for their lending strategies.

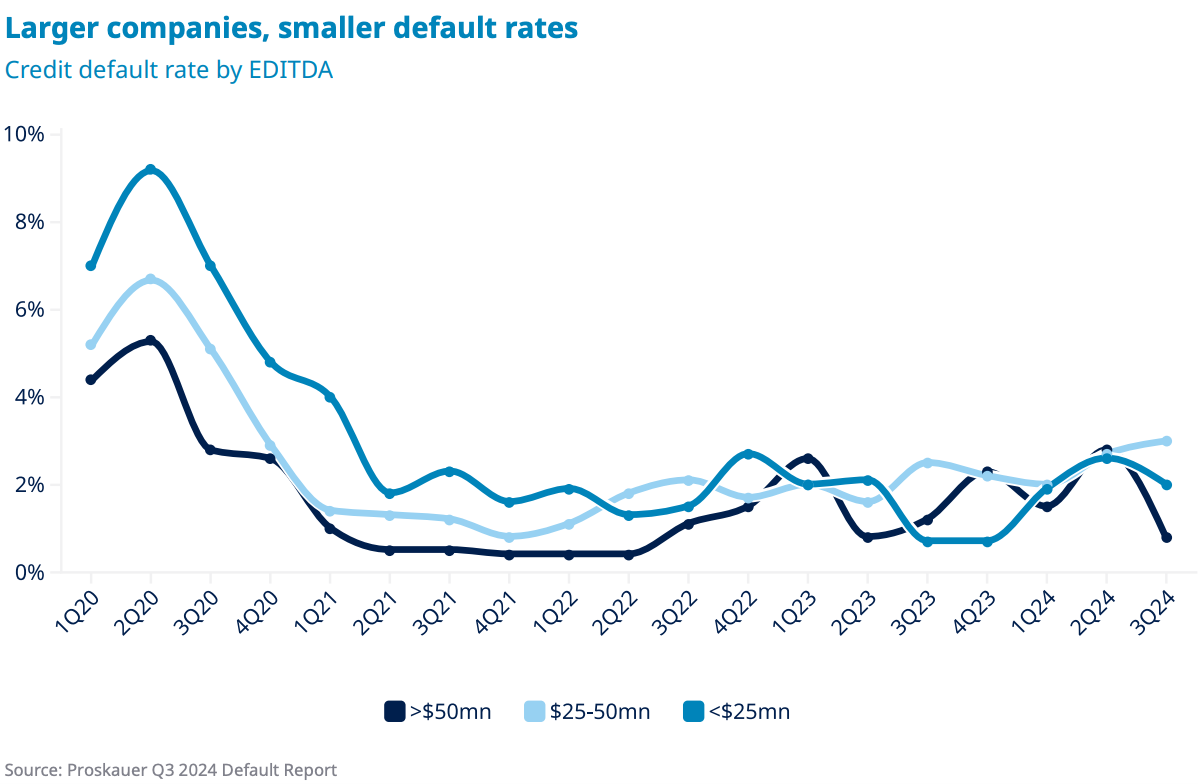

Blue Owl’s credit business is mainly focused on companies in the upper middle market ($100M+ EBITDA) in large part because bigger companies tend to “be more durable across the market cycle” and because the “upper middle market enjoys favorable competitive dynamics compared to the core and lower middle markets.” Blue Owl posits that the scarcity of firms able to transact in the upper middle market enables them to be disciplined on pricing and terms even though the borrowers are of higher quality than in the lower middle market.

The below chart from their 2025 Outlook supports this sentiment.

One of the attractive aspects of private credit is its ability to generate high single-digit to low double-digit IRRs on an annualized basis.

Compounding effects

Marathon’s Bruce Richards said this much in his LinkedIn post: “compounding double-digit IRRs over an extended period is huge.”

This observation is supported by research from other managers, like KKR, which shared it in their Q4 2024 Global Wealth Investment Playbook.

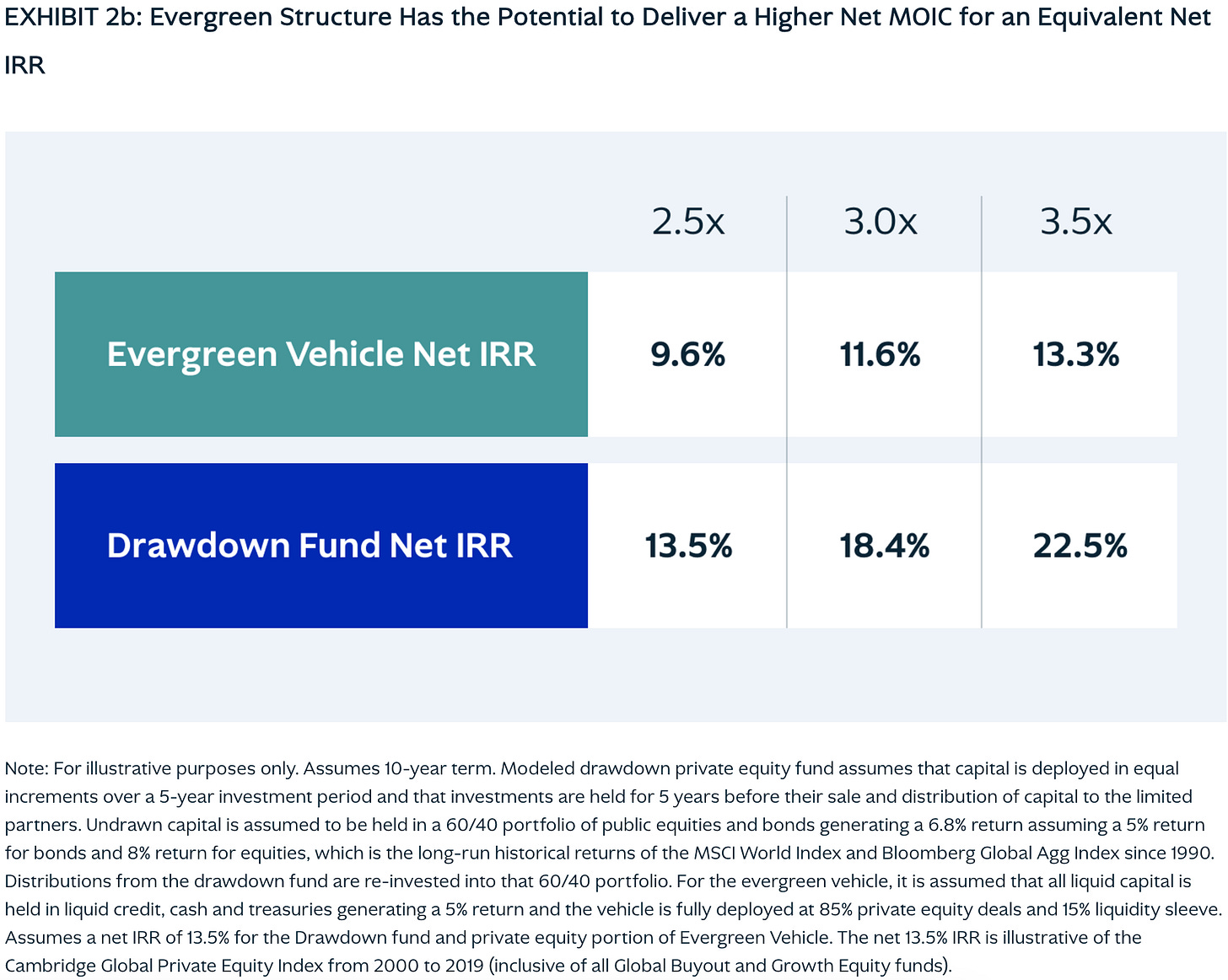

KKR’s May 2024 report by Alisa Amarosa Wood, Paula Campbell Roberts, and Justin Park on evergreen private equity vehicles highlights a similar sentiment.

Compounding 10-12% net IRRs annually in an evergreen structure has a meaningful effect on returns for investors, so much so that a drawdown fund requires significantly higher IRRs to generate the same multiple on invested capital.

In a world of increasing complexity — geopolitically, socioeconomically, and in financial markets — keeping things simple seems like a prudent course of action.

Finding ways to generate high single-digit or low double-digit net IRRs on an annualized basis is easier said than done, but sticking to fundamentals and avoiding irrational behavior and emotions would seem to be a good place to start.

Thinking about the next generation

But when reading Marks’ memo, my mind wanders to the behavior of the next generation of investors: how should investors, particularly younger investors that have grown up on a cocktail of retail brokerages, crypto, and investing made social, allocate their capital when they see investors (speculators?) generate 10x, 100x, even 1,000x in a matter of days on assets that appear to be mispriced from fundamentals?

A dilemma is fast-approaching financial advisors.

Nuveen’s recent study with Arizent Research and Financial Planning found that attracting new clients is the top challenge for advisors.

Interestingly, private markets might be part of the solution. A recent Brookfield Oaktree Wealth Solutions survey from their Alts Institute found that over 70% of non-users said they would begin investing in alternatives if their advisor recommended it.

Further, Nuveen’s study found that younger generations have a very different level of interest in alternatives versus older generations. Their study highlighted younger generations’ interest in alternative assets. 61% of new investors age 26 or younger are interested in crypto versus 5% of those ages 60 to 69 (note: this survey was done in 2023, so sentiment might be different today). Nuveen found that 44% of respondents between the ages of 45 and 59 are interested in alternatives versus 26% of those in the 70+ age range.

How can advisors plan to grow and maintain their client base in the long run? Certainly by understanding, if not allocating to, private markets.

Make boring cool

But how can advisors help their clients, especially younger clients, thrive in this uncertain environment?

By making boring cool.

Yes, there will be investors that figure out how to pick the next big winners in AI. Those venture funds and their LPs will be rewarded handsomely for making the right decisions. But on the path to the holy grail of returns there will likely be a graveyard of misallocated capital.

While not as exciting as owing equity in the next great company, the funds that finance the picks and shovels for the goldrush will likely find a way to generate returns. And do so in a way that balances risk and return.

Investing in data centers to finance the insatiable demand that the hyperscalers require to meet their technological and product needs is one such opportunity.

Blue Owl’s 2025 Market Outlook highlights the vast surface area of investable opportunity across the data center ecosystem.

Data storage and processing needs are massive. Data centers can help meet that demand.

It should be no surprise that there’s a secular upward trend in global spending on construction of data centers, as the below chart from BlackRock illustrates.

There are all sorts of ways to make money in investing. Some require more risk, some require less.

I’m not suggesting that investors should take one path or another — that comes down to the individual investors’ portfolio, mandate, risk tolerance, and liquidity needs. But it is worth thinking about ways to invest at prices that make sense in strategies and asset classes that provide the picks and shovels to those trying to strike gold.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

KKR recently formed a partnership with Gulf Data Hub to scale one of the Middle East’s largest independent data center platforms. This is the first data center investment for KKR in the Middle East, committing to support over $5B of total investment with GDH to build out data center capacity.

AGM News of the Week

Articles we are reading

📝 Apollo to Buy Argo Infrastructure to Add $6 Billion of Assets | Steve Dickson, Bloomberg

💡Bloomberg’s Steve Dickson reports on the latest alternative asset manager consolidation play, with Apollo agreeing to buy Argo Infrastructure Partners in a cash and stock transaction. The deal will add about $6B in AUM to the firm’s total assets, and will see up to 20 professionals join Apollo once the deal is completed. Argo invests in digital infrastructure, renewable energy, and transportation, among other industries. They manage 18 assets, including 40 U.S. data centers and three energy utilities that serve over 600,000 U.S. customers, according to their website. Apollo’s acquisition of Argo is the latest in a string of acquisitions by larger alternative asset managers to address their infrastructure investment capabilities. This deal follows BlackRock’s $12.5B acquisition of Global Infrastructure Partners last year. Apollo’s peers, Blackstone and Brookfield, also raised large funds focused on this strategy last year.

💸 AGM’s 2/20: This latest deal in the alternative asset management industry highlights the continued consolidation (and the currency of consolidation) in the space. The currency of consolidation is greater than ever. Adding AUM, particularly in a category like infrastructure, can be accretive to a firm’s earnings and ability to raise capital. A chart from Blue Owl’s 2024 Market Outlook illustrates that the top 10 managers are increasingly raising a disproportionate amount of the capital.

This phenomenon is particularly true in areas like infrastructure and natural resources, which perhaps helps to explain Apollo’s strategy of buying Argo.

LPs are also consolidating their relationships with top GPs, according to a chart from Blue Owl’s 2025 Market Outlook.

This trend of relationship consolidation by LPs would also suggest that the largest managers are going to figure out how to add strategies and AUM to their platform so they can continue to deepen their relationships with LPs in a bid to become one-stop-shops.

But do LPs want a one-stop-shop experience when it comes to investing? Data would suggest that this is a trend. But as wealth management firms continue to bolster their private markets capabilities by hiring teams or acquiring OCIO firms, as Cerity did with its merger with Agility and Hightower did with NEPC, it’s worth asking the question as to whether LPs will look for best-in-class managers in each asset class or strategy rather than centralize their relationship with a single firm / platform.

It’s hard to argue that the firms with the largest distribution teams won’t give themselves the best chance to win greater market share of wealth channel capital, particularly as the constituents underallocated to private markets relative to others invest more into the space (as this chart from Blue Owl’s 2025 Market Outlook illustrates). But how the wealth channel allocates will become an interesting question going forward.

📝 How did Ardian race to a $30B secondaries fund close? | Emily Lai, PitchBook

💡PitchBook’s Emily Lai goes inside the record fundraise by Ardian, where they closed on a $30B secondaries fund. ASF IX, which was oversubscribed, is 50% larger than its predecessor, ASF VIII, which closed at $19B in 2020. Ardian’s secondaries and primaries AUM stands at nearly $100B. Secondaries strategies have become quite popular as LPs are looking for liquidity in a bid to rebalance their portfolios.

Unsurprisingly, global secondaries fundraising achieved record numbers in response to investors’ need for liquidity. It hit an all-time high of $101.4B, doubling the $40.6B figure raised in 2022.

Larger funds dominated the fundraising market. Less funds raised capital in 2024 despite the increase in fundraising dollars going to secondaries strategies.

ASF IX attracted investors from around the world, with 465 investors from 44 countries comprising the LP base. Private wealth represented a large portion of the LP base, accounting for 22% of the total capital raised. This doubled the participation from the wealth channel in the last fundraise.

For LPs who asked if a bigger fund size would be able to consume the supply of opportunities, the data from deal sizes would seem to suggest that to be the case. The average transaction size for ASF IX’s deals is $2B, and the fund has already invested 50% of its capital. This deal size tracks with the trend of larger deals making up the secondaries PE buyout deal volume, as the chart from PitchBook illustrates.

💸 AGM’s 2/20: Ardian’s fundraise is notable for a few reasons. It illustrates continued validation for secondaries. LPs certainly seem to believe that secondaries will be an increasingly important part of private markets. It’s hard to argue with this belief. The data seems to indicate that to be so. According to data from Jefferies in this J.P. Morgan report, secondary market transactions have traded at almost double that from years ago. In the past decade, 5%–8% of primary private equity commitments have traded in the secondary market annually, a figure that has ticked up to 9%–10% in the past two years.

The other newsworthy item in Ardian’s fundraise is the presence of the wealth channel in their latest fund. Wealth investors represented 22% of the $30B raised. That’s $6.6B raised from the wealth channel, double that of their last fund. This trend mirrors that of other large secondaries fundraises. Lexington’s most recent flagship fundraise saw the wealth channel represent a meaningful portion of their $22.7B fund.

Secondaries represent a turnkey way — along with GP stakes investments — for newer LPs to gain access to private markets exposure. Secondaries provide instant diversification across a wide range of funds, vintages, and strategies, have a reduced J-curve, and often return capital faster than traditional primary investments. With the growth in continuation vehicles, secondaries strategies are encompassing more than just portfolios of funds, with secondaries funds picking specific assets they want to own.

It appears that Lexington’s success with the wealth channel following their acquisition by Franklin Templeton spurred the two firms to collaborate on launching its first open-end fund focused on secondary private equity investments. The Franklin Lexington Private Markets Fund (FLEX) was launched last week with $904.5M AUM through an initial partnership with two large U.S.-based wealth management firms.

It will be interesting to see continued productization and focus on the wealth channel with secondaries funds.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Investor Services Onboarding, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Senior Public Investor Relations Professional. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 BlackRock (Asset manager) - Vice President, Model Portfolios Business Development - EMEA. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Hightower Advisors (Wealth management platform) - Portfolio Management Solutions - Executive Director. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Sagard (Alternative asset manager) - Head of National Accounts, Private Wealth Solutions. Click here to learn more.

🔍 Nuveen (Asset Manager) - Global Client Group, UK Family Office Business Development, Vice President, Based in London. Click here to learn more.

🔍 Vega (Private markets infrastructure company) - Product Associate. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.