AGM Alts Weekly | 12.1.24: "The relationship between return and risk"

AGM Alts Weekly #80: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good morning from DC.

A little over a month ago, Oaktree Co-Founder Howard Marks published his most recent memo, “Ruminating on Asset Allocation.”

I’ve been thinking about it ever since.

The punchline of Marks’ memo is that there are really only two asset classes: ownership and debt.

He goes on to say, “if someone wants to participate financially in a business, the essential choice is between (a) owning part of it and (b) making a loan to it.”

Therefore, in his view, “one decision matters more than — and should set the basis for — all other decisions in the portfolio management process. It’s the selection of … the desired balance between aggressiveness and defensiveness. The essential decision in investing is how much emphasis one should put on preserving capital and how much on growing it.”

The goal in investing? To achieve “the best relationship between return and risk.”

The framework that Marks puts forth is quite a helpful one as private markets begin to feature more in portfolios. I’ve discussed before that it feels like the industry is moving from thinking of private markets as a slice of the asset allocation pie to buckets and spectrums across liquidity and illiquidity, risk, and return. In the 1.14.24 AGM Alts Weekly, I wrote:

Buckets and spectrums rather than slices of a pie

Are we moving towards a world where allocators live in buckets and spectrums rather than slices of a pie? What I mean by this is that allocators will look at their equity bucket across the spectrum of public equity and private equity and allocate accordingly, rather than think about their private equity exposure as a different piece of the pie than equities. Same with credit. This sentiment echoes what a number of others in private markets, including Apollo’s Chief Client & Product Development Officer Stephanie Drescher and iCapital’s Chairman & CEO Lawrence Calcano, have said.

Marks illustrates the relationship between risk and return in his latest memo. It’s quite a useful illustration because it highlights the spectrum (and increasing levels) of risk that one might take in pursuit of higher returns.

Investors have a choice between risk and return. Owning equity is an “offensive” choice. It’s the decision to try to maximize growth in exchange for lower certainty of returns that fixed income or debt investments provide. Investing in debt is a sacrifice of maximizing growth in exchange for the defensive act of limiting a portfolio’s volatility in order to generate a “fixed outcome.”

So, what does that make of asset allocation? It leads to investing along a continuum — of risk and return, of liquidity and illiquidity.

Marks illustrates different ways to combine investing in debt (fixed income) and ownership (equity).

The heart of what Marks is trying to convey is that portfolio construction should be about achieving the right mix of the risk / return continuum. That right mix is wholly dependent on an investor’s risk tolerance and their preference for risk relative to return. This decision is a deeply personal one, which brings us to the importance of customization and personalization in private markets. More on that later.

Once the objective is understood, asset allocation becomes a matter of implementation and the ability to “identify and access superior strategies and superior managers.”

Marks is not the only investor or firm to conceptualize investing through the framework of buckets and spectrums.

“Public is both safe and risky, and private is safe and risky”

Apollo CEO Marc Rowan echoed a similar sentiment on their February 2024 earnings call.

Private, at least in the old days, was risky. Private equity, venture capital and hedge funds dominated the private bucket. On the other hand, public was perceived as safe. Stocks and bonds, 60/40 portfolio. I believe we're moving to a world where public is both safe and risky, and private is safe and risky; and the difference is only a matter of liquidity [author emphasis].

I believe we are going to see a substantial pivot from institutions where they begin to think about private, not just in a traditional alternatives context, but they think about private as just another investment that has a little less liquidity. And the question they'll be asking is, am I being compensated for slightly less liquidity? I think that is nothing but a positive for our industry and for our firm.

Rowan’s comments highlight that one of the choices investors must make is about liquidity. Private markets is not so much an alternative as it is a choice to take on illiquidity in exchange for potentially higher returns (and possibly, more risk, depending on the asset class and investment strategy).

The investment world that was — “rates going from high to low, governments printing a lot of money, markets borrowing forward a lot of demand, and the benefit of globalization,” as Rowan said at the Norges Bank Investment Management Investment Conference in April 2024 — is no longer.

The new world order of investing requires a re-architecting of risk. And, even more so, a re-architecting of mindset.

Marks illustrates the evolution of his thinking for the current environment in the chart below. In a low-interest-rate environment, the expected return from debt made it relatively unattractive compared to equities.

But today, Marks argues, the expected return (and risk) of credit is more interesting relative to equities.

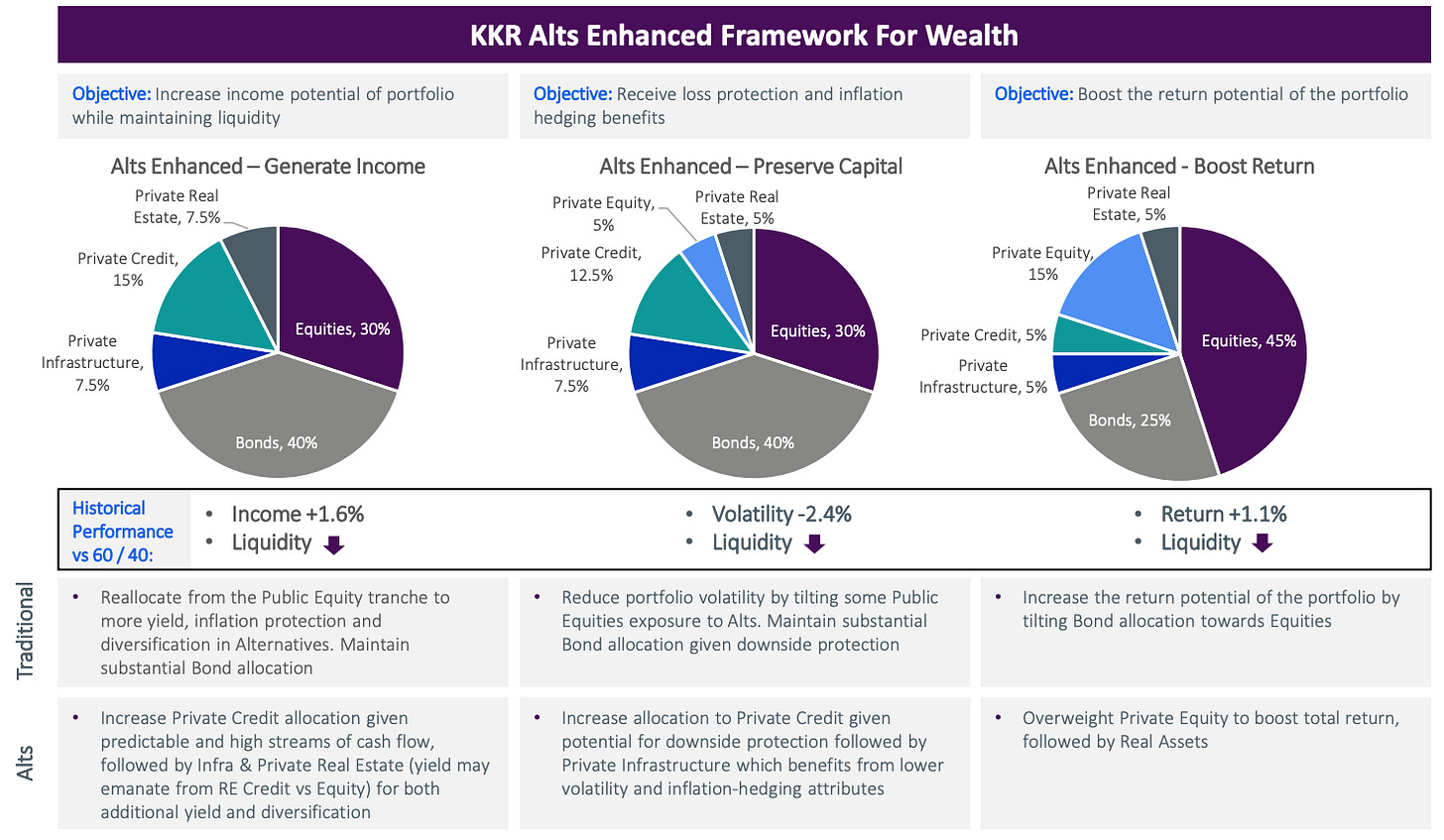

KKR’s Q4 2024 Global Wealth Investment Playbook shares a similar sentiment.

If features of the investment landscape include elevated inflation, higher borrowing costs, and slower real economic growth, KKR posits that “investors may need to diversify into alternative asset classes” based on expected returns over the next five years.

KKR goes on to share frameworks that they have created based on desired levels of risk and return.

KKR recommends that investors swap out some of their public equity and public credit exposure (based on the level of desired return and corresponding risk) for different forms of private equity and private credit strategies.

These asset allocation frameworks are helpful tools for the wealth channel, mainly because they provide an approach for investors as they think about the interplay between public and private markets in a portfolio.

Model behavior

The focus on frameworks belies another important trend taking hold in private markets: the rise of model portfolios.

Last week, iCapital announced the expansion of its model portfolio suite, adding a Growth Model Portfolio alongside its first model portfolio, a Balance Model Portfolio (iMAP) launched in May 2024.

The model portfolios were created to simplify the creation of diversified portfolios that provide exposure to private markets. In short, they provide a turnkey way for investors to have an allocation to private markets.

This news follows two other notable announcements about innovations in portfolio management in private markets.

iCapital, BlackRock, and GeoWealth announced a ground-breaking partnership last month that will enable wealth management firms that work with GeoWealth to seamlessly include private markets investments in their unified managed accounts (UMAs).

This partnership will leverage iCapital’s investment workflow tool that streamlines allocations to private markets funds and GeoWealth’s UMA technology to facilitate access to BlackRock’s custom models that will now incorporate private markets, direct indexing, and fixed income separately managed accounts (SMAs), alongside ETFs and mutual funds, in a single account.

BlackRock’s Co-Head of US Wealth Advisory Jamie Magyera highlighted the importance of “meeting the evolving needs of advisors and their clients through an … easy-to-use structure.”

Structure matters in private markets, particularly when it comes to wealth channel adoption of alternatives.

Magyera hit on a number of key trends that are top of mind for the advisor: personalization, customization, and convenient implementation.

In an interview with WealthManagement.com, she said: “Part of this is bringing together a platform that helps an advisor personalize and customize a portfolio across public and private markets and then easily, conveniently implement that through a platform. And that’s what we are doing through this partnership. Today, there are probably $4 trillion to $5 trillion sitting in model portfolios. We think in the next few years, it will double. That space — model portfolios, custom portfolios — is going to be the future of the wealth industry. But it has to be easy; it has to be implemented in a very convenient way.”

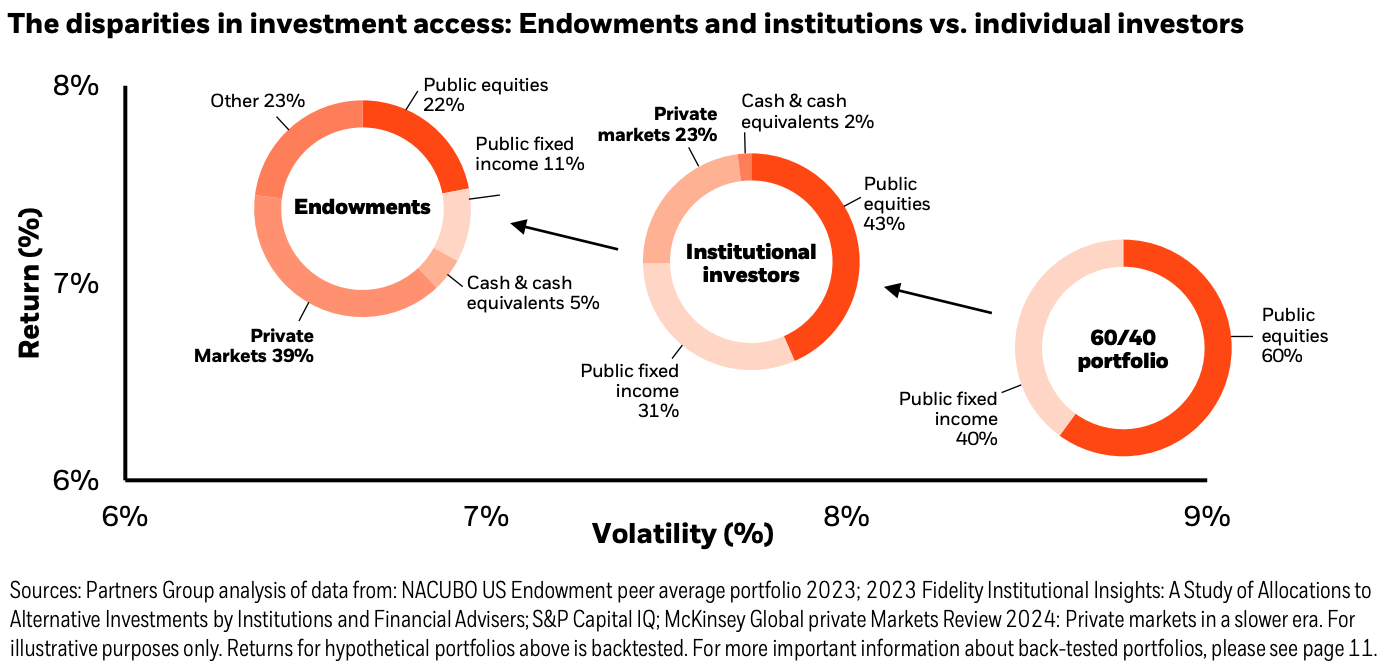

Model portfolios are a bet that BlackRock is doubling down on. The other big announcement from this fall was BlackRock’s partnership with Partners Group to create a “first-of-its-kind model portfolio solution streamlining retail wealth access to private equity, private credit, and real assets.”

According to a press release by Partners Group and BlackRock, the solution will “enable ease of access through a single subscription document versus requiring subscription documents for each underlying fund. It will feature robust operating procedures and risk management, including model rebalancing and comprehensive private markets asset allocation. Retail wealth investors will choose from three risk profiles to determine allocations to BlackRock and Partners Group funds, including BlackRock’s private equity, private credit, and systematic funds and Partners Group’s private equity, growth equity, and infrastructure funds.”

A whitepaper by Partners Group and BlackRock on the private markets model portfolio highlighted how adding private markets exposure could change the portfolio’s risk and return dynamics.

Historically, access has been the issue for the wealth channel. With innovations in infrastructure like iCapital, investors now have the access and straight-through-processing capabilities to manage a private markets investment from end to end. Now, it’s a matter of figuring out how to get the wealth channel exposure to private markets in ways that make sense for them.

That’s why this partnership between BlackRock and Partners Group — and the aforementioned news with iCapital’s model portfolios and the iCapital, GeoWealth, and BlackRock partnership on adding alts to UMAs — are so profound. These developments will enable wealth advisors and their clients to have an easy way to access private markets exposure and adjudicate how they want to allocate across the risk and return spectrums.

BlackRock going for blackjack

BlackRock’s innovation in private markets has no bounds. Their partnerships with Partners Group and iCapital follow three major acquisitions that put BlackRock’s stamp on private markets. eFront was BlackRock’s foray into private markets data and infrastructure (along with investing in iCapital in 2016). They followed up the eFront acquisition with the purchases of GIP and Preqin, paying a combined $15.7B for these respective firms.

And they could soon be adding a fourth acquisition to the mix.

The Financial Times reported that BlackRock has a deal to buy HPS, the $148B AUM credit firm.

HPS has had a rapid ascent (see AGM Alts Weekly 9.8.24 to read more on HPS), growing into one of the industry’s biggest players in private credit after spinning out of JP Morgan in 2016.

With increasing consolidation occurring in private markets, HPS represents one of the remaining crown jewels in alternative asset management.

BlackRock certainly sees it as such. They are reportedly willing to pay $12B to acquire HPS, a similar figure to their $12.5B acquisition of $100B AUM infrastructure manager GIP.

A successful purchase of HPS would mean that BlackRock will have spent almost $30B to acquire meaningful alts capabilities. This, mind you, is in addition to the $350B AUM BlackRock had in alternatives prior to acquiring GIP, which now stands tall in private markets relative to its peers with over $450B AUM post the GIP acquisition.

BlackRock’s bid to buy private equity firm Warburg Pincus earlier this year fell short, but it’s worth wondering if they will look to acquire private equity capabilities as well as secondaries, GP stakes, and possibly even venture capital strategies to round out their platform?

Certainly, they are building a formidable private markets platform, complete with the advisor desktop real estate (Aladdin) and data (eFront and Preqin), so it wouldn’t be a stretch to think that they will look to find ways to continue to fortify the product side of the equation since that will feed the creation of private markets model portfolios, which is one of the keys to unlocking private markets for the wealth channel.

Model portfolios can certainly help investors understand the risk and return features of private markets — and what adding private markets exposure does to an investor’s portfolio. This, perhaps, is the most important aspect of model portfolios, because, as Howard Marks said in his memo, it’s understanding and achieving “the best relationship between return and risk.”

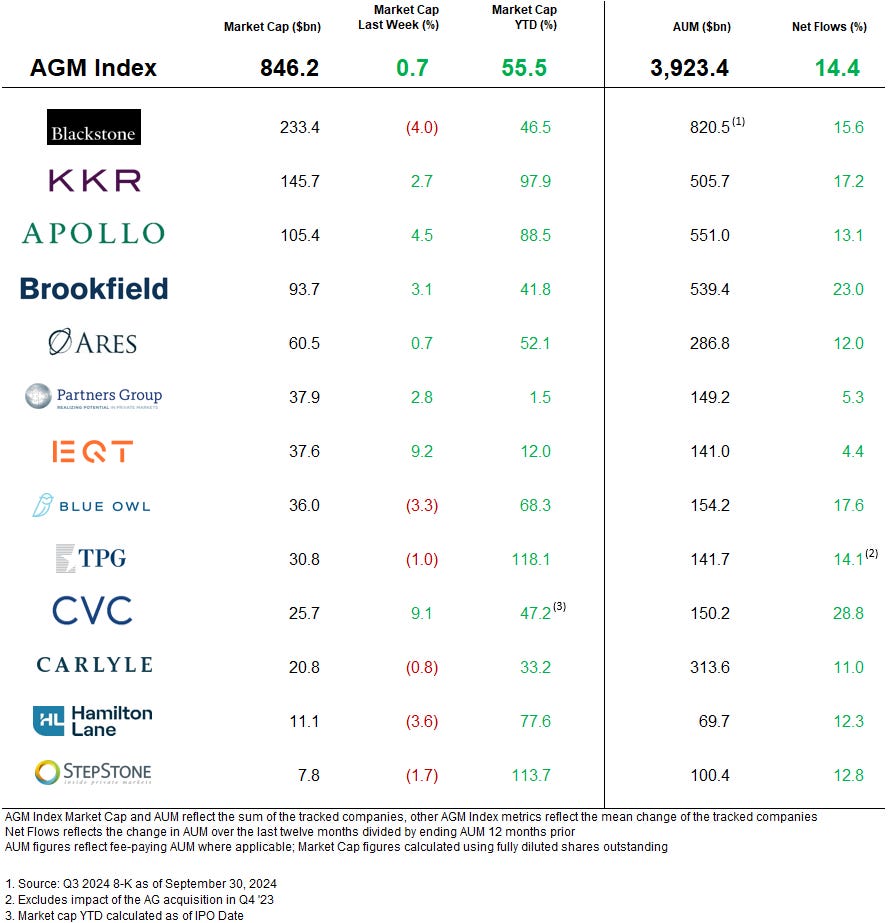

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the week

Apollo Chief Economist Torsten Slok’s “Daily Spark” shows that the amount of dry powder in global private equity has started to decline from its peak in 2023.

Is this a signal that 2025 will see a pickup in deal activity?

AGM News of the Week

Articles we are reading

📝 Churchill’s secondaries boss: Evergreen funds impacting pricing | Selin Bucak, Citywire

💡Citywire’s Selin Bucak reports that Churchill Asset Management’s Head of Secondaries has expressed concern that the amount of capital going into evergreen funds in the secondaries space could have an impact on pricing. Many asset managers have built out secondaries focused evergreen offerings to work with the wealth channel. Firms that have launched such funds include Coller Capital and Carlyle. CVC Capital Partners and Franklin Templeton are set to roll out evergreen secondaries funds next year. Evergreens invest the capital they receive relatively soon after it is raised (to limit cash drag), but there’s a concern that if there is no limit on fundraising and commitments flow in quickly, then funds could pay higher prices in an effort to invest the money quickly. Churchill Asset Management’s Head of Secondaries Nick Lawler voiced concern about the amount of capital flowing into the space and its potential impact on price. “The growth in evergreen semi-liquid type funds is a benefit because it’s attracting more capital to the space, which on an absolute basis, is lacking in the capital needed to consummate deal flow. A challenge is that so much capital today is being raised quicker than it can be put to work, which is shifting pricing.” Lawler also said that he believes bankers should be involved in transactions for the benefit of LPs achieving price discovery. “I’m a big believer that bankers should be involved in almost every process. Otherwise you can get situations where you run the risk of getting a little too creative and a little too buyer- or GP-friendly when you don’t have a true arms-length transaction. Allowing optionality and the ability to roll over is very important. The second consideration is symmetry in terms of information access.”

Lawler joined Churchill in 2022 when the group had raised $1.5B for its secondaries and co-investment programs. Most of the deals consummated in its secondaries funds are in assets where Churchill is an incumbent lender or equity investor. Its activity is 75% in GP-led deals and 25% in LP-led deals. The majority of the GP-led deals are in single asset transactions. Lawler believes that single-asset continuation vehicles provide them with the ability to invest in companies where they have conviction and “double down on those companies in what are true proven winners.” Lawler said that the adviser community has pushed many secondaries funds to complete multi-asset deals because they “started introducing this idea that if you have multi-asset deals your execution certainty is higher.” Lawler noted that created “too many deals [that] were a mixed bag in terms of quality.” He said that he can “adequately diversify his own portfolio by doing single-asset deals where he doesn’t really need the added diversification benefit of a multi-asset portfolio.

💸 AGM’s 2/20: Bucak’s interview with Churchill’s Lawler is notable for several reasons. Lawler’s comments about the challenge of matching capital raised against a pipeline of viable opportunities to deploy is a major topic for evergreen funds. This point is perhaps the most crucial aspect of managing an evergreen fund structure — how will funds manage inflows of capital into evergreen structures to ensure that they are continuing to invest in high-quality assets at the right price while also balancing the fact that it is a drag on returns to leave capital in cash? Structures create incentives — and incentives create outcomes. And the structure of an evergreen fund differs from that of a closed-end fund. An evergreen fund strives to be deployed into opportunities on a rolling basis rather than wait for opportunities to arise like a closed-end fund might do. An evergreen private equity vehicle is, on average, 80-90% deployed into existing private equity portfolio companies. This feature is intended to ensure that investors are exposed to private equity from day one of their investment into the vehicle versus a closed-end fund. It also limits reinvestment risk for investors, who would otherwise be out of the market for a period after a realization in a traditional drawdown fund structure. See below for a chart from KKR’s May 2024 paper on evergreen vehicles.

This structural feature can help investors on the exit. An evergreen fund can hold an asset longer because there’s no end of life for the fund that requires the fund manager to sell the asset and distribute cash back to investors. But it can make for a more challenging situation when it comes to fundraising and deployment. If an evergreen fund raises too much capital relative to the quality of investable opportunities — at the right price — in the market at a given time, then the fund manager is faced with the options of either (a) paying a higher price for assets or (b) leaving the capital raised in cash, which drags on returns. That’s why, as Partners Group’s Rob Collins said on his Alt Goes Mainstream podcast, managing an evergreen fund is an “infinite responsibility.”

Therefore, the skill of managing an evergreen fund is much different from that of a closed-end fund. Fundraisers and fund managers must work together in unison to manage an evergreen fund structure properly. Pipeline management with an evergreen fund structure is critical. Otherwise, evergreen funds may be forced to buy assets at higher prices, which could be to the detriment of its investors. Purchase price does matter, as Apollo CEO Marc Rowan often says. And evergreen funds shouldn’t get in situations where they are forced to buy assets at higher prices because they need to deploy capital. This, however, can be tricky, particularly if there’s meaningful demand for a fund. Fundraising isn’t just about sales; it’s also about investor psychology. It’s hard to prevent investors from being exuberant about putting capital to work when times seem good. It’s also hard to preclude investors from looking to withdraw capital when markets seem to be in disarray (which also might be a great buying opportunity for evergreen funds — if they have the available capital to deploy). It might take some time to play out given that the rise of evergreen funds is just getting started, but how funds manage the capital raising and deployment of evergreen funds is certainly something that bears watching. One remedy to this potential issue? Model portfolios and a focus on overall asset allocation rather than looking to invest in specific funds when it seems like the popular thing to do.

Reports we are reading

📝 Unlocking the Future of Portfolio Management for RIAs | Matt Magill, James Dahlen, Victoria Krauel, KKR

💡KKR’s Matt Magill, James Dahlen, and Victoria Krauel shared five key takeaways from their 2024 KKR RIA Forum, where they brought together CIOs, Directors of Research, and key decision-makers from top RIA firms across the US. RIAs shared how they are actively reshaping their asset allocation strategies by embracing private markets, reflecting a strategic focus on portfolio diversification, maximizing risk-adjusted returns, and accessing new opportunities.

KKR highlighted some of the topics discussed at their Forum, with conversation centering on the evolving terminology from “alternative assets” to “private markets” (see more from the AGM Alts Weekly 9.22.24 on this shift in terminology from “alternative assets” to “private markets” and why definitions matter) and why many RIAs no longer see private markets as truly alternative (see more from the AGM Alts Weekly 2.11.24 on why there “is no alternative”).

💸 AGM’s 2/20: Here are some of my takeaways from KKR’s survey:

RIAs are allocating a greater proportion of client portfolios to private markets investments

Interestingly, advisors who allocate more to private markets already plan to allocate even more to private markets, while advisors who allocate 10% or less to private markets are planning to decrease their allocations to private markets.

The question for firms looking to raise from the wealth channel: will the amount of dollars coming from advisors who already allocate meaningful capital to private markets outstrip the capital that advisors who don’t allocate much to private markets today?

It would be interesting to unpack this data further to see the breakdown of client type for advisors allocating 30%+, 20-30%, etc. to private markets. Are the majority of their clients qualified purchasers? Accredited investors? And how much of the portfolios for each respective client type currently have exposure to private markets?

KKR did ask advisors who participated in the survey the proportion of their book that is Qualified Purchaser vs. Accredited Investors vs. Non-Accredited Investors. Unsurprisingly, the majority of the advisors who participated in the survey have mostly QP or AI clients.

Private equity and private infrastructure appear to be most popular asset classes for 2025

Private equity and private infrastructure look to be the most popular asset classes for advisors. KKR states that many RIAs have already allocated to evergreen strategies in private credit and real estate, so private equity and infrastructure will now see growing interest as there’s now more registered evergreen structures available to accredited investors. Given the current environment, it’s also not entirely surprising that both private equity (given the possibility of more deregulation and companies staying private longer) and private infrastructure (given its uncorrelated features and capital required to meet the growing demands for infrastructure, digitalization, and decarbonization) are popular asset classes amongst the wealth channel.

Advisors like drawdown funds and evergreen funds

Perhaps the most surprising response (to me, at least) was the percentage of advisors who use drawdown fund vehicles. Yes, drawdown funds have historically been the way in which investors have accessed private markets, but I would have thought that evergreen funds would have been a more popular choice amongst the advisor channel. Managing the cashflows and capital calls of drawdown funds are not an easy task, so I would have expected evergreen funds would have far outstripped drawdown funds.

But perhaps there’s an explanation in the data as to why these advisors are using drawdown funds more than I would have thought. Over 53% of RIAs surveyed employ a hybrid approach which combines standardization with targeted customization, starting with a model portfolio but adding specific asset classes or allocations based on client requests or needs. The benefit of the hybrid model is that it is both scalable and flexible, enabling advisors to leverage this framework across its client base.

This hybrid approach seems to align with RIAs’ responses that they plan to work with more private markets investment managers rather than less.

Over 64% of respondents work with at least seven managers. And only 2% of advisors plan to decrease the number of private markets investment managers with whom they work.

RIAs believe that working with more managers enables them to customize portfolios based on client needs and fulfill fiduciary duties more effectively since it ensures they can access top-quality, suitable investments, all of which can enhance client satisfaction and provide them with a competitive advantage.

This data is somewhat surprising, as I would have thought that advisors would want to have more expansive relationships with fewer managers. Perhaps this is a reflection of the evolution of how the RIA market approaches private markets, particularly at the upper-end of the wealth channel. Large RIAs and RIA platforms have built out dedicated private markets teams to source, evaluate, diligence, and allocate to private markets managers. Some, like Cerity and Hightower, have taken their private markets capabilities to another level, acquiring OCIO capabilities as Cerity did with Agility and Hightower did with NEPC. This feature should enable advisors to be able to work with more managers, not less, because of all the work done by dedicated private markets diligence teams that can handle the sourcing and evaluation required in the private markets.

It will be interesting to see how menus at RIA platforms and model portfolios continue to evolve to meet the perceived demands of RIAs wanting more, not less, manager relationships.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Product Marketing, VP, EMEA. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Northern Trust (Asset manager) - Head of Alternatives Sales Specialists. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Financial Administration - InvestOne. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch the first episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.