AGM Alts Weekly | 1.5.25: A deepening dispersion to a more multi-polar world

AGM Alts Weekly #84: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

LemonEdge is a leading fund, partnership, and portfolio accounting solution for private markets investment firms with backing from Blackstone Innovations Investments, amongst others. LemonEdge helps GPs, VCs, Family Offices and Fund Administrators transform their back-office operations, through making the complex, simple.

LemonEdge helps firms manage equity, real estate and infrastructure across closed-ended, open-ended and hybrid structures of any variety, with all management fee, waterfalls or other typical Excel based calculations all embedded in LemonEdge. Scale your operations with high efficiency and deliver exceptional LP / GP service.

Good afternoon from New York City. I’m here to speak at a family office conference, meetings, record some podcasts, and my cousin’s 35th birthday party.

An uncertain outlook

2025 appears to bring both optimism and uncertainty for private markets. At least that’s what the 2025 outlooks penned by many of the asset managers seem to convey.

Geopolitical uncertainty looms large over a market (private equity) that is yearning for exits. In what Partners Group calls “a brave new world,” regional differences and macroeconomic volatility could reign supreme. Political polarization and trade policies, coupled with increasing debt and aging demographics in many developed nations, could make for both an interesting and challenging investment environment.

Partners Group’s commentary on the future centralizes around the fact that growth may not be what it has been in the past.

The upshot? Investors can no longer rely on GDP growth to drive investment performance, nor can they count on help from governments to lower rates to help increase asset prices.

New world order requires different set of skills

This view aligns with what Apollo CEO Marc Rowan said last year. The re-architecting of risk that Rowan referenced at the Norges Bank Investment Management Conference last May means that investors — and allocators — need to have a different set of skills to succeed in this new world order.

“How do we investors have success as investors when a series of things no longer exist?” Marc effectively asks.

A more disciplined underwriting approach and a focus on quality seem to be antidotes for an increasingly uncertain world.

Partners Group would also point to investment acumen and post-deal value creation as the skillset that is required to drive investment returns.

But it’s not just private equity that appears to be promising (for those that underwrite well). Apollo believes that the current market environment — and the delta between credit spreads in public and private markets — mean that investors can earn a premium for lending in the private markets.

BlackRock seems to agree with both Apollo and Partners Group about the attractiveness of investing in or lending to profitable companies that have size and scale.

A chart from BlackRock’s 2025 Outlook highlights that quality matters. Defaults of companies with >$100M EBITDA are meaningfully lower than smaller companies with less profitability and size.

This “deepening dispersion,” as BlackRock calls it, is not just prevalent in private credit. In their view, the theme of dispersion also “applies to liquid corporate credit, commercial real estate, and even the financial strength of the US consumer.”

A deepening dispersion to a more multi-polar world

The concept of dispersion reflects a bigger theme at work. Now, more than ever, we live in a multi-polar world. This characterization is as much a feature of geopolitics as it is of the investment world. Just as regional powers are emerging to exert influence or cause challenges geopolitically, there doesn’t appear to be one investment strategy (or alternative asset manager) that will reign supreme in this world of uncertainty.

The juxtapositions could not be more stark.

On the one hand, many countries are hurdling full-steam ahead towards a period of looking inward, nearshoring their manufacturing, and focusing on building their economic and military strength. On the other hand, many of the secular trends that could drive investment theses crosscut borders and could require countries to work together.

Partners Group states this view in their 2025 Outlook, noting that “investors can no longer count on real growth, nor on record low interest rates. The emphasis must be on what we build and on deploying capital behind investments that stand to benefit from long-term secular themes.”

What’s on the menu in 2025?

Investors seem to be betting on certain themes and trends going forward.

Apollo’s 2025 Outlook indicates that a number of investors, particularly wealth managers, have a target allocation for private equity that is above their current allocation.

Buyout funds appear to be back on the menu.

Investors appear to show an increased interest in buyout funds relative to a year ago.

More positive investor sentiment in private equity would align with favorable data on stabilizing exit values from BlackRock’s Investor Outlook.

Private equity exit values are now back to their pre-pandemic average after a period of volatility since 2022.

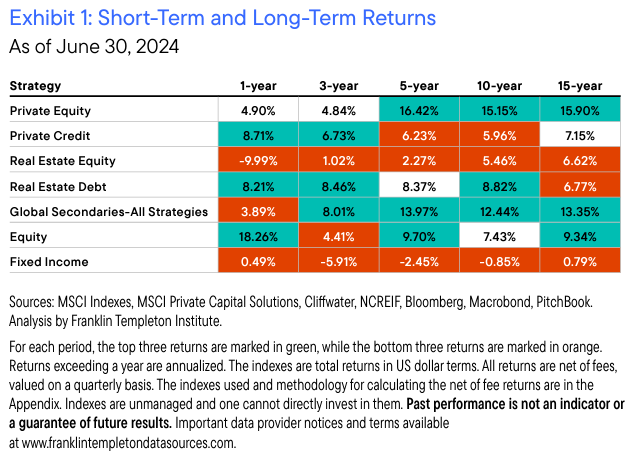

A more stable and favorable exit environment could bode well for the longer-term outlook on private equity, which Franklin Templeton highlighted in its Franklin Templeton 2025 Private Markets Outlook. Long-term returns for private equity over 5-, 10-, and 15-year periods have been favorable relative to other asset classes.

It’s hard to tell what the future will hold, but purchase price matters, as Marc Rowan and Apollo often say. And BlackRock’s Outlook highlights the attractiveness of purchase price multiples in private markets relative to public markets.

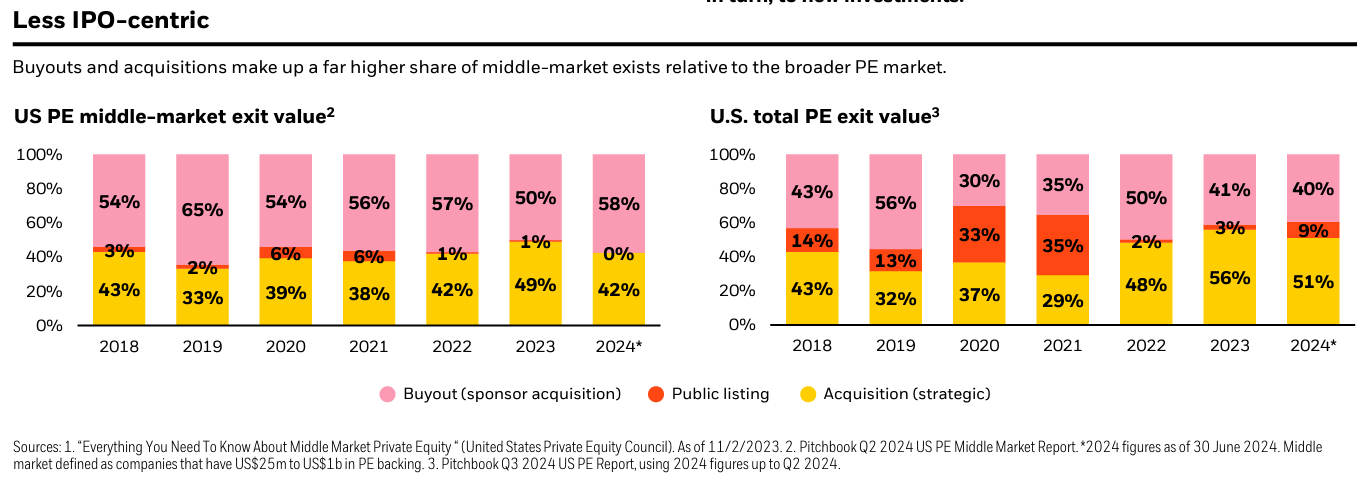

Middle-market private equity could be a beneficiary of more attractive multiples, in large part because the majority of exits in the middle-market are sponsor-to-sponsor or strategic acquisitions, as the chart below from BlackRock’s Outlook illustrates.

While it can be more of a challenge to find and underwrite the right middle market buyout funds, the work to find the right funds matters. A chart from Franklin Templeton’s Outlook highlights the stark contrast between top and bottom quartile private equity funds relative to other asset classes. The inter-quartile dispersion in private equity and venture is marked, so it’s critical investors partner with the right funds (you can read more on middle-market private equity on Alt Goes Mainstream here).

Partnership or power?

Certain secular themes — AI and the buildout and management of data centers, decarbonization, infrastructure — are global.

Some of these trends require so much capital that collaboration is necessary. That’s why we are seeing tie-ups between funds and regional organizations to invest into themes and trends that can propel countries forward, such as the $25B partnership between KKR, GIP, and Indo-Pacific Group to invest into infrastructure in the Indo-Pacific region.

It’s also why a multi-polar investment world might exist — and persist. Banks and private credit firms have become frenemies out of necessity. Private credit firms require origination. Banks require capital (much of which they can’t or don’t want to keep on their balance sheet). Even though they are both jostling for positions as leaders in the market, they might have come to grips — at least for the time being — with partnering to achieve their near-term goals, even if it poses greater competitive threats over the long term.

The above chart from Apollo’s 2024 Investor Day does a good job of capturing what might lie ahead for the future of the multi-polar investment market structure.

Alternative asset managers now occupy a much bigger part of the financial services universe than they did a decade ago. And it doesn’t appear that is changing anytime soon.

The chart below from Apollo’s 2025 Outlook — paired with the chart above about the increasing market capitalization of alternative asset managers relative to banks — highlights the efficiency of alternative asset managers relative to US commercial banks. This is particularly relevant as alternative asset managers encroach on banks’ territory in the ever-expanding universe of private credit.

With firms turning a major focus to the wealth channel, alternative asset managers are building brands that rival those of their bank and traditional asset manager counterparts.

Over time, I’d expect to see less appetite for partnership and more hunger for power and influence amongst asset managers. It’s part of what could drive continued consolidation in the asset management industry since the buildout of a one-stop-shop not only leverages synergies in fundraising across institutional and wealth channels. It can make it easier to cross-sell products to LPs but also highlights the value, as Partners Group notes, of having an investment platform with a broad multi-strategy offering that provides investment firms with the flexibility to deploy capital across segments and strategies according to “relative value attractiveness.”

Relative value attractiveness could open up opportunities for managers of all shapes and sizes to perform well in their market, but one common thread will run through what looks to be an uncertain investing and geopolitical economic era — understanding geopolitics and macro markets will loom large for both asset managers and the allocators that look to work with them.

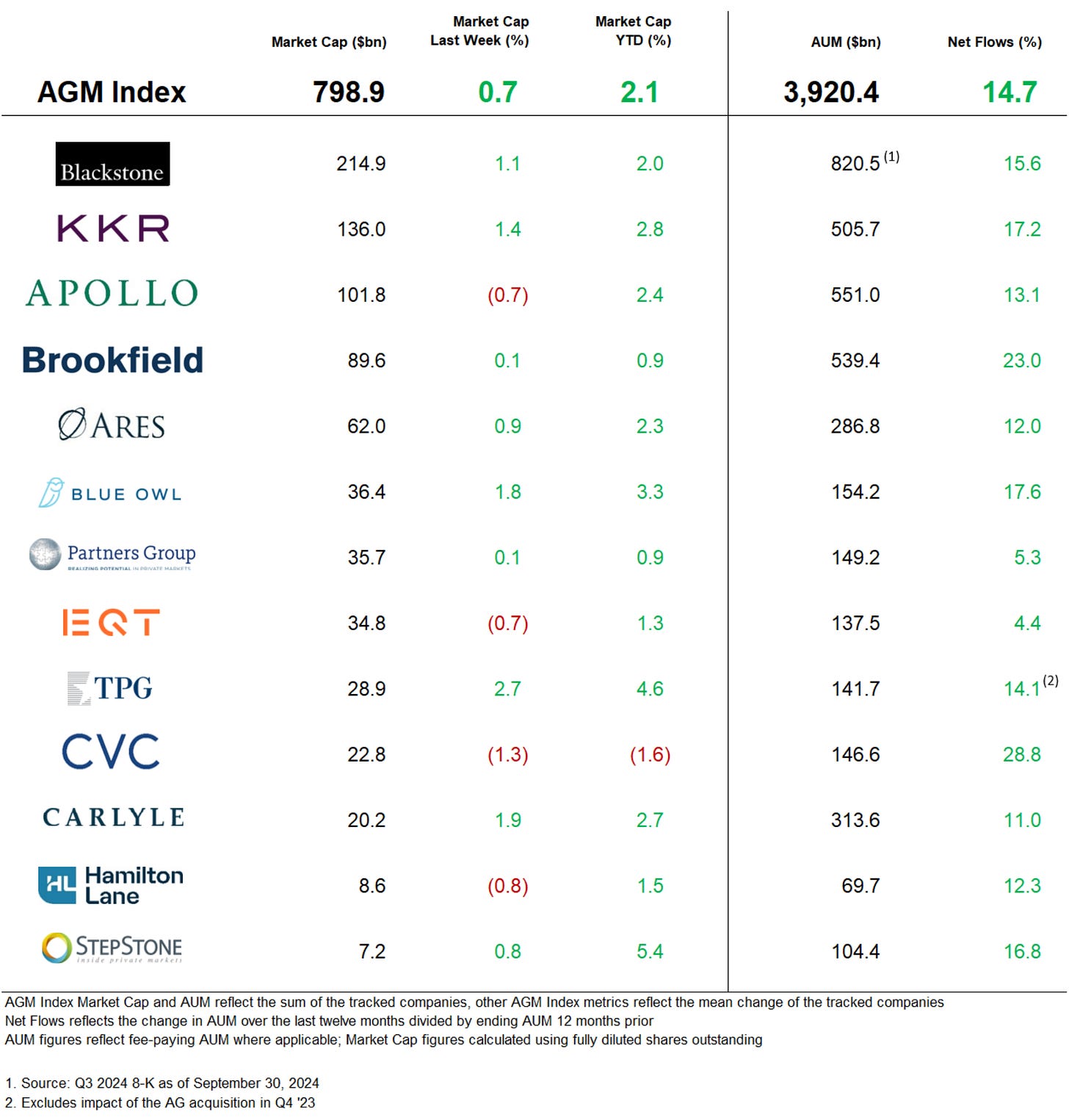

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

Ares shared its Q4 2024 Global Credit Monitor, looking into what 2025 might bring for credit markets.

AGM News of the Week

Articles we are reading

📝 Where the next financial crisis could emerge | John Plender, The Financial Times (Opinion, The Long View)

💡The Financial Times’ John Plender discusses the growth of private markets and poses questions about its future given the rapid and sizable flow of capital into the space. Plender cites the 20% growth rate of private markets since 2018 as part of the broader trend of private funds now taking a more dominant role in financial activity. Plender lists some concerns about the growth of private markets: the lack of transparency and disclosure in private markets posing challenges to investors, policymakers, and the public and the possibility of lower returns after a period of lower interest rates, yet a seemingly “ever-growing appetite” for illiquid alternative investments from LPs. High fees and charges for investing in structures designed to invest into private markets, opacity of the investment process and performance evaluation, high dispersion in investment returns, and record levels of dry powder all pose challenges, posits Plender. Plender references the concerns of Allison Herren Lee, a former commissioner of the US SEC, that the opacity of private markets could lead to a misallocation of capital. Plender then turns his focus to private credit, which he says could suffer from a deterioration in pricing and underwriting standards given the capital flowing into the sector, ultimately ending with a warning shot: that the next financial crisis could very well emerge from private credit.

💸 AGM’s 2/20: Any time a market experiences rapid growth or large inflows of capital, it’s worth pausing to evaluate the risks and challenges ahead. Plender’s concerns are valid. When capital flows into an industry or investment strategy, it can impact returns. It can also challenge psychology. Underwriting standards can loosen. Justifications for trying to win more competitive deals can be made. Risk can increase. And returns can suffer.

But it’s also worth zooming out and examining some data in the context of this healthy skepticism.

Apollo’s 2025 Investor Outlook provides a few charts and data points that offer perspective on private markets and its size relative to public markets.

While private markets have certainly experienced marked growth in recent years, the overall market size of private markets is still a fraction of public markets.

But private markets have grown so much faster relative to public markets in recent years one might say. Yes, but over the past 11 years, public markets have actually experienced a greater increase in size on an absolute basis relative to private markets, as the below chart from Apollo illustrates.

There are also other forces at work that are worth noting. Indexation and concentration in public markets make it necessary to rethink private versus public, as this chart from Apollo’s 2024 Investor Day illustrates.

With private companies staying private longer (and the overwhelming majority of companies in the US with >$100M in revenue being private companies), a shrinking universe of public companies, and a large concentration of value residing in a select few large-cap stocks in public markets, private markets can become a necessary tool for diversification for investors.

One pension plan surveyed in Amundi Investment Institute and Create’s December 2024 survey noted as much: “Public stock markets are no longer representative of the global economy. Private markets are a gateway to growing companies.”

A Finnish pension plan surveyed in the same report echoed this sentiment.

Yes, private markets have experienced rapid growth and an increase in inflows of capital. That could certainly impact returns going forward. But perhaps, taking into account the views above from the pension plan, exposure to private markets should be thought of as part of a more holistic approach to asset allocation and investing.

Private markets offer something different, as one pension plan in the survey noted: “As part of strategic asset allocation, private assets are free from the tyranny of capweighted benchmarks.”

Blackstone’s Jon Gray perspective on private credit, which he shared on the In Good Company podcast with NBIM CEIO Nicolai Tangen, is also noteworthy. Gray noted that private credit is a “farm-to-table business … removing the middleman and stripping out costs, which can generate higher returns since it’s the storage business rather than the moving business. It’s a hold-to-maturity business that trades liquidity for higher returns and, unlike banks, it can offer effective duration matching capabilities” (note: author paraphrasing of Gray’s comments).

These comments make the case for private markets being part of overall strategic asset allocation.

Pension plans surveyed in the Amundi / Create report certainly seem to think that framework makes sense.

Thinking holistically about asset allocation gives rise to questioning the merits of private versus public. Blackstone’s Gray made the important point on Tangen’s podcast that “alternative asset managers must deliver premium returns” in order to continue attracting LPs.”

Returns certainly matter. So too does diversification.

Apollo highlights this point in their 2024 Investor Day presentation as being a “replacement” for certain public equity and fixed-income investments.

Where does this leave us? Private markets are certainly not a panacea. There are risks and challenges, particularly as markets enter a period of uncertainty (as discussed above). And healthy skepticism, as FT’s Plender shares in his article, is a good thought exercise for both those in private markets and allocators considering private markets. But even with risks, challenges, and illiquidity, it does seem like there’s reason to consider private markets as part of a strategic asset allocation, so long as it’s done within reason, in the appropriate structure, and for the right client. Like may things, too much of something might not be a good thing, but some of it could be.

📝 Hedge funds Citadel and Millennium gain 15% in 2024 | Harriet Agnew and Costas Mourselas, Financial Times

💡Financial Times’ Harriet Agnew and Costas Mourselas report on returns from some of the industry’s largest hedge funds. $66B AUM Citadel reportedly gained 15.1% in 2024, just ahead of rival multi-strategy fund $72.1B AUM Millennium Management, which finished the year up 15%, as both firms beat the broader hedge fund industry. These pioneers of the multi-manager hedge fund model (or “pod shop” as some call it) trade across a spectrum of strategies in equities, fixed income, commodities, currencies, and other markets. These firms bested the wider $4.5T hedge fund industry last year. According to Hedge Fund Research data, hedge funds, on average, gained 2.4% in November and were up 10.2% in the first 11 months of 2024 (the data provider hasn’t yet published December figures). These figures fell short of US stock market performance. Last year, the S&P Index returned 23.3%, in large part driven by gains from big tech companies. Citadel and Millennium run a market-neutral strategy, which aims to generate returns irrespective of the direction of the market. Agnew and Mourselas note that some other hedge funds also turned in double-digit return performances.. Balyasny Asset Management ended the year at 13.6% and ExodusPoint, a multi-manager hedge fund founded by former Millennium Head of Fixed Income Michael Gelband, was up 11.3% last year. D.E. Shaw’s flagship multi-strategy Composite hedge fund gained 18% last year, and its second-largest fund, Oculus, a macro fund, gained 36%, according to data from Bloomberg.

💸 AGM’s 2/20: Multi-manager hedge funds have become emblematic of a major evolution in the hedge fund industry. Their structure affords the manger to allocate capital where risk and return are most attractive — and having risk managers focused on discrete strategies can lead to less correlation. The proof of success may very well be in the returns. Research from Goldman Sachs (note: using data through June 30, 2023) finds that multi-manager firms grew AUM significantly more than other hedge funds.

AUM for multi-strategy hedge funds grew 175% from 2017 to 2023, while the hedge fund universe grew only 13% over the same timeframe.

Allocators have taken an interest in multi-manager hedge funds for good reason. According to Goldman’s research, they’ve delivered better returns with lower volatility and correlation to equities than other hedge funds.

But it’s not necessarily a simple task for allocators to invest into the top performing multi-manager hedge funds. There’s significant performance dispersion amongst top and bottom quartile multi-manager hedge funds — and the best funds are either closed to new investors or very difficult to access.

The evolution of the hedge fund industry is mirroring a broader trend in private markets: the emergence of one-stop-shop alternative asset managers, which I wrote about at length last year. Funds are turning into firms — whether its hedge funds or private equity firms. And this is a trend I certainly don’t see going away, particularly as the wealth channel becomes a more prominent player as an allocator to private markets.

Podcasts we are listening to

📝 In Good Company with Blackstone President & COO Jon Gray | Nicolai Tangen, CEO of Norges Bank Investment Management

💡The conversation between NBIM’s Nicolai Tangen and Blackstone’s Jon Gray had some fantastic insights about private markets and Blackstone.

Here are a few takeaways:

Gray’s answer to Tangen’s question about what makes a good business

A company that is in a large market that’s growing.

Has a moat.

Generates higher margins, recurring revenues, and is less capital intensive.

Lacks client concentration risks.

What are the best businesses Gray has seen?

Hilton, which is one of Blackstone’s investments.

Blackstone.

Gray cites the size and scale of the global travel industry and the capital light nature of Hilton’s business model as features that make it an attractive company.

Gray mentions Blackstone as a business that is capital light, features a strong brand, is in a growing market, and delivers for their customers.

Gray also mentions that scale is a major advantage for companies and funds. He cites scale as a major advantage for private markets investment firms because it enables them to win deals and put capital behind the companies / investments required to grow and become a market leader.

Gray’s comments on private credit

Gray made interesting comments on private credit and why he believes that the growth in private credit is a net-positive for the industry.

Gray describes private credit as a “farm-to-table business, which removes the middlemen and strips out costs (hopefully generating higher returns).” It’s a “hold-to-maturity business, where liquidity is traded in exchange for higher returns.” Unlike banks, private credit firms are in the “storage business [rather than the] moving business,” which means private credit firms can be better at “duration matching,” which can reduce systemic risk.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Product Marketing, VP, EMEA. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Vanguard (Asset manager) - Venture Investing - Senior Associate. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 BMO (Asset manager) - VP, GAM Alternative Investments, Investor Relations. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Google (Tech company) - Partner Manager, Private Equity and Venture Capital. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Sagard (Alternative asset manager) - Head of National Accounts, Private Wealth Solutions. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.