AGM Alts Weekly | 2.23.25: The $1T RIA

AGM Alts Weekly #91: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Alto enables investors to use tax-advantaged IRA capital to invest in alternatives like private equity, venture capital, real estate, and crypto.

We work with asset managers, wealth managers, VC funds, fintechs, and financial advisors to help them access the $11+ trillion IRA market. Our platform streamlines legal, administrative, and compliance tasks, ensuring transparency and enabling more efficient capital raise.

Good afternoon from Washington, DC, where I’m back from a week of meetings and podcast recordings in NYC.

The $1T RIA

Earlier this week, Pathstone CEO Matt Fleissig told Citywire: “Let’s be the $1T RIA.”

Pathstone is far from the only RIA with the goal of reaching the $1T AUM threshold. But the $162B AUM firm certainly seems to be heading in that direction.

Firms like Captrust, Creative Planning, Mariner Wealth, Rockefeller, Cerity Partners, Corient, Fisher Investments, Edelman Financial Engines, and Mercer are but a few of the firms (and very much a non-exhaustive list) that have grown and scaled their business to a size where the $1T figure seems within reach.

And that’s without mentioning the wealth management platforms, like Focus Financial, Hightower, Dynasty, and independent broker-dealers like LPL (which has over $1.7T in assets, including $1.3T in the advisor channel), Osaic, Cetera, and others, that have either reached $1T or are on the path to reach that threshold.

It took almost 40 years for the first alternative asset manager, Blackstone, to cross the $1T AUM threshold.

Is $1T AUM a feasible feat for the large — and growing — RIAs?

For a $1T RIA to emerge, the industry will have to continue to grow in size and scale. To put the RIA industry’s growth in the context of alternative asset management’s growth, the industry had its first $1T AUM firm (Blackstone) when overall industry AUM crossed $14-15T. Now, I’m cognizant that this comparison is somewhat of an apples-to-oranges comparison as allocating to private markets funds and investment strategies is a different sales cycle, decision-making process, growth trajectory of AUM, and portion of capital that would be allocated when compared to the wealth management industry. But thinking about how big the RIA industry has to become to support a $1T RIA is an interesting thought experiment.

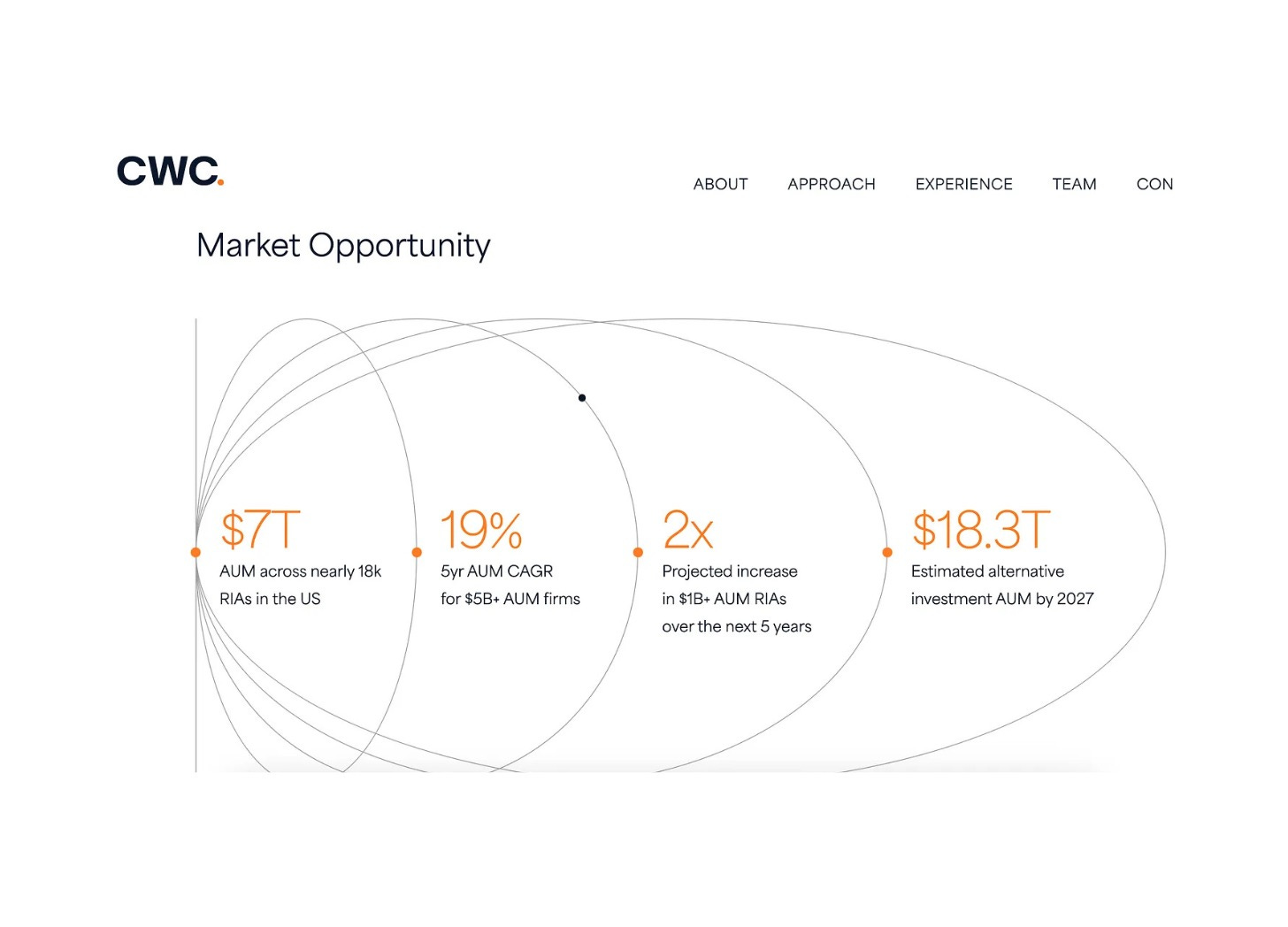

RIA industry AUM, according to a chart by minority RIA investor, Constellation Wealth Capital, illustrates that there’s around $7T in AUM across almost 18,000 RIAs.

If Schwab’s 2024 RIA Benchmarking Study is any indication, it appears that the RIA industry continues to demonstrate impressive growth.

Organic growth has driven AUM growth across the industry, particularly for the largest firms.

But not all RIAs are created equal, at least when it comes to AUM.

Much like the alternative asset management industry, scale matters in RIA-land.

In 2023, 88% of advisors had under $5B in AUM. The remaining 12%? They managed the lion’s share of the industry’s AUM.

A chart from a report by the Investment Adviser Association hammers home the point of where AUM is aggregated in the RIA space: to the largest managers.

Just 1.3% of the industry’s advisors manage 66.1% of the industry’s assets. With an industry comprised of nearly 18,000 RIAs, the long tail is highly fragmented.

A chart from Fidelity illustrates a similar point.

The result? An industry ripe for continued concentration.

A recent 2024 survey from DeVoe & Company suggests that there’s appetite for growth.

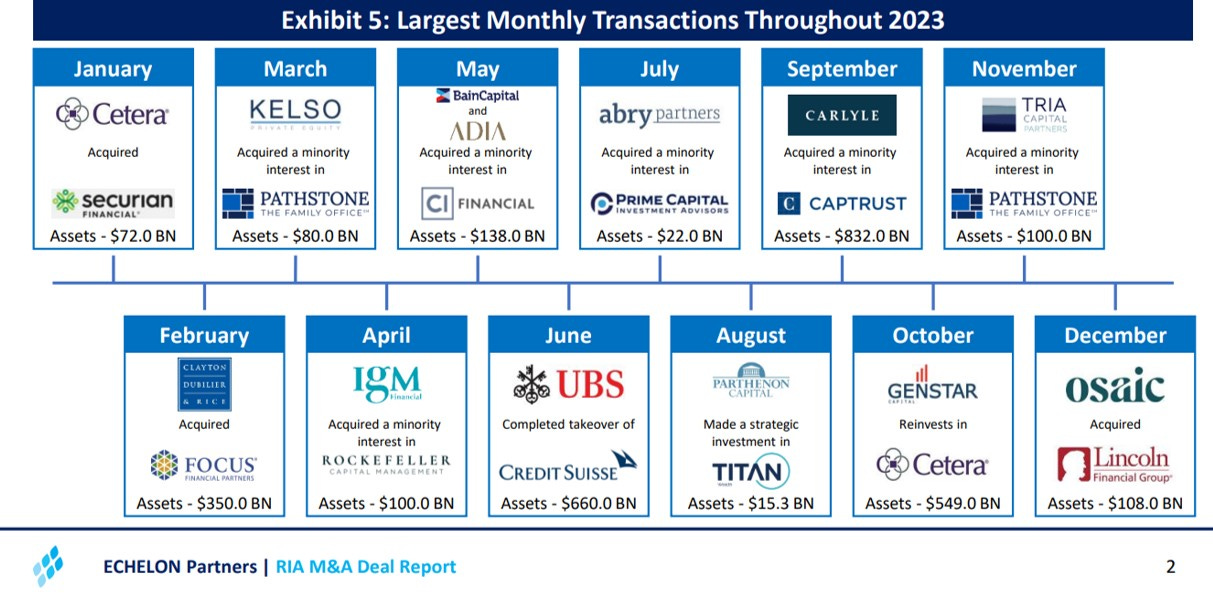

Not surprising in an industry that is increasingly becoming a domain of private equity investment, as a graphic from a 2023 Echelon Partners report illustrates.

If Fleissig’s view on the RIA industry evolution is right, then it might be early days for wealth management consolidation.

Fleissing told Citywire, “this feels like a first or second inning where we’re sitting here today and you’re starting to see RIAs hit a decent size.”

At $162B AUM, Pathstone certainly has room to run, even after its recent acquisition of $45B AUM Hall Capital Partners.

Pathstone’s acquisition of Hall Capital Partners was but one indication that RIA M&A is going from strength to strength.

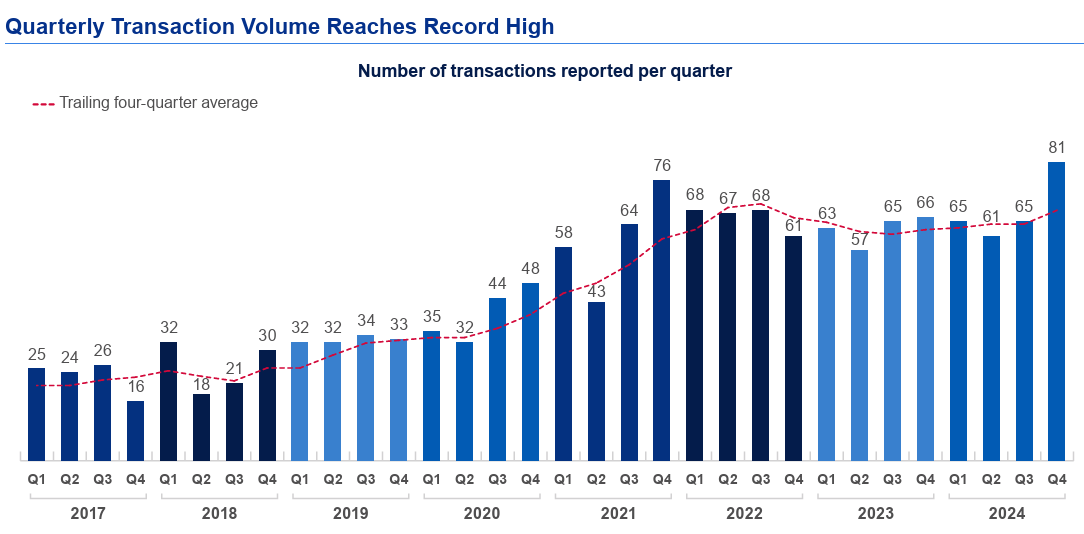

DeVoe & Company’s Q4 2024 report found that quarterly M&A transaction volume hit a record high.

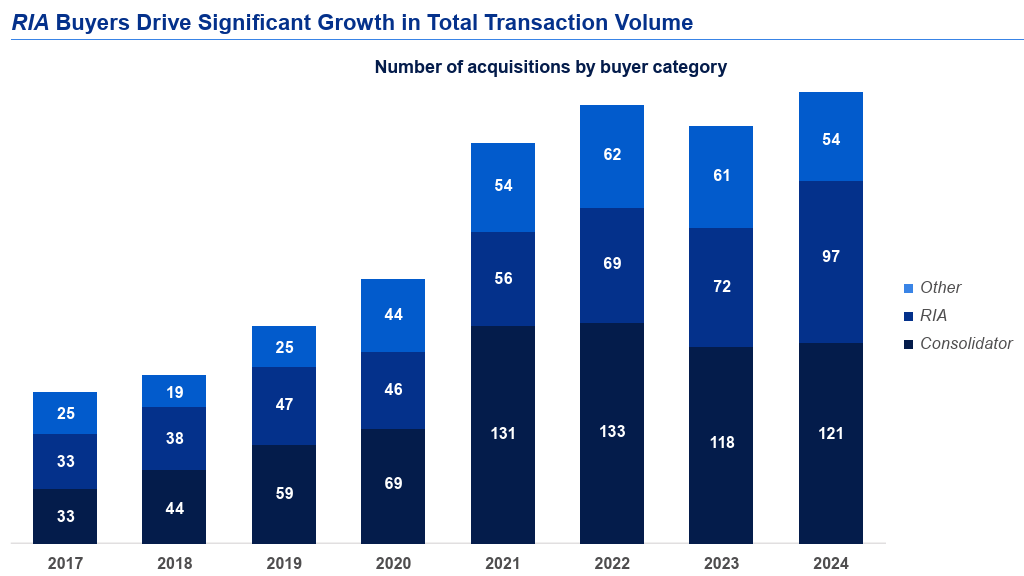

And, often, it was RIAs buying other firms.

RIAs were active buyers of other wealth management firms in 2024, as the below chart from DeVoe & Company illustrates.

Consolidators, which have been more well-capitalized than RIAs, have also been very active buyers, not surprisingly.

The big get bigger

The big are expected to get bigger, too.

Constellation’s graphic above notes that $1B+ RIAs are projected to double in size over the next five years.

A chart from the Investment Adviser Association highlights that to the scaled players go the spoils. This trend was particularly acute in 2023, when firms over $100B in AUM saw the biggest increase in AUM relative to firms of other, smaller sizes.

Some of that growth will come from client acquisition. Some will likely come from organic AUM growth from market performance.

While RIAs have enjoyed a strong equity market and low interest rates over the past decade, the game on the field has changed. The investment world, particularly private markets, has entered a new world order.

Growth in a new world

It’s possible that RIAs can’t rely on investment performance to drive AUM growth as much as they have in years past given current economic and geopolitical uncertainty.

Additional growth could also come from inorganic M&A that can help firms scale quicker. M&A, while not easy to do well and achieve the right cultural fit, provides a growth path for firms with ambition to scale.

In fact, I’d anticipate that the larger RIAs and consolidators will look to be more aggressive with acquisitions, particularly to add firms with deep private markets expertise and capabilities. Cerity Partners and Hightower demonstrated their focus on adding private markets capabilities with their recent acquisitions of Agility and NEPC (Hightower took a majority stake in NPEC), respectively. The interest in acquiring a firm like $6.8B Seven Bridges Advisors, which is co-run by an experienced asset allocator and CIO Ram Lee, as reported by Citywire this week, is one such example.

It’s entirely plausible that private markets isn’t just a nice to have — particularly in a world where public equity returns could be lower than in recent years — but a need to have. Customization and differentiation — particularly in private markets — also become increasingly important features of a wealth management practice that has ambitions to grow and scale.

After all, there’s a correlation (and probably some causation) between wealth management firms that offer more unique, differentiated, and up-market services, like private markets capabilities, and a preponderance of HNW and UHNW clients.

A chart from Schwab’s 2024 RIA Benchmarking Survey illustrates that the largest clients (>$10M in assets) generate an outsized percentage of a firm’s revenue.

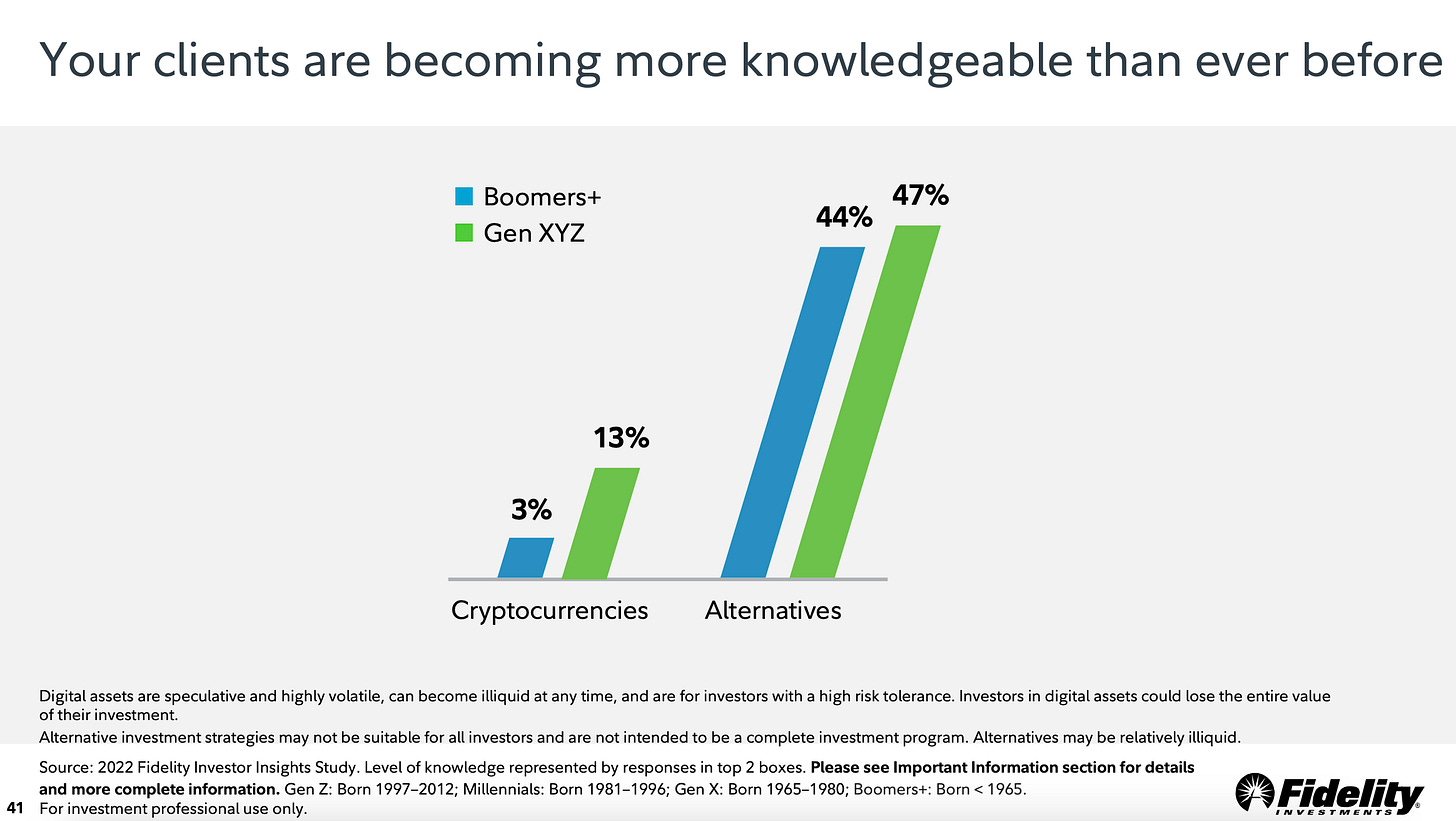

Clients are becoming more knowledgeable about their investing activities — and are demanding more from their advisors. A chart from Fidelity’s Trends in Wealth Management presentation (with data from a 2022 Fidelity Investor Insights Survey) highlights that investors, particularly Gen XYZ, are keen to better understand private markets.

A chart from Hamilton Lane’s 2025 Annual Global Private Wealth Survey hammers home the point.

If a firm wants to be on the growth path to $1T, then it’s critical that they find ways to engage and attract the next generation client. Data from Fidelity illustrates that firms that engage the next generation produce produce more revenue and profits than households that are unengaged.

One way to engage the next generation?

Private markets.

Diversifying away from a bet on the S&P 500

If a bet on the wealth management industry is a bet that’s correlated to the growth of the S&P 500, then it might explain why some wealth managers are looking to diversify into other asset classes and strategies with client AUM.

The below quote from Hamilton Lane’s 2025 Annual Global Private Wealth Survey illuminates some of this advisor and client sentiment.

These factors could perhaps explain why strategies like private credit and infrastructure have been — and continue to be — appealing to the wealth channel.

Hamilton Lane’s survey highlights increased interest in allocating to private infrastructure, private equity, and private credit from advisors in 2025.

Access to private markets offerings can also be good for advisors’ business. It can serve to deepen client relationships and attract new clients, according to advisors that responded to the Hamilton Lane survey.

Private markets capabilities are one area where the scaled RIAs can start to look like their wirehouse peers.

Staffing up private markets capabilities is a trend that’s occurring across many of the larger wealth platforms. The intersection of private markets and wealth management could help to explain why Cerity Partners acquired OCIO Agility and why Hightower acquired NEPC.

What firms like Cerity Partners and Hightower added enable them to provide comprehensive services, particularly in private markets, that begin to rival wirehouse platforms.

And that seems to be where industry veteran and CEO and President of Mariner Wealth Advisors Marty Bicknell thinks this could go.

"In five to 10 years, there will be a handful of truly large independent RIAs that can rival the size of the wirehouses," Bicknell, CEO and president of Mariner Wealth Advisors, told ThinkAdvisor in an interview in 2024.

The path to $1T AUM

So, how can wealth management firms put themselves on the path to $1T AUM?

Acquisitions

Firms with the largest war chests and platforms that have the capabilities for factory line-like M&A sourcing and execution processes are well-positioned to scale their AUM through acquisition.

The chart below could provide some insights into firms that are in a position to scale AUM through acquisition. Many of the firms on the list below have private equity backing, giving them the war chest and post-acquisition integration capabilities to tuck in and repeat.

Going global

Expanding beyond borders can be a way to differentiate. $72B AUM AlTi Global has done just that. And, as AlTi Global CEO Mike Tiedemann said on his recent Alt Goes Mainstream podcast, their global footprint provides them with an advantage when it comes to building relationships with ultra-high-net-worth clients.

UHNW clients ($30M+) represent an outsized portion of the global wealth market by AUM. That figure is expected to rise by 6.6% CAGR through 2028, making this segment of the market attractive to wealth management firms with ambitions to grow.

UHNW clients demand more — both in terms of advanced investment capabilities and services — but they can also generate more revenue due to growth in their AUM and their allocations to private markets.

While the below chart from Fidelity might not provide an apples-to-apples comparison of costs to serve a UHNW client, the illustration proves the point: The top 25% of clients make up an outsized percentage of total revenue for a wealth management firm.

Private markets capabilities and sophistication

Wealth management firms are becoming very evolved in how they interact with private markets, which can help to increase and scale revenues and AUM.

Some firms, like Cerity Partners, have brought OCIO capabilities in house. This feature enables them to provide institutional investment allocation experiences to wealth management clients. It also affords them with the ability to create and structure more bespoke arrangements with private markets managers for the benefit of their clients.

Others, like Cresset Partners, have created their own asset management divisions to enable clients to allocate to bespoke investment products they’ve created. Cresset, which recently rebranded their private markets business into Peakline, has turned Peakline into an independent entity to continue to serve $65B AUM Cresset Asset Management as well as other outside clients. Not only does this structure create a differentiated experience for Cresset clients, but it also serves as a client acquisition tool for Cresset Asset Management as a lead gen function.

Many of the largest wealth management firms have the size, scale, capabilities, and capital to create unique and customized private markets offerings, either with in-house teams or by creating an external but affiliated firm that serves the wealth management client base.

Iconiq is another example of a firm that found a way to create differentiated private markets offerings for their client base, ultimately becoming so successful with the buildout of their private markets capabilities that they parlayed a wealth management business into a 2/20 alternative asset management business that has over $80B AUM (and a GP stake from Blue Owl’s Dyal Capital Partners).

General Catalyst is the next firm to create such a tie-up, recently announcing the creation of GC Wealth, a wealth management firm affiliated with the $35B AUM venture and growth investment business. They’ve incubated GC Wealth with wealth management veteran Dave Breslin, who ran First Republic’s wealth management business until May 2023, and have grown to $2.3B AUM out of the gate. They have an initial client base to choose from: GC Partners, entrepreneurs within the GC network, and LPs that have invested in GC funds.

It’s quite an interesting construction, as the potential flywheel effects from returns generated within the GC ecosystem, whether they be for GC Partners from management fee and carry from their funds or from GC-backed entrepreneurs and portfolio companies, can create a path for that capital to flow to GC Wealth.

The sales pitch to those not yet affiliated with the GC ecosystem is also quite compelling: family offices and HNW investors that want access to venture capital and growth investing can work with GC Wealth and have ready-made access to these hard to access investment strategies.

What GC has done is something that I would imagine is on the mind of alternative asset managers.

GC Wealth has figured out a way to manufacture distribution for its private markets funds.

Alternative asset managers have made investments into wealth management firms in a big way. Will they take the next step and look to acquire or build a wealth management business so that they can manufacture distribution into their funds?

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

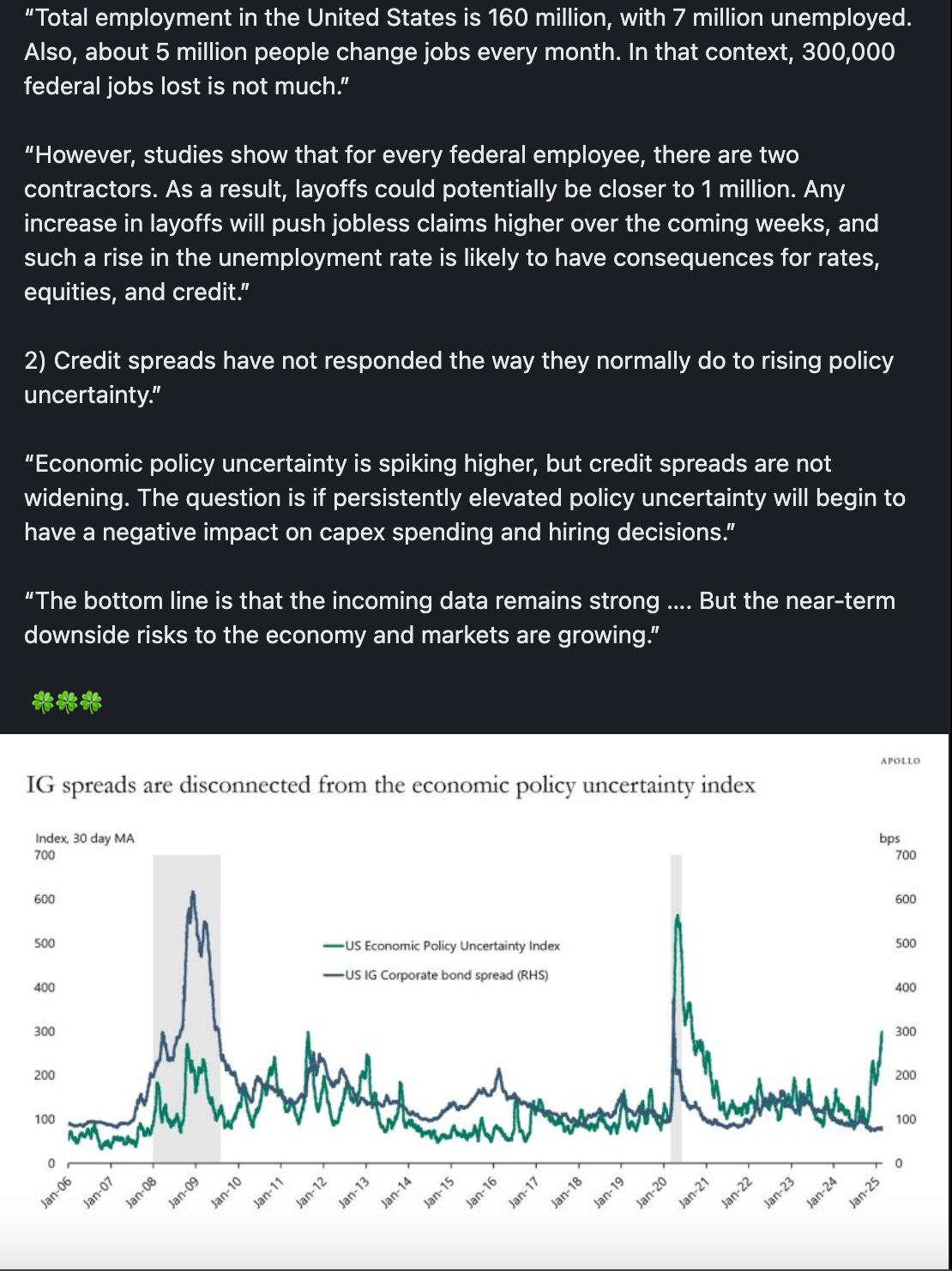

A LinkedIn post by Dave Wald about Apollo Chief Economist Torsten Slok’s recent Daily Spark post about downside risks intensifying.

AGM News of the Week

Articles we are reading

📝 Private equity’s steep path to AI | Madeline Shi, PitchBook

💡 PitchBook’s Madeline Shi discusses how AI is impacting the operations of private equity firms. Many GPs are embracing technology and the application of AI across the investment lifecycle, from pre-investment through to post-investment workflows (more on that below, given fundraising news from 73 Strings, raising $55M led by Goldman Sachs Growth and DiligentIQ, raising $12M from Fintop). Some alternative asset managers believe that it could give them a leg up relative to their peers. GP stakes firm Investcorp’s Tim Osnabrug illuminated on the value of using AI to help them with investment diligence. Investcorp is a customer of DiligentIQ, a GenAI platform founded by former KKR CIO Ed Brandman, to streamline the due diligence process. Onsabrug said that efficiency gains have helped them save meaningful time and resources — and that it could become a competitive advantage going forward. He noted that “firms that do not invest in these capabilities might find themselves disintermediated by those using it to their advantage, either to make better investment decisions or to be a better value-added partner to their portfolio companies.” Onsabrug’s Partner, Ravi Thakur, the COO & GP Development Partner at Investcorp, said that their affiliates are all thinking about how to leverage AI for efficiency gains. “We feel that middle-market GPs in our portfolio, [and] almost every business, [have] to bring and make AI as part of the conversation. Otherwise, there’s a real potential that they’re going to miss out and be put into a less competitive situation,” said Ravi Thakur, the COO & GP Development Partner at ISCG. Some note that larger firms see the benefits of leveraging AI to analyze data and create efficiencies because they have bigger pools of data from which to gain insights, but firms large and small can benefit from streamlining processes with AI.

💸 AGM’s 2/20: AI innovation is an important story in the development of private markets technology. Pre- and post-investment processes are in the process of being transformed and augmented by the use of AI. While private markets is still in the early days of its adoption curve of leveraging technology to improve its workflows and processes, firms are beginning to look for tools that they can leverage to improve efficiencies.

Fundraising rounds completed this week — 73 Strings’ $55M round led by Goldman Sachs Alternatives and DiligentIQ’s $12M round led by Fintop — are emblematic of the interest that private markets firms have in applying AI to pre- and post-investment processes. 73 Strings (note: 73 Strings is a Broadhaven Ventures portfolio company), a financial intelligence platform that uses AI to revolutionize data extraction, monitoring, and valuation for alternative asset managers, raised a $55M round led by Goldman Sachs Alternatives. The round also included some of the industry’s largest alternative asset managers: Blackstone, Golub Capital, and Hamilton Lane. 73 Strings’ AI extraction tool automates much of the document and data extraction to enable quicker and more accurate delivery of portfolio monitoring and valuations for private equity and private credit. The ability to better monitor and track private markets positions and valuations is becoming increasingly important as evergreen and interval funds become an increasing feature of private markets, particularly in private credit. And, over time, better technology could lead to uniformity and standardization with private markets fund performance data, as 73 Strings CEO Yann Magnan discussed on a recent Alt Goes Mainstream podcast.

One of the reasons why improvement in post-investment processes is so critical to the development of private markets is because better, faster, and more accurate / real-time post-investment data, valuations, and portfolio monitoring solutions will help with product innovation and distribution of investment products, such as evergreen structures, to the wealth channel. It’s partly why we’ve focused heavily on investing in critical post-investment infrastructure in private markets at Broadhaven Ventures by partnering with firms like AltExchange (acq. by iCapital), 73 Strings, LemonEdge, DealsPlus, and others.

Alternative asset managers are only beginning to adopt some of these tools, in part because AI is in its (relatively) early stages of development, but as these tools and technology applications become more commonplace, they should have a big impact on a firms’ operations, their client service, their investment decision-making and underwriting, and ultimately, their margins.

📝 Wall Street Is Selling ETFs That Mimic the Private Equity Boom | Vildana Hajric, Bloomberg

💡 Bloomberg’s Vildana Hajric dives into the continued intersection of public and private markets. This time? As Wall Street awaits regulatory approval for the first full-blown private asset ETFs, like the Apollo State Street ETF that will hold private credit investments alongside public credit investments, opportunistic issuers are manufacturing products that look to replicate exposure to the asset class. According to Harjic, a handful of ETF issuers are creating products that mimic private equity exposure by investing in small-cap stocks of companies that are that are similar to those held in buyout vehicles. These new funds don’t claim direct private equity investments but rather are portraying themselves “as a rough approximation to them.” Strategas Senior ETF Strategist Todd Sohn said: “We can’t help but think of these recent launches as Bud Light for PE: watered down and not the real thing, like a true private equity fund.” These funds offer indirect or synthetic exposure based on an index or theoretical investment approach that would be akin to a buyout firm’s investing activities. One example of this type of product creation is the KraneShares Man Buyout Beta Index ETF, which focuses on small and mid-cap firms that have characteristics similar to those in buyout funds. These funds seem to have gained very little traction to date, with the KraneShares ETF only managing $12M of assets to date. One fund has seen strong inflows year-to-date. ERShares Private-Public Crossover ETF (XOVR) has seen $130M of YTD inflows as the fund has apparently been buying shares of SpaceX, which is a private company. Bloomberg Intelligence’s Athanasios Psarofagis said that this signals that “investors want something that actually holds private companies, and XOVR does that the closest, even though it’s not fully private.”

Morningstar’s Head of Client Solutions Ben Johnson shared an important note of caution about products that are trying to replicate private markets exposure, saying that “second-hand, liquid, low-cost exposure to private assets involves trade-offs. The outcomes these funds produce will often be materially different from those delivered by direct investment in a particular corner of private markets. Investors hoping for an A5 wagyu filet might get something more like ground-up hooves.”

💸 AGM’s 2/20: The point made by Morningstar’s Johnson is a good place to start. Investors expecting wagyu filet but ending up being served ground-up hooves is not a positive development for private markets. Product innovation for private markets products is a net good for the industry and for investors looking to participate in private markets. But product innovation must be done in a responsible, thoughtful manner. I fear that certain types of product innovation, like the aforementioned ETF products looking to replicate or mimic exposure to private markets for end investors, could create a square peg, round hole dynamic. Just because a product offers exposure to private markets does not mean that it is an appropriate way for investors to access private markets.

To create a private markets ecosystem that benefits all investors, notwithstanding of the quantum of capital that they have to invest in private markets, means going back to first principles. What is the intent of a specific product? What is the purpose of a specific product? What is the goal — and what is the risk?

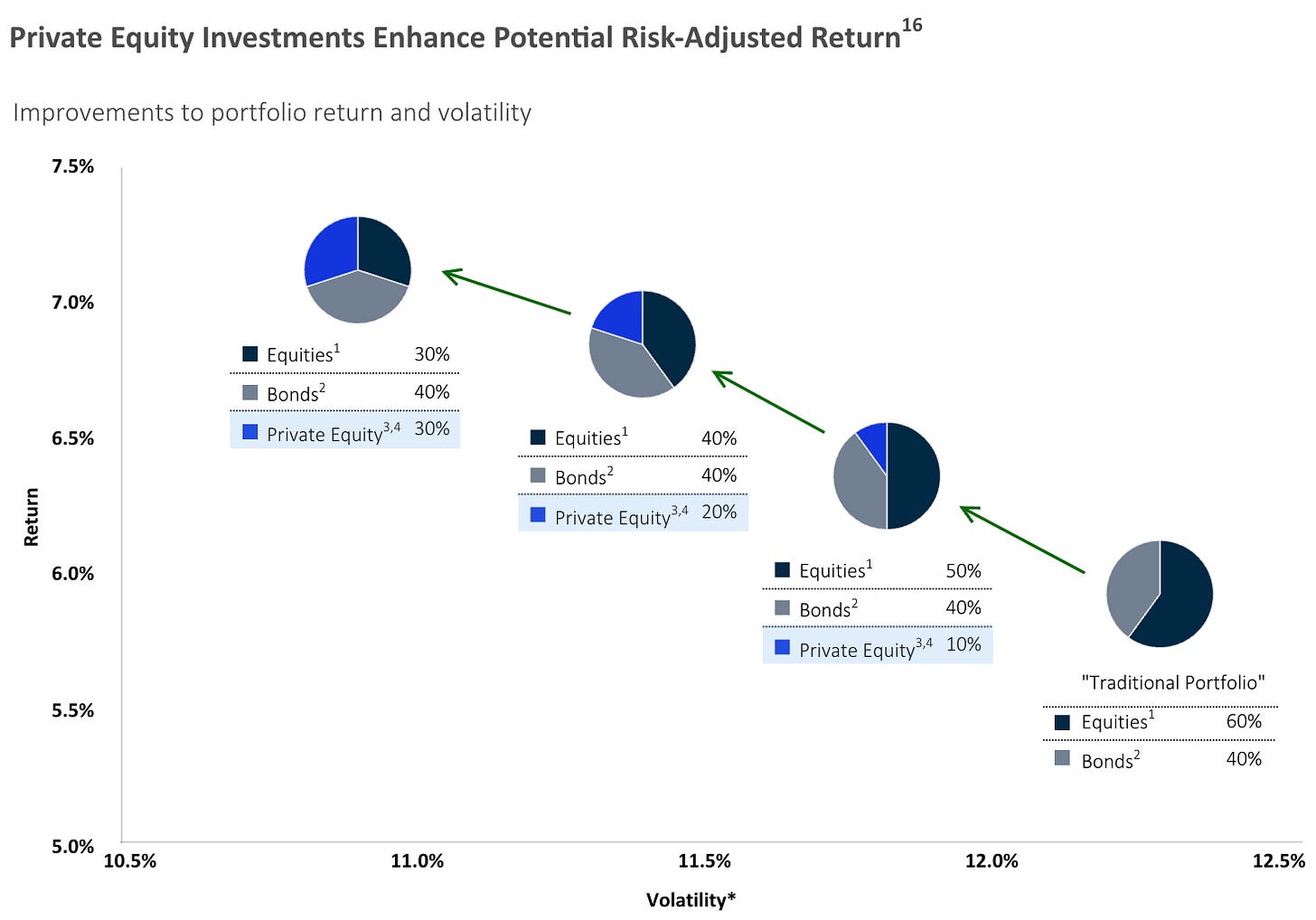

Private markets — when done right — can be additive to a portfolio. It can help improve both returns and volatility, as the below chart from Adams Street’s newly launched Advisor Academy illustrates.

Some of the product innovation in private markets can be chalked up as a positive. Evergreen funds, products that firms like Partners Group have been constructing and managing for over 20 years, can provide a solution to many investors that are looking for private markets exposures — and do so at low investment minimums (note: provided that investors have the appropriate accreditation status).

Evergreen funds are not for everyone — for a myriad of reasons. And evergreen funds are not a panacea. There are advantages to investors choosing to allocate to closed-end fund structures, too. But, as the below chart from Partners Group illustrates, evergreen funds can streamline many of the pre- and post-investment processes for investors and create a simpler way for investors to gain access to private markets, which is particularly relevant for investors newer to private markets.

Evergreen structures are one way that investors can access private markets. While they are limited to investors — or their advisors — that have the requisite accreditation status and access, there are other avenues for investors to access exposure to private markets.

Exposure to private markets can be done via public markets. Hg Capital created a publicly traded investment trust, HgCapital Trust (HgT), that trades on the London Stock Exchange. This investment trust offers investors exposure to the underlying funds and portfolio companies in $70B AUM alternative asset manager Hg Capital. Others, like HarbourVest, have done something similar.

Other publicly listed vehicles, such as Goldman Sachs’ Petershill and P10, are two different constructs (which trade in their own respective geographies — Petershill in London on the LSE and P10 in New York on the NYSE) that have been created to provide exposure to a portfolio of ownership stakes in alternative asset managers.

And then there’s the ability to buy equity of the publicly traded alternative asset managers, such as Blackstone, Apollo, KKR, Ares, Blue Owl, EQT, Carlyle, TPG, Partners Group, CVC, Hamilton Lane, StepStone Group, and others. Each firm has its own features — and there are investment cases around each of them given their core competencies, asset class focus, investment performance, and fundraising capabilities.

There are many ways to gain exposure to private markets — or the trends associated with the growth of private markets. The key, both for investors and those manufacturing products, is that investors have a good experience with their investments in and around private markets, so product construction, brand, and track record will all be critical.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Senior Video Producer, SVP - Marketing. Click here to learn more.

🔍 Alto (Self Directed IRA investment platform) - Investor Sales Associate. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Investor Relations Professional. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager– Senior Vice President. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click hear to learn more.

🔍 BlackRock (Asset manager) - Aladdin Wealth Tech - Vice President, Implementation Manager. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Hightower - Crest Capital Advisors (Wealth manager) - Private Wealth Associate - Crest Capital Advisors. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Edward Jones (Wealth manager) - Director, Alternative Investment Strategy. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Keith Jones, Senior Managing Director, Global Head of Alternative Investments Product at Nuveen live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Wow - comprehensive post, thanks Michael. Looking forward to more.