AGM Alts Weekly | 5.25.25: Evergreen questions

AGM Alts Weekly #104: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings and podcast recordings in NYC and Miami.

I traveled to Miami mid-week for a live podcast and dinner with attendees from the wealth channel that EQT’s Peter Aliprantis, Amy Appicelli, Ashley Scipione, Winston Newton, and I co-hosted at the Soho Beach House in Miami. Peter is a veteran of both private markets and the wealth channel, as he shared on his recent Alt Goes Mainstream podcast, so it’s always fascinating to hear his views on how the wealth channel can navigate private markets.

Apparently, Peter and I weren’t the only ones in Miami this week with the wealth channel on our minds.

This week, Miami-based Orlando Bravo, Managing Partner of $179B AUM Thoma Bravo, shared his views on the wealth channel’s participation in private markets in an interview with the Financial Times’ Alexandra Heal.

Bravo made some very important points about the industry’s focus on private wealth.

He expressed concerned that individual investors may end up investing into companies that private equity firms are having trouble exiting, saying that “retail could end up saving these companies that people cannot sell.” Bravo was apparently referring to the growth in popularity of continuation vehicles — and evergreen vehicles, some of which have been buying stakes in portfolio companies out of prior funds.

What are evergreens investing in?

Data from Campbell Lutyens found that evergreen vehicles paid, on average, 4% more last year for fund stakes than traditional buyers. The Financial Times reported earlier this month that evergreen funds were ramping up deal activity in recent months in order to deploy capital that was raised. In a May 11 Financial Times article, StepStone Private Wealth CEO Bob Long noted that the firm was getting “the same deals, the same price.”

Evergreen funds are increasingly becoming a popular structure for investors, particularly those in the wealth channel, to access private markets.

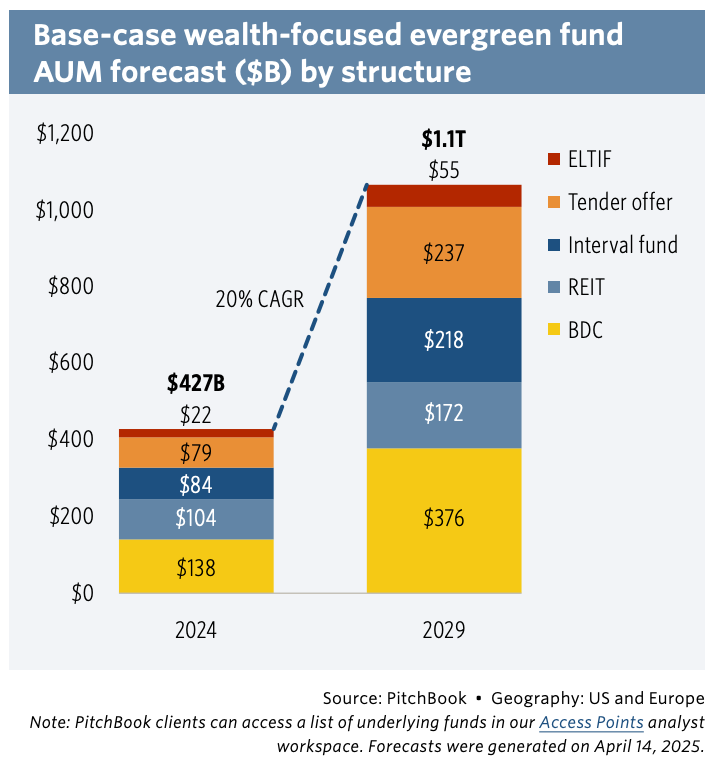

A recent report by PitchBook, 2029 Private Markets Horizons, highlights the growth of evergreen structures.

PitchBook estimates that around $2.7T is now managed across evergreen funds. That number is projected to reach $4.4T by 2029.

PitchBook expects tender offer and interval funds, two of the main evergreen fund structures built for the wealth channel, to grow significantly in the coming years.

According to PitchBook, new evergreen private equity funds can be “seeded with mature portfolios acquired through secondaries transactions.” This type of investing activity may occur at the outset of the launch of an evergreen fund, in part because the structure provides for dollars to be put to work immediately.

While Bravo expressed concern about the wealth channel’s increased adoption of private equity, he also noted that Thoma Bravo did not want to be “left out” of the “incredible flows” of capital from individual investors, saying that “there’s only so much money from the institutional community that you can access.”

If we unpack Bravo’s comments, he’s sounding an alarm for the private equity industry, but he’s also acknowledging the importance of the wealth channel in the continued growth of private markets.

By saying that Thoma Bravo does not want to be “left out” of working with wealth, Bravo is recognizing that the wealth channel is both a key LP and one that his firm will likely work with in the future.

He’s also sending an important message to the industry: the wealth channel will need to have a good experience with its private markets investments if they are to continue to invest in these types of assets and strategies.

Bravo’s commentary gives rise to a number of important points about working with the wealth channel.

The right product for the right investor at the right time, delivered in the right way

For the wealth channel to have a good experience with private markets, the right product must be delivered for the investor — at the right time and delivered through the right structure.

This is especially critical for the investors who are allocating to private markets for the first time.

Investor experience matters, said EQT’s Peter Aliprantis this week in Miami. It’s important that investors receive both returns and diversification, as well as an experience that is seamless and low friction.

Product structure will matter — critically so depending on the type of investor that is allocating to the product.

Peter talked about the importance of evergreen structures and model portfolios opening up private markets to an entirely new set of investors within the wealth channel.

There are many investors in the wealth channel where $250,000 or $500,000 of exposure to private markets makes sense. This type of exposure to private markets might not be best achieved through an investment into a single fund or strategy but rather into an evergreen structure that combines strategies across a firm’s multi-strategy platform or into a model portfolio that enables an advisor to make a single allocation decision across a set of strategies and rebalance both private and public market exposures accordingly.

KKR’s recent whitepaper, “The Art of Learning,” highlighted the benefits of a more diversified global portfolio, particularly in the current economic and geopolitical regime.

KKR noted that the addition of private markets to asset allocation can enhance inflation protection and returns, as the above and below charts illustrate.

A model portfolio, if built in a certain way, can incorporate the different private markets strategies that help build a portfolio for investors that delivers diversification and inflation protection while also potentially enhancing returns, as KKR’s chart illustrates.

I discussed the importance of delivering the right product for the right investor at the right time delivered in the right way on the recent Capital Allocators podcast I did with Ted Seides.

Many firms are taking thoughtful approaches about how to deliver products for different investors in the wealth channel. They are thinking hard about whether or not they should even be in certain segments of the wealth channel — which is the right way to approach working with the space.

Wealth is not monolithic, as I discussed in the 10.13.24 AGM Alts Weekly.

Some firms probably shouldn’t work with the wealth channel, even if it’s an opportunity to expand the LP base beyond institutional investors. To work with certain segments within the wealth channel, an evergreen fund structure might be required.

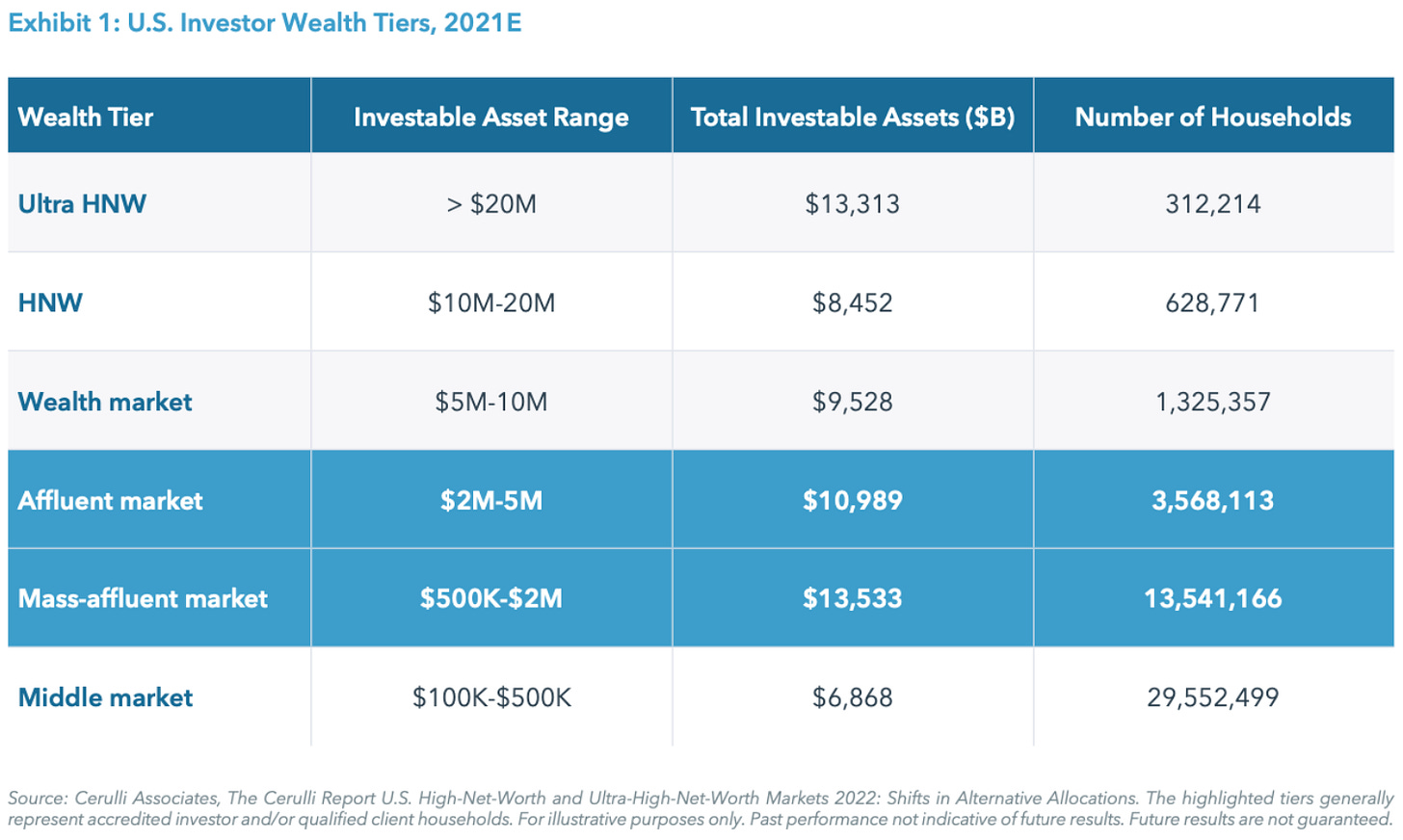

There’s a lot to play for, as I wrote in the 1.14.24 AGM Alts Weekly, where I highlighted a report by Hamilton Lane and iCapital that outlined why “The Future is Evergreen.” The 17 million affluent and mass-affluent households in the US alone were estimated to hold $24.5T in 2021.

Evergreen structures might be the right fit for these wealth tiers. But, only firms of a certain size — with a certain amount of dealflow and resources — are well-positioned to create and manage evergreen structures.

Flowing with deals

Funds must have enough dealflow to be able to source ample investments for evergreen structures. KKR’s Alisa Wood discussed the nuances of managing evergreen structures on her recent Alt Goes Mainstream podcast. She also unpacked why KKR created the KKR Conglomerate LLC, its operating company structure.

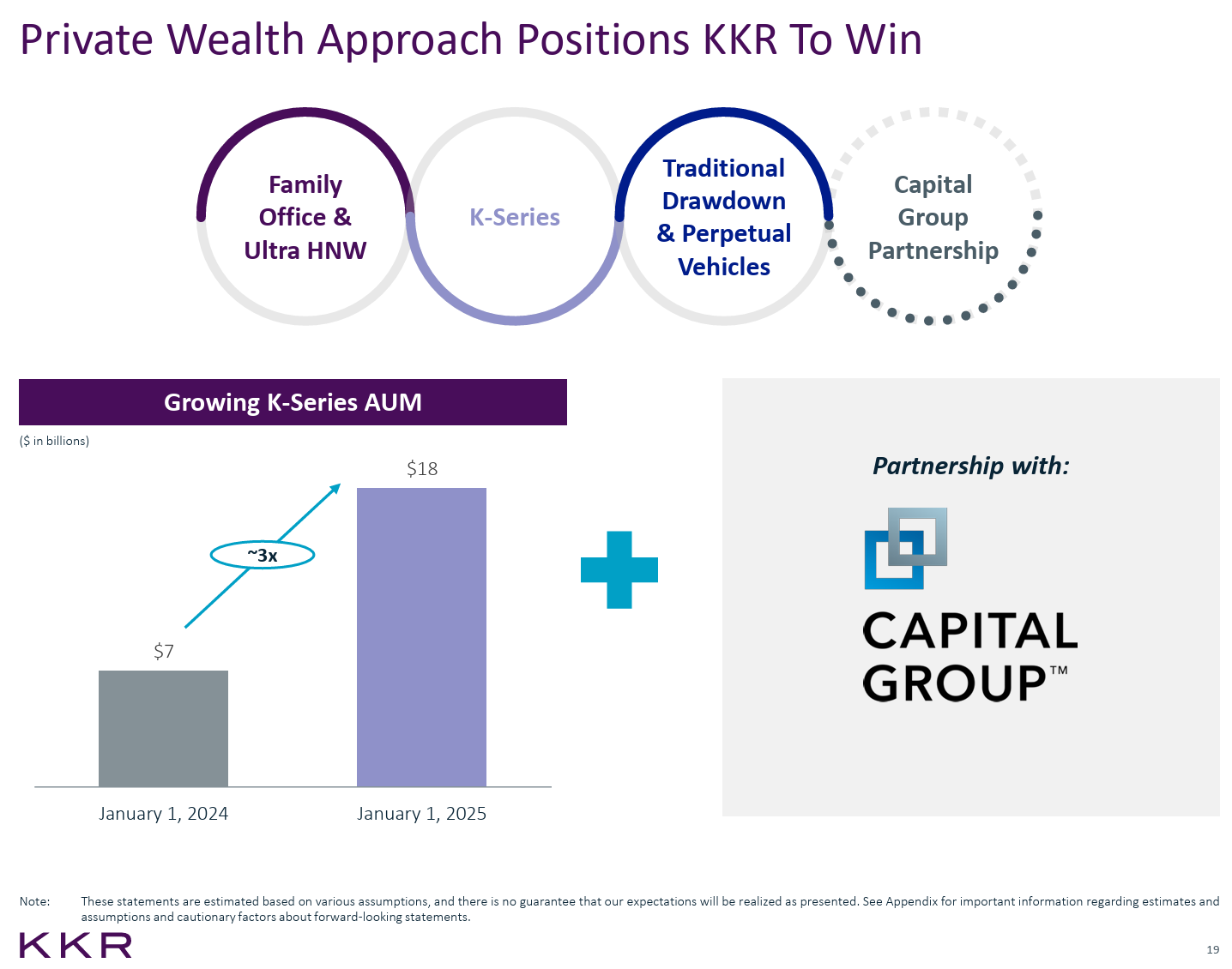

KKR was an innovator in the evergreen space, launching the K-Series Funds, including KKR Private Equity Conglomerate LLC (“K-PEC”).

Why is the K-PEC fund an LLC? The company is structured as an operating company that was “formed to acquire, own, and control portfolio companies.”

K-Series, which also includes other strategies beyond K-PEC in private equity to span categories like infrastructure, has been successful in attracting capital from the wealth channel.

Since January 1, 2024, K-Series AUM almost tripled, from $7B to $18B by January 2025.

Other firms, like EQT, are following suit.

EQT CEO Christian Sinding discussed in March 2024 at EQT’s Capital Markets Day about creating a “structure that is evergreen, across asset classes, even.” Sinding noted that these fund structures would enable EQT to hold assets they want to retain ownership of beyond the typical fund life of a drawdown private equity vehicle.

EQT’s Co-Founder and Chairman Conni Johnson echoed Sinding’s comments, saying there’s value in not being “forced to exit assets we know we can grow and make better in the long run.”

For a firm that is focused on being an active owner and taking a long-term approach, an operating company that enables a portfolio company to compound its growth in an indefinite life structure could make sense.

As the below chart from a May 22 EQT’s Capital Markets Event in London illustrates, EQT’s companies, particularly in their Private Capital (private equity) unit, have experienced consistent and impressive growth.

Sales and margin expansion have represented the majority of the growth from EQT’s portfolio, another reason why an evergreen structure could make sense for certain investments.

A year later following Sinding’s comment at the March 2024 Capital Markets Day, EQT has brought the vision that Sinding and Johnson referenced to life. The firm has created a US private equity operating company, EQPE, led by Gautam Nadella that will invest alongside the firm’s core private market strategies, putting wealth clients side by side with EQT’s institutional investor base, according to an article recently written by Nadella.

The other aspect of creating the right structure for the wealth channel is that firms should endeavor to provide investors with the same investment as institutional investors are receiving.

Blue Owl has made the concept of treating institutional investors and individual investors similarly a core tenet of its DNA from the outset, dating back to when the firm started as Owl Rock. Co-CEO Marc Lipschultz discussed the firm’s dedication to delivering the same investor experience for the wealth channel as its institutional investors on his recent Alt Goes Mainstream podcast and Co-CEO Doug Ostrover did the same on a 2021 episode of Capital Allocators.

Funds also must have enough resources with a wealth solutions team across distribution, marketing, product strategy, operations, and fund servicing to deliver the end-to-end experience across continuous education, seamless subscription, turnkey investor reporting, and investor relations.

Building out a wealth business requires meaningful investment in people, process, and product. It’s not for everyone — and that’s ok.

Education is critical

EQT’s Aliprantis mentioned the importance of education multiple times in our conversation on Thursday.

Aliprantis’ sentiment has been — and continues to be — echoed by many throughout the industry. Education is a critical component to helping the wealth channel understand private markets and gain an understanding of both the merits and risks of adding private markets to a portfolio.

Many of the industry’s largest firms across both traditional and alternative asset management have adopted the framework that education comes before allocation.

Education also can lead to allocation. That’s perhaps why many firms have invested so heavily in education.

While certain firms may end up being relative winners when it comes to raising capital from the wealth channel, it’s worth noting that there is an element of rising tides lift all boats. The wealth channel market is so underpenetrated at present that everyone can win. This feature of the current market makes it all the more important that firms focus heavily on education and creating and structuring high-quality product structures and investment experiences so that investors win, too.

Evergreens shouldn’t just be for “continuation vehicle” activity

Bravo made an important point this week: that evergreen funds should not be reserved solely for continuation vehicle activity.

Apparently, evergreen structures aren’t only the domain of private equity assets that firms cannot exit or sell to secondaries funds.

As the below chart in a Citywire article by XA’s Kim Flynn illustrates, credit appears to hold the largest share of AUM in evergreen structures.

In private equity, there is likely an element of secondary buying occurring with evergreen funds. Part of this could be structural: new evergreen structures need to be seeded with assets so the capital raised is put to work immediately.

This structure can create some misalignment of incentives if not done properly. Funds may look to put capital to work to avoid drag on IRR and to fulfill the stated promise of immediately compounding capital.

But that shouldn’t mean buying assets that a firm’s closed-end fund structure needs to sell to generate liquidity.

Yes, private equity is going through some structural challenges, particularly as it pertains to institutional investors.

A recent paper, “Allocation Conundrum,” by Goldman Sachs’ Juliana Hadas, Daniel Murphy, and James Gelfer highlighted the “denominator effect” that has plagued many institutional investors. Swings in public market performance — and increased volatility — have made investors “mechanically over/underweight to private markets.” This feature has made it more difficult for institutional investors to allocate to private markets in recent years, in large part because the past few years have not delivered distributions to institutional investors.

Bain & Company’s Global Private Equity Report 2025 highlighted some of the challenges that the industry is facing with distributions.

As I discussed in the 3.9.25 AGM Alts Weekly, distributions have slowed in the current wave of private equity.

2022 and 2023 proved to be tough years for distributions. Distributions ground to a halt in recent years, with the ratio of distributions to contributions coming in at 0.8 in both 2022 and 2023.

Many firms — and LPs — are searching for exits.

Could evergreen funds be a source of liquidity for funds and their (mainly) institutional LPs? Perhaps so, in theory. And exposure to mature assets could make sense for certain components of an evergreen private equity fund portfolio for investors. But that wouldn’t necessarily be a good thing for new wealth channel investors coming into private markets, unless the assets are high-quality and are projected to grow at a rate commensurate with the return hurdles that evergreen private equity funds are promising to provide.

Bravo’s words might prove prescient at a time when the wealth channel is increasing its investing activity into evergreen funds.

But it’s also worth zooming out to recognize that evergreen structures are — and appear to project to be — a small portion of overall private equity AUM.

PitchBook’s Janelle Bradley cited research from PitchBook’s 2029 Private Markets Horizons report, which illustrated in the below chart that drawdown funds will still represent the majority of PE AUM.

Wealth channel-focused evergreen funds appear to certainly grow in size, but they will still pale in comparison to drawdown funds.

Now, evergreen structures may be the main — and, in some cases, the only — way for certain segments of the wealth channel to access private equity exposure. So, Bravo’s points should resonate with managers and wealth channel allocators. But evergreen funds should only consume a portion of private equity AUM, even with its rapid growth.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM Post of the Week

UBS released its 2025 Global Family Office Report. The Report included a breakdown of expected asset allocation for family offices for 2025. Private equity exposure is expected to be reduced while developed market public equities and private credit are expected to see increases from 2024.

AGM News of the Week

Articles we are reading

📝 Private market funds battling to get ‘shelf’ space | Melanie Tringham, FT Adviser

💡FT Adviser’s Melanie Tringham writes about the battle for “shelf space” on private bank and wealth management platforms. Asset managers are in the midst of an intense fight to be selected by private banks and wealth managers. StepStone Private Wealth CEO Bob Long noted that there is real competition to be chosen by a bank or wealth management platform: “Almost all significant wealth management firms have increased their focus on private markets over the last few years. When we go to a private bank, they are likely to have only a few that they are particularly comfortable with.”

The industry’s largest private banks and wealth management platforms have been the recipients of pitches from asset managers that are looking to distribute their private markets products through this channel. Wealth manager RBC Brewin Dolphin Head of Global Manager Research in Europe Shakhista Mukhamedova highlighted that they are being discerning when it comes to evaluating pitches, in part because of the need that many asset managers have for liquidity: “We are obviously aware that pension funds have been selling private markets, and we know there’s a big, big need for liquidity in private markets within asset managers, that means we have to be more careful [when] we select.”

Mukhamedova noted that the firm looks for performance over various market cycles and examines their philosophy and process when choosing a fund for its platform, which is available to high-net-worth and ultra-high-net-worth investors.

Wealth Club, a private markets platform for individual investors founded by former Hargreaves Lansdown Director Alex Davies, has curated a menu of fund managers for its customers. Wealth Club’s research team, which is comprised of five diligence professionals, looks for track records and years of outperformance. Davies noted that “we have Hg and they consistently deliver fantastic performance — they will specialise in different areas and that’s what the client is investing in.”

Wealth Club has “got 10 funds from eight managers. Some of these are very big funds and they do their diligence on us as well as we do our diligence on them,” remarked Davies.

Wealth Club, which currently has 13,000 clients, currently has £28M invested in private markets funds.

💸 AGM’s 2/20: Asset managers face a competitive market to win shelf space on a private bank or wealth management platform. There are only a limited number of spots on each platform, making it a challenge for asset managers to win coveted space. And certain firms are more likely to have success than others. Firms either need to be “really big or really unique,” as I said on the Capital Allocators podcast. Wealth Club’s Alex Davies echoed this sentiment in his quote above. Firms need to deliver “fantastic performance,” and, in the case of Hg, one of the managers on Wealth Club’s platform, “they will specialise in different areas.”

While there’s no silver bullet to gaining admission to a bank or wealth management platform’s menu, there are ways for managers to win:

Build the relationship: Managers that are able to build the relationship with private banks and wealth management platforms are more likely to tilt their odds in favor of success. Firms that already have long track records and recognizable brands are in a better position, too. The incentive in wealth management is to help clients preserve wealth. Uncovering the new fund that has the potential to generate outsized returns but also represents meaningful risk is often not what wealth managers are focused on. Therefore, it’s the funds that have both strong track records and recognizable brands that will likely win the day with wealth managers.

Brand: Brand matters. That’s why many of the industry’s largest firms have invested so heavily in building their brand, as I wrote about in the 8.25.24 AGM Alts Weekly. A recognizable brand resonates with both wealth managers and end clients. While there are many other reasons why a gatekeeper will choose a fund to put on its platform, brand certainly doesn’t hurt its chances.

Product: Asset managers need to be able to productize for the wealth channel. That will, in many cases, mean creating evergreen structures. Only certain firms have the resources and platform to build and manage these structures effectively, as I discussed in the piece above. Wealth platforms will look for this capability within managers. That’s also why we are starting to see — and will continue to see — partnerships between managers and a race to be in model portfolios, particularly for firms that are slightly smaller in size and scale. The largest managers have the ability to create this type of exposure captive within their own platform, perhaps across strategies or stages. But not many firms have this capability. So managers that are sub-scale relative to the industry’s largest firms will need to figure out where and how to work with the wealth channel and pick their spots.

Coverage: Gatekeepers will look to see how much coverage a firm can provide. Does the asset manager have the boots on the ground to effectively reach and educate the advisors in its ecosystem? Once again, the largest firms are best equipped to do this at scale. Many of these firms have built out distribution and marketing teams that can cover wealth platforms either regionally or in a channelized structure. This feature could also make traditional asset managers either very attractive partners for alternative asset managers, since they have the distribution reach in the wealth channel, or the partner of choice for wealth platforms due to existing relationships and historical brand recognition.

📝 The Art of Learning | Henry McVey, David McNellis, Aidan Corcoran, Changchun Hua, Kristopher Novell, Brian Leung, Rebecca Ramsey, Rachel Li, Ezra Max, Bola Okunade, Asim Ali, Miguel Montoya, Allen Liu, KKR

💡KKR’s Global Macro and Asset Allocation team shared a fantastic report on asset allocation strategies based on recent macro developments, such as “Liberation Day,” and its effects on private markets. KKR makes sense of the current data and what this means in the context of the broader “Regime Change” thesis that the firm has shared in recent years.

KKR’s “Regime Change” thesis, which was first laid out as the world exited Covid, is driven by four factors:

Heightened geopolitical competition.

Bigger fiscal deficits.

A messy energy transition.

Stickier inflation.

KKR notes that one of the biggest changes in this “regime change” is that “government bonds are no longer fulfilling their role as the ‘shock-absorbers’ in a traditional portfolio.”

What does this mean for asset allocation?

KKR shares the view that investors might look to diversify out of the 60/40.

KKR also notes that private equity tends to outperform in weaker equity markets.

Another interesting perspective to note?

KKR discussed the shifting geopolitical landscape. The team wrote:

Of the factors mentioned above, the geopolitical factor has been the most amplified of late. As my colleagues General (Retired) David Petraeus and Vance Serchuk remind me often, we have moved from an era of benign globalization to one of great power competition. Increasingly in this world, politics is driving economics, and there is a blurring of capital markets policy and national security policy as cross border barriers to the flow of capital, data, technology, and people rise. Seen through this lens, key milestones such as Brexit and now ‘Liberation Day’ represent just the latest ‘textbook’ examples of the convergence that the KKR Global Institute has been suggesting for some time.

This is a profound statement — and one that is critically important to both asset managers and allocators. In today’s world, being a good investor doesn’t just mean understanding financial statements. It also means understanding geopolitics and the impacts that national security policy and economic policy is having on capital markets policy.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 KKR (Alternative asset manager) - Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Strategy & Corporate Development Associate. Click here to learn more.

🔍 Franklin Templeton (Asset manager) - Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

🔍 BlackRock (Asset manager) - Global Head of Product Strategy, Private Market Solutions - Managing Director. Click here to learn more.

🔍 Brookfield (Alternative asset manager) - SVP - GCG Head of Content Strategy. Click here to learn more.

🔍 Vista Equity Partners (Alternative asset manager) - Associate, Business Operations (Private Wealth). Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - Vice President. Click here to learn more.

🔍 Arcesium (Private markets technology company) - SVP Business Development, Private Markets. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - SVP, Business Development. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Arcesium’s Private Markets Head Cesar Estrada discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch GeoWealth President & COO Jack Hannah and iCapital SVP, Partnerships Michael Doniger discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Goldman Sachs’ Managing Director, Global Head of Alternatives, Third Party Wealth Kyle Kniffen discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Fortress Investment Group Managing Director & Co-Head of Private Wealth Solutions Adam Bobker discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch Constellation Wealth Capital President & Managing Partner Karl Heckenberg on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to Ted Seides, Founder of Capital Allocators, and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a Capital Allocators mini-series on Private Wealth. Listen here.

🎥 Watch BlackRock Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business Jaime Magyera and iCapital Chairman & CEO Lawrence Calcano discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch EQT Partner & Head of Private Wealth Americas Peter Aliprantis discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch KKR Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) Alisa Wood discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.