AGM Alts Weekly | 6.8.25: Spinning tracks at SuperReturn

AGM Alts Weekly #106: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good afternoon from London. Last week, the industry descended on Berlin for SuperReturn to take stock of the current state of private equity and look to the year ahead — and fundraise (including in log cabins turned meeting huts lined up on the street outside of the InterContinental).

On Monday, I chaired SuperReturn’s Private Wealth Summit, as well as moderated the panel, “The rise of semi-liquid fund structures: opportunities and risks for investors” with an experienced and thoughtful panel that included Markus Egloff from KKR, Diana Celotto from UBS, Boris Maeder from Coller Capital, Jose Luis Gonzalez Pastor from Neuberger Berman.

The panel artfully covered the why and the how of evergreen funds — and made some very important points about why definitions and words matter in private markets.

The launch of the Private Wealth Summit at SuperReturn, a conference that has historically been focused on bringing together the industry’s largest institutional allocators with the industry’s biggest alternative asset managers, highlights the continuing trend of the private wealth channel as a new “institutional LP” (along with insurance companies, as Lincoln Financial’s CIO Jayson Bronchetti discussed in this week’s Alt Goes Mainstream podcast).

Private wealth was present in both the conference agenda and in a number of conversations and interviews on the ground. It’s inclusion in the SuperReturn agenda is emblematic of its importance as a strategic imperative for the business of asset management.

A symphony of meetings, music, and musings

SuperReturn was a whirlwind. Attendees rushed from meeting to meeting — onsite at the conference, at the nearby hotels, where hotel rooms were rented out and repurposed into meeting rooms, and even outside the event venue at the InterContinental.

The frenetic, non-stop stream of meetings did not end as day turned to dusk. In fact, it was quite the contrary.

Events were aplenty around the city, with only so many nights to match the number of events held by various asset managers, banks, and service providers.

Music continued to be a theme of the conference — both on stage and at the afterparties.

Bono, who is a Co-Founder of The Rise Fund and Rise Climate, a fund that is part of TPG’s investment platform, shared the stage with TPG’s Founding Partner and Executive Chairman Jim Coulter to recount the rise of its impact-focused fund to over $28B in AUM and 80 active portfolio companies across 80 countries.

Evercore, whose party always seems to feature a famous singer, had Melanie C, also known as “Sporty Spice” of the Spice Girls, spin tracks as a DJ at Evercore’s annual “white party.”

Speaking of spinning tracks, last year’s AGM postcard from SuperReturn wondered if private equity had gone all Pete Tong.

Last year, my newsletter reflected on the sober and realistic tone of 2024’s SuperReturn as the industry grappled with a lack of liquidity and fundraising headwinds.

These trends have far from abated this year. And that certainly loomed large over the mood at SuperReturn.

But there was optimism in certain areas — and firms talked about their focus on emerging trends and regions, as Apollo’s President Jim Zelter spoke with Bloomberg about the firm’s excitement about Europe, noting that they plan to invest $100B in the region over the next 10 years.

$1.5T AUM asset manager Franklin Templeton also announced its acquisition of €5B European private credit firm Apera Asset Management, growing the firm’s global alternative credit AUM to $87B and the firm’s total pro-forma alternative asset AUM would grow to approximately $260B in a bid to continue its European expansion following its acquisition of Alcentra in 2022.

Vista CEO Robert Smith said he expects AI to have a marked impact on knowledge workers, telling the SuperReturn audience that “We think that next year, 40% of the people at this conference will have an AI agent and the remaining 60% will be looking for work.”

AGM spinning tracks, SuperReturn EP 💽

After last year’s SuperReturn, I said that I was no Pete Tong, but I did think it would be fitting (and fun) to spin some tracks from my Spotify Playlist to match themes that were discussed in Berlin this week at SuperReturn.

So, without further ado, AGM is back spinning tracks about themes and takeaways that highlighted this year’s SuperReturn, but with a twist. Following my opening set, I’ve invited a number of guest DJs — from some of the industry’s leading private markets firms — to share their takeaways from SuperReturn and the state of the industry through the lens of music.

What type of castle do you want to build?

Asset managers find themselves at a crossroads. Who are they? Who do they want to be?

How do they “design [their own world]” and “build up castles in the sky and in the sand” as Paul Kalkbrenner and Fritz Kalkbrenner sing in Sky and Sand.

“And we build up castles

In the sky and in the sand

Design our own world

Ain't nobody understand

I found myself alive

In the palm of your hand

As long as we are flyin'

All this world ain't got no end”

Traditional asset managers are very much moving the chess pieces on the board to position themselves as alternative asset managers, particularly as they continue to build out capabilities to deliver solutions to the wealth channel.

Franklin Templeton’s announcement of its acquisition of Apera at the conference highlights this trend that has been occurring in a big way over the past few years. This news punctuates last year’s landmark acquisitions by BlackRock, where they spent north of $25B to acquire $100B GIP and $150B HPS to build a $300B+ private markets franchise.

Franklin Templeton’s acquisition of Apera brings its private markets AUM to almost $260B.

As private markets becomes an increasingly integral part of portfolio construction for many investors, traditional asset managers are looking to find ways to deliver solutions across all asset classes.

As traditional asset managers look to “design their own world,” they understand that the world can change.

Oh has it changed for them over recent years in traditional asset management. There’s been a secular decline in fees for public markets funds, as the below chart from Bain & Company’s 2025 Private Equity Report illustrates.

Traditional asset managers are now looking to build new castles in private markets. With long histories, brands built up, and boots on the ground that provides connectivity to financial advisors, traditional asset managers that have the scale, size, and brand aim to be formidable players in private markets.

Meanwhile, alternative asset managers are grappling with how to grow and scale their business in an increasingly competitive fundraising environment.

The question for alternative asset managers is what type of castle do they want to build?

There is no one right answer for firms facing the question of their future.

Some firms are looking to build castles in the sky.

Those firms are designing worlds of their own.

These strategic moves look to be part of a long game that builds castles in the sky — and that sky is changing how private markets assets, particularly private credit assets, are originated, packaged, and distributed or owned, which can be important in a business where scale matters and fee compression will occur.

Not every firm needs to be everything to everyone. Some firms might be better off as a specialist. And that can work just fine, too.

As I mentioned on Capital Allocators’ podcast with Ted Seides, firms need to figure out who they want to be, but they should aim to be either “really big or really unique.”

The time is now

As asset managers look to build their own castles, the competition has never been greater or more intense.

It’s “all or nothing,” sing Lost Frequencies and Axel Ehenstrom in “All Or Nothing.”

Asset managers do “know what [they’re] doing, but the clock is ticking.”

“All or nothing

You know what you're doing, but the clock is ticking

Give it your best and then you're onto something

And keeps on getting closer, closer

All or nothing”

Firms are marshaling resources to build out distribution teams to cover both institutional and wealth channels. Firms are building out their brand — and devising ways to educate the wealth channel about private markets and their brand.

On one hand, it’s far from a zero sum game, particularly in the wealth channel. There’s trillions of dollars to play for even with single digit percentage increases in allocations to private markets from the wealth channel. That sentiment has been echoed by a number of people in the asset management space. And, in some respects, there’s an understanding that collaboration can benefit all parties. That’s why partnerships are being forged, as we saw recently with Blackstone, Vanguard, and Wellington.

But it also feels like the time is now. Firms are ramping up their hiring and building out their capabilities in wealth solutions to ensure that they win market share.

And that won’t be divided equally. Firms with evergreen structures will be better positioned, in many cases, to win in wealth. The intensified focus on evergreen structures is inextricably linked to brand-building efforts. To win in wealth, firms must invest in their brand. They must invest in marketing to provide the effective support for distribution efforts.

EQT’s Global Head of Content Henry Jones suggests that the competition might be intensifying. Is it a case of “The Winner Takes It All,” as ABBA sang?

Tread carefully

As asset managers look to productize for the wealth channel as they look to gain market share, it’s important to remember to “be careful whose advice you buy.”

This is particularly helpful advice as both the number and volume of capital flows to evergreen funds at a relatively rapid pace, as the below chart from iCapital illustrates.

“Be careful whose advice you buy”

Wear Sunscreen, Mau Kilauea

As I wrote in last year’s AGM Alts Weekly about SuperReturn, the themes from Mau Kilauea’s lyrics still very much ring true a year later for wealth channel investors:

The theme of wearing sunscreen can apply to many aspects of the current state of private markets.

As new investors, like the wealth channel, begin to allocate to private markets more actively, the concept of protection is important. There are a number of reasons why the wealth channel should have exposure to private markets. Certainly, many could make the case that a good portion of individuals should have more exposure than they currently do. But private markets done right for the wealth channel means that individuals and their advisors should tread carefully, particularly as many alternative asset managers are looking to build investment products to bring the wealth channel into the space.

Some of the lyrics from Mau Kilauea’s song ring true, particularly for the wealth channel and their wealth managers:

“Be careful whose advice you buy, but be patient with those who supply it.

Advice is a form of nostalgia. Dispensing it is a way of fishing the past from the disposal, wiping it off, painting over the ugly parts and recycling it for more than it's worth.”

As each firm aims to sell its wares, sharing why it believes its strategy, process, or product construct is best, it’s worth remembering to “be careful whose advice you buy.”

HgT’s Chairman of the Board Jim Strang made quite an important point about investors in his Alt Goes Mainstream podcast. He said that “consulting is about what you know, whereas investing is about what you think.” As LPs evaluate GPs, it’s worth understanding what’s unique and special about what they think. How can LPs do this well? Part of that answer is being careful about whose advice to buy.

Some advice that’s worth listening to comes from some of the attendees at the conference. When senior executives from some of the industry’s largest firms that are shaping private markets speak (or, in this case, spin some tracks), it’s worth paying attention.

I was just the opener. Without further ado, let’s bring the guest DJs on stage:

Cara Griffiths, Blue Owl GP Strategic Capital

The world has changed. Many of the features that the investment world held true over recent years — and benefitted from — are no longer the case.

Is it “the end of the world as we know it?” Cara chose “It’s The End Of The World As We Know It” by R.E.M. to start her set. Both macro trends and evolving business imperatives (and new structures, like evergreens) could be the signal that private markets have entered a new world.

Low rates and globalization characterized much of the recent years in investing. Those features dictated a certain type of strategy for investing. A more multi-polar world, defined by a trend of deglobalization, is impacting how firms invest and where capital flows. The game on the field has now changed, requiring a different skillset for GPs to navigate the new world order of investing.

And perhaps requiring GPs to be a different level of size and scale in order to win, to which Cara spins to the tune of “Only the Strong Survive” by Bruce Springsteen.

Scale matters more than ever in today’s world of private markets. Scale matters when investing. In certain asset classes and strategies, such as credit and infrastructure, scale can be the differentiator for winning large deals. Scale is certainly an advantage in fundraising, particularly with the wealth channel.

A chart from Blue Owl’s 2024 GP Strategic Capital Outlook highlights just how critical scale can be in fundraising.

To win in wealth, firms must have enough distribution and marketing firepower, which requires scale. Firms must also have the ability to create, manufacture, and manage evergreen structures, which requires scale. And if firms are to run evergreen strategies, they must have enough scale on their platform to be able to have the dealflow to support an evergreen fund structure both now and in the future.

Firms don’t have to be big to survive. They can either be really big or really unique. But they have to have both strong culture and strong performance to persist in today’s private markets, where fundraising headwinds have reached gale force for many firms.

One skill that Cara mentioned, which is particularly important when it comes to providing distributions and when it comes to managing evergreen funds, is a line from The Gambler by Kenny Rogers, “know when to hold ‘em, know when to fold ‘em.”

Portfolio management has moved to the forefront as investors seek distributions. It’s also a critically important skill for managers who are running evergreen strategies.

Themes of optimism were present at SuperReturn — and Cara’s choices of “Don’t Stop Believin’” by Journey and “Beautiful Day” by U2 highlight some of the promise that private markets can deliver.

Martina Sanow, Ben Schultz, Katie Forbes, Hg

Hg’s set covered everything from AI to DPI.

Their songs reflect where the industry is and where it could be going. And they also shared some songs that reflect Hg’s culture.

Will AI replace white collar jobs, asks Hg? They spin a track to the tune of “Irreplaceable,” by Beyoncé.

The focus on DPI was top of mind for GPs and LPs alike at SuperReturn. It’s something that Hg has spent a lot of time thinking about as they manage both their closed-end funds and their newer evergreen structure, Fusion.

They chose “For the Love of Money,” by The O’Jays.

But knowing when to “fold ‘em” is also balanced by knowing when to “hold ‘em.” Hg has held onto some of its investments, like Visma, for years because of the compounding nature of the business.

To that theme, Hg sings to the tune of “You’re Still The One,” by Shania Twain.

But holding on to assets is a choice. That’s why Hg, like others, has a realization committee to keep themselves honest. They reference “Man in the Mirror” by Michael Jackson.

And then they play “You Should Probably Leave” by Chris Stapleton.

What Hg continues to focus on? A culture of continuous improvement, to which they sing “The Climb” by Miley Cyrus.

And despite the firm’s successful run of form, they believe “the rest is still unwritten,” from “Unwritten” by Natasha Bedingfield.

Jake Walker, Apollo

Apollo’s Jake Walker ties in the theme of asset-based financing and music royalties to his song choice as he ponders what the future of portfolios might look like.

He wrote:

To pay homage to the greatest tour of all time, Taylor Swift’s Era’s closed December 2024.

Her epic 46 song setlist and 3 hr and 15 min show ends with ...

“Karma” ...

Karma is private markets being 50% of public private portfolios.

Karma is delivering investor outcomes and solving the global retirement crisis.

Hat tip to my 15 year-old for educating me on how Taylor Swift understands private markets ... she herself, [and] her song library may be one of the greatest asset-backed, music royalty private markets investments of all time.

Dan Parant, Vista Equity Partners

Our final guest DJ gives us a thought-provoking look into where the world might be heading.

Vista Equity Partners’ Dan Parant sees times “a-changin’” given the application of AI and how the wealth channel is becoming an increasingly important part of the private markets puzzle. He sees the industry through the lens of Bob Dylan’s “The Times They Are A-Changin’” to share fascinating questions as to what the industry might look like in a few years time.

He wrote:

For me, Bob Dylan’s The Times They Are A-Changin’ sums up the state of the private markets right now. For nearly 50 years, the private equity model has remained the same – drawdown funds mainly funded by large institutional investors. Through technology, product innovation, GP prioritization, and client demand for portfolio diversification and access, there is a new paradigm in private markets with both drawdown and evergreen funds and institutional and private wealth driving the industry. Administrative efficiency and long-term compounding have caused family offices and some small and medium-sized institutions to consider evergreen funds as a portfolio construction tool for private markets. At the same time, Generative AI and the agentification of work flows and work forces will very quickly change operating models across all industries and has the potential to facilitate increased profit margins for those that move fast first and possess sovereignty and dominion over the data.

It's hard not to imagine what the industry looks like five years from now. Will evergreen become a new delivery model for the private markets more broadly? What impact will Gen AI have on how we all work and will it help the PE industry “move the pig through the python?”

Come gather 'round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You'll be drenched to the bone

If your time to you is worth savin'

And you better start swimmin'

Or you'll sink like a stone

For the times they are a-changin'

That’s it for this year’s SuperReturn set. See you next year 🤙.

And if anyone wants to hear an actual DJ who is in private markets spin some tracks, head out to Montauk on July 3 to see Blackstone’s Private Wealth Solutions Associate Brian Schorr play at Montauk Project.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM Post of the Week

Thoma Bravo Founder and Managing Partner Orlando Bravo was interviewed at SuperReturn by Bloomberg’s Dani Burger, where he discussed why and how “you always have to be selling, and you always have to be buying.”

This past week, Thoma Bravo announced the completion of fundraising for our buyout funds totaling more than $34.4 billion in fund commitments: Thoma Bravo Fund XVI, a $24.3B fund, Thoma Bravo Discover Fund V, an $8.1B fund, and as previously announced our first dedicated Europe Fund, with approximately €1.8B in capital commitments.

AGM News of the Week

Articles we are reading

📝 CVC Says Europe Can Be ‘Challenging’ as Buyout Rivals Pile In | Swetha Gopinath and Kat Hidalgo, Bloomberg

💡 As the private markets world congregated in Europe to discuss the state of the industry, Bloomberg’s Swetha Gopinath and Kat Hidalgo dove into comments made at SuperReturn by CVC Chief Executive Officer Rob Lucas. Some firms expressed optimism about the European investment opportunity. But European-based firm CVC’s Lucas shared a word of warning: investing in Europe can be challenging. Lucas shared on a panel at SuperReturn that investors will need to navigate cultural and economic differences and find value despite the region’s less efficient markets.

Lucas noted that Europe is a “very, very important area,” although it’s a complex place to navigate given the diversity of the various countries and number of smaller economies. “I think it’s very challenging for any firm, actually, to make a real success across Europe,” Lucas said. “It’s just difficult to come here and to really understand all the nuances of each of the different markets.”

Gopinath and Hidalgo noted that Lucas’ comments followed views shared by firms like Apollo, BC Partners, and Permira, which all referenced the opportunity to invest in Europe as the region gains traction due to its relative economic stability with the US.

Lucas said that he is encouraged by the focus on Europe, but he also noted that the region has always been a “fascinating” place to invest. “It’s great to see the level of activity and the interest in Europe,” Lucas said. “Having said that, I’m not sure I would call it a renaissance, only because I really just don’t think Europe’s ever really gone away.” He also shared the observation that returns in Europe have been strong. “Sure, GDP and the stock market indices have lagged over the last decade. But actually the ability for the private markets to generate returns has been very strong,” Lucas said. “And certainly we have seen across CVC, the returns we’ve been able to generate within Europe have been impressive.”

Lucas also discussed consolidation. For firms that are scaled platforms, the need to expand into other asset classes and capabilities is critical. He referenced CVC’s acquisitions of secondaries business Glendower Capital and infrastructure manager DIF.

“There are winners and losers,” Lucas said. “The LP community are always looking to reduce and to consolidate their relationships as we go through these types of periods. And I’m sure that’s exactly what will happen.”

Lucas also noted that the current private equity market might represent an opportunity amidst the volatility. “Over the 40 years I’ve been doing this, you see periods of strong activity and you see periods where things rebased somewhat,” said Lucas. “We have cycles, and clearly we’re going through one of those at the moment. The really interesting thing about that, is that these periods of instability and dislocation, they are the periods when you can make the best investments.”

💸 AGM’s 2/20: Lucas’ comments highlight a number of current trends in private markets. His views on Europe were particularly interesting as more firms look to increase their activity in the region. Lucas has a point — investing in Europe can be more difficult. Navigating different jurisdictions, cultures, and regulatory frameworks is not easy. It can make it more difficult for companies to expand across the region. While this is certainly true, it’s worth wondering if it can make European companies more resilient and, for those that are able to expand successfully across the region, build the muscles that put them on the path to success.

After all, does doing the hard things earlier on make it easier for companies to move to other regions later? It would be an interesting question to unpack.

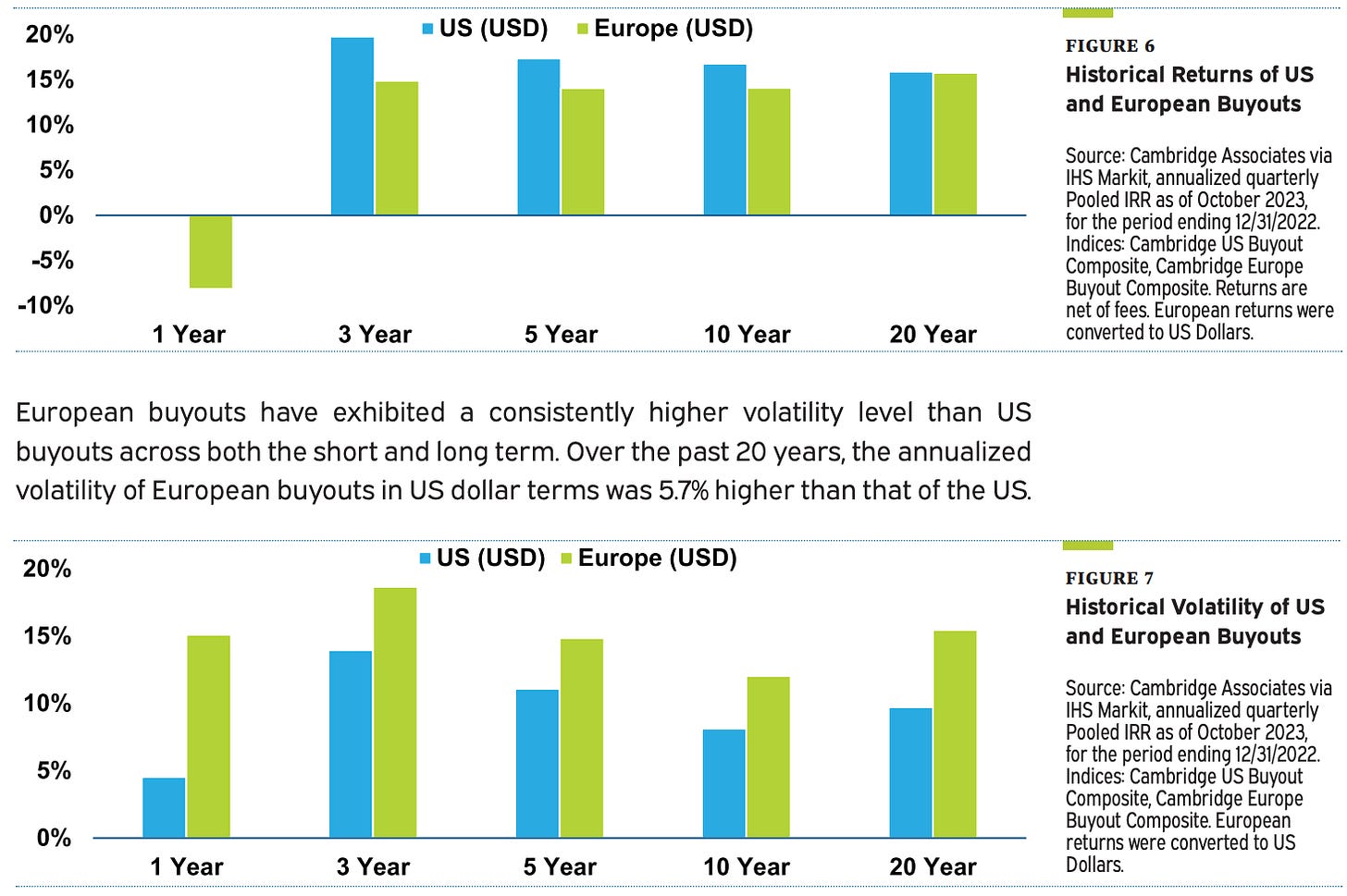

What can be unpacked is performance data. Data from Meketa from 2024 shows that historical European buyout performance has been in line with historical US buyout performance (note: this data is up to 2024, and performance data is in USD currency, which could have experienced fluctuations since).

As the above chart illustrates, over a 20-year period, US and European buyout performance was in line. However, volatility has been higher for European buyouts.

Looking at performance data in local currency, volatilty diverged a bit, making it important for investors to understand the currency in which they are looking for returns.

Manager alpha was also relatively similar in both the US and Europe, emphasizing that manager selection matters irrespective of the region. Standout performers will be standout performers anywhere.

The 2024 HEC Paris Dow Jones Small Cap Buyout Performance Rankings also highlights European fund performance. Of buyout funds raised between 2011 and 2020, over half the top performing private equity firms were European based.

Another interesting topic that Lucas covered is the increasing trend of LPs consolidating their relationships with fewer managers. That could explain, in part, why larger firms are expanding their platforms through acquisitions. CVC has done so with its acquisitions of Glendower and DIF.

Firms becoming one-stop shops to be able to serve LPs — both institutional and wealth channel cohorts — is a strategic decision. The firms doing so recognize that LPs, particularly in the wealth channel, may want to make less decisions, not more. A one-stop shop where LPs trust the brand in addition to underwrite the performance can deliver on that.

I wrote about this topic in the 3.3.24 AGM Alts Weekly:

Wealth managers, generally speaking, want to make fewer decisions, not more. Enter the one-stop shop alternative asset manager. As discussed above, wealth managers have a number of pressing needs competing for their time. Alternatives allocations are one item on the menu, but not always the main course. In fact, they are not often the main course given that many advisors have 1-5% allocations to alts on behalf of their clients.

Alternative asset managers can give advisors the easy button: provide a one-stop shop. This feature is only possible for certain types of alternatives managers, namely the largest firms or traditional asset managers who are now adding alternatives capabilities, but firms that are able to do so should be the beneficiaries.

It appears that this is how CVC’s Lucas views the evolution of the market — and, perhaps, can help explain CVC’s — and many of its peers — strategic moves.

“There are winners and losers,” Lucas said. “The LP community are always looking to reduce and to consolidate their relationships as we go through these types of periods. And I’m sure that’s exactly what will happen.”

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 KKR (Alternative asset manager) - Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

🔍 Apollo Global Management (Alternative asset manager) - Vice President, Strategy & Innovation – Model Portfolios and Annuity Solutions. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Strategy & Corporate Development Associate. Click here to learn more.

🔍 Franklin Templeton (Asset manager) - Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

🔍 BlackRock (Asset manager) - Global Head of Product Strategy, Private Market Solutions - Managing Director. Click here to learn more.

🔍 Brookfield (Alternative asset manager) - SVP - GCG Head of Content Strategy. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - Vice President. Click here to learn more.

🔍 Arcesium (Private markets technology company) - SVP Business Development, Private Markets. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - SVP, Business Development. Click here to learn more.

🔍 Lincoln Financial (Insurance) - Alternative Investment Sales Specialist Account Executive. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lincoln Financial’s EVP and CIO Jayson Bronchetti discuss the role of insurance companies in private markets as he discusses how he manages a portfolio of $300B in assets. Watch here.

🎥 Watch Krilogy’s Partner and CIO John McArthur discuss how an RIA can chart a growth path by building out its private markets capabilities. Watch here.

🎥 Watch New Mountain Capital’s Founder & Chief Executive Officer Steve Klinsky discuss how $55B AUM New Mountain has built a business that builds businesses. Watch here.

🎥 Watch Arcesium’s Private Markets Head Cesar Estrada discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch GeoWealth President & COO Jack Hannah and iCapital SVP, Partnerships Michael Doniger discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Goldman Sachs’ Managing Director, Global Head of Alternatives, Third Party Wealth Kyle Kniffen discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Fortress Investment Group Managing Director & Co-Head of Private Wealth Solutions Adam Bobker discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch Constellation Wealth Capital President & Managing Partner Karl Heckenberg on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to Ted Seides, Founder of Capital Allocators, and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a Capital Allocators mini-series on Private Wealth. Listen here.

🎥 Watch BlackRock Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business Jaime Magyera and iCapital Chairman & CEO Lawrence Calcano discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch EQT Partner & Head of Private Wealth Americas Peter Aliprantis discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch KKR Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) Alisa Wood discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.