AGM Alts Weekly | 10.20.24

AGM Alts Weekly #74: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Designed with GPs at heart and LPs in mind, the bunch operating system, coupled with an advanced workflow management tool, is designed to streamline and automate cumbersome back-office processes and become the single source of truth for you to collaborate with your service providers.

With over 50 fund clients and $3 billion in committed transactions across five jurisdictions in Europe, bunch has a proven track record of freeing up valuable time for fund teams by taking over the fund administration so you can focus on what truly matters: maximizing returns and enhancing the LP experience.

Good morning from Washington, DC, where I’m back from a week in New York of meeting with alternative asset managers, private markets companies, and LPs in private markets.

Back in March, I wrote about the ever-expanding universe of private credit, as an increasing number of consumer loans are now being funded by a growing corner of the private credit world: asset-based finance (ABF).

As banks have retrenched from the credit markets in large part due to regulatory and balance sheet constraints, private credit has filled the void. A chart from a Wall Street Journal article by Matt Wirz highlighted just how much alternative asset managers have crept into banks’ territories by completing large-scale asset-based finance deals.

Even more credit

This past week, news of yet another large consumer finance deal sent shockwaves through the industry. The FT reported that Klarna, a leading “Buy Now Pay Later” provider, agreed to offload its £30B UK BNPL loan portfolio to $70B AUM US alternative asset manager Elliott.

This development follows another sizable BNPL transaction in Europe: KKR’s 2023 agreement to buy up to €40B of PayPal’s European originated loans.

Klarna’s partnership with Elliott to transfer risk off of their balance sheet and unlock capital relief so they can deploy shareholder equity more effectively wasn’t the only fintech to partner with a private credit firm this week.

SoFi announced that they received a $2B credit facility from Fortress to fund personal loans on SoFi’s loan platform business.

Carlyle has also been active in partnering with fintechs. In September, it entered into a partnership with Unison to purchase up to $300M of equity sharing home loans.

Blue Owl has agreed to purchase $2B of consumer installment loans from Upstart over the next 18 months in a forward-flow agreement via Atalaya, the private credit firm that Blue Owl recently acquired. To add to the private credit party, Apollo’s structured credit originator, Atlas SP, will provide debt financing for the loan purchases.

This deal with Blue Owl isn’t the first partnership that Upstart has had with private credit firms. Over the past 18 months, Upstart has financed loans with Castlelake, Centerbridge, Ares, and Eltura.

It’s not surprising that private credit is making its way into consumer finance. These asset types could conceivably be transitioned from banks to nonbank lenders.

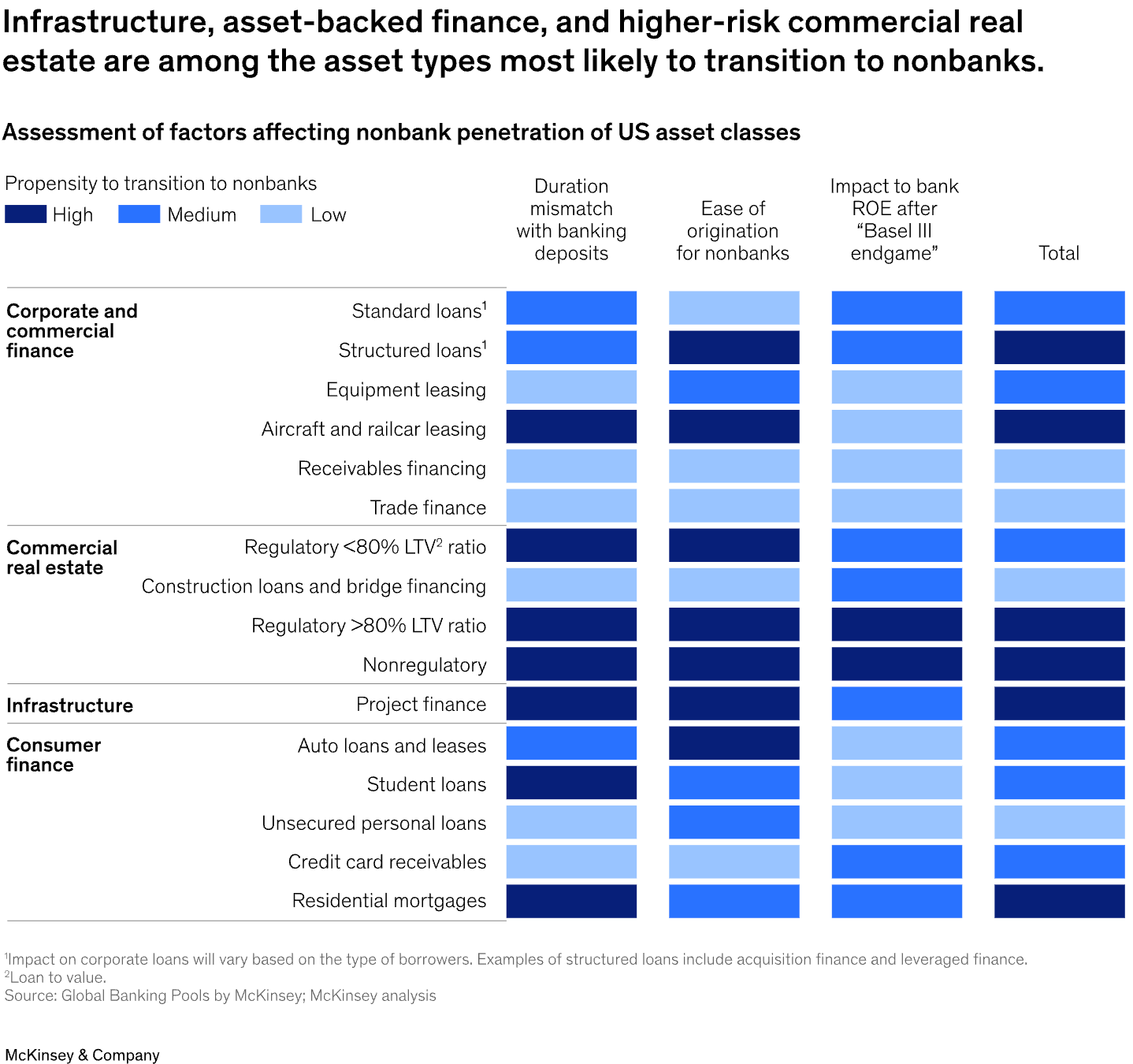

McKinsey’s recent article, “The next era of private credit,” highlights areas of credit that could transition to private credit firms. McKinsey pegs much of the consumer finance landscape — auto loans and leases, student loans, credit card receivables, and residential mortgages as medium to high likelihood to transition to nonbank lenders in the US.

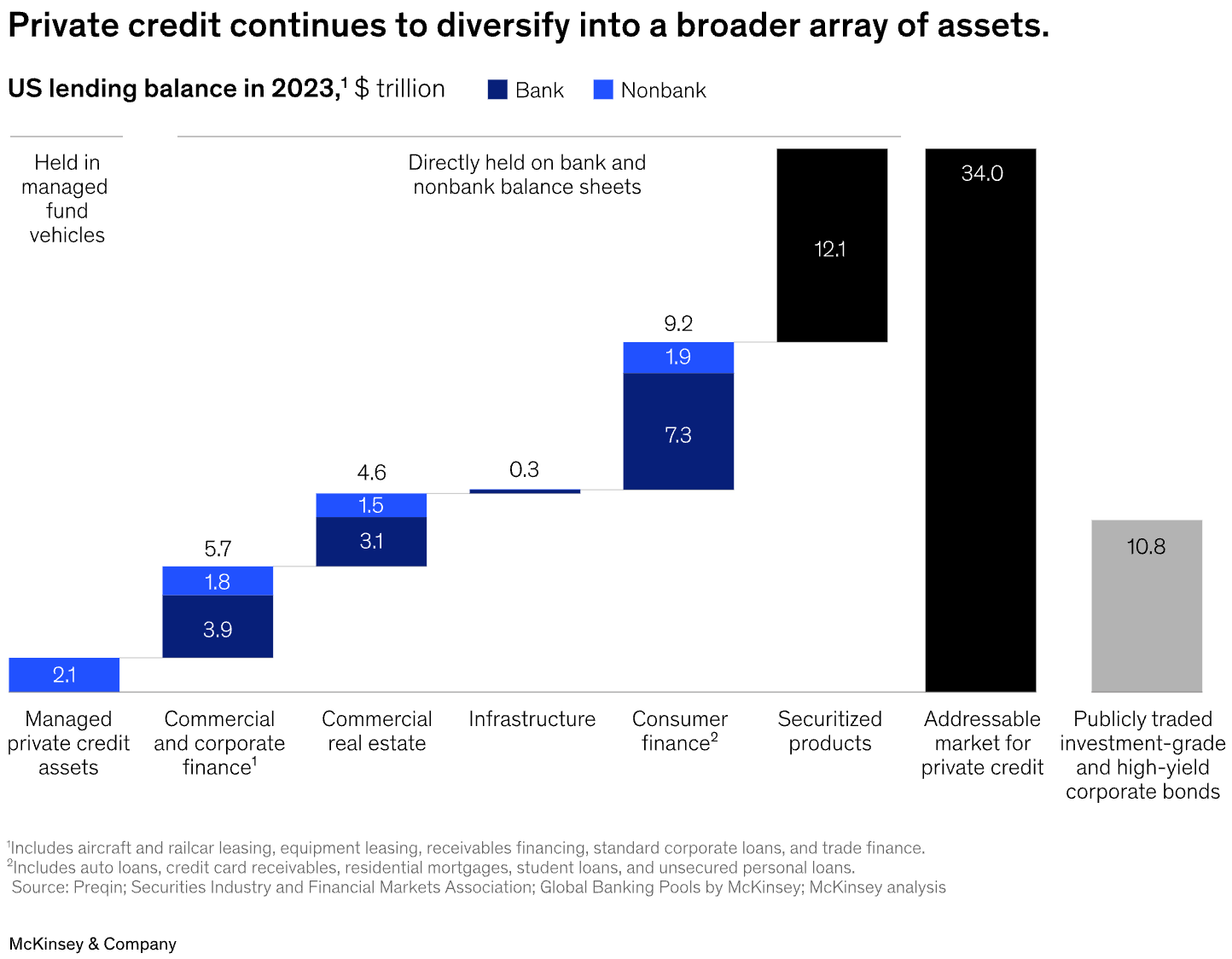

As private credit continues to march into bank territory, it appears that there’s plenty of room for private credit firms to expand into areas such as consumer finance. McKinsey estimates consumer finance assets to be $9.2T of lending balance in 2023, with only $1.9T of the $9.2T held in nonbank lenders’ hands.

Private credit 🤝 FinTech

It was probably only a matter of time before private credit would make its way into fintech in a big way.

FinTech has matured rather rapidly since its rather humble beginnings of peer-to-peer online lenders or other forms of lending businesses that began to crop up in the early 2000s such as Lending Club, Prosper, Zopa, OnDeck, Kabbage, SoFi, and Klarna (note: I consider capital markets infrastructure such as electronic exchanges and digital payments companies like PayPal to be fintech, which came about before the advent of online lenders, but for the purposes of this article, I’ll characterize the early days of fintech as the online lenders).

These online lenders began life with a bold and groundbreaking mission: to disrupt traditional financial services by removing the middleman (banks) from the equation.

As they grew and evolved as businesses, they initially raised funds from HNW individuals to raise what would be their early lending capital for the consumer loans they originated. They then partnered with private credit funds that would provide them with credit facilities before ultimately maturing to a size and scale where credit facilities from banks were required to meet their sizable origination volume.

Somewhat ironically, some of these fintechs, such as Lending Club, Zopa, and Klarna, all possess bank licenses themselves today.

The maturation and evolution of the lending and digital banking fintechs also happened to mirror the evolution of some of the private credit firms that were early to the trend of working with consumer fintechs.

Private credit firms focused on fintech in the 2010s might have been well-known names in the fintech space, but they were much smaller players in the broader private credit universe at the time. The likes of Victory Park Capital, Atalaya, Upper90, CoVenture, Fasanara, i80 and others have all grown into firms that possess multi-billion dollars of AUM, in part because of their astute decision to focus on fintech.

At the time that Victory Park Capital launched a private debt fund focused primarily on providing credit to fintech lending businesses in 2014, it was a 31 person outfit and managed a loan portfolio of $1.4B since their founding in 2007. Today, it stands at over $10.3B and was recently acquired by global asset manager Janus Henderson.

Another private credit firm that was an early mover in providing capital to the fintech ecosystem had an evolution similar to Victory Park. Atalaya, a $10B private credit firm focuses on asset-based finance, was acquired by Blue Owl earlier this year for $800M in cash and stock as Blue Owl continues its push into the ABF arena.

These firms — and others — would seemingly do well to continue to focus on the growing fintech sector. Despite fintech’s rapid rise over the past 15 years, a recent BCG and QED report finds that the $320B of fintech revenue represents less than 3% of the annual global financial services revenue of $14T, according to QED Investors Managing Partner and former Capital One Co-Founder Nigel Morris.

And as digital banks and lenders continue to evolve into more mature businesses, as the likes of Lending Club, Zopa, Chime Revolut, Nu, Klarna, and many others have, it will not be surprising to see private credit continue to partner with fintechs.

Private credit and fintech could indeed be a match that makes sense. They are both growth industries, and their respective growth could be aided further by working together.

What’s next?

Evolutions power revolutions

The intersection of fintech and finance isn’t just limited to private credit firms working with fintechs to power the next phase of their business growth.

Software innovation from fintech companies is making its way to private credit. Technology market structure evolution is often what makes for more efficient, functioning markets.

I wrote about this in June 2022, when talking about how we at Broadhaven Ventures see the technology market structure evolution occurring in private markets.

We see the world through the lens of market structure evolutions. We believe that evolutions in underlying financial infrastructure power consumer and enterprise financial services revolutions.

A well-functioning market works when there is efficient and effective data and technology across the lifecycle of a trade or investment. As new markets are built, market structure requires technology innovation to create transactional efficiencies. A functioning market structure enables investors to have price discovery, invest or trade efficiently, and process, custody, and value trades and investments.

As market structure evolves, so too does its liquidity. More participants come to a market that functions better. Liquidity begets liquidity and the market grows. It happened with equities. It happened with listed derivatives.

And now, a similar market structure evolution is making its way to private markets — and private credit, in particular.

Private credit markets are so large — larger than the venture capital industry that is often funding the startups that are looking to provide software solutions — that it’s only a matter of time before data solutions for the private credit industry start to take off in a big way.

Debt facility warehouse management is an obvious area for innovation. As fintechs (think lenders, BNPLs, and digital banks) grow their loan books, their warehouse debt facility management to finance their lending activities becomes increasingly complex. No longer can they rely on manual processes and Excel spreadsheets, nor should they.

Companies like Setpoint (which has raised $76M from the likes of a16z, Henry Kravis, and more recently from strategic investors Citi and Wells Fargo), Finley (which has raised $20M from Bain Capital Ventures, CRV, and Upper90, amongst others), Cascade, and CardoAI (backed by private credit firm Fasanara) are all helping fintechs and / or private credit firms understand and manage their credit facilities and loan books in more automated fashion.

Siepe, which recently raised a $30M Series B from WestCap, a large investor in iCapital and Addepar, with a team that has a history of building capital markets innovators like Ipreo, is focused on enabling credit funds and CLO managers to manage and track their credit exposures.

73 Strings and LemonEdge, both of which are backed by Blackstone (note: Broadhaven Ventures is also an investor in both companies), are solving critical post-investment processes for private credit funds in portfolio monitoring and valuations (73 Strings) and fund accounting (LemonEdge), respectively.

It’s not just the fintech startups that could hep accelerate the growth of private credit and fintech. It’s also larger scaled technology companies that focus on fixed income. Imagine if the likes of Tradeweb, one of the innovators in the electronification of fixed income markets and a $28B+ market cap public company, or BlackRock, with their Aladdin, eFront, and now Preqin software suite, end up moving into private credit as the lines between public and private become increasingly blurred.

Private credit funding private credit?

This trend of fintech innovation for private credit markets may, in fact, end up eating into private markets itself.

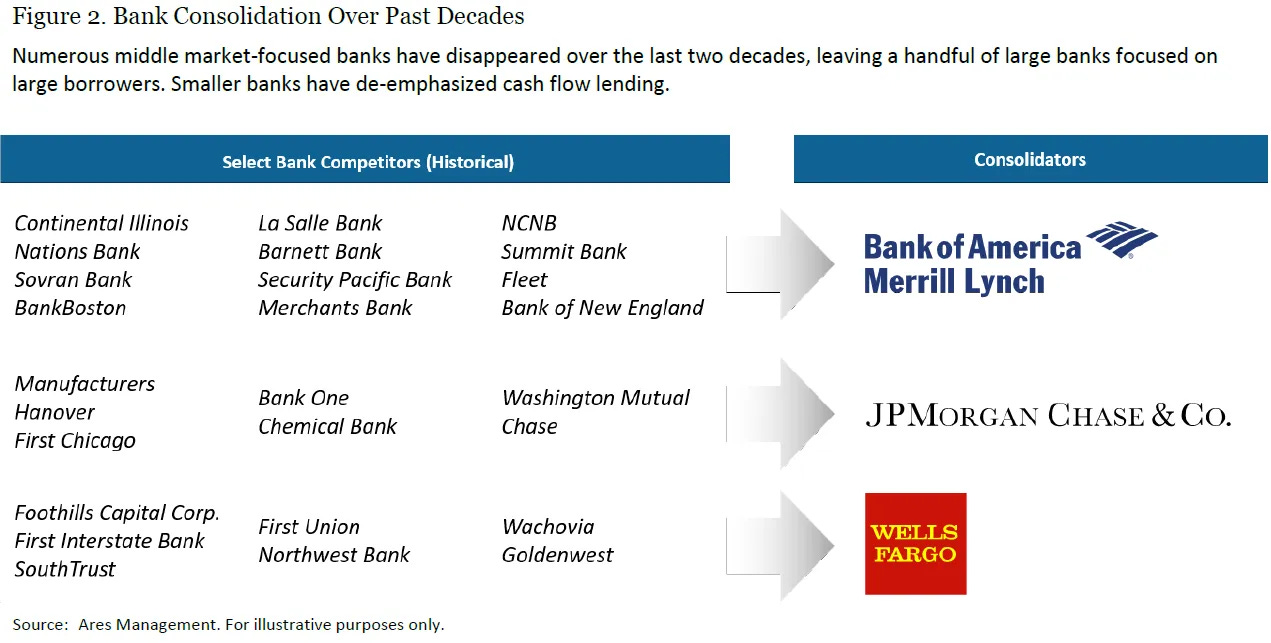

NAV loans and capital call lines of credit are not a new phenomenon. Banks, like First Republic and Silicon Valley Bank, would often be providers of credit to GPs and LPs at alternative asset managers to provide fund finance solutions. As we know, those banks no longer exist in their prior form (although it doesn’t mean they won’t continue these fund finance activities in their new form). And private credit firms are filling the void left by banks, which has undergone a tremendous amount of consolidation over the past two decades.

Earlier this week, Goldman Sachs and Blackstone teamed up to do a $475M securitization of bonds backed by loans made by banks to alternative asset managers. These capital call receivables are likely backed by commitments to funds from large institutional investors. In this case, the pool of capital call lines refers back to several thousand limited partners in these private markets funds, the largest of which include Singapore’s sovereign wealth fund and the Abu Dhabi Investment Authority. LPs, particularly large institutional investors with the sophistication and experience of cashflow planning for their private markets investments, rarely default on capital calls, making this type of underwriting a low-risk exercise.

Morningstar DBRS rated the top tranche of this securitization AAA, in large part because the asset class has had low credit risk, according to Morningstar DBRS Senior Vice President Stuart Rothenberg.

This deal follows two trends in private markets: one, banks are looking to release risk capital exposure under Basel III Endgame rules by offloading that risk via synthetic risk transfer transactions, and, two, both private credit firms like Pemberton and large sovereigns or insurers are searching for additional yield over the benchmark in exchange for consuming this type of underwriting risk.

Earlier this year, law firm Cadwalader estimated that lending against capital call lines is a $900B market.

Goldman Sachs’ Head of US Fund Finance Adam Zotkow said that this area of the market is a focus area for the firm: “The subscription line business has been a key focus for us.” This deal “enables us to scale lending while partnering with investors looking to access this growing segment of the fund finance market.”

It’s not just institutional investors that firms like Goldman are looking to underwrite. As private wealth becomes an increasingly important investor in private markets, Goldman reportedly aims to double its lending over the next five years to UHNW private bank clients with account sizes exceeding $10M, according to a Reuters article from June of this year.

This lending activity to UHNW clients won’t be limited to fund investments and capital call lines or NAV loans against private markets fund investments. It will also extend credit for the purchase of luxury homes or sports teams.

Goldman is far from the only bank to engage in this activity in their wealth management unit. Their lending activity as a percentage of its wealth client assets is 3%, far below the average of 9% amongst its private bank peers, according to a report by Autonomous Research. Bank of America and JPMorgan Chase’s total outstanding loans and leases to wealth management clients was around $220B last year.

Fintech innovation could also unlock this capability for the independent wealth channel. Could we ultimately see a “BNPL-like,” click-to-buy loan product at “checkout” embedded into private banks’ and alternative investment platforms’ offerings when a wealth client decides to invest into a private markets fund? The industry would do well to be mindful of how much leverage is extended to the wealth channel, but it does seem like this is the direction where things could be headed.

All roads, however, lead back to continued fintech innovation. To do this well? Continued evolution of market data and real-time valuation of private markets assets becomes even more critical as alternative asset managers, private banks, and investment platforms work with the wealth channel LP.

It will be interesting to see how this convergence of fintech and finance continues to play out as both industries continue to grow.

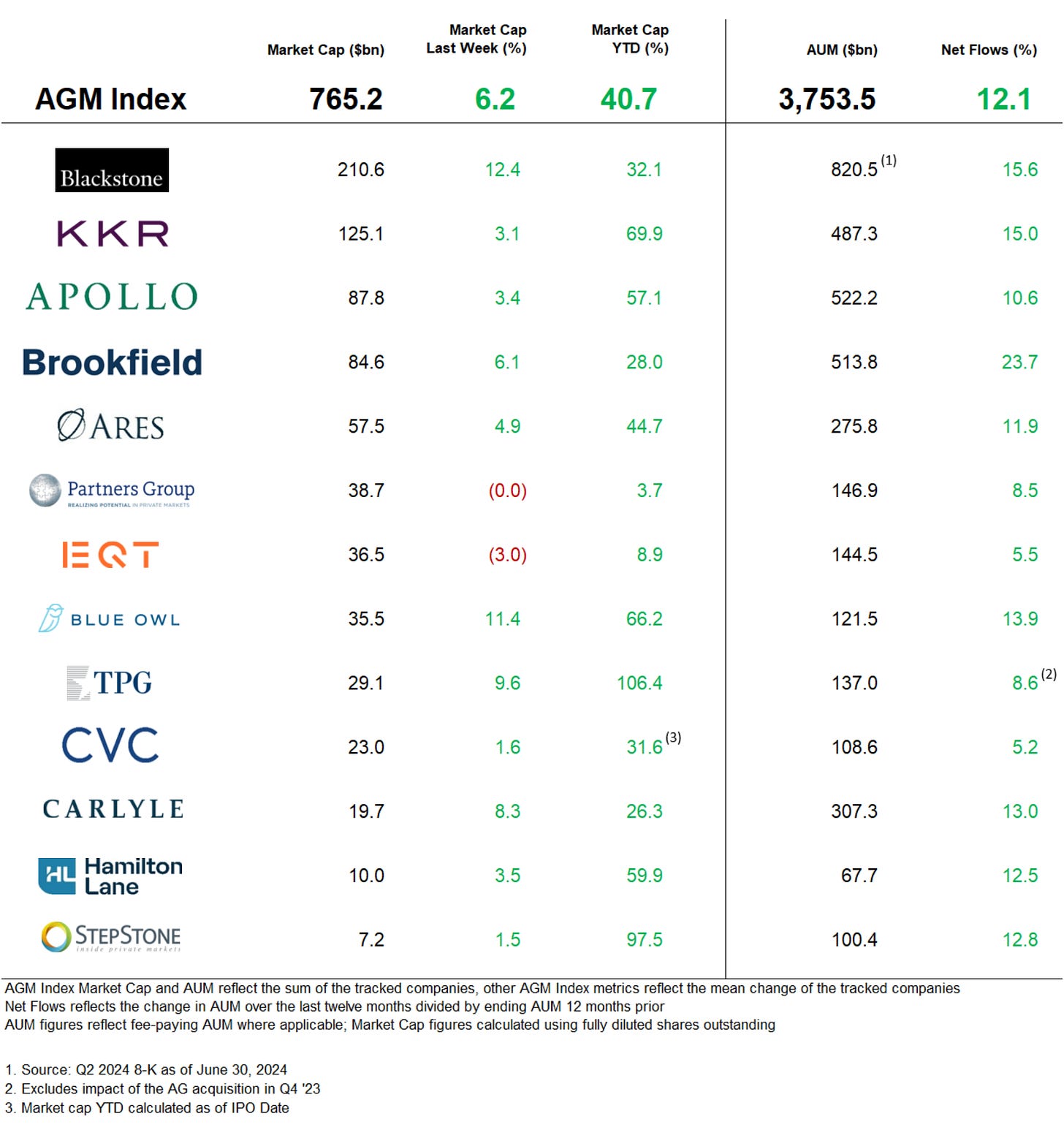

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the week

Armen’s Max Darque’s LinkedIn post on GP stakes.

Is GP stakes “better than SaaS?” More on this in my post about GP stakes from May 2024.

AGM News of the Week

Articles we are reading

📝 J.P. Morgan Asset Management Is a Quiet Giant in Alts. A Reorganization Aims to Change That | Julie Segal, Institutional Investor

💡Institutional Investor’s Julie Segal covers the growing focus for one of the world’s largest banks. J.P. Morgan, which is by no means a small player in alternatives, with AUM standing at $400B, is increasing its focus on private markets. George Gatch, CEO of J.P. Morgan Asset Management, has restructured their alternatives business, providing more resources and executives in a bid to grow AUM to compete with the largest firms in private markets. Jed Laskowitz, who has been with J.P. Morgan for over 28 years and has built product lines such as multi-asset and ETFs, has taken over all direct investments, including real assets, private equity, infrastructure, and macro. Anton Pil, Global Head of Alternatives, will lead private equity and hedge fund of funds. Gatch has also combined the alternatives capabilities from asset management and the private bank for the first time.

Gatch has his sights set on competing with some of the industry’s largest players in private markets. He told Institutional Investor, “how do we build this out and compete more directly against the biggest and the best alternatives firms, such as Hamilton lane and Cliffwater on the fund-of-fund side, and with Carlyle and Blackstone, on the direct private market business?”

This restructuring comes at a time when Gatch is also focused on doubling down on active management more broadly, including ETFs and developing strong public markets capabilities. Over the past five years, assets have increased 12% annually from $1.9T to $3.3T, including $440B in net new inflows into long-term investments. JPMAM’s alternatives platform was initially developed for institutions, but now that there’s a bigger focus on the wealth channel, the firm has built products in the evergreen space, including a PE tender offer fund focused on middle-market companies, co-investments, and secondaries (see AGM podcast with JPMAM’s Tyler Jayroe here). J.P. Morgan US Private Bank CEO David Frame cited some of the differences with working with the wealth channel as they provide solutions tailored to this type of investor: “One of the biggest challenges with investing in private equity and private credit is managing it alongside everyday life. Investors receive distributions and capital calls, which require active management. However, many prefer a more streamlined approach where they can allocate capital and have it grow, with all distributions and capital calls managed within the investment vehicle itself.”

Direct investments are a burgeoning area of interest for JPM’s largest private bank clients. Frame noted that they aim to tap “into co-investment opportunities from [their] third-party manager investments [to] significantly enhance [their] strategy” in large part because family offices want a large portion of their portfolios in direct investments.

Gatch is looking to add products to JPMAM where the firm doesn’t have a competitive advantage. This could explain JPM’s overtures with Monroe Capital, the $19B private credit firm they looked to buy, as Gatch cited private credit as a white space

💸 AGM’s 2/20: Traditional asset managers and large global banks that possess both asset management arms and private bank units represent the sleeping giant that could play a much larger role in private markets going forward. These firms, like JP Morgan, at over $400B AUM, and Goldman, at $456B in alternative assets, are no small players in private markets.

These firms might not be included in the AGM Index because they aren’t pure-play alternative asset managers, but they should be considered far from afterthoughts in private markets. In February, I wrote about Goldman’s focus on growing their alternatives business. A maniacal focus on alternatives fundraising has yielded fundraising success over the past few years that has rivaled some of the industry’s largest alternative asset managers.

JP Morgan, with its breadth and scale in both asset management and private banking, could surely follow a similar path.

The advantage firms like Goldman and JP Morgan have? A captive wealth channel to distribute product, not to mention the ability to offer other tools and value-added services that enable wealthy clients to participate in private markets, like offering loans against alternative assets, as I discussed above.

Yes, the asset management divisions of firms like JP Morgan and Goldman are burdened by the bank when it comes to valuation multiples compared to their leaner and higher valued alternative asset management peers, but there are benefits from being affiliated with a bank and broader platform across the capital markets spectrum, particularly as private and public converge.

And a broader trend is at play here, too. Basel III Endgame and the liquidity requirements that it’s placing on banks is forcing banks to think about how to externalize their private markets activities. That means a greater focus on asset management solutions where the capital comes from third parties rather than principal capital (enter the wealth channel) and a likely rise in synthetic or significant risk transfer transactions. These developments pose some challenges to banks in terms of what they can do, but it doesn’t mean they won’t try to play.

📝 Blackstone builds a ‘performing credit juggernaut’ | Madeline Shi, PitchBook

💡PitchBook’s Madeline Shi reports that Blackstone is staking its claim on credit. Their third quarter marked its second-highest deployment quarter on record, according to the firm’s earnings released this past Thursday. Lending activity across its corporate and real estate credit portfolios, which includes direct lending, CLOs, real estate debt, private investment-grade credit, increased 20% year over year to $432B. This figure was buttressed by over $100B in fresh capital inflow over the past 12 months. Blackstone’s leaders believe that there’s plenty of room to run in the ever-growing private credit market. They cited the promise of asset-based credit, estimating a $25T market size, which is five times the size of today’s leveraged finance world. Yet, alternative asset managers represent only 2% of the asset-based finance space. Blackstone’s COO and President Jon Gray said on Thursday’s earnings call that the firm is building a “performing credit juggernaut,” as he anticipates that pension and sovereign wealth capital will come into the space as LPs in addition to the insurance capital that has funded the expansion of asset-based lending.

Private credit helped Blackstone ring in a strong Q3. The firm posted $780.8M net income this quarter, up 41.5% year over year. Distributable earnings grew to $1.28B, up nearly 6% from $1.21B in the same period last year.

💸 AGM’s 2/20: The race to grow a footprint in private credit is on. The industry’s largest alternative asset managers are, in many respects, as much private credit managers as they are private equity managers. Blackstone’s Q3 performance highlights how big of a player they are in private credit even though their origins started in private equity. This path is not uncommon for most of the industry’s largest alternative asset managers, many of whom are no more than 40 years old.

But what’s one of the most interesting aspects of the expansion of their platform? The synergies created between different investment strategies and platforms.

I discussed above how the alternative asset management units of banks like JP Morgan and Goldman benefit from the synergies derived from their broader bank activities. While alternative asset managers like Blackstone, KKR, Apollo, and Blue Owl will likely never want to move to become a bank, there are real benefits to conducting activities across the private markets spectrum. Let’s take the growth of data centers as an example. Blackstone has been a major investor in data centers via their real estate and infrastructure strategies. They can also play the data center trend by investing into either the credit or equity of large companies, such as chip makers, that are benefitting from the growth of AI. The multiple ways that these firms can finance a macro trend, whether it’s data centers, digitalization, or decarbonization, shows the power and benefit of scale. A firm like Blackstone with the scale to put capital against the biggest trends is what gives them an advantage, as scale begets scale, as former Blackstone CFO and WestCap Founder and Managing Partner Laurence Tosi said on his Alt Goes Mainstream podcast.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Carlyle (Alternative asset manager) - Vice President, Client Relationship Manager, Wealth Management (Southeast). Click here to learn more.

🔍 State Street (Asset manager) - Head of Corporate Strategy, Senior Vice President. Click here to learn more.

🔍 Fidelity Investments (Asset manager) - Director, Alternatives Product Marketing - Fidelity Institutional. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Vice President - FP&A - Financial Services. Click hear to learn more.

🔍 73 Strings (Private markets data) - Account Executive. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🔍 Marathon Asset Management (Alternative asset manager) - Investor Relations: Capital Formation - Managing Director - Institutional Investors. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch the first episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Very interesting read. Do you know of APIs that aggregate alternative investment account data? Something like Plaid for alts. I am looking for one for my net worth app.