AGM Alts Weekly | 2.16.25: The Blueprint

AGM Alts Weekly #90: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Alto enables investors to use tax-advantaged IRA capital to invest in alternatives like private equity, venture capital, real estate, and crypto.

We work with asset managers, wealth managers, VC funds, fintechs, and financial advisors to help them access the $11+ trillion IRA market. Our platform streamlines legal, administrative, and compliance tasks, ensuring transparency and enabling more efficient capital raise.

Good morning from Washington, DC, where I’m back after meetings in Southern California and New York City.

Growth companies

When people think of growth companies, they generally think of technology companies.

But what about alternative asset managers?

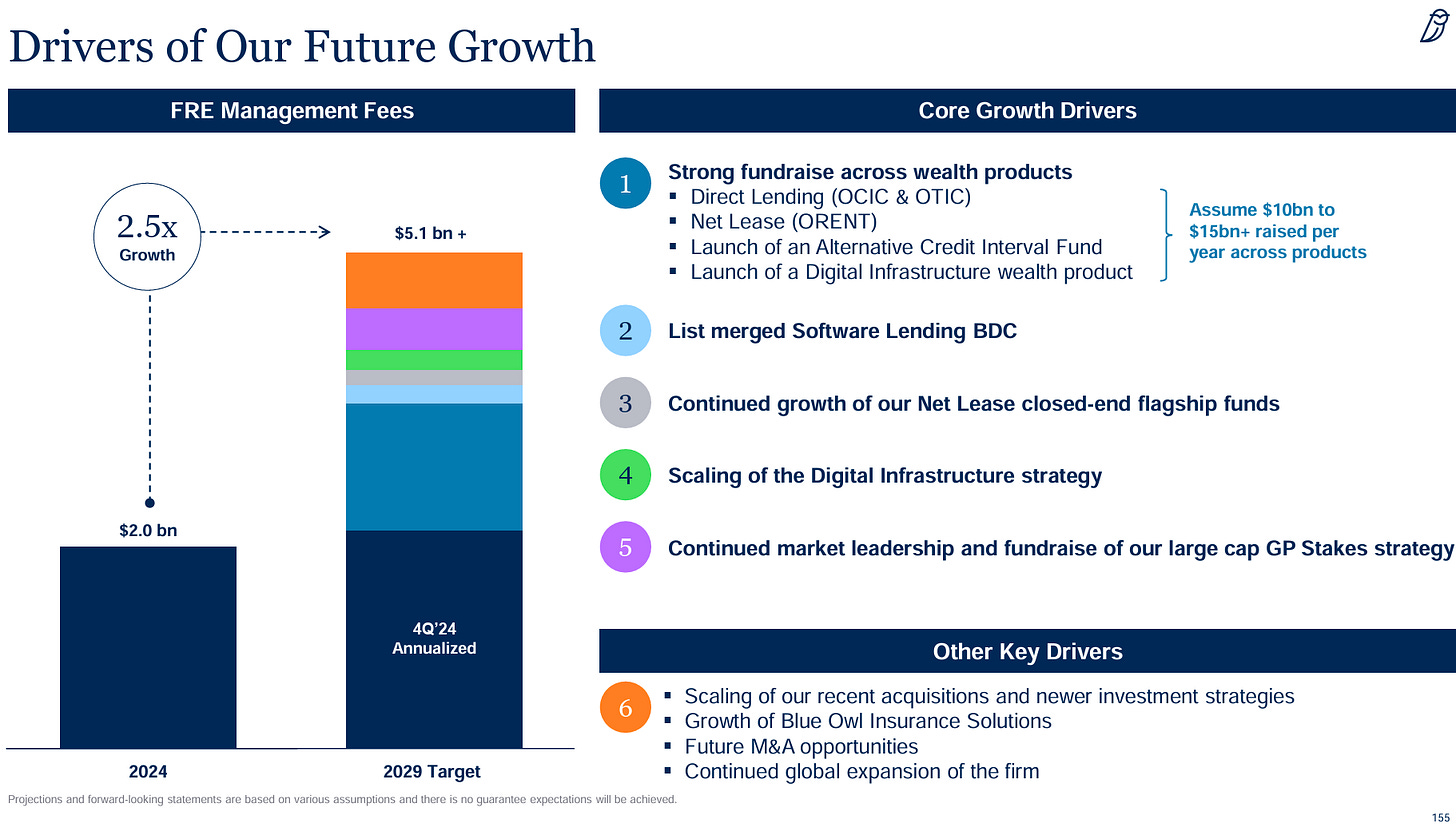

Blue Owl’s recent Investor Day Presentation paints the picture of a fast-growing company.

Since its listing in May 2021, the firm has experienced explosive growth.

AUM has quadrupled from $62B to $251B today.

That growth has led to FRE revenue more than doubling, from $0.9B to $2.2B, which has helped market cap more than triple from $12B to $38B and a 2.6x increase in share price.

To serve the growing needs and demands of clients, and through acquisition, Blue Owl has increased its headcount by over fourfold from 250 to 1,100.

Blue Owl is not alone. Its impressive growth trajectory has been mirrored by the other large — and growing — alternative asset managers.

A chart from Apollo’s Investor Day Presentation highlights the growth of alternative asset managers as businesses, illustrating just how much alternative asset managers have moved into the mainstream.

Blue Owl’s growth path echoes sentiments from Apollo CEO Marc Rowan, who said on a quarterly earnings call in February of 2024 that, since 2008, Apollo grew 14 times. That means they grew faster than Apple’s revenue, Microsoft’s revenue, and semiconductors.

We've just come back from our Partners Retreat, where all 201 Apollo partners get together and we discuss the outlook. And I began those remarks by anchoring people in history. In 2008, we were $44 billion of AUM. If you fast forward, we've grown 14 times; that's faster than Apple's revenue, that's faster than Microsoft's revenue, that's faster than semiconductors. Truly extraordinary [author emphasis].

I'd like to think that was all as a result of management acumen and management positioning, but we are the beneficiary of macro industry factors that drove not just us, but our entire industry. Dodd-Frank, substantial money printing, a research for excess return in a low rate environment, and the commoditization of debt and equity markets – public markets through indexation and correlation, were the powerful tailwinds that drove our industry and allowed us to grow 14 times.

Blue Owl could trot out a similar narrative.

They’ve grown at 49% CAGR, largely by leaning into areas that represent secular growth trends: data centers, digitalization, direct lending, and distribution.

They reference digital infrastructure as one such “generational opportunity” due to the supply / demand imbalance.

By matching supply of capital that’s looking to generate returns (and, in many cases, yield) against the growing need for large-scale capital demand to finance the aforementioned megatrends, Blue Owl has successfully positioned itself, along with its peers, in the sweet spot of being able to grow AUM in order to deploy capital into large and growing markets.

Winning in wealth

Speaking of capital supply, their focus on the wealth channel — and how they have approached working with the wealth channel — has paid off in spades.

In 2024, the top six firms by capital raised in the wealth channel captured 60% of wealth channel dollars raised. Blue Owl was one of the six.

This performance is an extension of the growth they’ve achieved within the wealth channel since 2021, increasing wealth channel AUM from $20B to $52B.

Despite such marked growth to date, many in the industry are suggesting that it’s just the beginning of a new time in private markets, particularly when it comes to adoption from the wealth channel. Blackstone’s Global Head of Private Wealth Solutions, Joan Solotar, who has spearheaded the firm’s astronomical growth in the wealth channel alone to over $250B of AUM (across Blackstone funds) in the past ten years, said in her Alt Goes Mainstream podcast that “it’s still spring training.”

Blue Owl’s data on wealth channel adoption of private markets corroborates the opportunity that Joan references. Blue Owl’s presentation pegs wealth channel exposure to private markets at 3%. This figure pales in comparison to the ~20% allocation from institutional investors.

Notably, firms like Blue Owl seem to enjoy the benefits of size and scale in the wealth channel in ways that smaller firms cannot.

The average market share of each manager in wealth channel capital raised is an average of 11% for the top six managers. The market share of each of the next 7-25 managers is just 1% on average.

Arctos’ Ian Charles shared a similar narrative on a recent Capital Allocators podcast with Ted Seides. Charles stated “among 6,500 private market firms, just 15, or 0.2%, control 20% of the AUM. Moving down to level 7, 700 firms control 90% of the industry AUM.”

It’s worth noting that in traditional asset management, the top five firms by AUM control roughly 24.4% (as of December 2023) of the industry’s total AUM.

In Blue Owl’s case, their strong performance in the wealth channel has been achieved with only nominal cross-selling amongst platforms and products to date.

In both their wealth and institutional distribution businesses, cross-selling has only happened with a small percentage of clients. In wealth, 64% of transacting platforms have only invested in one product. With institutional investors, only 9% of their 900+ clients have invested across two platforms.

Cross-selling in and of itself represents another large opportunity for Blue Owl — and the broader alternative asset management industry given such underpenetration from the wealth channel thus far.

The blue-print

Growing AUM in private wealth is not an easy task.

It requires focus, capital, resources, and scale to do well.

Blue Owl’s presentation illustrates a blueprint for success in working with wealth.

It’s hard to do wealth well without a dedicated, scaled effort. And it’s not just distribution that’s required to do wealth well. It’s marketing and education, too.

Education is table stakes. While every firm benefits from their peers sharing insightful educational content, each firm needs to have their own educational initiatives so allocators associate its brand with the educational content.

But to do this well? Scale is required. Human capital is required. Multiple touchpoints with an advisor and their team are required. Events are required.

Marketing is critical to the success of a private wealth business: a ground game doesn’t work without aerial support.

If there’s a reason why firms are willing to invest into their wealth channel distribution efforts, it’s because the juice is worth the squeeze.

Blue Owl’s presentation illuminates the opportunity ahead.

The industry is so early in tapping into new areas of private wealth, whether it’s the retirement market, model portfolios, or tax-advantaged solutions.

And that’s just the opportunity in the US alone. That’s not even scratching the surface of the global wealth market, which Blue Owl highlights in the illustration below.

If meaningful allocations are rolled out of cash in large economies across Japan, Europe, and Australia, private markets allocations should grow.

The tea leaves are there to be read. It makes sense that firms like Blue Owl have recently hired boots on the ground in Japan and Australia to build out private wealth solutions for local markets.

Strong businesses

Another chart from Blue Owl’s presentation stands out.

The size and scale of an alternative asset managers’ client base is a critical feature as to why alternative asset managers are strong businesses.

The above chart from Blue Owl’s presentation that illustrates the breakdown of institutional LP clients shows that there’s both scale and stickiness that comes with building a large-scale asset management business.

37% of Blue Owl’s clients have committed $1B or more to the firm’s funds. 82% of Blue Owl’s clients have committed over $100M to funds that the firm manages.

These clients are large-scale, enterprise clients. The sales cycles can certainly be long, given how sizable the commitments by LPs are, but the juice is worth the squeeze. If we assume that institutional clients are paying 1% annual management fee, which would be low given that most funds in private markets charge between 1.25-2% annual management fees, over 82% of Blue Owl’s fee-paying institutional clients would be paying the firm over $1M in annual revenues. With 900 institutional clients, the firm is generating a good portion of their $2B in FRE management fees from large, sticky, and repeat institutional clients that will likely return if the firm delivers on its investment performance.

When viewed through the lens of large enterprise contracts, it’s easy to see why the business model of alternative asset managers is “better than SaaS.”

With contractual commitments from customers to pay a management fee annually over the life of a fund, virtually guaranteed revenues over a seven-to-ten-year period are even more attractive than SaaS revenues, where customers generally come up for renewal annually to every few years. Yes, fund managers are also fighting for LP re-ups into new funds every two-to-three-year fundraising cycle (or sooner, if they have different strategies), but with many firms evolving into multi-strategy platforms and one-stop-shops for allocators, growing LP wallet share appears to be the trend as allocators are beginning to increasingly invest in multiple products across a firm’s investment platform.

Alternative asset managers appear to be going from strength to strength.

A chart from Tikehau’s investor presentation in 2024 highlights the potential revenue capture for alternative asset managers, which is projected to dwarf traditional asset managers despite controlling less AUM.

Blue Owl is but one example of this secular trend of alternative asset managers growing their businesses in meaningful ways. And their business evolution and growth are emblematic of the opportunity ahead for alternative asset managers.

Their focus on the wealth channel might also prove to be an interesting bellwether for alternative asset manager distribution in wealth.

Blue Owl’s performance in the wealth channel to date would suggest that they can raise $10-15B per year from wealth, as they state below.

Can they raise another $50B+ over the next five years from working with the wealth channel? Other firms, like Apollo, have stated that they aim to grow their wealth channel AUM to $150B by 2029. EQT has laid out plans to grow AUM by $100B in its next fundraising cycle. Blackstone, the industry’s behemoth, has made ambitions to cross $1T in AUM (across Blackstone funds) from the wealth channel alone in the coming years.

It could certainly be interesting to keep an eye on their performance — and Blue Owl’s larger peers like Blackstone, Apollo, KKR, Ares, Brookfield, Carlyle, EQT, Partners Group, CVC, TPG — in wealth as a barometer for how the wealth channel is adopting private markets.

And I wouldn’t bet against them — or their industry peers — continuing to soar to new heights with their businesses and working with wealth.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

Oaktree Capital Management Managing Director and Assistant Portfolio Manger, Global Credit Strategy, Danielle Poli discussed on Bloomberg why shifting focus from spreads to yields makes sense in today’s market.

AGM News of the Week

Articles we are reading

📝 We Built These Investments for Individuals – Now Institutions Want In | Peter Beske Nielsen, EQT

💡EQT Partner and Global Head of Private Wealth Peter Beske Nielsen penned an op-ed on EQT’s ThinQ content platform, discussing how evergreen funds are not just changing the investor experience for individual investors but for institutional investors as well. While product innovation has been oft-discussed in the wealth channel due to operational demands and desires from individual investors, it’s notable that institutional investors also appear to be benefitting from this innovation.

Nielsen references EQT’s latest evergreen investment strategy, EQT Nexus Infrastructure, as a live case study of institutional investors desiring some of the same benefits that the product was designed to deliver to the wealth channel. Evergreen structures can reduce complexity, increase flexibility, and enable investors to have their capital put to work much sooner than in a closed-end fun.

Nielsen cites feedback from institutional clients across four areas that have resonated with investors:

Less complexity: Nielsen says that large investors appreciate the “simplified process — avoiding the complexity of subscription documents, capital calls, and reinvestment cycles.”

Compounding returns: Proceeds are reinvested in an evergreen structure so investors can enjoy the compounding effects.

Immediate exposure: Evergreen strategies eliminate the J-curve effect by providing instant exposure to a diversified portfolio of private market assets, usually across a combination of primary, secondary, and co-investment opportunities.

Flexibility: Evergreen strategies offer flexibility, enabling ongoing contributions and withdrawals.

💸 AGM’s 2/20: Nielsen’s view is notable because it validates a trend that’s emerging in private markets: product innovation in the wealth channel is not limited to the individual investor’s domain. In fact, quite the opposite. The innovation in private markets for the wealth channel investor is benefitting the long-time investors in private markets: institutional investors.

What’s interesting about this development is that institutional investors appreciate the same features of evergreens that appeal to individual investors: ease of use, flexibility, and compounding through immediate investing that limits the J-curve effect.

Ease of use is a critical component of delivering investment products, particularly to the wealth channel. It’s something that Blackstone’s Global Head of Private Wealth Solutions highlighted in her recent Alt Goes Mainstream podcast. She said, “ease of use is it.” Evergreens can certainly add helpful features to a portfolio — and removing barriers to investing in private markets is a net positive for both LPs and GPs.

But, the evolution of evergreens also brings up a number of interesting questions:

(1) If institutional investors look to evergreen funds as a solution of their private markets investing activities, will it change how distribution and investor relations functions are built out and organized within alternative asset managers? As we’ve discussed before, many of the largest alternative asset managers have built out dedicated teams focused on serving wealth channel investors. This development makes sense and, arguably, is a prerequisite for success in the wealth channel. The wealth channel requires boots on the ground coverage to properly engage, educate, and sell products. But, with institutional investors now showing an interest in utilizing evergreen structures, should there be a consolidation of institutional and wealth distribution teams so that information and feedback on product innovation can be more streamlined? It’s a question worth considering as both institutional and individual LPs evolve their buying preferences.

(2) With more product choice, how should investors go about building an investment program that incorporates both evergreen structures and closed-end vehicles?

As an October 2024 white paper by Goldman Sachs discusses, neither evergreens nor closed-end funds are the solution on a standalone basis. There is “no universal best choice,” they state. A chart from their report illustrates this notion.

Investors will have to make tradeoffs based on their desired outcome. If they want more liquidity and investor discretion and control on both the entry and exit into evergreen structures, they might want to leverage evergreen structures.

But performance might differ with evergreen funds relative to closed-end vehicles in a meaningful way. Goldman states that a drawdown structure might offer 2.25-2.75% greater annualized net return (time-weighted) than the comparable evergreen structure in private equity. They also state that the corresponding difference in returns in private credit is 1.5-1.75%. So, investors might be trading returns for ease of use by going with an evergreen structure over a closed-end vehicle.

Something I’d love to see is a framework for portfolio construction that incorporates both closed-end and evergreen structures and helps investors navigate the tradeoffs between vehicles, liquidity and illiquidity, ease of use, and returns. Certainly, portfolio construction should look different for an investor with no current exposure to private markets (who should likely start with evergreens in order to get invested into the market and not have to worry about building an investment program) and allocators with existing exposure to private markets. The first step was building out structures that enable investors to have the flexibility of choice. Now, approaches to portfolio construction are needed to help investors navigate the increasing choice — and pros and cons — of each respective structure and how they can fit together to create an optimal approach to private markets.

📝 What next for the private equity minnow? | Camilla Palladino, Financial Times

💡Financial Times’ Camilla Palladino discusses the challenges ahead for smaller funds. She references the paradox that many smaller buyout funds are facing: smaller funds often outperform larger funds, yet they often have a more difficult experience with fundraising. Private markets are in a phase where scale has advantages — and one of those advantages that firms with scale enjoy is in fundraising. This advantage is particularly enjoyed in the wealth channel, with the top six firms raising over 60% of the capital from the wealth channel, as I discussed above in my analysis of Blue Owl’s Investor Day Presentation.

Palladino cites data from Preqin that smaller private equity managers have outperformed their peers across 2012-2021 vintages.

But Palladino also notes that smaller funds are finding it more challenging to raise capital than larger funds. Pitchbook data on European fund managers finds that, increasingly, between 2014-2022, the percentage of funds that raised €1B or greater has been an increasingly large portion of new funds raised.

Palladino is likely correct in her observation that these trends will continue, as the new growth area of private markets distribution is in the wealth channel, where the largest firms are most well-equipped to raise capital. Palladino concludes by observing that smaller private equity firms have an increasingly unappealing set of options. One is to keep doing what they are doing. The other is to consolidate into a larger platform that is looking to add to its capabilities and investment strategies. The latter is likely to continue happening, although firms will need to be truly differentiated in order for the larger firm to want to acquire its capabilities and team. And, possibly, possess the right investment strategy that can scale its capacity once it has the distribution firepower of a larger platform.

💸 AGM’s 2/20: Alternative asset managers are at an interesting crossroads, particularly for those firms that are in the middle. The largest firms have charted out a clear growth path: they will grow in size and scale, they will work with the wealth channel and be appropriately staffed to grow AUM from this new, burgeoning LP, and they will likely go public or take in minority investment in the form of growth capital from a GP stakes firm that will enable them to continue their growth trajectory as they continue their quest to become a one-stop-shop, as I wrote about here in May 2024. The smallest firms can continue to carve out their niche, staying small and focused on their core area of expertise but likely foregoing the opportunity to work with the wealth channel in a big way due to limitations of size and scale. As they continue to have success, they will have a decision to make: do they try to grow, taking in growth capital from a GP stakes firm or looking at a partnership or acquisition by a larger platform, or do they stay small?

I wrote last week about how it’s critical to be either “really big or really unique.” This maxim certainly seems to ring true in private markets right now.

It’s the firms in the middle that are in a real predicament. It’s a space that HgCapital Trust’s Chairman of the Board Jim Strang referenced on his Alt Goes Mainstream podcast. Do they have the scale, ambition, capital, and wherewithal to take the next step and try to propel themselves into the upper echelons of private markets? Possibly. There are a number of firms, many referenced in AGM’s Next Wave, that could make that jump. Note that this is a non-exhaustive list of firms that are on the cusp of the next step.

But the middle are not out of chess moves. There are things they can do to continue to build their businesses, which, by the way, are not bad businesses at all if they manage tens of billions in AUM.

Strategic partnerships: If a firm wants to maintain some level of independence as a brand or access the distribution capabilities of a larger firm without consolidating into a larger alternative asset manager, they can follow the path of a Churchill or Pemberton. Both firms started by partnering with a larger platform, $1.2T AUM Nuveen in Churchill’s case, and $1.16T AUM Legal & General in Pemberton’s case. Sure, they gave up ownership in their firm, but they also gained immeasurable benefits in the form of initial seed capital, distribution resources, and brand association by joining forces with larger asset managers. Today, Churchill stands at over $50B in committed capital, and Pemberton has over ~$18B AUM. And, interestingly, this week Nuveen is reportedly exploring the sale of a stake in $78B AUM Nuveen Private Capital, which includes $52B managed by Churchill and $26B managed by Arcmont. Another form of partnership could come through strategic alliances. I wrote last week about how firms devoid of competitive overlap can work together to create best-of-breed model portfolios. This could certainly happen. It could also be the precursor to mega acquisitions between two or three firms that are $30-50B+ AUM to form a $100B+ alternative asset manager that would enjoy the benefit of scale that the industry’s largest firms do right now.

“Riches in niches”: A smaller firm can carve out a niche by focusing on a category that’s not currently big yet, but will undergo consolidation as larger alternative asset managers will look to buy that capability rather than build. Sports investing, which requires unique skillsets, knowledge, and networks, is one example where this could make sense.

Figure out your customer: For a manager in the middle, it’s critical for them to hone in on their ideal LP customer profile and where they can differentiate for that LP base. Is there a strategy in which they can excel as a firm? Is there a strategy where scale is the enemy of performance and differentiation? There are still enough “riches in niches” in private markets where sometimes size will be the enemy of returns. Performance should beget popularity. LPs will want to allocate to firms that generate strong performance. If performance can be sustained even as fund size increases, then a firm may have found its calling card.

There’s no one way to play the game on the field for alternative (and traditional) asset managers. But with things changing rapidly, how they play the game could determine their futures.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Senior Video Producer, SVP - Marketing. Click here to learn more.

🔍 Alto (Self Directed IRA investment platform) - Investor Sales Associate. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Internal Sales Desk Manager - US Wealth. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager– Senior Vice President. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click hear to learn more.

🔍 BlackRock (Asset manager) - Aladdin Wealth Tech - Vice President, Implementation Manager. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Hightower - Crest Capital Advisors (Wealth manager) - Private Wealth Associate - Crest Capital Advisors. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Edward Jones (Wealth manager) - Director, Alternative Investment Strategy. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Keith Jones, Senior Managing Director, Global Head of Alternative Investments Product at Nuveen live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.