AGM Alts Weekly | 3.2.25: Are "super-alts" firms super?

AGM Alts Weekly #92: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Alto provides access to alternative investments within self-directed Traditional, Roth, and SEP IRAs, allowing investors to diversify their portfolios while benefiting from the tax-advantaged growth. Through a streamlined platform and transparent pricing, Alto allows advisors to help their clients combine alternative investments' benefits with retirement assets' tax advantages.

We work with asset managers, wealth managers, VC funds, fintechs, and financial advisors to help them access the $11+ trillion IRA market. Our platform streamlines legal, administrative, and compliance tasks, ensuring transparency and enabling more efficient capital raise.

Good afternoon from Washington, DC, where I’m back from a week of meetings and podcast recordings in NYC.

“Super-alts”

Citywire’s Lawrence Lever, Alex Steger, and Alan Walsh penned a piece this past week about their recent CEO Summit, where they gathered nine asset management CEOs who collectively manage over $9T in assets.

Principal Asset Management’s CEO Kamal Bhatia made an interesting — if provocative — comment:

“I think the whole concept of a super-alts firm is a dangerous concept. Fundamentally, firms are good at one thing. To say you’re excellent at private equity and private credit and real estate and every form of private market, I think, is where this issue will come to a head.”

Bhatia has a point. Differentiation is critical in asset management. This sentiment is particularly true in private markets, where specialization and a manager’s edge often lead to outperformance.

Embedded within Bhatia’s comment are a number of important concepts.

When a firm looks to scale, it is possible that it could lose focus on specialization and returns at the expense of growing AUM. While that endeavor can help grow the enterprise value of the firm for the General Partners and its investors in the management company, larger fund sizes can potentially lead to lower returns for LPs.

As the saying goes, your fund size is your strategy.

There’s certainly truth to that. Fund size can drive performance.

One size doesn’t always fit all

Not every asset class within private markets benefits from scale.

The middle is far from middling, particularly for private equity.

A June 2024 report by Alt Goes Mainstream podcast guest Tyler Jayroe from JPMorgan finds data from MSCI that top-quartile US and European buyout funds that were sub-$3B meaningfully outperformed funds $3-10B and $10B+ during the 2010-2020 vintages. Return dispersions were not small — sub-$3B funds generated 25.8% IRR, 2.1% greater than funds $3-10B in size and 5.5% greater than funds $10B+ in size.

Is it a disadvantage to be a “super-alts” firm?

However, given the changing nature of private markets, perhaps the concept of a “super-alts” firm is not always a disadvantage to the alternative asset manager or its LPs.

Bhatia is right. It is challenging to be an asset manager that is all things to all people. It is not easy to be the best firm at everything.

But there are areas of private markets where having features of a “super-alts” firm can be beneficial to both the asset manager and its LPs.

Scale matters

Certain strategies in private markets sometimes require scale to succeed.

Infrastructure, private credit, and real estate are all examples of strategies where scale can be an advantage for asset managers.

Take a trend that sits at the intersection of infrastructure and real estate: digital infrastructure.

Blue Owl projects a $1.1T capital expenditure is required to build new data center capacity to meet the insatiable global data center demand.

Further, global data center demand is projected to grow at 15% CAGR over the next six years.

Who will be able to meet the growing demand for data center infrastructure? Firms that have the size and scale to finance the massive capital expenditures required to fund data center investment.

A firm that possesses capabilities and expertise across both infrastructure and real estate should appear to be well-positioned to win larger data center deals.

Credit is another area where scale can be impactful.

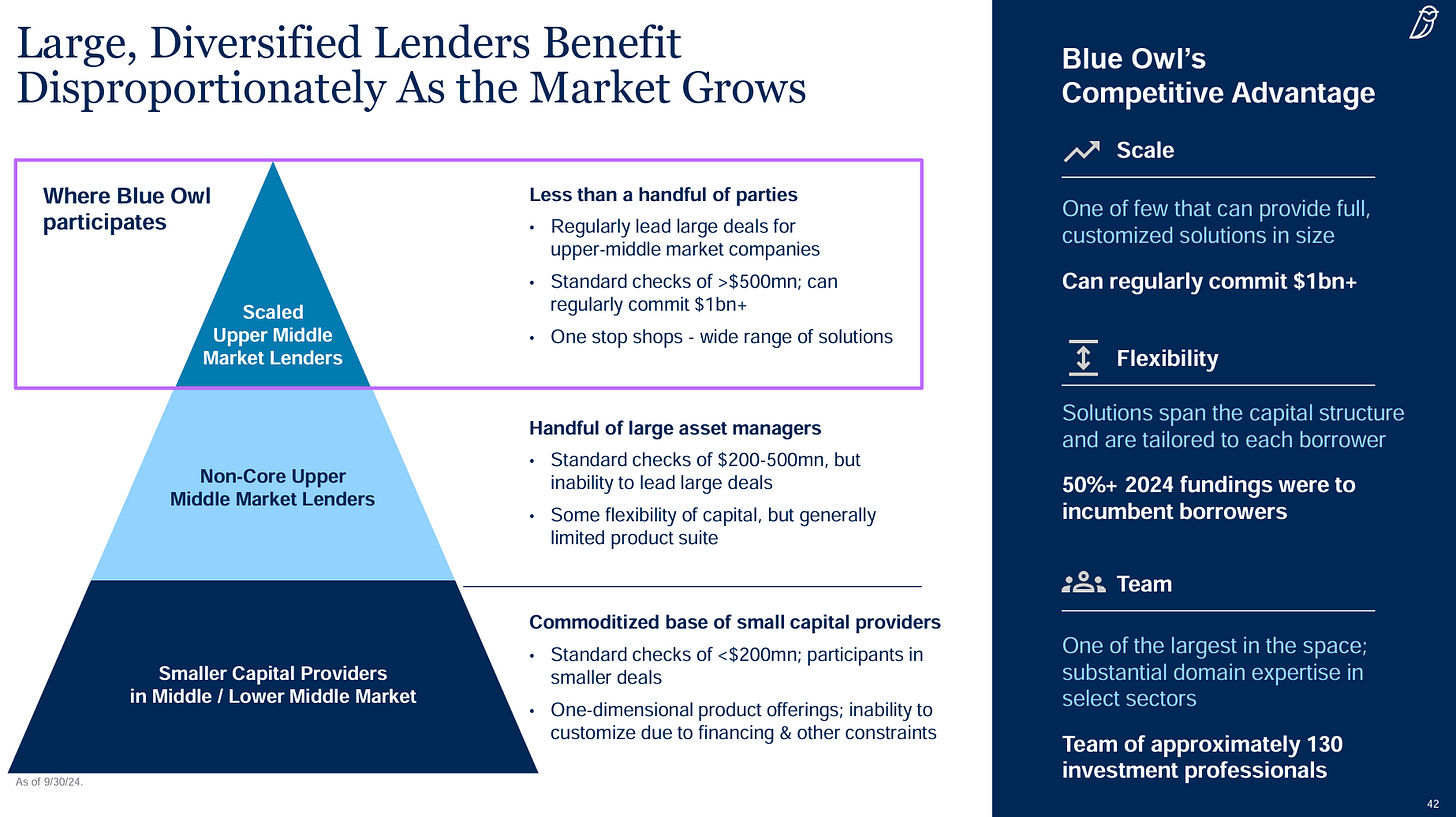

Take it from Blue Owl’s Investor Day Presentation.

What do they highlight as the key features of the market’s evolution to unitranche direct lending activity?

“Privacy, predictability, and partnership.”

Blue Owl notes that firms that possess the size and scale in direct lending are able to meet borrowers as a “consistent and reliable” source of capital.

There are only a small number of players, often firms that are one-stop-shop solutions providers, that have the ability to write $500M to $1B+ checks to upper-middle market companies.

Blue Owl would appear to make the case that being a one-stop-shop as a credit business enables them to be a solutions provider to borrowers, enabling for a greater variety of investment products and structures across a wider array of counterparties.

An illustration of how their credit platform has expanded since 2022 highlights how their “one-stop financing solution” can, in their view, benefit borrowers and investors.

Origination nation

PGIM’s President & CEO Phil Hunt asked an important question at the Citywire CEO Roundtable: “how does a firm originate assets?”

Origination is an area where scale matters.

Apollo is a poster child of a firm that has been able to generate an advantage in origination, in large part due to the 16 captive origination platforms it owns that enable it to manufacture deal flow.

A slide from Apollo’s March 2023 Investor Presentation highlights the unique value that their origination platform ecosystem provides to their credit business.

Without the scale that Apollo possesses as a business — and, arguably, as a public company with the currency to make strategic investments in or buy specialized origination capabilities — it’s likely that they would be devoid of the edge that they have today.

Apollo’s ability to leverage public company currency this past week to acquire $50B of AUM in real estate for $1.5B in stock illustrates the power of scale.

Apollo’s presentation explaining their acquisition of Bridge Investment Group highlighted “differentiated origination” in the first slide.

David Sambur, Apollo Partner and Co-Head of Equity, echoed a similar sentiment of the firm’s desire to enhance its origination capabilities: “We are pleased to announce this transaction with Bridge, which is highly aligned with Apollo’s strategic focus on expanding our origination base in areas of our business that are growing but not yet at scale.”

“Scale is our niche” … and “scale begets skill”

Speaking of scale, some firms would argue that scale itself can be a differentiator.

Former Blackstone CFO and Founder & Managing Partner of WestCap Laurence Tosi (“L.T.”) recounted a story on his Alt Goes Mainstream podcast from his time at Blackstone where CEO Steve Schwarzman said that “scale is their niche.”

L.T.’s other point when recounting the story may be just as important as the first.

L.T.: I remember when Steve said that. That scale is niche. I'm going to add a second part, which I guess gets less covered. He would also say that scale begets skill. And the more skill you can put against creating value, the more you can justify the scale [author emphasis]. So in the early days of Blackstone, shortly after we went public, there was a lot of confusion about, well, how's this different from the 40 Act shops that do mutual funds, et cetera. And the answer was we found businesses where skill really matters, i.e., finding businesses and knowing how to turn them around. And then we found a little bit of the golden rule that the more scale that we had, the more resources we would have at Blackstone to invest in creating alpha, if you want to call it that, or value creation. And so the scale actually made us more competitive. If I think back to when I joined the firm, I think our private equity fund was six billion, and our real estate fund was probably three billion. Those are about now both 30. That difference is not just adding more assets like you would to a mutual fund or a hedge fund. Those assets have translated to deep operating teams, asset management teams that can actually help create value during the course of the whole [author emphasis]. Also, going out and finding more deals, negotiating them. The golden rule in investing is where can you find a space that the more you invest in your returns, the greater the alpha you generate was. That's the right place to scale [author emphasis]. If you don't have that, then scale doesn't create what Steve said. It’s not your niche and doesn't create value.

L.T. noted that Steve said, “Scale begets skill.” And that skill is what has enabled Blackstone to create value in both investing and in post-deal value creation.

L.T.’s point about talent is critically important. Asset managers’ greatest asset is its people. The more scale a firm possesses, the more capital it will likely have to be able to pay for the best talent. Now, of course, there will always be cases where next-generation talent decides to spin out and start a firm on its own to capture more economic value on its own. But large firms that have scale — and the currency of a public company stock price, particularly when it’s on a growth path (see: The Blueprint on Blue Owl) — have a leg up on attracting and retaining top talent.

Evercore’s Glenn Schorr, a top-ranked equity research analyst who covers the publicly traded alternative and traditional asset managers, said as much on the first episode of the “Going Public” series. The most important feature of an asset manager?: “People, and then people, and then some good people,” said Glenn.

Certainty of execution

Scale enables certainty.

That certainty can come in the form of compensation to retain talent or acquire new capabilities, as many of the largest alternative asset managers — and traditional managers, like BlackRock, Franklin Templeton, and T. Rowe Price — have done.

Certainty can also come in the form of execution. In areas like private credit or infrastructure, a company might want to know that a firm can fund a transaction of size with certainty.

There isn’t a large preponderance of funds that can show up to finance a debt transaction with true size and scale. But alternatives managers that have raised large credit funds can do so.

News from this past week is case in point. Bloomberg reported that Meta is in talks to raise $35B for data center financing led by Apollo.

How many firms have the size and scale to provide $35B of capital? Now, it doesn’t look like Apollo will finance the transaction alone. KKR is also reportedly part of the syndicate.

But this news follows a trend: large private credit managers have the ability to be a capital provider of size to big companies.

Databricks secured over $5B in debt financing from Blackstone, Apollo, and Blue Owl. Intel received $11B from Apollo to finance new manufacturing facilities in Ireland.

There are few funds that have the capability to finance transactions of this size and scale. That alone creates a competitive advantage in origination and negotiating deal terms.

Fundraising fitness

Executing on sizable transactions isn’t the only feature that affords large firms the advantages of scale.

Scale enables the biggest firms to build an end-to-end investor experience that provides them with the ability to serve more investors — institutional and individual — in more ways on a global scale.

Only a handful of firms have the capital, global reach, and size to productize for the wealth channel and properly serve these investors, particularly when it comes to delivering a high-quality evergreen investment experience.

Blue Owl is an example of what success looks like when a firm focuses on building a business for the wealth channel.

As Blue Owl noted in its 2025 Investor Day Presentation, the majority (79%) of alternative asset managers don’t have a dedicated private wealth team.

Blue Owl’s moat relative to other firms? Scale.

It’s no accident that the industry’s largest firms have named their business units that serve the wealth channel “Private Wealth Solutions.” These managers can be solutions providers to the wealth channel. That requires different products for a diverse set of investors.

As I wrote in the 10.13.24 AGM Alts Weekly, wealth doesn’t have a singular definition or client type.

A large, diverse capital base and unique set of products doesn’t just give GPs an advantage in capital raising and further their quest for greater enterprise value creation; it can also help them win deals.

Evergreen funds can serve as a strategic asset for firms that employ their structures properly and responsibly. Evergreen structures enable managers to act quickly and with certainty to close a deal. That can help them show up with a larger check or better align with a family-owned business that may be looking for more permanent capital. The flexibility these new product structures offer can, in and of themselves, be a sourcing advantage.

Blackstone President & COO Jon Gray highlighted this point in a February 2024 article in Forbes:

“We partnered with the family that owned Carrix, the largest port operator in the U.S. and Mexico. And with the Benetton family on the privatization of Mundys [formerly Atlantia], which is the largest transportation infrastructure company in the world with a bunch of roadways in Spain and France, and the Rome and Nice airports,” Gray says, referring to deals in Blackstone’s $40 billion infrastructure group. “These families love the idea of partnering with a perpetual vehicle. Because if we tell them we’re gonna buy it and in three years we gotta sell, they’re like, ‘I don’t want that.’ ”

Evergreen structures are still in their early days of development. They must be thoughtfully constructed. Education will be critical, as Columbia Threadneedle CEO Ted Truscott noted at the Citywire CEO Summit.

But one thing is becoming more certain: evergreen funds are changing the very operating model of alternative asset managers, both in how they partner with LPs and how they can interact with companies.

Embedded investing?

But does a strategy like middle-market private equity have to be done as a standalone firm, or can it be done well within a larger platform?

Managers have tended to strike out on their own, in part because younger talent has often left larger firms that have achieved scale to move on to greener (yes, pun intended) pastures where managers can build their own firms and capture more of the enterprise and carry value.

But there are a number of firms that have growth equity or middle-market private equity strategies as part of a larger investment platform. And it hasn’t necessarily impacted those respective firms’ performance. In fact, the resources and capabilities of a larger platform, particularly with respect to fundraising, could offer an advantage over striking out independently.

The fundraising environment, particularly in private equity, is facing significant headwinds, as the below chart from S&P illustrates.

The fundraising pain is felt more acutely by emerging and smaller managers, so will those who are thinking about spinning out to start a new fund instead stay at a larger platform that affords more safety and certainty?

So, could this mean that the space will continue to see more partnerships and acquisitions that enable larger firms to add capabilities and smaller firms to benefit from the scale across investment and non-investment related activities as the market increasingly bifurcates between the haves and have-nots?

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

Goldman Sachs’ Co-Head of their Global Institute George Lee and Global Co-Head of Investment Banking Kim Posnett discuss the emergence of the new “data economy” and why 2025 could be the year of “enterprise scaling and adoption” for AI.

AGM News of the Week

Articles we are reading

📝 Firm consolidation prices out GP stakes PE investors | Jessica Hamlin, PitchBook

💡 PitchBook’s Jessica Hamlin covers how the consolidation in alternative asset management could have a reverberating impact on GP stakes investing activity. Hamlin looks at data from PitchBook’s Q4 2024 US Public and GP Deal Roundup to find that the majority of transactions were controlling, strategic stakes in other firms. PitchBook data illustrates that minority interest GP stakes deals represented just 15% (21 of the 141) of the asset manager-focused deals completed in 2024.

Recent years had less deal activity, but GP stakes deals represented a larger percentage of the total deal activity.

Does this shifting market dynamic result in larger alternative and traditional asset management firms pricing out GP stakes investors since strategic acquirers could be paying a premium for those assets? That’s the point PitchBook’s Hamlin appears to be making.

💸 AGM’s 2/20: Alternative asset management is in the midst of a wave of consolidation. PitchBook’s chart above illustrates that in no uncertain terms.

But are GP stakes investors priced out of doing deals because of this wave of consolidation? Perhaps, but then again, there might be other ways to look at the developments in the space.

Certainly, larger alternative asset managers with the currency of public stock can afford to pay up to accrete value. Perhaps some might look at this past week’s all-stock $1.5B acquisition of $50B AUM Bridge Investment Group by Apollo as an example of a larger firm generating value by acquiring the AUM and platform of a smaller firm.

Apollo’s presentation on their acquisition of Bridge highlights why it is accretive to the firm — both in terms of growing pro forma AUM and how they are able to trade in a lower FRE multiple on Bridge and absorb it into their own platform, which trades at a higher FRE multiple.

But outside of strategic acquisitions by larger platforms, there’s plenty of deal activity that could occur, particularly in the middle market.

Two factors drive my view that strategic acquisitions are not necessarily pricing out GP stakes investors from executing minority stake transactions.

One is more anecdotal in nature, the other more quantitative.

At the upper end of the market, firms that are approaching size and scale as multi-strategy platforms might decide to take on strategic minority investment to grow themselves as they chart a path to a future public exit rather than look to be consolidated by a larger firm.

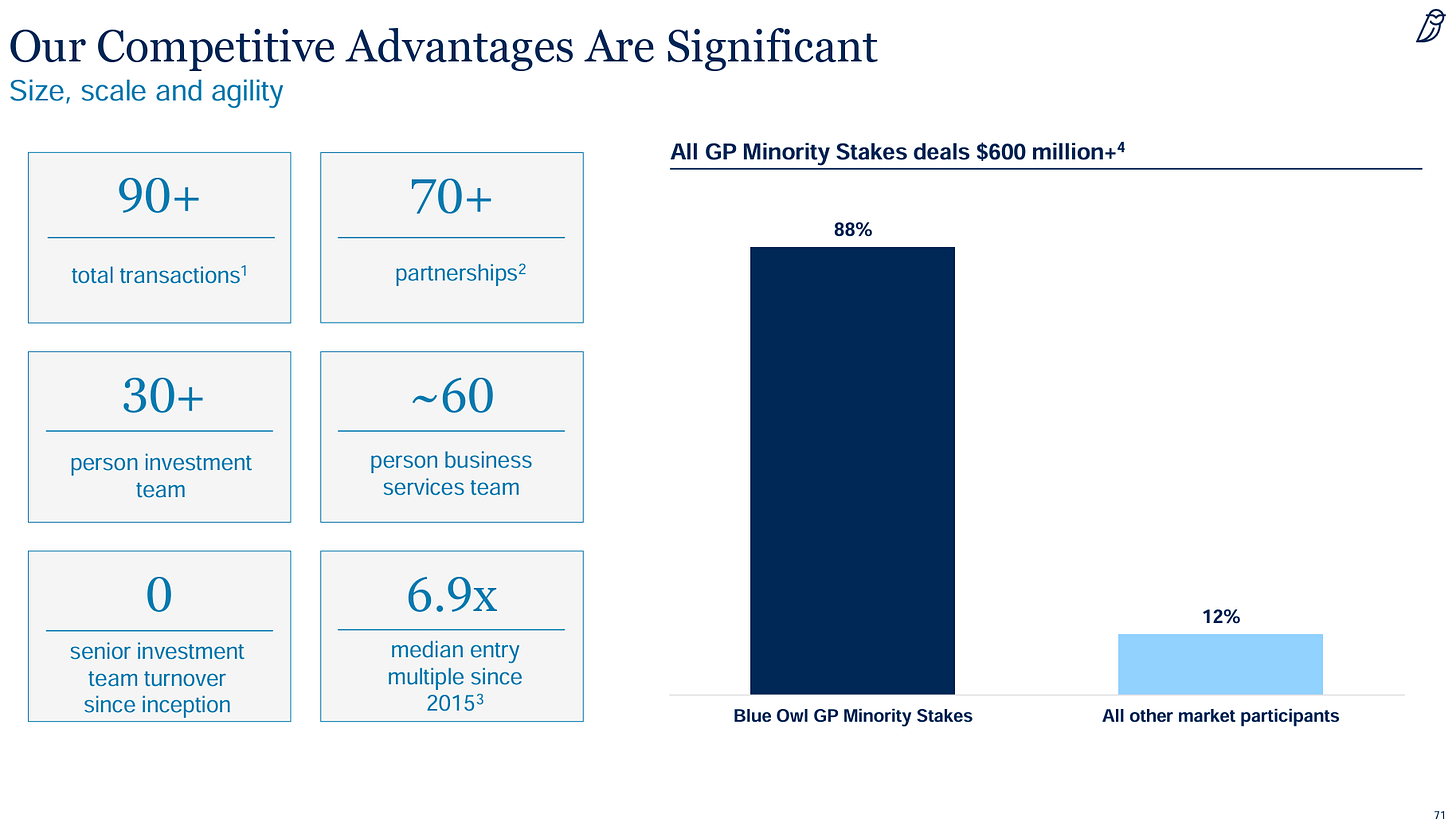

Yes, a good number of firms at the top end of the market have already taken in minority investment by a GP stakes fund. Blue Owl’s GP Strategic Capital business owns that market, completing 88% of all minority stakes deals $600M or greater in size.

Many of the firms that Blue Owl has invested into could grow to the size and scale where they could eventually go public themselves.

A number of these firms have been highlighted in AGM’s Next Wave, a non-exhaustive list of privately held alternative asset managers that have achieved the size and scale that would put them in a position to go public or continue on as a scaled privately held firm.

As these firms continue to think about their growth path, I’d expect to see them consider additional investment from stakes investors or large institutional LPs (like pensions or sovereigns) — or consider acquisitions of smaller firms themselves.

A chart from Blue Owl’s Investor Day presentation illustrates that they believe there to be ample opportunities to continue to invest in current partner managers.

Another more quantitative perspective focuses on the middle market.

Analysis from Cantilever, a middle-market focused GP stakes investor, finds that under 4% of GPs with $0.5B-8B AUM have sold GP stakes to investors. That leaves around 1,700 of the roughly 1,800 GPs in this category as possible targets for stakes (or acquisition). There’s a meaningful supply / demand imbalance in this part of the market. Less than $10B of capital has been raised across GP stakes funds to target minority investments in middle-market firms. While some firms in the middle-market may be consolidated by larger firms at premiums to where many middle-market firms might trade, this supply / demand dynamic should far from price GP stakes firms out of transactions.

When I asked Cantilever Co-Founder & Managing Partner and ex-Goldman Sachs Partner Todd Owens about his views on the middle-market stakes landscape, he said that he’s not concerned about a lack of investment opportunity for stakes investors. In fact, he doesn’t mind that control bids are at higher valuations because it implies a discount for a stake investment, making a minority stakes investment at the right price an attractive proposition for firms looking to invest in the category. There are plenty of firms that do not want to sell control positions, yet are still in need of capital to fulfill their growth ambitions.

📝 Scoop: General Catalyst is considering an IPO | Dan Primack, Axios

💡 Axios’ Dan Primack reports that General Catalyst, the $32B AUM VC (well, now much more than just a VC fund), is considering an IPO. If GC were to go public, it would be a watershed moment for the VC industry. GC would be the first US venture capital firm to become a public company, nearly two decades after Fortress and Blackstone led the charge for the private equity industry. Primack notes that GC is in the preliminary stages of exploring an IPO. They haven’t hired bankers or laid out a timetable. GC is, however, taking all the steps necessary to diversify its business and ready itself to be a public company.

💸 AGM’s 2/20: General Catalyst appears to be moving all the chess pieces in a manner that diversifies their business so they could eventually appeal to public market investors. The initial challenge for private equity firms like Fortress and Blackstone, when they went public, was that it was hard for public market investors to figure out how to value these firms. Now that a number of alternative asset managers have entered the mainstream and have been in public markets for a prolonged period of time, it’s become easier for public market investors to understand their businesses and what drives their growth (read: fee-paying AUM, for the most part).

The biggest headwind that GC could face in a path to an IPO? How would public markets value the firm? This question is particularly pertinent to a firm with its roots steeped in venture capital, where carry, rather than management fees, are king. Sure, a $32B AUM platform generates plenty of management fees (just the new $8B in AUM alone should generate hundreds of millions of dollars in fee-related earnings), but the carry, particularly in venture capital, can prove to be much more elusive to value. And, this form of revenue is generally valued a discount to the more consistent, predictable management fee revenues.

With GC exploring an IPO, the next step will be to prove that they are a diversified platform with a consistent, steady, and durable stream of revenues.

Some of their recent actions would suggest that they are making the moves to do so. One example? They recently unveiled a wholly-owned wealth management business with over $2.3B in AUM, GC Wealth, by bringing in First Republic’s Head of Wealth Management Dave Breslin, to build out a full-fledged wealth management offering to those in the GC network and beyond. Wealth management is a perfect example of a business that provides steady revenues to offset the more uncertain revenues that a venture capital-focused alternative asset manager would possess.

They’ve also launched an incubation arm that has bought a hospital, creating a Health Assurance Transformation Company.

And, the firm’s management and external investors seem to believe that there’s upside. They recently bought back most of a minority stake held by Goldman Sachs’ GP stakes firm Petershill Partners that is comprised of GC’s management fee earnings and future performance related earnings at a significant premium to where Petershill invested in 2018 when GC had $5B in AUM. It looks like General Catalyst’s purchase of the Petershill position was financed through interest-bearing loan notes at a 10% interest rate, enabling GC to reduce their cost of capital (and reduce the number of outside shareholders) in advance of any future financing activity.

So, if we are creating a checklist of the steps that GC would need to take to pave the way for a public offering, it would seem like they are doing the things that would put them on the path to IPO:

✅ Raising large funds and growing AUM.

✅ Diversifying revenue streams — both by launching a wealth management business and an incubation arm.

✅ Going global and expanding their footprint — by acquiring European VC firm La Famiglia and Indian VC firm Venture Highway.

✅ Hiring from top alternative asset managers — by bringing in former Blackstone CMO Arielle Gross Samuels.

✅ Buying back a stake from their GP stakes investor, Petershill.

Could we look back in a few years’ time and say that the tea leaves were there for us to see when GC was readying for an IPO? It’s certainly possible.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Investor Relations Professional. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Alto (Self Directed IRA investment platform) - Investor Sales Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager– Senior Vice President. Click here to learn more

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Credit Executive Office, Senior Associate / Associate - Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click hear to learn more.

🔍 BlackRock (Asset manager) - Director, Alternatives Operations Change & Transformation Management Lead. Click hear to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Hightower - Crest Capital Advisors (Wealth manager) - Private Wealth Associate - Crest Capital Advisors. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Edward Jones (Wealth manager) - Director, Alternative Investment Strategy. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Keith Jones, Senior Managing Director, Global Head of Alternative Investments Product at Nuveen live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.