AGM Alts Weekly | 3.9.25: Wave after wave

AGM Alts Weekly #93: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Alto provides access to alternative investments within self-directed Traditional, Roth, and SEP IRAs, allowing investors to diversify their portfolios while benefiting from the tax-advantaged growth. Through a streamlined platform and transparent pricing, Alto allows advisors to help their clients combine alternative investments' benefits with retirement assets' tax advantages.

We work with asset managers, wealth managers, VC funds, fintechs, and financial advisors to help them access the $11+ trillion IRA market. Our platform streamlines legal, administrative, and compliance tasks, ensuring transparency and enabling more efficient capital raise.

Good afternoon from New York, where I have been in town for a week of podcast recordings and meetings.

Wave after wave

Every industry’s evolution goes in waves.

Private equity is no different.

A chart from the recently published Bain & Company’s Global Private Equity Report 2025 illustrates the industry’s current wave.

It’s a tough wave to ride right now, particularly in fundraising. In fact, it’s probably more like swimming against a current.

Private markets fundraising in 2024 ended down 24% year-over-year from 2023 and down an additional 15% from 2022. Private equity fundraising in 2024 came in 23% lower than in 2023.

The culprit? Well, there are a number of factors. But chief amongst them is the ratio of distributions to contributions.

2022 and 2023 proved to be tough years for distributions. Distributions ground to a halt in recent years, with the ratio of distributions to contributions coming in at 0.8 in both 2022 and 2023.

The result? Increasing reluctance to allocate to private equity.

Recent trends have left private equity near the trough of a wave. As the above chart illustrates, global buyout assets under management, which had experienced a significant secular growth trend of 14% CAGR from 2015 to 2023, slowed in 2024.

It’s not like the industry hasn’t experienced a more challenged wave of growth before. Private equity experienced a meaningful uptick, albeit when the industry was smaller, before the global financial crisis (“GFC”). Post-GFC, the industry struggled with continued increases in AUM as liquidity was harder to come by.

Could a similar trend lie ahead?

Perhaps. But Bain’s report did offer some hope that the industry could catch a new wave.

Riding a wave of exits?

The exit market made its way out of a two-year decline, reaching exit values at levels higher than 2020.

The driver? Sponsor-to-sponsor exits, which saw a 141% year-over-year increase in exit value and a 26% increase over its five-year average.

There are certainly valid questions about the sustainability of sponsor-to-sponsor exits, particularly as deal multiples remain elevated compared to prior years.

Median EV/EBITDA multiples saw increases in 2024 in both North America and Europe — and remain elevated over their five-year averages.

Questions arise when going through the exercise of what elevated multiples mean when paired against the backdrop of heightened levels of dry powder.

Not only is dry powder at record levels but aging dry powder (dry powder held for four years or more) is at 24%.

Funds, particularly the biggest ones, have continued to raise large funds in recent years. However, distributions have failed to keep up with growth in AUM.

GPs have had to look for ways to generate liquidity. Growth in secondaries has been an outgrowth of the lack of exits.

Other tools in the toolkit for GPs have been dividend recaps, NAV loans, and minority interests, as 30% of companies in buyout portfolios have had some sort of liquidity events as the industry has raised over $360B to facilitate distributions for LPs.

A hard wave to catch

Fundraising has never been harder — or longer — for many buyout funds.

The number of funds that have successfully closed a fundraise in six months in 2024 has hit its nadir over the past ten years. Conversely, the majority of funds are now faced with a one, if not a two, or more year fundraising process.

For those who were reading the AGM Weekly in June of 2024, they will know about my love of electronic music. Pete Tong had presented at the industry gathering at SuperReturn in Berlin, making it a fitting week to spin some tracks, which I did in my SuperReturn EP (if anyone is looking for a DJ at their party at SuperReturn Berlin, you know where to find me).

With private equity currently facing the music, I figure it’s fitting to return to the studio (no, not the AGM Studio).

If private equity were a song right now, it’s quite possible Mr. Probz’s Waves (the Robin Schulz Remix Radio Edit, of course, given my penchant for electronic) would characterize how GPs are feeling.

My face above the water

My feet can't touch the ground

Touch the ground, and it feels like

I can see the sands on the horizon

Every time you are not aroundI'm slowly drifting away (drifting away)

Wave after wave, wave after wave

I'm slowly drifting (drifting away)

And it feels like I'm drowning

Pulling against the stream

Pulling against the streamI wish I could make it easy

Easy to love me, love me

But still I reach, to find a way

I'm stuck here in between

I'm looking for the right words to sayI'm slowly drifting, drifting away

Wave after wave, wave after wave

I'm slowly drifting (drifting away)

And it feels like I'm drowning

Pulling against the stream

Pulling against the stream

GPs are certainly pulling against the stream. They are trying to make it easy for LPs to love them, but that’s not easy in the current market.

Perhaps it hasn’t all gone Pete Tong

But there are reasons to believe it hasn’t all gone Pete Tong.

Yes, private equity might be going through a challenging wave, but there are also waves of innovation and consolidation (both by LPs investing in the biggest managers and by GPs looking to consolidate specialized managers to add to their scaled platforms).

GenAI has the ability to make a profound impact on private equity firms and their portfolio companies.

Some statistics and anecdotes from Bain’s report stand out:

Bain surveyed private equity firms representing $3.2T in AUM in September 2024. Respondents reported that the majority of their companies are either testing or using AI. 20% of their companies have operationalized GenAI use cases and are already seeing concrete results.

Some firms, like Vista Equity Partners, have made it a priority for their portfolio companies to adopt AI. Bain’s report mentioned a profound viewpoint: over the next three to five years, Vista expects AI’s impact on a software company’s top and bottom line will reframe the famed “Rule of 40” (growth rate plus free cash flow rate should be 40% or greater) in SaaS to make the new standard for revenue growth plus margin to be 50-60%.

Vista Founder, Chairman, and CEO Robert Smith noted at the firm’s 2024 CXO Summit that ~15% of Vista’s portfolio companies have already implemented GenAI-powered customer support tooling with measurable impact.

Some of Vista’s portfolio companies have already benefitted from the adoption of AI (from Smith’s talk at their CXO Summit):

Mindbody achieved $1.25M in annual savings by integrating a GenAI-driven customer bot to help handle customer contact and by consolidating their customer experience technology stack.

Quickbase achieved a 30% increase in marketing content creation by leveraging GenAI in their marketing efforts.

Avalara has seen sales representatives respond 65% faster (a median response time of 51 seconds) thanks to Drift’s GenAI tool that drives sales efficiency.

Pipedrive has achieved a 9% increase in deployments per developer as well as a 31% decrease in total bugs thanks to implementation of an AI-assisted code generation tool.

It’s quite possible that AI adoption has come at an opportune time for private equity to catch the crest of a new wave: more efficiency and margin expansion thanks to AI.

Coupled with the possibility of more reasonable valuations (which could be plausible if markets continue to perform as they are), AI-driven operational efficiencies could make for some strong upcoming vintages for private equity.

In fact, I’d go so far as to say that private equity might be the big beneficiary of continued AI innovation and adoption, even more so than venture capital. Many services industries stand to benefit from increases in efficiency from AI, which will reduce costs and headcount, resulting in even better margins. With private equity, there’s now an opportunity to own already profitable businesses and make them even better. The biggest winners of AI (other than the VCs that hit on what become the market-leading AI companies, which today still seems somewhat unclear) could be the world’s substantial companies that apply AI and can compound their earnings at an even faster rate due to technology innovation.

That seems like a promising outlook for private equity.

Paddling or surfing?

Bain’s report also covers the strategic imperative for private equity firms.

In increasingly choppy waters, strategy is ever more important for firms to be able to effectively play the game on the field.

The current game on the field is much harder than in years past.

A challenging exit environment, higher levels of dry powder, the requirement to invest more capital into the firm to drive initiatives in fundraising and post-deal value creation all come at a time when fees are falling.

Traditional asset managers have seen this movie before. A sustained period of growth in mutual funds and ETFs has made way for a secular decline in fees.

Will fee compression make its way to private markets? Well, Bain indicates that it already has. Although 2/20 (2% management fee, 20% carry) is still the typical rack rate for PE funds, fee compression is already starting to happen.

Bain & Company analysis finds that the average net management fee has been reduced by as much as 50% since the global financial crisis.

How long before private markets start to experience a trend akin to traditional asset management? It will likely happen, but the question is when. Evercore’s Glenn Schorr discussed this topic in his episode of Going Public.

Firms that are thinking hard about their strategy are adapting to this game on the field.

The firms that see fee compression on the horizon have gone into the lab to figure out how to create structures that make sense in a new world order of investing — and capital raising.

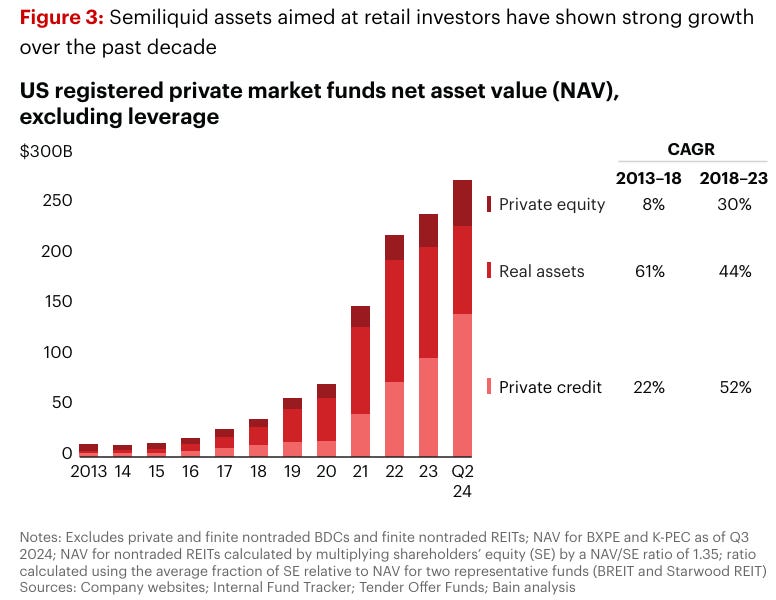

Private credit and real assets have been the early beneficiaries of this innovation. Perhaps these asset classes and strategies have been easier to fit into evergreen structures, but private equity is starting to catch up. Private equity evergreen AUM has seen asset growth of 30% CAGR from 2018 to 2023 after a period of 8% CAGR from 2013 to 2018.

Continued use of evergreen structures in private equity has some currents moving in its favor. Private companies are staying private longer, so an evergreen structure could make sense for some of these assets. So too could family owned businesses that view perpetual vehicles as the right type of structure to enable them to grow with the advantages of private capital in a vehicle that has a long term, if not perpetual, horizon. KKR’s innovative Conglomerate LLC (“K-PEC”) structure, an operating company formed to acquire, own, and control portfolio companies, is one example of firms understanding the strategic imperative to innovate as the industry evolves.

The industry’s largest firms have also made chess moves that have put them in a position to play the game on the field.

They’ve brought in quite a high-impact sixth man off the bench to play the new game on the field that involves more perpetual capital: by owning or structuring their business and vehicles in a way that provides them with more access to permanent capital. Apollo, KKR, and Blue Owl, amongst others, have all bought or own large stakes in insurance companies that provide them with access to permanent capital.

But only certain types — and a certain number — of firms have the ability to make these types of strategic moves and manufacture and distribute these evergreen products at scale.

Smaller firms can navigate this changing game, but it won’t be easy. The firms that will surf this next wave will be the ones that “align on ambition,” as HgCapital Trust’s Chairman of the Board Jim Strang has said, and, in many cases, will be firms that have the scale to play to win.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the Week

Two of Wall Street’s titans — one in public markets (BlackRock) and one in private markets (Blackstone) — came together for a picture this past week for a Barron’s article by Andy Serwer and Rebecca Ungarino.

Does anything capture the convergence between public and private more than this picture? Private is becoming more public — Blackstone is offering more and more evergreen funds and being more public with its brand. Public becoming more private — BlackRock spending almost $30B to add over $230B of AUM to its private markets capabilities. Perhaps illiquid is becoming more liquid just as liquid is becoming more illiquid.

AGM News of the Week

Articles we are reading

📝 Apollo and Motive Partners Create a Private-Markets Client Services Provider | Isaac Taylor, Wall Street Journal

💡 WSJ’s Isaac Taylor reports that Apollo and Motive Partners, in which Apollo holds a minority equity stake, have agreed to set up and build a client services company to enable fund managers to more efficiently and effectively manage the growing investor relations responsibilities that are coming with increased participation from investors in private markets. Lyra Client Solutions Holdings is being spun out of Apollo’s client services division and will offer fund managers operations and technology solutions to perform client service functions for investors. Lyra will offer its clients “everything from the data room and portal support to portfolio-construction services,” said Stephanie Drescher, a Partner and Chief Client & Product Development Officer at Apollo. The creation of Lyra comes at a time when many large alternative asset managers are looking for ways to increase the size and scale of their relationships with the wealth channel. The operational burden of working with the wealth channel is significant, requiring alternative asset managers to rearchitect much of their pre- and post-investment functions to better serve investors at scale. Taylor mentions a number of developments that indicate that the industry’s largest firms — both traditional and alternative asset managers — are ramping up their work in the wealth channel, citing Blackstone’s evergreen vehicles, BREIT and BXPE, as well as BlackRock’s partnership with Partners Group. Motive Founding Partner and Head of its Investment Team Scott Kauffman noted, “There is a real need for a high-end client service platform for the [private-markets] industry that can scale as the industry is growing.” Kauffman also believes that offering scalability via a vendor relationship is preferred to managers trying to scale internally.

💸 AGM’s 2/20: The creation of Lyra is notable because it is the signal of an important trend: the focus on creating solutions to help GPs manage and handle the requirements of working with the wealth channel. It’s exciting to see innovation in pre-investment GP solutions since much of the technology innovation to date has focused on post-investment solutions such as portfolio monitoring and valuations, fund administration, fund accounting, portfolio management, and data management. All of the innovation post-investment will undoubtedly continue — and it’s an area where I’m excited about increasingly better solutions for both alternative asset managers and investors into these funds. I’ve believed for quite some time — and part of our investment thesis is centered around this concept — that private markets market structure required post-investment innovation in the aforementioned areas in order to be ready to create solutions in pre-investment solutions like we are seeing with the likes of Lyra. This announcement is but one example that the market is ready for pre-investment GP solutions that will help GPs innovate on diligence and distribution beyond the businesses that have already been built in this space (and, by the way, some of these businesses that are the operating system for private markets can very much build and offer these solutions).

What the Lyra announcement reinforces is how critical client experience will be if GPs are to effectively serve the wealth channel. Apollo’s Stephanie Drescher said as much in her recent Alt Goes Mainstream podcast episode:

Making sure that you're the best partner in every way to the financial advisor, to the high-net-worth client is valuable. We try to put ourselves in their seat with this client-centric approach.

Client experience matters, particularly in the wealth channel. Advisors are in the business of making things easier for their clients — and if private markets are to be adopted at scale by the wealth channel, then client experience must be in a place where advisors feel confident that the managers they work with are able to deliver on seamless fund subscriptions, reporting, and tax experiences. Delivering a good customer experience at scale will only become harder as investment minimums continue to decrease. As the below chart from Bain’s report illustrates, the wealth channel still remains meaningfully underpenetrated, particularly those in the high-net-worth ($1-5M) and mass affluent (less than $1M) categories.

If private markets is to realize the increase in AUM from these cohorts that Bain is predicting in the chart above, client service at scale will be right in the center of realizing this prediction.

But there is an interesting twist to this story: will Apollo’s peers be comfortable using a technology solution developed and owned by their competitor? Perhaps so, but I think that the fact that everyone can win in the growth of private markets AUM, albeit with some firms becoming greater relative winners than others, means that firms will find a way to leverage technology to better enable their business.

This question gives rise to another important question as private markets continues to find ways to work with the wealth channel: are there areas where firms should look to collaborate even if they are effectively competitors? My view? Absolutely. There are areas, like education, where everyone wins by collaborating to better serve the industry. Continued innovation in data and reporting could be another.

Is the Schwarzman / Fink photoshoot from this past week a foreshadowing of more “frenemy” relationships to come?

📝 Permira Sees Private Capital Opportunities in Volatile Markets | Fion Li and Swetha Gopinath, Bloomberg

💡 Bloomberg’s Swetha Gopinath and Fion Li report that Permira’s Executive Chairman Kurt Björklund sees opportunities for private capital during a period of higher market volatility. “When the markets are really weak, that is when the opportunities emerge for private equity,” Executive Chairman Kurt Björklund said in a Bloomberg Television interview on Wednesday. “It is easy to forget our job is to look for good value when there’s less capital chasing good opportunities.” Björklund noted that owners and companies might look for liquidity or look to sell in a more volatile market, paving the way for private equity to invest into these types of opportunities that arise. Björklund also said that defense, particularly in Europe, could become a more attractive and economically significant sector as European governments look to increase their military spending. Bjorklund, whose firm manages $85B in AUM and has offices across Europe, the US, and Asia, said that this year could feature volatility. “This year is going to be marked by extreme volatility,” said Björklund. “We have seen that the last couple of months. It’s going to continue. I’m not sure that is the right environment to look for stable dealmaking.”

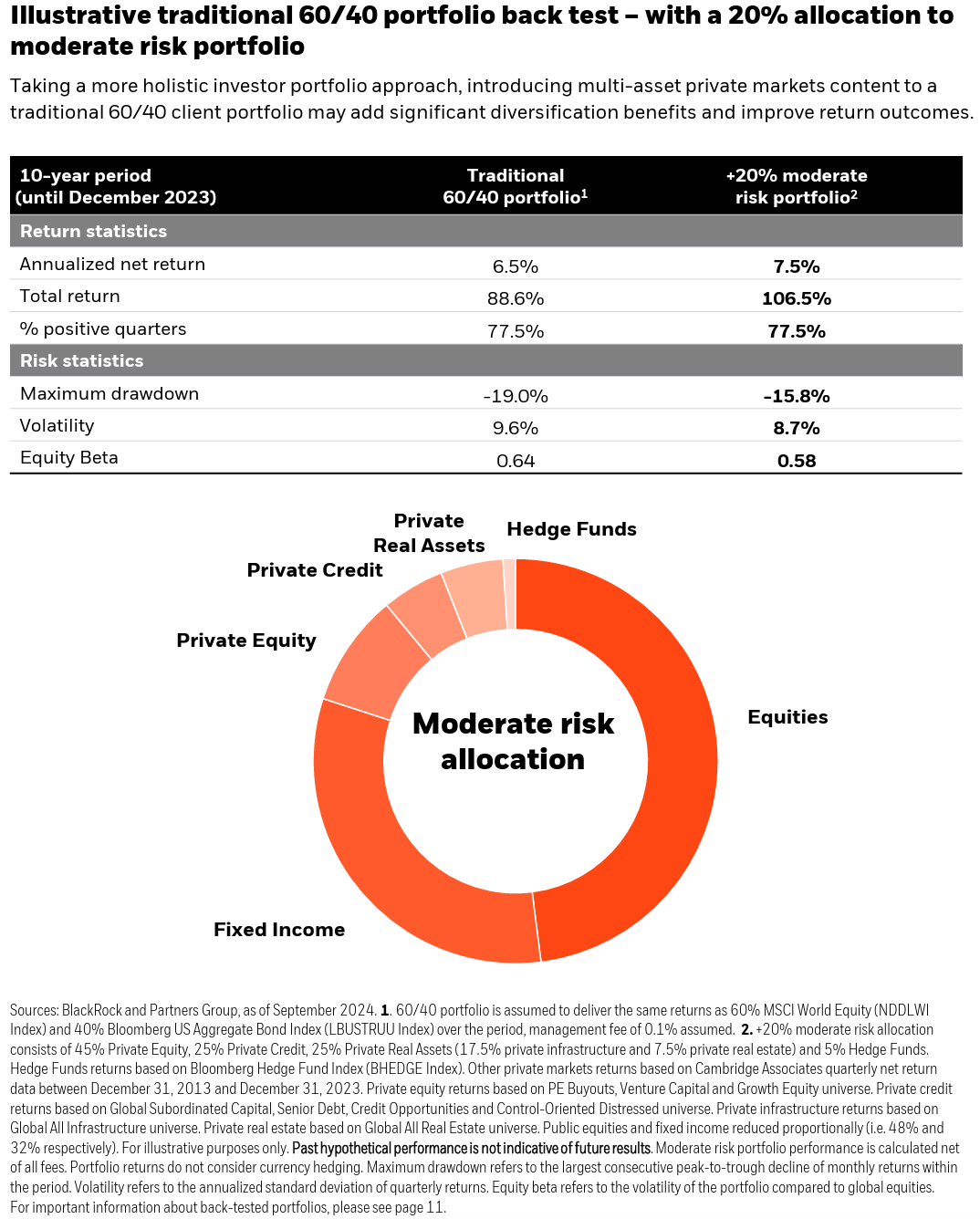

💸 AGM’s 2/20: Björklund’s comments come at a time when investors are navigating a period of uncertainty — economically, geopolitically, socially — all of which is making markets increasingly hard to read. Uncertainty often leads to volatility, which can create a difficult environment for investing. Private markets has its flaws — and illiquidity can have its challenges — but there’s an argument to be made that adding private markets to an investors’ portfolio can help to dampen volatility. The long-term nature of private equity can, in certain cases, help investors ride out certain market cycles or periods of volatility. Yes, certain market cycles can be more or less attractive times to invest in private markets, but, over a prolonged period of time, private markets can help smooth a portfolio’s volatility (and, in some cases, enhance returns).

A few charts from BlackRock and Partners Group’s September 2024 white paper on private markets and model portfolios illustrate how adding a private markets allocation to a portfolio can reduce volatility relative to a traditional 60/40 portfolio.

Investors have clearly shown increased interest in private markets, particularly in the wealth channel. Will continued volatility make even more investors start to allocate to private markets — or allocate in bigger quantums?

Podcasts we are listening to

🎙️Atomization of Private Equity Decisions at Charlesbank with CEO and Co-Head of Flagship PE Michael Choe | Ted Seides, Capital Allocators

💡 Ted’s February podcast with Charlesbank’s Michael Choe was a great episode on the evolution of private equity and how to think about risks and underwriting.

Some points and topics that stood out:

“Hidden risks” and how to evaluate them in the context of underwriting and modeling different outcome scenarios.

Why Choe believes the five year LBO model is flawed due to how to think about outcome dispersions in actuality versus in a modeling scenario and how their two year “fan of outcomes” model has helped them evaluate investment decisions.

Modeled outcomes as probability distributions.

The decision of underwriting is the asymmetry between upside scenario and downside scenario.

Why two year EBITDA performance is a good predictor of investment success.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Investor Services Onboarding, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Investor Relations Professional. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Credit Executive Office, Senior Associate / Associate. Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click hear to learn more.

🔍 BlackRock (Asset manager) - Director, Alternatives Operations Change & Transformation Management Lead. Click hear to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 AlTi Global (Wealth manager) - Senior Compliance Officer, Funds & Alternatives. Click here to learn more.

🔍 Edward Jones (Wealth manager) - Director, Alternative Investment Strategy. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Stephanie Drescher, Partner & Chief Client & Product Development Officer discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Watch here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Keith Jones, Senior Managing Director, Global Head of Alternative Investments Product at Nuveen live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.