AGM Alts Weekly | 7.20.25: To whom much is given, much is expected

AGM Alts Weekly #112: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Some testimonials about the AGM Sunday Alts Weekly newsletter include:

"Alt Goes Mainstream is category of one." Global Head of Marketing & Communications, $X00B AUM alternative asset manager.

“When it comes to the intersection of alternative investments and wealth management, Michael just gets it.” CIO, $18B AUM RIA.

“This is our primary resource for learning and reading about alts.” Head of Marketing, $250B AUM alternative asset manager.

“If you want timely and informative insights on everything private markets, Michael Sidgmore and Alt Goes Mainstream weekly update and podcast are fantastic resources.” CIO, $47B AUM RIA.

“The only email I never delete when clearing my inbox.” Senior distribution professional, $330B+ AUM asset manager.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends at the intersection of private markets and wealth management and navigate this rapidly changing landscape.

Presented by

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good afternoon from Washington, D.C.

The convergence of public and private has opened up the door to a raft of partnerships between traditional and alternative asset managers.

The race for retirement is creating new types of partnerships.

This week’s news of Blue Owl’s strategic partnership with Voya Financial, a provider of retirement, investment, and benefit solutions, is emblematic of the growing focus on delivering private markets solutions to retirement accounts.

The partnership will initially see Blue Owl and Voya develop investment products specifically tailored for defined contribution retirement plans. According to a press release by Blue Owl, the firms will jointly develop collective investment trusts (“CITs”) that provide access to private markets strategies by Blue Owl and Voya. These CITs will be distributed through advisor-managed accounts on Voya’s retirement platform and through target date solutions managed by Voya Investment Management.

Voya is a behemoth in the retirement and defined contribution market.

The firm serves over 39,000 US employers and their 9.3 million retirement plan participants. These relationships account for over $630B in defined contribution assets on Voya’s retirement platform, as the below slide from their Q1 earnings presentation illustrates.

This partnership, which will also extend into Voya’s insurance asset management capabilities by engaging Blue Owl in its direct lending and investment grade asset-backed finance private credit strategies, is the tip of the iceberg of a much bigger opportunity for asset managers looking to serve the retirement savings industry.

The bigger picture?

The $12.4T in assets as of the end of 2024 held in US defined contribution plans, according to the Investment Company Institute.

Miriam Gottfried, Dylan Tokar, and Matt Wirz from The Wall Street Journal reported this week that an executive order is expected to be signed that will inch closer to reform in the US that could see private markets assets in defined contribution plans in a bigger way.

Many of the industry’s largest private equity firms and alternative asset managers have had a long history with the retirement security business, as KKR reminds us in their 2025 Mid-Year Outlook:

“KKR has been a pioneer in the retirement security business since 1976 when we began managing capital on behalf of public and corporate pension funds, as well as insurance companies. These companies and public plans have long recognized the importance of allocating a portion of their investment portfolio to Alternatives, with the beneficiaries of this approach including firefighters, teachers, police and many other public and private sector workers.”

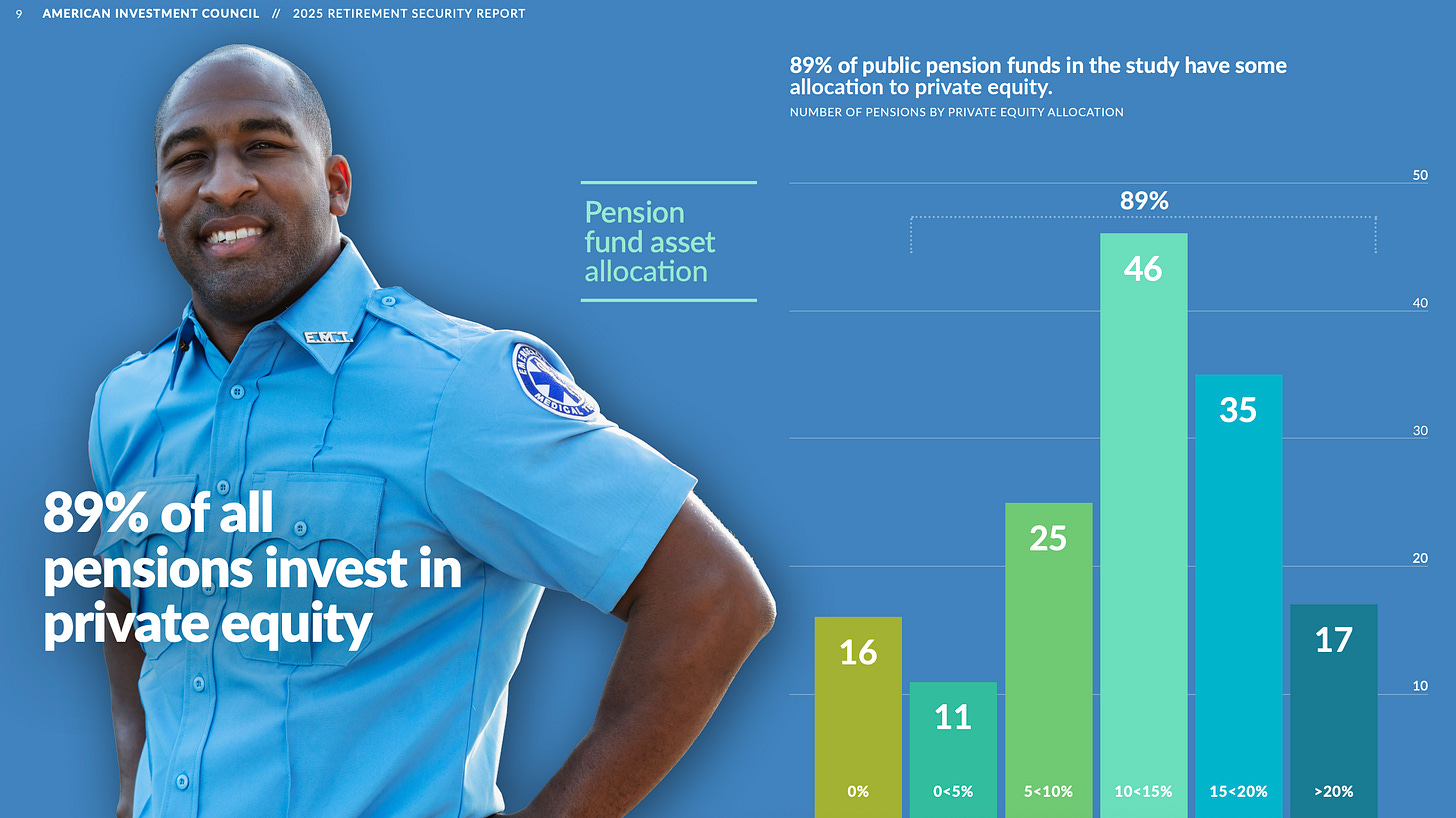

Data from the American Investment Council 2025 Retirement Security report supports this sentiment.

According to the AIC’s report, in 2025, more than 89% of public pension funds allocated a portion of their portfolio to private equity. These funds support more than 34 million public sector workers and retirees.

Over 10 years, private equity has outperformed other asset classes for pension funds.

The devil is in the details, as a recent AGM Op-Ed from Susan McAndrews highlights when discussing CalPERS’ recent Annual Program Review for Private Equity.

But, according to data from the AIC, adding private equity to a pension fund portfolio can enhance returns relative to those of public equities.

As a result, many pension plans in the US have some exposure to private equity.

But while defined benefit plans (like pensions) have often included private markets exposure in their portfolios, defined contribution plans (like 401(k)s) have not.

A chart from KKR highlights the stark difference in allocation to private markets between target date funds and defined benefit and public pension plans.

Target date funds have 1% allocation to private markets, while possessing 67% allocation to public equities (40% US equities, 27% non-US equities).

Pension plans, on the other hand, have roughly 20% allocation to private markets.

These allocations, at least based on historical data, can lead to very different return outcomes over a long time horizon.

KKR’s Rachel Li notes in her work on capital markets assumptions and retirement savings that asset allocation is the primary driver of long-term outcomes. Li finds that asset allocation matters even more than fees or manager selection.

Data from Georgetown University’s Center for Retirement Initiatives highlights the possible “structural disadvantage” of not having exposure to private markets.

In scenario modeling, where they back-tested three scenarios that replace a 10% allocation to US large cap equities and core bonds with 5% private equity and 5% real assets, the researchers found that returns can be increased in target date funds without materially adding to risk. The results of the back-testing resulted in a 15 basis points annualized median uplift.

The upshot?

The data from the researchers and KKR indicates that the addition of private markets exposure could enhance net return in a 25-year-old investor’s target date fund by approximately 70 basis points per year.

Compounded over a 20 to 30 year time horizon, 70 basis points of enhanced returns on an annualized basis can make a material impact on a portfolio.

Perhaps that’s why Apollo CEO Marc Rowan’s comments in his talk with Morningstar CEO Kunal Kapoor at the Morningstar Investment Conference were so profound. Rowan noted that the promise of additional returns can help investors save for retirement.

Rowan said that a “1.5% excess return in private markets creates a 50-100% better outcome in retirement.”

Helping investors achieve better outcomes for retirement should be a critically important ambition.

While there is nuance to whether or not private markets exposure can help retirees achieve these goals, there are certainly a few undeniable features and trends in both public and private markets that make private markets at least worthy of consideration in retirement portfolios.

First, I’ll acknowledge that there are business imperatives as to why alternative asset managers are excited about unlocking retirement assets.

Yes, asset managers are playing for trillions of dollars in inflows. And yes, structural challenges in recent years in private markets, including illiquidity, a lack of exits, and institutional investors hitting their limits on exposure to private markets, have been partly why alternative asset managers have turned such an intense focus on the wealth channel.

But, there are also a number of reasons why it could make sense for retirement assets to have exposure to private markets.

The public company universe is shrinking

There has been a secular decline in the number of listed public companies in the US over the past 30 years. Data from iCapital highlights just how steep this tapering has been: the number of public company listings today is roughly half of what it was in 1996.

Value creation is increasingly happening in private markets rather than public markets.

Currently, many target date funds and 401(k)s don’t have any exposure to the value creation in private markets.

As EQT’s Peter Aliprantis wrote in a recent Op-Ed on Alt Goes Mainstream, there are structural reasons why investors are choosing private markets.

The overwhelming majority of companies with $100M in revenue or greater reside in private markets.

Research from Hamilton Lane finds that in 2022, there were a mere 2,800 public companies in the US with annual revenues greater than $100M. That figure pales in comparison to the 18,000 private companies with north of $100M, meaning that investors who can only participate in public markets investing have access to only 13% of the companies in the US with over $100M in revenue.

For investors who lack access to private markets, they are limited in the universe of investing options.

Indexation, correlation … and the “Mag 7 vs. the S&P 493”

Not only are investors that can only invest in public markets subjected to a smaller universe of investable options, but public markets have become increasingly indexed and correlated.

Further, the S&P 500 has been a tale of two cities in recent years.

A chart from Hamilton Lane’s 2025 Market Outlook highlights just how much a select set of companies has driven the majority of the returns in the S&P 500.

Data up until March 2025 shows that the 10 largest stocks in the S&P 500 accounted for over 1/3 of the total market capitalization in the index.

Many retirement accounts and target date funds have meaningful exposure to these assets. That has certainly benefited investors over the past 10 to 15 years. But there’s also inherent risk for investors in having so much exposure to assets that are indexed and correlated.

As Apollo CEO Marc Rowan has said in the past, the game on the field has changed.

Investing has entered a new world order so a re-architecting of risk — and return — is required.

According to data from Hamilton Lane’s 2025 Market Outlook, private equity returns have acquitted themselves well over long periods of time compared to public market equivalents, both on a vintage year basis and on a 10-year rolling time-weighted return (TWR) basis.

Private equity has consistently outperformed public market indices on 10-year rolling TWRs, according to Hamilton Lane data.

Could it make sense for portfolios, particularly for those that are investing over a long time horizon, to have some exposure to private markets?

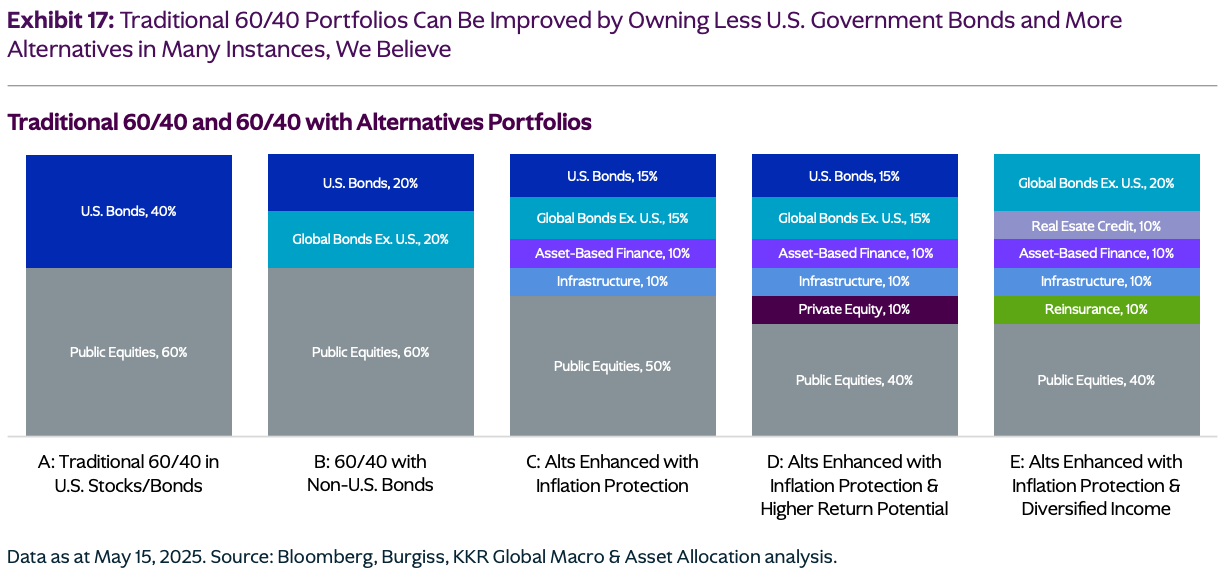

A chart from KKR’s 2025 Mid-Year Outlook finds that adding private markets (particularly asset-based finance, infrastructure, or private equity) to a 60/40 portfolio, based on historical return data from 2004-2024, can add to annual returns while reducing volatility.

Portfolios that add private equity, credit, and infrastructure (letters D - which includes 10% allocations to private equity, infrastructure, and asset-based finance, respectively, and E - which includes 10% allocations to asset-based finance, real estate credit, and infrastructure, respectively) outperform the 60/40 and exhibit lower volatility.

KKR’s view?

A “traditional 60/40 portfolio can be improved by owning less US government bonds and more alternatives in many instances,” they believe.

BlackRock appears to be set to embed private markets investments into their target-date funds.

According to a Wall Street Journal article from June 26, 2025, BlackRock reportedly plans to allocate about 15% to 20% to private investments for people ages 25 to 50, and taper that to 5% to 10% for those nearing retirement into a 401(k) target-date fund offered by Great Gray Trust Co., which offers 401(k) investments.

The challenges and opportunities in serving retirement assets

Inserting private markets exposure into retirement products does not come without its challenges and complications.

Vehicle structure has to be right.

Fees have to be reasonable, even as the burden for reporting and operational overhead increases with the required management of more smaller investors.

Reporting has to be streamlined and valuations have to be delivered on a timely and more frequent basis, particularly with evergreen structures.

Liquidity has to be on offer, as individuals may have life events or require income for retirement.

But, taking a step back, the intent of private markets is to generate excess returns over a period of time relative to both risk and return available in public markets.

If private markets can deliver on that promise, then perhaps adding exposure to an investment structure — retirement accounts — that is meant to compound over years, could make sense.

Apollo CEO Marc Rowan discussed this point in his talk with Morningstar CEO Kunal Kapoor at the Morningstar Investment Conference.

As I wrote in the 7.6.25 AGM Alts Weekly, Rowan lays out the different types of risks that investors can take:

The big question for investors comes down to risk.

What risks are investors willing to take?

Marc cites four types of risks that investors can take:

➡️ Credit risk.

➡️ Duration risk.

➡️ Equity risk.

➡️ Liquidity risk.

Marc asks a thought-provoking question: if investors have a 30-day to 30-year investment horizon, why can’t they take liquidity risk and get paid with “excess return?”

If that’s the case, then perhaps there is no alternative for some portion of an investor’s portfolio to be allocated to private markets in order to capture that additional return if the private markets allocation does come with the “excess return per unit of risk” as Marc noted a number of times in his talk with Kunal.

Rowan is not the only asset management leader to harp on the importance of solving for retirement.

BlackRock Chairman and CEO Larry Fink is critically focused on helping to deliver returns for savers into their retirement years.

In his Annual Chairman’s Letter to Investors, Fink makes the case for adding private markets exposure to retirement accounts — and he chalks it up to returns:

We're going to need better ways to boost portfolios. As I wrote earlier, private assets like real estate and infrastructure can lift returns and protect investors during market downturns. Pension funds have invested in these assets for decades, but 401(k)s haven't. It’s one reason why pensions typically outperform 401(k)s by about 0.5% each year.40

Half a percent doesn't sound huge, but it adds up over time. BlackRock estimates that over 40 years, an extra 0.5% in annual returns results in 14.5% more money in your 401(k). It’s enough to fund nine more years of retirement, helping you stop working on your own terms. Or, put another way, private assets just bought you nine extra years hanging out with your grandkids.41

Private markets assets can sit in retirement accounts, as I wrote in the 11.24.24 AGM Alts Weekly. Partners Group, amongst others, has structured funds for DC plans. Collective Investment Trusts (CITs) can also house private markets investments.

But the industry is still awaiting more mainstream adoption of private markets in retirement accounts.

Perhaps model portfolios and continued adoption of evergreen structures will pave the way for broader utilization of private markets investments in retirement accounts. Regulatory reform is also part of the equation.

News from recent weeks and changes to regulatory frameworks might usher in a new era of private markets.

Providers of retirement and wealth management services, like Empower, and asset managers have been readying for this moment. A few months ago, Empower announced that it would start to offer private markets in its retirement portfolios later this year.

The firm will be partnering with a number of asset managers, including Apollo, Franklin Templeton, Goldman Sachs, Neuberger Berman, PIMCO, Partners Group, and Sagard, to likely embed these firms’ private markets products through collective investment trusts (CITs).

Empower’s CEO Edmund Murphy believes that this is just the beginning for 401(k) plans adopting private markets.

At an industry conference earlier this month, Murphy said that defined-contribution portfolios could allocate as much as 10-15% to private markets assets in the next 10 to 15 years.

A lot is at stake

The industry’s largest asset managers have been readying for this moment.

The largest firms will likely be the biggest beneficiaries of these asset inflows. They are also most well-equipped to handle and service them. That’s partly why Voya picked Blue Owl to partner on bringing private markets assets to its DC plans. According to Blue Owl’s Global CEO and President of Private Wealth Sean Connor, it was the infrastructure in place that has enabled 40% of Blue Owl’s $273B in AUM to come from the wealth channel that helped the firm land the deal with Voya.

This will likely create a case of haves and have nots in private markets. Certain firms will grow their AUM because they are able to work with individual investors in ways that other firms are not equipped to do so.

It doesn’t mean that smaller firms can’t build fantastic investment engines, produce strong returns, and build great businesses. In fact, both things can be true.

But the industry’s largest firms are the ones most well-equipped to grow AUM to serve the trillions of dollars that could come in from retirement accounts.

The industry’s largest firms also have the most to lose, in theory, if they get it wrong or don’t deliver returns for retirees net of fees.

So to whom much is given, much is expected.

And, it should be expected that the industry’s largest asset managers deliver on the promise of helping investors save for retirement. Because a lot is at stake — not just for the future of the asset managers themselves, but crucially so for the retirees that they will be serving.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM Post of the Week

Apollo Partner and Co-Head of Private Equity David Sambur shared his outlook on private equity dealmaking in 2025 with PE Hub. The focus for many in the private equity industry is operational value creation and active management done well.

AGM News of the Week

Articles we are reading

📝 Vestmark, BlackRock, iCapital, and Dynasty forge four-way private market partnership | Leo Almazora | InvestmentNews

💡 InvestmentNews’ Leo Almazora dives into the details behind an announcement this week about a partnership between Vestmark, BlackRock, iCapital, and Dynasty Financial Partners that intends to make it easier for RIAs to combine private markets investments with traditional assets in a single, tax-managed unified managed account. The collaboration will reportedly enable advisors to allocate to subscription-based private markets investment products alongside ETFs, mutual funds, equity and fixed income SMAs, and direct index SMAs, all within a single custodial account. The solution is set to streamline the process for building diversified portfolios and enable wealth managers to offer more investment options to clients. This partnership follows an earlier partnership between BlackRock, iCapital, and GeoWealth, which unveiled the ability to create customizable model portfolios across public and private investments within a unified managed account (UMA). This new offering will leverage iCapital’s technology platform to enable Dynasty advisors to integrate private investments into UMA portfolios utilizing asset allocation models developed with BlackRock. Vestmark CEO Karl Roessner is “excited for how this offering will revolutionize the advisor experience.” BlackRock’s Head of Solutions for the firm’s US Wealth Business Eve Cout highlighted how the collaboration delivers “expanding choice to RIAs.” This partnership is an extension of the Model Select program that Dynasty has employed and, according to Dynasty COO Marc Hineman, has been popular amongst the firm’s advisor network. Hineman noted that the ability to add subscription-based private investments enables advisors to better serve larger, more sophisticated client relationships and manage those portfolios at scale.

💸 AGM’s 2/20: The partnership push extends across asset managers, technology infrastructure and service providers, and platforms that can help deliver the right solutions to advisors and their end clients. The partnership between Vestmark, BlackRock, iCapital, and Dynasty is emblematic of what is required to help bring private markets to the wealth channel in a scalable way.

Partnerships will be critical in order to deliver the right solutions to the right investors at the right time and in the right product structure. There are a number of pieces to the puzzle that need to be put together across technology, pre- and post-investment solutions, investment execution, product structure and wrappers, and operations. Not many firms are singularly well-equipped to handle these burdens on their own, which is why partnership is required to deliver these solutions.

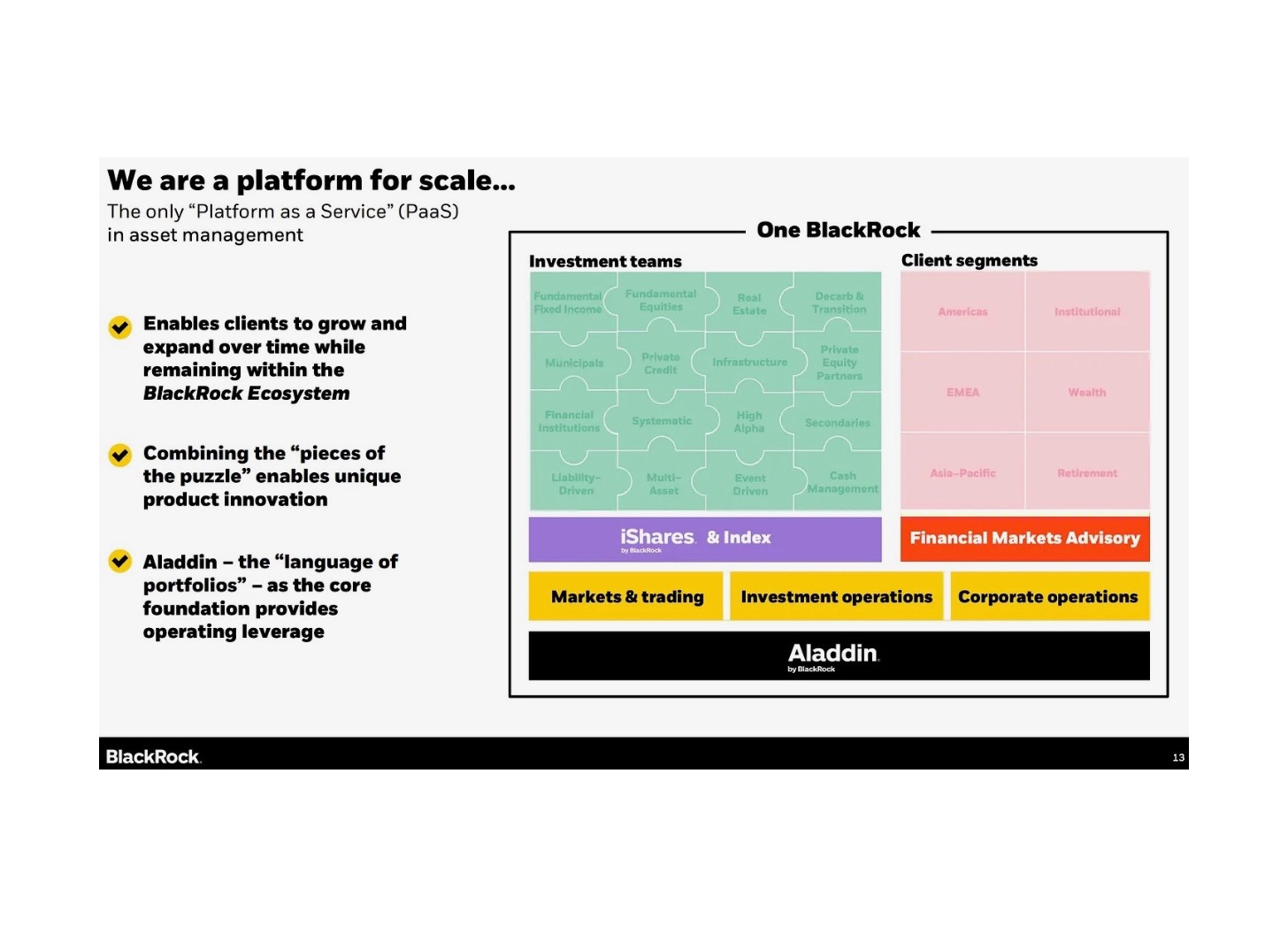

Perhaps BlackRock is one of the few firms that is positioned to put together all the pieces of the puzzle as they help deliver public and private markets investment solutions in a single product, a single portfolio, and with the technology and risk management tools to track, manage, and rebalance assets across its investment and technology franchises.

Over the years, they’ve astutely built a “Platform as a Service” in asset management, as this chart from their 2023 Investor Day presentation illustrates.

A recent report from BlackRock, their 2025 Private Markets Outlook, highlighted some of the complexity that comes with this industry evolution:

This democratization comes with challenges. These emerging vehicles require new processes. Ensuring that private markets are effective within the portfolios of these new investors calls for portfolio construction expertise to build diversification, while providing a degree of liquidity.

Solving these challenges requires a broad suite of tools. Modeling is essential to predict cashflows, manage liquidity and optimize holdings. Equally important is finding the right mix with public-market assets to provide liquidity and mitigate the J-curve often seen in private markets.

We are still in the early stages of this new phase in the private markets, with rapid developments in product design, regulatory frameworks, as well as the tools and solutions for clients.

The industry is trying to fit the pieces of the puzzle together. That happened a few months ago with the partnership between BlackRock, iCapital, and GeoWealth, which has brought public and private markets investments into UMAs, as BlackRock’s Jaime Magyera and iCapital’s Lawrence Calcano discussed.

It’s now happening again with this partnership between Vestmark, BlackRock, iCapital, and Dynasty.

Delivering solutions to advisors scalable and streamlined solutions at scale to advisors is critical to bringing private markets and total portfolio solutions to advisors. This evolution is just in its infancy. I expect that we’ll see innovation from many of the wealth platforms — and partners that work with them — to create solutions that make it easier for advisors to allocate to private markets.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 KKR (Alternative asset manager) - Vice President, Structured & Asset Backed Credit. Click here to learn more.

🔍 Apollo Global Management (Alternative asset manager) - Managing Director, Head of Investment Grade Research. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Tax Advantaged Strategy - Principal. Click here to learn more.

🔍 Franklin Templeton (Asset manager) - Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - Vice President. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Asset & Wealth Management, Sustainability & Impact, Value Creation, Associate - New York. Click here to learn more.

🔍 Partners Group (Alternative asset manager) - Social Media Specialist. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - SVP, Business Development. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Network Partner Marketing, VP. Click here to learn more.

🔍 JPMorgan Chase (Asset manager) - Asset Management - Private Equity Associate - Program Associate. Click here to learn more.

🔍 Morningstar (Data and analytics provider) - Senior Product Manager, Public/Private Convergence. Click here to learn more.

🔍 Juniper Square (Fund software and services) - Director, Private Equity Sales. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Blue Owl Co-President and Global Head of Real Assets Marc Zahr share the story of how he built Oak Street from $17M in AUM in 2009 to what is now Blue Owl’s $67.1B AUM Real Assets business in a live Alt Goes Mainstream podcast at Future Proof Citywide. Watch here.

📝 Read The AGM Op-Ed with former Pantheon Partner Susan Long McAndrews on why everything we need to know might be in Sacramento (where CalPERS is located). Read here.

🎥 Watch Hg’s Partner and Head of Hg Wealth Martina Sanow discuss how Hg has unlocked opportunities for the wealth channel to invest in Europe’s largest portfolio of software and services businesses. Watch here.

🎥 Watch Goldman Sachs’ Partner and Global Co-Head of the Petershill Group at Goldman Sachs Robert Hamilton Kelly discuss the evolution of the GP stakes industry and how Goldman has become a market leading GP stakes investor. Watch here.

🎥 Watch Blue Owl’s MD, Head of Alternative Credit Ivan Zinn unpack private credit and why ABF has become a prominent part of the private credit ecosystem. Watch here.

📝 Read The AGM Op-Ed with Blue Owl Head of Alternative Credit Ivan Zinn on why “asset-based finance today mirrors the evolution of corporate direct lending from over a decade ago.” Read here.

🎥 Watch Lincoln Financial’s EVP and CIO Jayson Bronchetti discuss the role of insurance companies in private markets as he discusses how he manages a portfolio of $300B in assets. Watch here.

🎥 Watch Krilogy’s Partner and CIO John McArthur discuss how an RIA can chart a growth path by building out its private markets capabilities. Watch here.

🎥 Watch New Mountain Capital’s Founder & Chief Executive Officer Steve Klinsky discuss how $55B AUM New Mountain has built a business that builds businesses. Watch here.

🎥 Watch Arcesium’s Private Markets Head Cesar Estrada discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch GeoWealth President & COO Jack Hannah and iCapital SVP, Partnerships Michael Doniger discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Goldman Sachs’ Managing Director, Global Head of Alternatives, Third Party Wealth Kyle Kniffen discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Fortress Investment Group Managing Director & Co-Head of Private Wealth Solutions Adam Bobker discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch Constellation Wealth Capital President & Managing Partner Karl Heckenberg on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to Ted Seides, Founder of Capital Allocators, and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a Capital Allocators mini-series on Private Wealth. Listen here.

🎥 Watch BlackRock Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business Jaime Magyera and iCapital Chairman & CEO Lawrence Calcano discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch EQT Partner & Head of Private Wealth Americas Peter Aliprantis discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch KKR Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) Alisa Wood discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

🎙 Hear CAIA CEO Bill Kelly discuss the importance of education in private markets and being a fiduciary. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Ryan McCormack, Nick Owens, and Michael Rutter for their contributions to the newsletter.