AGM Wrapped: 2023 in tens

What topped the charts? Wrapping up 2023 in Alt Goes Mainstream style

2023, it’s been real.

Many in private markets, particularly venture, might say good riddance. The beginning of 2023 was a bumpy ride for private markets. SVB happened. Then FRB happened. Liquidity dried up. Valuation multiples, particularly for public company tech stocks, dropped precipitously from 2021 and 2022 levels. Fundraising became an uphill climb for many.

This year, private markets took us places. Different genres of private markets — from the steady drumbeat of private debt to the erratic but exciting electronic highs and lows of venture capital — provided a diverse set of tones to the symphony of alternative investments.

All was not bleak for private markets in 2023.

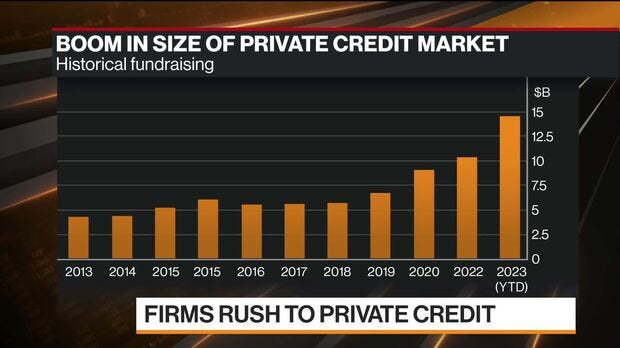

Blackstone crossed the $1T AUM mark and moved into the S&P 500 (while embarking on the Taylor Swift-themed “Alternatives Era” tour). The majority of the publicly traded alternative asset managers, including Blackstone, Apollo, and Ares, ended the year with their stock price at 99%+ of their 52-week-high. Private markets continued to evolve and grow, particularly with technology innovation pushing private markets forward. Private credit inched closer to $2T of AUM. Secondaries raised record levels of funding. Asset manager M&A was alive and well. Talk of tokenization moved into the mainstream.

The close of 2023 appears to provide a light at the end of the tunnel as we head into the new year. The S&P is near record highs. The IPO window seems ready to open. Talk of a soft landing could mean private markets take flight in 2024.

Blackstone and Apollo’s holiday videos illustrate that more investors — and in particular, individuals — are joining the alternatives chorus.

What kind of beats did private markets drop in 2023? 🎧

Spotify’s Wrapped campaign provides inspiration for this post as we continue to take the pulse of private markets here at Alt Goes Mainstream.

This is the edition of tens … In private markets, it often takes ten years to build a company that’s ready go go public.

Ten years ago, private markets had $10T less AUM (close to $4T AUM). It’s now at over $14T of AUM.

Ten years ago, Blackstone had $265B AUM. They now have over $1T AUM.

A lot happens in tens.

So, without further ado, let’s go to the chart toppers: the Top Ten on Alt Goes Mainstream and Ten Things That Happened in Private Markets in 2023. And we end this post with some alternative tunes to give you inspiration as we head into “The Alternative Era.”

AGM Wrapped

A lot happened on AGM this year. We continued with the tradition of publishing podcasts with industry leaders, and we added podcast partnerships with iCapital (see the Monthly Alts Pulse here) and EUVC (here and here). We also launched the AGM Alts Weekly, a weekly newsletter that covers and analyzes current topics and trends in private markets, complete with an index of publicly traded alternatives managers provided by leading financial services investment bank Broadhaven Capital Partners, a private markets jobs board, and thought pieces by yours truly.

So, without further ado, let’s see get on with the show and see which guests and topics struck a chord.

Top 10 podcasts on AGM in 2023 🎙

(1) Ep. 70: 🎙Wealth management industry titan Haig Ariyan of Arax Investment Partners on the private equity opportunity in wealth management and the intersection of wealth and alts. Listen here.

(2) Ep. 75: 🎙Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as an LP. Listen here.

(3) Ep. 77: 🎙How Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

(4) Ep. 69: 🎙A masterclass in investing and VC: Investing legends John Burbank and Ken Wallace of Nimble Partners on why the winners will win big and how to find them. Listen here.

(5) Ep. 71: 🎙How $9B OCIO Capricorn Investment Group has proven that doing well and doing good don't have to be mutually exclusive: A conversation with Partner Bill Orum. Listen here.

(6) Ep. 68: 🎙Live from Allocate's Beyond Summit: $40B AUM Cresset's Avy Stein and Jordan Stein on how private markets are changing wealth management. Listen here.

(7) Ep. 66: 🎙How Phil Huber, the award-winning CIO of $18B AUM Savant Wealth, approaches investing in private markets. Listen here.

(8) Ep: 72: 🎙How "tech's most unlikely venture capitalist," Pear VC's Pejman Nozad, has built a seed investing powerhouse. Listen here.

(9) Ep. 52: 🎙Wrexham AFC & English Football Executive Shaun Harvey on how a dash of Hollywood has spurred success on and off the pitch to create the "Wrexham Effect." Listen here.

(10) Live from AltsLA with CAIA: 🎙A conversation with $300B CalSTRS CIO Christopher Ailman, one of the world's largest institutional investors. Listen here.

(10a) Ep. 63: 🎙Dealing with the realities of today's venture market: A conversation with top allocator StepStone's Seyonne Kang. Listen here.

Top 10 podcasts on AGM of all time 🎙

(1) Ep. 70: 🎙 Wealth management industry titan Haig Ariyan of Arax Investment Partners on the private equity opportunity in wealth management and the intersection of wealth and alts. Listen here.

(2) Ep. 44: 🎙 iCapital CEO Lawrence Calcano & SIMON CEO Jason Broder on iCapital's landmark acquisition of SIMON and why they want to build a one-stop shop for alts. Listen here.

(3) Ep. 43: 🎙 Hightower's Robert Picard on how a $117B wealth management platform approaches alternative investments. Listen here.

(4) Ep. 75: 🎙Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as an LP. Listen here.

(5) Ep. 77: 🎙How Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

(6) Ep. 69: 🎙A masterclass in investing and VC: Investing legends John Burbank and Ken Wallace of Nimble Partners on why the winners will win big and how to find them. Listen here.

(7) Ep. 1: 🎙iCapital Network CEO Lawrence Calcano on how to build an alts platform for the wealth management community. Listen here.

(8) Ep. 71: 🎙How $9B OCIO Capricorn Investment Group has proven that doing well and doing good don't have to be mutually exclusive: A conversation with Partner Bill Orum. Listen here.

(9) Ep. 68: 🎙Live from Allocate's Beyond Summit: $40B AUM Cresset's Avy Stein and Jordan Stein on how private markets are changing wealth management. Listen here.

(10) Ep. 52: 🎙Wrexham AFC & English Football Executive Shaun Harvey on how a dash of Hollywood has spurred success on and off the pitch to create the "Wrexham Effect." Listen here.

Top 10 newsletters on AGM in 2023 📝

(1) AGM Alts Weekly #13: The era of the Super RIAs and why private equity sees the opportunity in wealth.

(2) AGM Alts Weekly #29: Takeaways from London LP & Allocator dinner and how GPs and LPs are innovating on the GP/LP relationship.

(3) AGM Alts Weekly #27: Selling into the wealth channel and what private equity courting the wealth channel means for the future of alternative asset managers and investors.

(4) AGM Alts Weekly #32: “The Alternatives Era:” What Blackstone and Apollo’s holiday videos mean for the mainstreaming of private markets.

(5) AGM Alts Weekly #31: Devising a strategy for working with the wealth channel and why working with the wealth channel is like enterprise sales.

(6) AGM Alts Weekly #30: The evolution of business models in alternative asset management and how alternative asset managers are encroaching on banks’ territory.

(7) AGM Alts Weekly #26: Teardowns of Q3 earnings reports on Apollo, Ares, and Blue Owl and key takeaways from their results.

(8) AGM Alts Weekly #25: Beta in search of alpha in private markets and why manager selection matters more in certain private markets strategies.

(9) AGM Alts Weekly #28: GP stakes and summary of the SuperInvestor Zurich panel on the evolution of GP staking.

(10) AGM Alts Weekly #18: Why it’s important to think in 10-year time horizons, the importance of going long duration, and Joe Burrow.

10 things that happened in private markets in 2023 (in 10 charts) 📊

A lot happened in private markets this year … let’s wrap up the year with ten major events in alts.

(1) Blackstone hit $1T of AUM and joined the S&P 500. See this Bloomberg article here for more on Blackstone crossing the $1T milestone.

(2) Silicon Valley Bank and First Republic Bank’s failures took many by surprise and sent shockwaves through the venture ecosystem, causing a major slowdown in funding for both companies and funds. Despite SVB being the biggest bank by total assets to fail since 2008 (see The Seattle Times article on the news from March 2023 here), private markets managed to steady the ship for the most part in 2023.

(3) Despite a challenging fundraising environment, private equity saw the largest single fund raised in history. CVC raised the largest ever private equity buyout fund, successfully closing on 26B, besting the prior record by Blackstone Capital Partners VIII, which closed in 2019 on $26.2B. See more from Reuters here on how some of the industry’s largest private equity firms pushed back against the 2023 fundraising headwinds.

(4) Private equity and, in particular, venture saw meaningful write-downs in marks, but investors flocked toward private credit. See this Bloomberg article here for more.

(5) Secondaries became a primary focus. Investors became excited by the opportunities to buy companies at a discount in a market where many LPs became liquidity constrained due to the impacts of the denominator effect. Secondaries funds that invest in private equity raised more capital through Q3 in 2023 than any other similar period to date, according to Secondaries Investor. Vehicles that held their final close between January and end of September 2023 raised $67.69B, a 168% increase over the same period last year. See this S&P Global article for more on secondaries fundraising trends here.

(6) Crypto made a comeback. BTC (up over 153% YTD) and Coinbase (up almost 400% YTD) were amongst the year’s top returning assets as the industry readies for what seemingly looks like more inflows with Bitcoin ETFs on the horizon. See this Bloomberg article here for more on Coinbase’s winning year (note: Coinbase price chart below is from November 2023, not capturing Coinbase’s December performance, which brought returns to almost 400% YTD).

(7) Investment minimums in private markets investment vehicles kept coming down. Apollo’s recently launched credit vehicle, the Apollo Asset Backed Credit Co., enabled investors with $2,500 minimums to access their fund (see Bloomberg article here on the launch of their new fund). This news is a foreshadowing of the continued mainstreaming of private markets, which I anticipate will see increasingly lower minimums as technology and investor experience continue to improve. See Bloomberg’s deep dive here on private equity courting the wealth channel and what it means for private markets.

(8) RIA M&A activity saw its most active Q3 on record, with the 86 announced transactions far surpassing the 65 transactions in Q2. Q3 and Q4 saw a number of large deals close, including Goldman Sachs selling its Personal Financial Management business (formerly United Capital) to Creative Planning, a $245B RIA, Carlyle investing in Captrust, and Osaic acquiring $108B AUM Lincoln Wealth from Lincoln Financial Group. Despite an up-and-down year in transaction volume, particularly in Q2, wealth management M&A continued to cash in on a strong year of activity. See this PwC report on asset and wealth management deal activity here for more.

(9) AI gave venture hope amidst a muted year of fundraising for startups in other categories. AI related startups raised a whopping $27B in 2023, punctuated by OpenAI’s $10B raise. But it was not venture funds who poured the lion’s share of the capital into AI startups. Rather, tech giants like Microsoft, Google, and Amazon splashed the cash to own some of AI’s foundational companies (see Financial Times article by George Hammond for more on this topic here).

(10) Climate funding for PE and VC-backed companies cooled, dropping 50% YoY versus 2022 to $638B (as of Oct 2023, according to a PwC report). Despite the slowdown in funding, hope should not be lost for increased investment into the global energy system. BlackRock projects an average of $4T per year of capital investment in the global energy system through 2050, up from $2T per year currently.

My alts playlist for 2023 🎵

🎶 Blackstone’s “The Alternatives Era:” It’s the alternatives era. We are going mainstream.

🎶 “We’re going mainstream,” by Alt Goes Mainstream.

🎶 But let’s not forget where we came from because private markets still has a long way to go. “Don’t Forget (Welcome to Wrexham),” Welcome to Wrexham’s Season Two opening song by Jon Hulme. And let’s "[not] forget to sing when we win.”

🎶 Private markets are still in their early innings. Let’s “think about [our] dream and envision it.” To all the builders in private markets, “I applaud you for running toward your dreams, I applaud you for believing in yourself … don’t stop running toward your dreams.” “Solasta” by Sixth Ocean.

Thanks for being a part of the Alt Goes Mainstream journey in 2023 as we all continue to push private markets forward. Happy, healthy, and exciting new year and look forward to continuing the journey together in 2024!