AGM Alts Weekly | 12.22.24: A year in the Book of Alts

AGM Alts Weekly #83: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

LemonEdge is a leading fund, partnership, and portfolio accounting solution for private markets investment firms with backing from Blackstone Innovations Investments, amongst others. LemonEdge helps GPs, VCs, Family Offices and Fund Administrators transform their back-office operations, through making the complex, simple.

LemonEdge helps firms manage equity, real estate and infrastructure across closed-ended, open-ended and hybrid structures of any variety, with all management fee, waterfalls or other typical Excel based calculations all embedded in LemonEdge. Scale your operations with high efficiency and deliver exceptional LP / GP service.

Good morning from DC.

A year in the book of alts.

There was a lot to write about in private markets this year. Alternative asset managers CVC and TPG went public. Blackstone crossed the $1T AUM mark. Blackstone, KKR, and Apollo entered the vaunted gates of the S&P 500. BlackRock made big moves in private markets, acquiring GIP, HPS, and Preqin for close to a collective $30B and adding over $240B of AUM to their private markets franchise.

Asset allocation and portfolio construction shifted from slices of the pie to buckets and spectrums as many allocators have come to realize that there is no alternative. Thought-provoking questions about liquidity and illiquidity, what’s risky and what’s safe, what’s public and what’s private were top of mind. Definitions dominated the lexicon.

There was indeed a lot to write about. Turns out, for Alt Goes Mainstream, that amounted to almost 1,000 weekly newsletter pages (and, while I didn’t get in the saddle for a holiday video, I did spin some tracks).

Thank you to all of our subscribers for being so interested and engaged. I have certainly enjoyed writing and thinking deeply about all the fascinating developments in private markets this year and I am looking forward to a lot more to come in the next year.

I’ve categorized this year’s writing into themes so there’s an easy way to find the areas that interest you. I hope you enjoy.

Evolution of asset management as a business

Integration Nation and Culture Considerations: Integration nation; Currency of consolidation; Culture considerations with acquisitions; What’s next?

BlackRock, HPS, and the AGM Next Wave: “Fees rule everything around me;” Distribution deluge; There were clues (about BlackRock’s acquisitions in private markets); The remaining pieces of the private markets puzzle; What chess moves are left on the board?

BlackRock / Preqin Acquisition: An Index Company, Literally?: BlackRock’s evolutionary revolution of private markets: Standardization, Distribution, Indexation; Revolutions happen in evolutionary ways.

Stuck in the Middle and the Coming Age of Consolidation: Stuck in the middle; The coming consolidation in alternative asset management; If it’s survival of the fittest, size will matter.

When Funds Become Firms: Our Partnership with Cantilever Group, a GP Stakes Firm: From funds to firms; Trends that are defining the business evolution of alternative asset managers — The currency of consolidation; Wealth is a winning strategy; One-stop-shops in the alts supermarket; The barbell effect; The distribution of talent; Proven in public markets; Owning the growth of an industry; Far from stuck in the middle; Access to the secular growth trend of private markets; “The best business model in finance;” Better than SaaS; Shades of private credit, private equity, and secondaries; Characteristics of a GP stakes investment; Cantilevers for helping asset managers construct their foundation.

Apollo’s Marc Rowan’s Talk at the Norges Bank Investment Management Conference: A re-architecting of risk; A new world order.

Marketplace Musings: Marketplace finance as the future of finance; Marketplace maxims; The magic of marketplaces; Shopping in the alts supermarket.

An evolving strategy for GP Stakes / A New World Order: A maturing market; An evolving allocation strategy in GP stakes; Shining a spotlight on what’s next; Apollo’s Investor Day Presentation; A new world order; Meeting the moment; A new era, a new need.

Masters of Scale: Bigger Can Be Better: Relationships, trust, and reliability; Advantages of incumbencies; Expertise; Asset managers as data companies; The next frontier of scale: data.

Private Markets: What Could It Become In 15 Years?: What could come next for private markets?; Private markets, 15 years from now; Big questions for the future.

The Power of Permanent Capital & Evercore’s Glenn Schorr’s Report on Blue Owl: Not all permanent capital is created equal; Permanent capital, permanent questions.

Teardowns of Alternative Asset Managers

HPS — and the Next Wave of Alternative Asset Managers That Could Go Public: A rapid ascent; Going public; Riding the wave of private credit; AGM’s Next Wave; Preparing for going public.

CVC’s IPO and What’s Next?: Breaking down CVC’s business; Public ambitions; What does the future hold? The so what; Who is next?

Ares Annual Letter Breakdown: The big are getting bigger; Credit drove AUM growth; You get credit, I get credit, we all get credit; The credit question: will you still love me tomorrow?; Wealth a growth driver of AUM, but don’t forget the institutional LPs; Becoming a one-stop-shop; Growing the platform through acquisition and permanent capital; Stock price outperformance; “Even more mainstream.”

The Power of Permanent Capital & Evercore’s Glenn Schorr’s Report on Blue Owl: Not all permanent capital is created equal; Permanent capital, permanent questions.

Goldman Sachs: A Sleeping Giant in Alternatives: Benefitting from the bank; Playing catch-up, but not far behind.

Apollo Q4 2023 Earnings Call Teardown — There Is No Alternative: The next seismic shift beyond the wealth channel, the 401(k) market; What are the key questions and themes going forward?

Distribution solutions

The Wealth Channel Is The New Institutional LP (January 2024): Beyond 2/20: The (downward) flight of fees; The juice is worth the squeeze; A $24.5T problem to solve in the US alone; A convergence between liquid and illiquid? Buckets and spectrums rather than slices of a pie; The poetic arc of alternatives.

What is the wealth channel?: Wealth & retail; Categorizing wealth; Where wealth & retail intersect; The brokerages that could go for broke; Multiple definitions of wealth; Multiple winners.

The Wealth Channel Is The New Institutional LP and The Wires Are Plugged In But Super(RIA)man Flies In: Another day, another record private equity fundraise in Europe (CVC’s €26B buyout fund); The wealth channel is the new institutional LP; Growth, from where?: The wires are plugged in, Super(RIA)man flies in, Less is more, The haves and have-nots, Searching for (distribution) solutions.

The Investment Product Specialist: The Travis Kelce of Alternatives Distribution: Food for thought; The Travis Kelce of alternatives distribution; Opening up the sales playbook for the investment product specialist; Learning from the Product Marketing Manager role in enterprise software sales; Investment product specialists : Alts distribution :: PMMs : Enterprise software sales; Developing product specialists; National Investment Product Specialists Day.

The Education Endgame — Educating and Developing Distribution Talent: What can the alts industry learn from the growth of the ETF industry?; Selling alts is a strategic, consultative sale; Creating a framework for portfolio construction; Training a salesforce.

Risk On: The Investing Habits of the Next Generation of Wealth: Risk on; Anything but conservative; $84T at stake; How to become a millionaire; Make boring cool; Master the marketing.

A Fundraising Playbook — Ways to Win the Game on the Field: Drop it in the bucket; Play the long game; Find the platform; Scale matters; Fee-ling a change; Liquid courage; Create your own distribution luck; The cutting edge.

Fundraising Playbook — Part Deux: Advice from senior capital raising and distribution professionals on how to win the wealth channel; Key themes: “You don’t need to be everything to everyone;” The importance of productizing by channel; Take a partnership approach; The big questions: "Is the distribution talent there for alternative asset managers to build out distribution teams?; Where do funds that can’t get a spot on a wirehouse menu go?; Will we see more alternative asset managers turn to strategic investors, GP stakes funds, and large asset managers to help with their distribution (Nikko / Tikehau partnership)?; What happens to managers stuck in the middle in alternative asset management?

The new world order of portfolio construction and asset allocation

Howard Marks’ Memo: Ruminating on Asset Allocation, Model Behavior, and BlackRock Going for BlackJack: “Public is both safe and risky, and private is safe and risky;” Model behavior; BlackRock going for blackjack.

Private Markets Are Eating The World: The private markets tsunami; Private markets are on the menu; Private markets are eating the 60/40 portfolio; Private markets are eating public markets; Private markets are eating how companies are financed; The future is private.

A convergence of public & private — and institutional & wealth and thoughts on HighTower’s majority stake in OCIO NEPC: The downward flight of fees; From interest to implementation; The why, then the what and the how.

Future Proof, The Intersection of Finance x Fun and Alts x Wealth: Finance x fun; The collision of culture and finance; The intersection of alts x wealth; The merging of traditional and alternative, public and private; Model behavior.

Permanent Capital and Evergreen Structures: The alternative going mainstream; Distribution dilemmas; The business imperative that lies in the (ever)green; Does the business evolution of asset managers impact performance?; A holistic approach to the private markets growth trend; The “so what.”

If You Knew the End Date, How Would You Invest … And Live Differently?: Straddling complexity and simplicity; Infinite time, infinite responsibility; A long-term time horizon in a short-term world; The paradox of time.

An Evergreen Question: Growing in popularity; Approach and psychology; Being built for purpose; Where does it go from here?

The “Canadian Model” and What Private Markets Can Learn from the Canadian Allocators: Just getting started; A tipping point? How can the Canadian market develop? Thinking like the Maple 8.

NFL Draft — Picking Right in Football and Investing: The diligence paradox; Picking right — in the NFL Draft or investing; Quotes from NFL players Ryan Kalil and Damiere Byrd; Trusting the process; Investing in success.

The magic of marketing and building brand

Building Brand: Tactics for Winning the Brand Battle: “Build [brand] with Blackstone;” Catalyzing the next trend?; Tactics for winning the brand battle.

The Investment Product Specialist: The Travis Kelce of Alternatives Distribution: Food for thought; The Travis Kelce of alternatives distribution; Opening up the sales playbook for the investment product specialist; Learning from the Product Marketing Manager role in enterprise software sales; Investment product specialists : Alts distribution :: PMMs : Enterprise software sales; Developing product specialists; National Investment Product Specialists Day.

What’s in a Name: An Alternative Definition is Required: Future Proof; What’s in a name?; An alternative definition is required; Beyond alternative into the mainstream.

Future Proof, The Intersection of Finance x Fun and Alts x Wealth: Finance x fun; The collision of culture and finance; The intersection of alts x wealth; The merging of traditional and alternative, public and private; Model behavior.

Evolution of wealth management

Alts: From Sold to Bought? Cerity’s Acquisition of OCIO Agility: Alts: from sold to bought; From “nice to have” to “need to have;” The need for customization and differentiation; Outside in, or inside out?; Navigating this industry evolution; In a sea of similarity, there’s an opportunity to be different.

A convergence of public & private — and institutional & wealth and thoughts on HighTower’s majority stake in OCIO NEPC: The downward flight of fees; From interest to implementation; The why, then the what and the how.

Private Markets Data & Technology

BlackRock / Preqin Acquisition: An Index Company, Literally?: BlackRock’s evolutionary revolution of private markets: Standardization, Distribution, Indexation; Revolutions happen in evolutionary ways.

Connecting The Dots In Alts: Three Key Words — Holistic, Utility, Standardization: The year of traditional in alternatives; A new chapter for private markets.

Masters of Scale: Bigger Can Be Better: Relationships, trust, and reliability; Advantages of incumbencies; Expertise; Asset managers as data companies; The next frontier of scale: data.

AGM Studio: The Meeting Place for Private Markets

AGM Studio: The Meeting Place For Private Markets — Making Sense of The Trends in Private Markets: The private markets evolution; A $40T market hiding in plain sights — and that’s only one piece of the puzzle; Winning in wealth; The opportunity; Distribution revolution and technology evolution go hand in hand; Where “fin” and “tech” rely on each other; Alts going mainstream requires innovation in both technology and asset management; What are the challenges with building in private markets? Why does private markets need a Studio?; The AGM Studio: A solution for companies and funds building in private markets; Where Content, Community, Capital come together; Who is the AGM Studio for? We are different; The next phase of private markets.

AGM Sound Track

Has It All Gone Pete Tong? AGM Spinning Tracks, SuperReturn EP: Songs that summed up the themes of private markets and SuperReturn feat. Today, Simon Erics, Lazarusman, The Palindromes; Keep On Waiting, Napkey, Tez Cadey; Wear Sunscreen, Mau Kilauea; Freed from Desire, Gala Rizzatto; Hotel California, Eagles; Northern Soul — Spencer Brown Remix, Above & Beyond, Richard Bedford, Spencer Brown.

Evergreens

Permanent Capital and Evergreen Structures: The alternative going mainstream; Distribution dilemmas; The business imperative that lies in the (ever)green; Does the business evolution of asset managers impact performance?; A holistic approach to the private markets growth trend; The “so what.”

If You Knew the End Date, How Would You Invest … And Live Differently?: Straddling complexity and simplicity; Infinite time, infinite responsibility; A long-term time horizon in a short-term world; The paradox of time.

The Power of Permanent Capital & Evercore’s Glenn Schorr’s Report on Blue Owl: Not all permanent capital is created equal; Permanent capital, permanent questions.

An Evergreen Question: Growing in popularity; Approach and psychology; Being built for purpose; Where does it go from here?

Connecting the Dots — The Rise of Perpetual Funds: To a more permanent place; Evergreen thinking: from the trees to the forest; Where do the dots lead now?

OCIOs and customization in a world where access is table-stakes

Alts: From Sold to Bought? Cerity’s Acquisition of OCIO Agility: Alts: from sold to bought; From “nice to have” to “need to have;” The need for customization and differentiation; Outside in, or inside out?; Navigating this industry evolution; In a sea of similarity, there’s an opportunity to be different.

A convergence of public & private — and institutional & wealth and thoughts on HighTower’s majority stake in OCIO NEPC: The downward flight of fees; From interest to implementation; The why, then the what and the how.

Private credit

The $40T Private Credit Universe: A $40T addressable market; What is asset-based finance?; ABF: a growing market; Private markets are eating the world.

Apollo & Citi: A Multipolar Credit World: If you can’t beat ‘em, join ‘em; Frenemies out of necessity; A multi-polar credit world.

The Private Credit Opportunity: Specialty gets credit (ABF); A good asset to have; The why behind an acquisition.

The Next Era of Private Credit: Even more credit; Private credit meets fintech; What’s next; Evolutions power revolutions; Private credit funding private credit?

GP stakes

When Funds Become Firms: Our Partnership with Cantilever Group, a GP Stakes Firm: From funds to firms; Trends that are defining the business evolution of alternative asset managers — The currency of consolidation; Wealth is a winning strategy; One-stop-shops in the alts supermarket; The barbell effect; The distribution of talent; Proven in public markets; Owning the growth of an industry; Far from stuck in the middle; Access to the secular growth trend of private markets; “The best business model in finance;” Better than SaaS; Shades of private credit, private equity, and secondaries; Characteristics of a GP stakes investment; Cantilevers for helping asset managers construct their foundation.

An evolving strategy for GP Stakes / A New World Order: A maturing market; An evolving allocation strategy in GP stakes; Shining a spotlight on what’s next; Apollo’s Investor Day Presentation; A new world order; Meeting the moment; A new era, a new need.

Permanent Capital and Evergreen Structures: The alternative going mainstream; Distribution dilemmas; The business imperative that lies in the (ever)green; Does the business evolution of asset managers impact performance?; A holistic approach to the private markets growth trend; The “so what.”

Infrastructure

Private Markets: What Could It Become In 15 Years?: What could come next for private markets?; Private markets, 15 years from now; Big questions for the future.

Private equity

The Middle is Far From Middling: Looking over the private markets vista; The middle (market) is far from middling; Earning a return; A larger universe; Lower entry prices; Who has the leverage; Resilient market fundamentals; More exit off-ramps; A promising vista for middle-market private equity.

Big Bets, Concentration, Continuation Vehicles, Scale Matters, and on Silver Lake’s $20.5B Fundraise: Silver Lake; Concentration is king; When the going gets tough; A flight to quality for LPs; Scale matters; Continuation vehicles — another form of concentration; LPs will concentrate their relationships.

Venture capital

Connecting The Dots In Venture Capital: Capital Has Shifted — From Country Roads To City Lights: Capital and Capitol: Capital has shifted in the Capitols of Venture; Country roads and city lights can both shine bright; Living in the country or the city.

Notes From An Institutional Allocator — The Institutionalization of Venture Capital: Should venture have a more nuanced definition?; What does the wave of venture look like?; A more permanent place in VC?; The road ahead for VC.

Sports

The Miracle of the Washington Commanders; the Miracle of Sports: Miracles don’t happen overnight; The turnaround; Winning off the field; How sports investment can boost communities; Show me the money.

Women’s Soccer Goes Mainstream: A Trip to Watch NWSL’s Angel City FC Play KC Current in KC: “It’s like buying the Boston Celtics in the 1960s;” Dollars and sense; Taking women’s soccer mainstream; “You’ve got a media company, not just a sports team” (Avenue Capital’s Marc Lasry); Sports, meet finance.

Live from the UEFA Champions League Final: Private Equity in Sports: Hey Jude; A lot on the line — a €20M match; Follow the money.

NFL Draft — Picking Right in Football and Investing: The diligence paradox; Picking right — in the NFL Draft or investing; Quotes from NFL players Ryan Kalil and Damiere Byrd; Trusting the process; Investing in success.

Retirement

Decades Note Years — and Defined Contributions: A newer contribution to private markets; Decades, not years; Defining contributions.

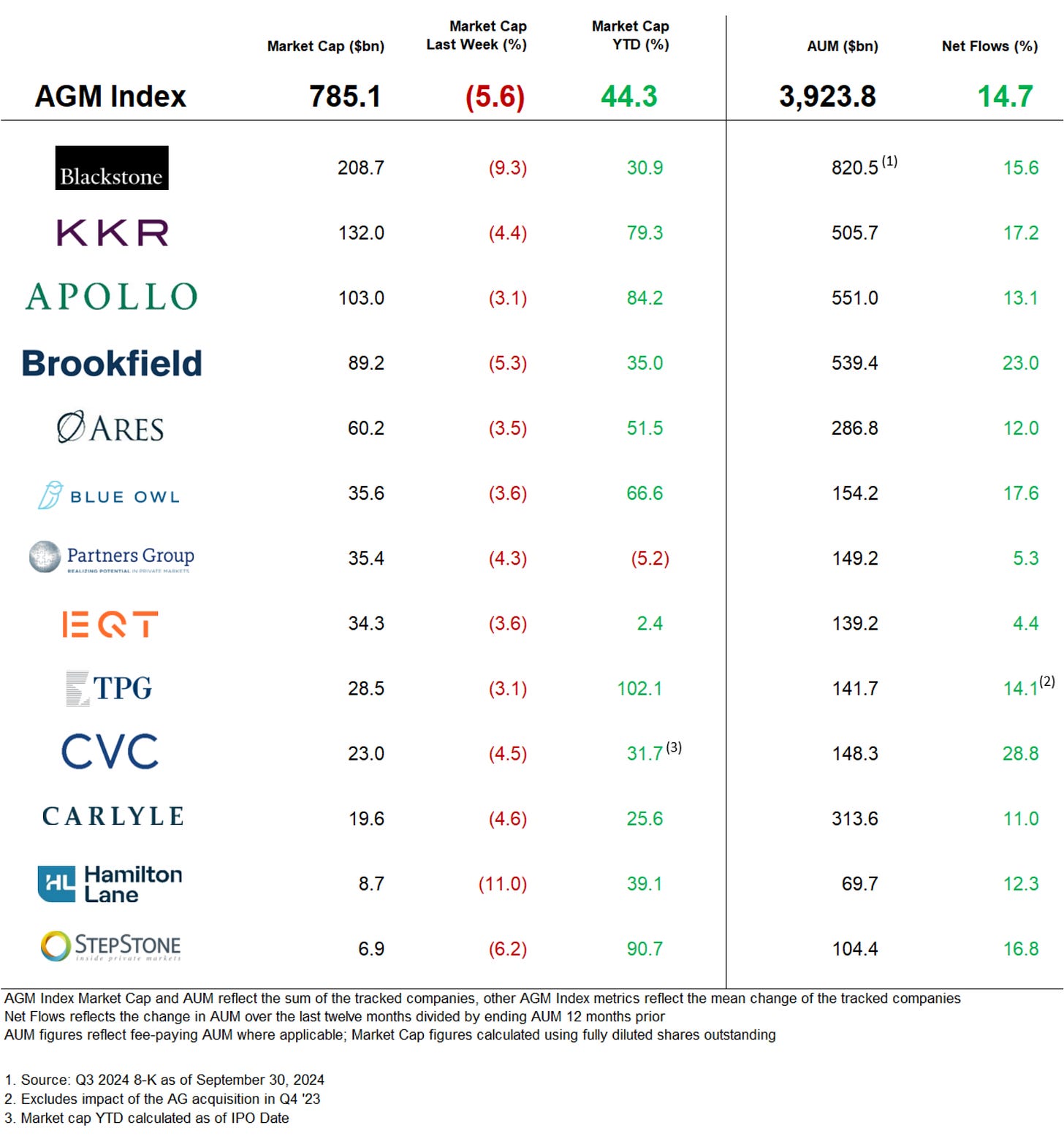

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Product Marketing, VP, EMEA. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Vanguard (Asset manager) - Venture Investing - Senior Associate. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of RIA Channel Marketing, Principal - Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Alternative Credit Product Marketing, Vice President - Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - SVP, Relationship Management – Retail Alts. Click hear to learn more.

🔍 Arcesium (Financial data management platform) - SVP, Business Development, Private Markets. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Data Intelligence. Click here to learn more.

🔍 Sagard (Alternative asset manager) - Head of National Accounts, Private Wealth Solutions. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch the third episode of Investing with an Evergreen Lens Series with iCapital and Vista Equity Partners, KKR, and Hamilton Lane with iCapital Co-Founder & Managing Partner Nick Veronis and Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis. Watch here.

🎥 Watch the second episode of Investing with an Evergreen Lens Series with iCapital and Vista Equity Partners, KKR, and Hamilton Lane with iCapital Co-Founder & Managing Partner Nick Veronis and KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa. Watch here.

🎥 Watch the first episode of Investing with an Evergreen Lens Series with iCapital and Vista Equity Partners, KKR, and Hamilton Lane with iCapital Co-Founder & Managing Partner Nick Veronis and Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant. Watch here.

🎥 Watch the second episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.